peterschreiber.media

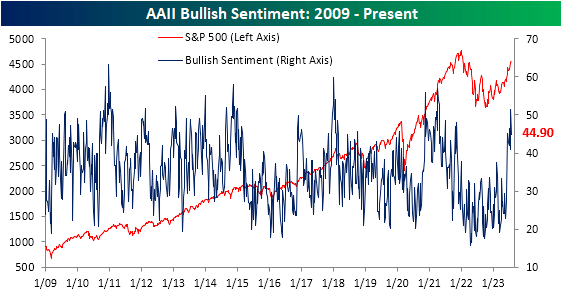

The S&P 500 has continued its rally, however sentiment has not precisely mirrored that. The most recent studying on investor sentiment from the AAII survey confirmed bullish sentiment dropped again beneath 50% this week. 44.5% of respondents reported as bullish within the previous week, which is true according to the typical studying of the previous two months.

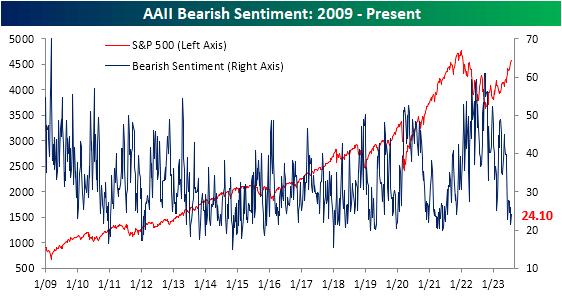

The 6.5-point decline in bulls was solely partially picked up by bearish sentiment, which rose from 21.5% (the bottom stage in over two years) to 24.1%. Albeit increased sequentially, that is still a muted studying.

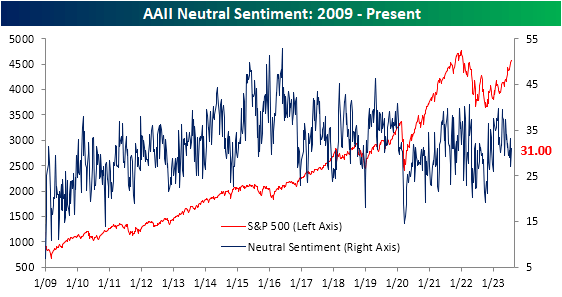

Impartial sentiment took dwelling a bigger share of the drop to bulls, with the studying rising to 31% from 27.1%. That’s solely essentially the most elevated studying in two weeks, as impartial sentiment is the closest of any response to its respective historic common.

Whereas the AAII survey confirmed some moderation in optimism this week, that was not the case for different surveys. In final Thursday’s Nearer, we mentioned how alongside the AAII survey, a number of different sentiment readings have tipped in favor of bulls not too long ago.

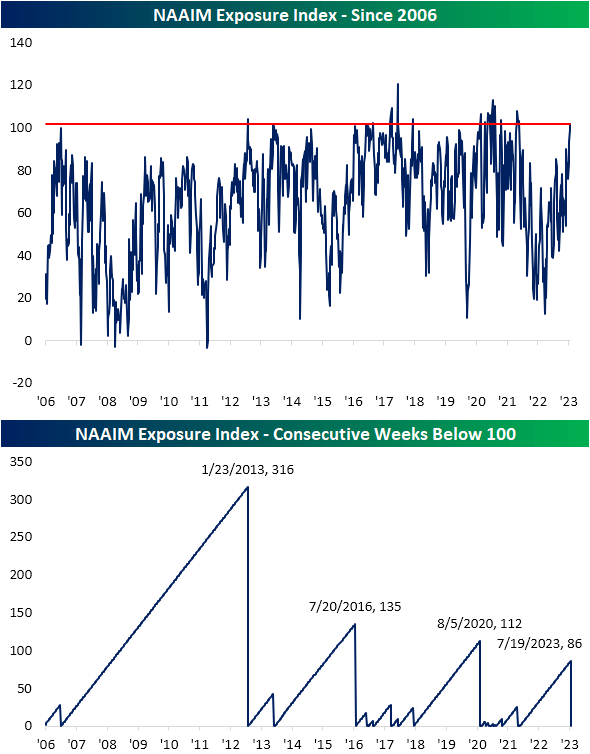

One such indicator that has continued to change into extra bullish is the NAAIM Publicity index which tracks the typical fairness publicity of lively funding managers.

Readings vary from -200 to +200. -200/+200 would suggest on common cash managers are leveraged brief/lengthy, readings of -100/+100 could be totally brief/lengthy, and a studying of zero could be market impartial.

This week, the index tipped above 100 for the primary time since late November 2021. In different phrases, lively cash managers are actually totally lengthy for the primary time in over a yr and a half. That streak of readings beneath 100 additionally ends because the fourth longest within the survey’s historical past at 86 weeks in a row.

Authentic Put up

Editor’s Be aware: The abstract bullets for this text had been chosen by In search of Alpha editors.