NatanaelGinting

By Sandrine Soubeyran and Robin Marshall, World Funding Analysis, FTSE Russell

BoC Tightening and Inflation Dangers: The weblog raises the query of whether or not the current price hike by the BoC might have been extreme, given the decline underway in Canadian inflation and indicators the labour market is cooling It explores the likelihood the June and July tightening measures are designed as pre-emptive inflation insurance coverage by the BoC… …. geared toward defusing dangers of inflation expectations destabilising, given the lagged results of financial coverage and excessive financial stimulus in 2020-21.

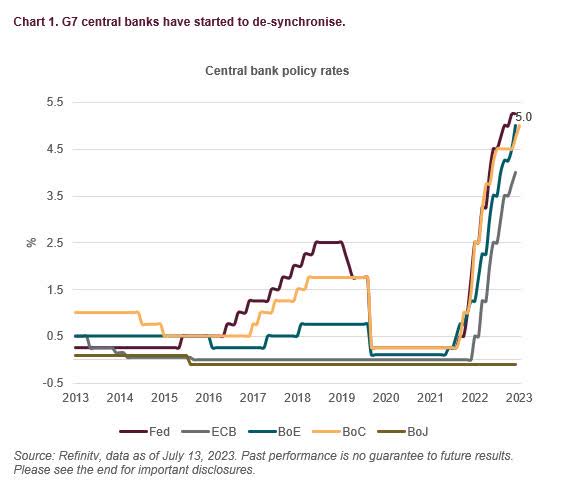

The Financial institution of Canada has been totally clear with its financial coverage because the Covid restoration, having promptly responded to inflation accelerating by elevating charges, and switching from quantitative easing to quantitative tightening beginning in Q2 2022 (Chart 1). However after two months of coverage pauses and obvious success in cooling the economic system, the BoC shocked markets by elevating charges 25bp in June and an additional 25bp in July, regardless of indicators of financial softening. Why did the BoC really feel the necessity to implement two small price will increase of 25bp within the final two months? Have been these will increase too far?

The BoC justified its first transfer, in June, on the premise the economic system “was stronger than anticipated within the first quarter of 2023, with GDP progress of three.1% and consumption progress was surprisingly robust and broad-based… [while] housing market exercise has picked up. Total, extra demand within the economic system appears to be extra persistent than anticipated”. The second transfer centered extra on “[slower] downward momentum in inflation” because of robust demand, family spending, inhabitants progress and accrued family financial savings.

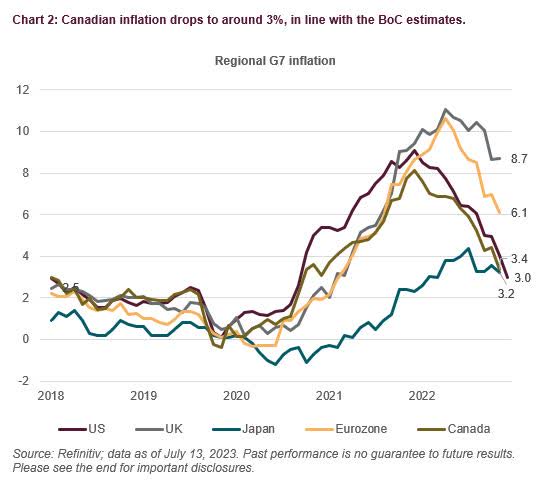

However by most measures and, additionally acknowledged by the BoC, the Canadian economic system has since been slowing. This justified the BoC’s choice to pause coverage in March and April after the rate of interest improve in January this 12 months, in contrast to different central banks, which continued to tighten coverage. Price hikes within the UK, Eurozone and US have been deemed needed, and properly flagged (i.e., Eurozone), as inflation ranges stayed stubbornly excessive, regardless of current easing, although the UK was an exception, as inflation remained unchanged at 8.7% y/y since Could, and core inflation accelerated.

However in Canada, CPI Could inflation fell near its 2% goal, at 3.4% y/y, from 4.4% in April, and the BoC had certainly forecast the inflation price to drop to “3% in the summertime, as decrease vitality costs feed via and final 12 months’s massive worth positive aspects fall out of the yearly knowledge”. Core inflation (ex-food & vitality) additionally fell to three.7% y/y (Chart 2). The current sharp fall in US CPI inflation in June was additionally very encouraging.

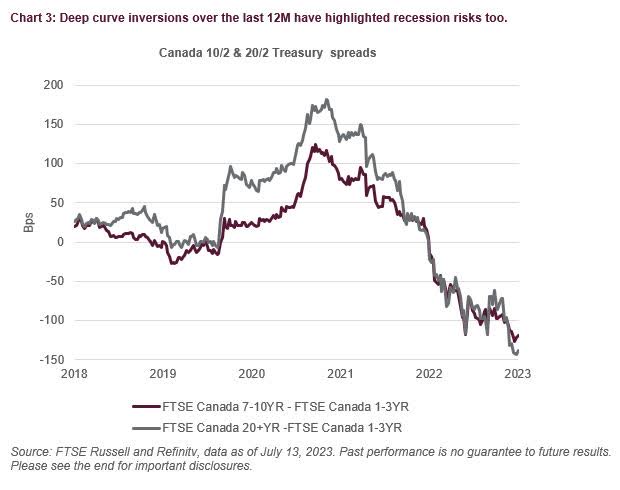

Furthermore, the Canadian bond market has been signaling recessionary dangers since final June, as may be noticed by the deeply damaging spreads and deep yield curve inversions during the last twelve months in Chart 3. Each 10/2 and 20/2 yield curves have fallen properly via -100bp, with 20/2s at the moment near -150bp on the time of writing.

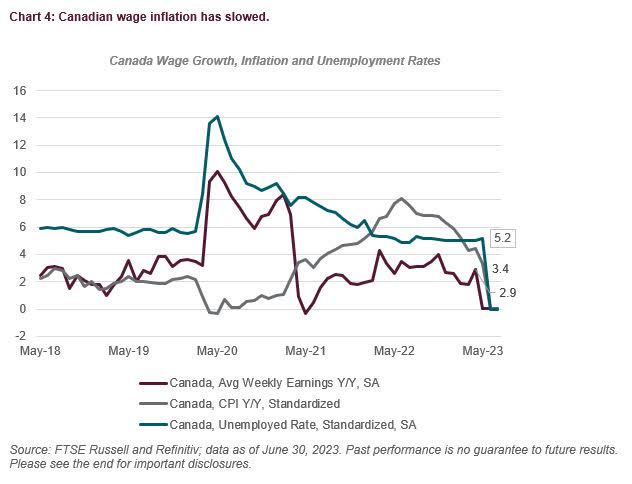

Different macroeconomic measures have additionally confirmed Canada’s financial slowdown. Canadian wage inflation, whereas nonetheless sturdy, has eased (Chart 4), and though unemployment stays near historic lows, the most recent determine has additionally ticked up modestly, transferring away from its lows.

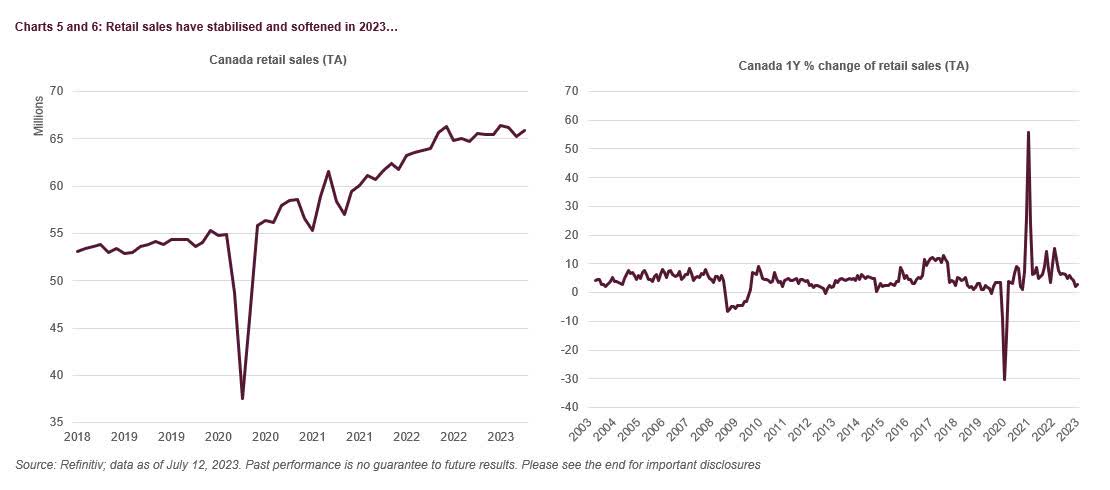

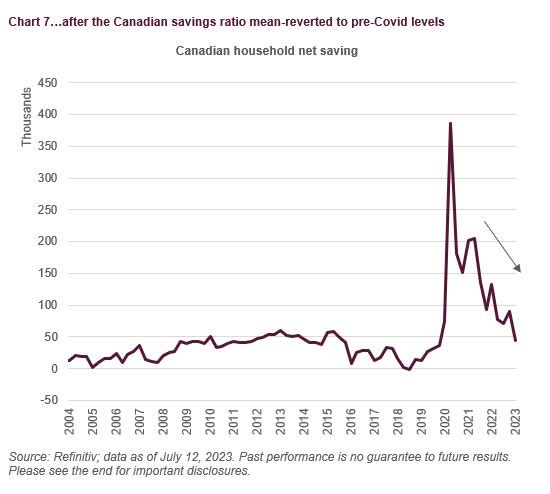

Even so, the power of home demand and consumption has remained a fear. As Chart 5 reveals, retail gross sales, in worth phrases, bounced again strongly in Could in absolute phrases, although the broader development seems to be stabilising. Nevertheless, from a year-on-year perspective, the proportion change highlights a transparent cooling as seen in Chart 6. A lot of this seems to have been funded from the Covid windfall in financial savings, accrued in the course of the Covid lockdown (Chart 7). Different measures reminiscent of Canadian housing begins have additionally weakened.

A BoC tightening too far?…

The weakening Canadian economic system raises the query as as to if the most recent 0.25% BoC price rise this month might have been a rise too far and will ship the economic system right into a deeper slowdown than needed. In spite of everything, the Canadian economic system doesn’t have the identical diploma of labour market tightness, wage and worth inflation as some G7 members, notably the UK. As well as, the BoC’s versatile inflation concentrating on regime permits the BoC flexibility in bringing inflation again to the two% goal over time [1]and contains an goal to maximise employment and protect monetary stability.

…or insuring towards an inflation regime change

An alternate clarification is current strikes might symbolize an try and claw again a few of the excessive financial stimulus utilized in 2020-21 and to defuse dangers of inflation expectations de-stabilising. If financial coverage labored with no lag to have an effect on inflation and output progress, this activity could be extra simple, and the BoC would have extra room to attend and react if inflation expectations destabilised.[2]However estimates of the coverage lag counsel this can be so long as one or two years, so a pre-emptive tightening turns into extra needed, if coverage works with a lag, and there’s a threat of inflation regime change.

[1] BoC inflation concentrating on regime.

[2] See “Financial Coverage Lag, Zero Decrease Certain, and Inflation Focusing on”, Shin-Ichi Nishiyama, BoC Working Paper, January 2009.

© 2023 London Inventory Trade Group plc and its relevant group undertakings (the “LSE Group”). The LSE Group contains (1) FTSE Worldwide Restricted (“FTSE”), (2) Frank Russell Firm (“Russell”), (3) FTSE World Debt Capital Markets Inc. and FTSE World Debt Capital Markets Restricted (collectively, “FTSE Canada”), (4) FTSE Fastened Earnings Europe Restricted (“FTSE FI Europe”), (5) FTSE Fastened Earnings LLC (“FTSE FI”), (6) The Yield Guide Inc (“YB”) and (7) Past Scores S.A.S. (“BR”). All rights reserved.

FTSE Russell® is a buying and selling title of FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “FTSE4Good®”, “ICB®”, “The Yield Guide®”, “Past Scores®” and all different logos and repair marks used herein (whether or not registered or unregistered) are logos and/or service marks owned or licensed by the relevant member of the LSE Group or their respective licensors and are owned, or used below licence, by FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB or BR. FTSE Worldwide Restricted is authorised and controlled by the Monetary Conduct Authority as a benchmark administrator.

All info is offered for info functions solely. All info and knowledge contained on this publication is obtained by the LSE Group, from sources believed by it to be correct and dependable. Due to the potential of human and mechanical error in addition to different elements, nevertheless, such info and knowledge is offered “as is” with out guarantee of any sort. No member of the LSE Group nor their respective administrators, officers, staff, companions or licensors make any declare, prediction, guarantee or illustration in anyway, expressly or impliedly, both as to the accuracy, timeliness, completeness, merchantability of any info or of outcomes to be obtained from using FTSE Russell merchandise, together with however not restricted to indexes, knowledge and analytics, or the health or suitability of the FTSE Russell merchandise for any specific goal to which they could be put. Any illustration of historic knowledge accessible via FTSE Russell merchandise is offered for info functions solely and isn’t a dependable indicator of future efficiency.

No duty or legal responsibility may be accepted by any member of the LSE Group nor their respective administrators, officers, staff, companions or licensors for (A) any loss or injury in entire or partially attributable to, ensuing from, or regarding any error (negligent or in any other case) or different circumstance concerned in procuring, accumulating, compiling, deciphering, analysing, enhancing, transcribing, transmitting, speaking or delivering any such info or knowledge or from use of this doc or hyperlinks to this doc or (B) any direct, oblique, particular, consequential or incidental damages in anyway, even when any member of the LSE Group is suggested prematurely of the potential of such damages, ensuing from using, or lack of ability to make use of, such info.

No member of the LSE Group nor their respective administrators, officers, staff, companions or licensors present funding recommendation and nothing on this doc ought to be taken as constituting monetary or funding recommendation. No member of the LSE Group nor their respective administrators, officers, staff, companions or licensors make any illustration concerning the advisability of investing in any asset or whether or not such funding creates any authorized or compliance dangers for the investor. A call to put money into any such asset shouldn’t be made in reliance on any info herein. Indexes can’t be invested in immediately. Inclusion of an asset in an index is just not a advice to purchase, promote or maintain that asset nor affirmation that any specific investor might lawfully purchase, promote or maintain the asset or an index containing the asset. The overall info contained on this publication shouldn’t be acted upon with out acquiring particular authorized, tax, and funding recommendation from a licensed skilled.

Previous efficiency isn’t any assure of future outcomes. Charts and graphs are offered for illustrative functions solely. Index returns proven might not symbolize the outcomes of the particular buying and selling of investable property. Sure returns proven might mirror back-tested efficiency. All efficiency offered previous to the index inception date is back-tested efficiency. Again-tested efficiency is just not precise efficiency, however is hypothetical. The back-test calculations are primarily based on the identical methodology that was in impact when the index was formally launched. Nevertheless, back-tested knowledge might mirror the applying of the index methodology with the good thing about hindsight, and the historic calculations of an index might change from month to month primarily based on revisions to the underlying financial knowledge used within the calculation of the index.

This doc might comprise forward-looking assessments. These are primarily based upon quite a few assumptions regarding future circumstances that finally might show to be inaccurate. Such forward-looking assessments are topic to dangers and uncertainties and could also be affected by varied elements which will trigger precise outcomes to vary materially. No member of the LSE Group nor their licensors assume any obligation to and don’t undertake to replace forward-looking assessments.

No a part of this info could also be reproduced, saved in a retrieval system or transmitted in any type or by any means, digital, mechanical, photocopying, recording or in any other case, with out prior written permission of the relevant member of the LSE Group. Use and distribution of the LSE Group knowledge requires a licence from FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB, BR and/or their respective licensors.

Unique Submit

Editor’s Word: The abstract bullets for this text have been chosen by Looking for Alpha editors.