Really helpful by Jun Rong Yeap

Get Your Free Equities Forecast

Market Recap

Earnings from Netflix and Tesla have triggered some profit-taking in large tech corporations in a single day, as pockets of weaknesses of their outcomes appear to present rise to issues for different upcoming large tech outcomes as effectively. Given the stellar tech rally because the begin of the yr, market contributors could also be pricing for not simply an earnings beat, however a powerful steering in company earnings over the approaching quarters with present ‘delicate touchdown’ hopes. Any indicators to problem that narrative might name for some re-rating of their current lofty valuation.

Wall Avenue ended combined total (DJIA +0.47%; S&P 500 -0.68%; Nasdaq -2.05%), with additional catch-up good points in worth sectors because the DJIA delivered its nineth day successful streak. Weaker-than-expected learn within the Philadelphia Fed Manufacturing Index (-13.5 versus -10 forecast) and a deeper contraction within the Convention Board Main Financial Index have been largely shrugged off, with the earnings season taking centre stage and expectations well-positioned for the final price hike from the Fed subsequent week. Treasury yields largely headed larger, with the 10-year yields leaping 10 basis-point (bp) in a single day.

One to observe would be the US greenback, which is again to retest its earlier support-turned-resistance stage on the 100.50 stage. For now, the broader development of decrease highs and decrease lows may nonetheless counsel sellers largely in management, whereas there are the chances that the latest upmove is a near-term moderation from oversold technical situations following a hefty 4% sell-off over the previous two week. Failure to reclaim the 100.50 stage over the approaching days may go away its July 2023 low on watch on the 99.00 stage for a retest.

Supply: IG charts

Really helpful by Jun Rong Yeap

Get Your Free USD Forecast

Asia Open

Asian shares look set for a destructive open, with Nikkei -0.69%, ASX -0.22% and KOSPI -0.75% on the time of writing. The financial calendar is comparatively quiet to finish the week, with focus this morning revolving across the Japan’s inflation information for June. The headline print was decrease than anticipated (3.3% versus 3.5% year-on-year), however the core facet proceed to indicate some persistence with a match of consensus at 4.2%.

Which will nonetheless preserve speculations of a coverage adjustment from the Financial institution of Japan (BoJ) in place, with the Japanese 10-year bond yields hovering close to its two-month excessive into the BoJ assembly subsequent week. Whereas there was some pushback from authorities currently for a July transfer, the consensus stays {that a} coverage shift shall be a matter of when and will ultimately happen by the tip of this yr.

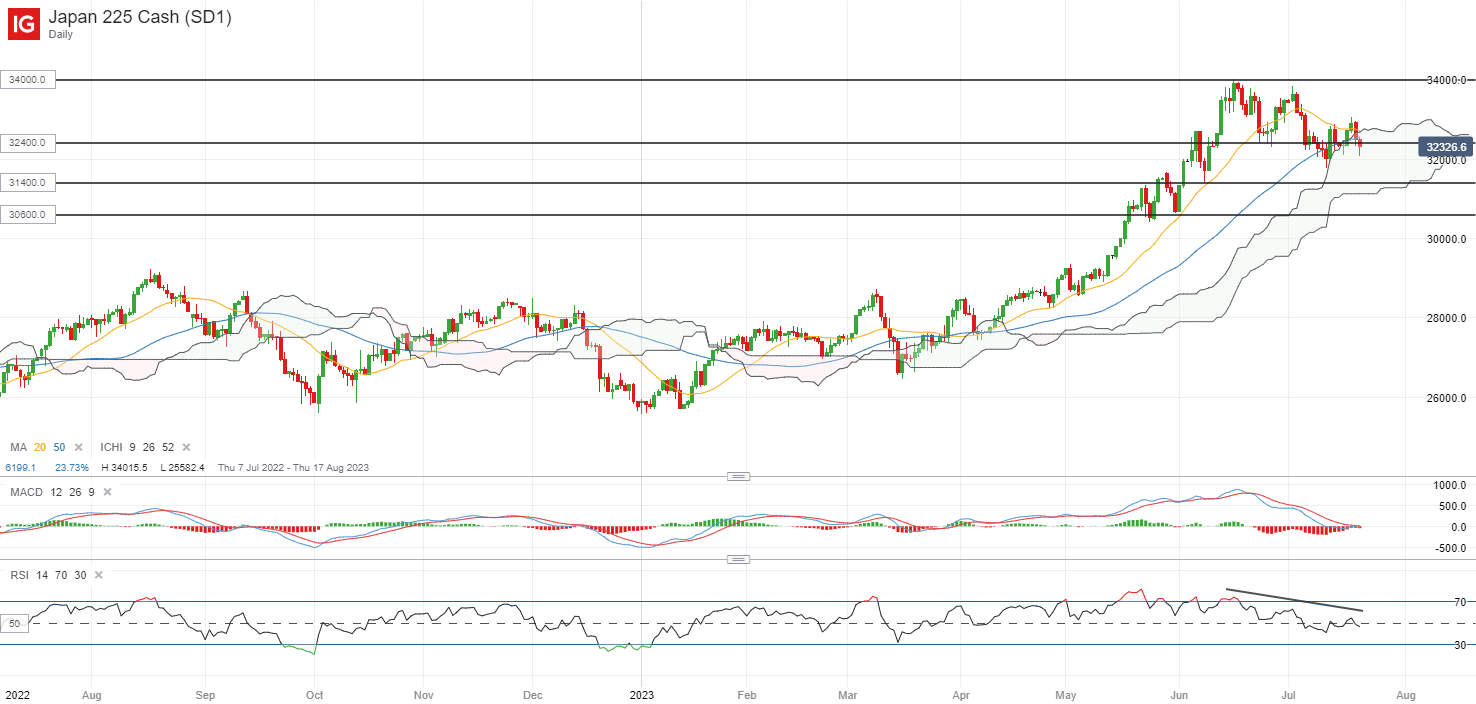

Any hawkish shift in coverage settings could also be destructive for the Nikkei 225 index, as seen from the two% sell-off again in December 2022 on the BoJ’s shock yield curve management (YCC) tweak. However whereas that’s nonetheless perceived to be a couple of conferences away, the index is at present making an attempt to defend a key double-top neckline on the 32,400 stage. The latest decrease highs on its Relative Power Index (RSI) level to some exhaustion in upward momentum for now, whereas the index makes an attempt to remain above its 100-day shifting common (MA) for now. Failure to defend the 32,400 stage might doubtlessly pave the best way in the direction of the subsequent line of assist on the 31,400 stage.

Supply: IG charts

On the watchlist: AUD/JPY again to retest key resistance as soon as extra

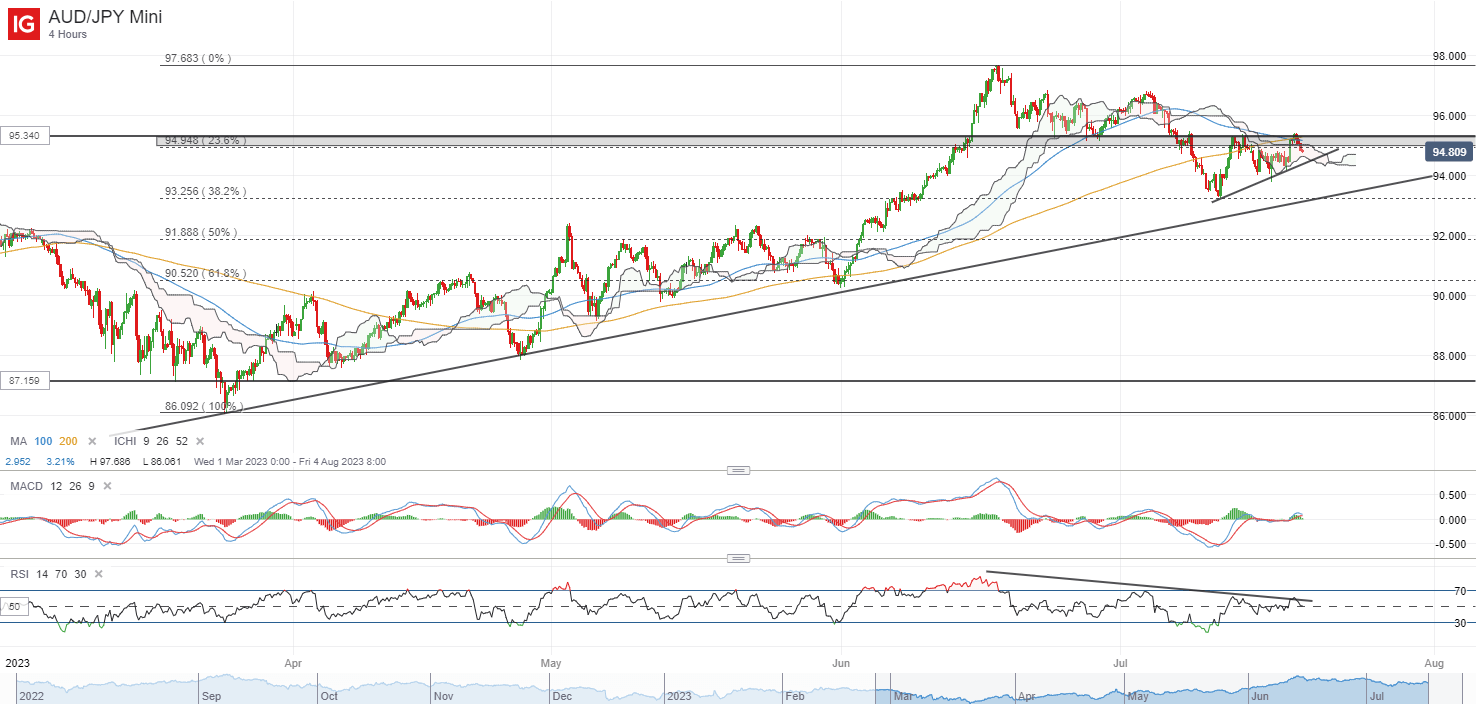

A warmer-than-expected jobs information out of Australia yesterday has prompted a hawkish recalibration in price expectations for the Reserve Financial institution of Australia (RBA), as market contributors value for a better odds of a 25 bp transfer from the central financial institution subsequent month. That triggered an preliminary soar within the AUD/JPY earlier than the extra subdued threat surroundings dampened some optimism across the risk-sensitive AUD.

With that, the AUD/JPY is as soon as once more again to retest its key resistance on the 95.34 stage, with a near-term ascending triangle sample in place on the four-hour chart. Patrons might have to beat the 95.34 stage to offer larger conviction for a transfer to retest its June 2023 excessive, however for now, the dangers of a decrease excessive continues to be current, with any draw back doubtlessly leaving the 93.20 stage on watch as fast assist.

Really helpful by Jun Rong Yeap

Get Your Free AUD Forecast

Supply: IG charts

Thursday: DJIA +0.47%; S&P 500 -0.68%; Nasdaq -2.05%, DAX +0.59%, FTSE +0.76%

factor contained in the factor. That is in all probability not what you meant to do!

Load your software’s JavaScript bundle contained in the factor as an alternative.

Source link