Adam Bettcher

Construct-A-Bear Workshop, Inc. (NYSE:BBW) operates as a multi-channel retailer of plush animals and associated merchandise. The corporate operates by means of three segments: Direct-to-Client, Business, and Worldwide Franchising.

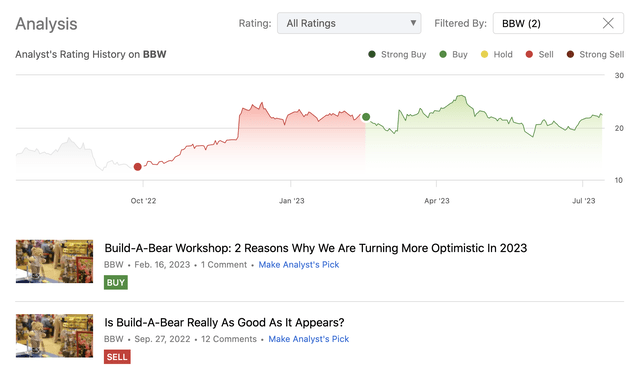

Now we have been following BBW since Q3 2022 and have printed two articles concerning the agency on Looking for Alpha since then.

Evaluation historical past (Writer)

In Q3 2022 we now have initiated a protection with a “Promote” score because of the important macroeconomic headwinds, together with poor shopper sentiment, elevated uncooked materials costs and elevated ranges of inflation. At the moment we believed that these components are more likely to negatively impression the agency’s monetary efficiency within the close to time period.

A lot to our shock, the inventory worth has climbed regularly from that time onwards. Early 2023 we now have revised our earlier thesis and noticed that regardless of these headwinds BBW has managed to maintain its internet revenue margin steady, whereas additionally rising the agency’s effectivity, as indicated by the asset turnover. This led to a score improve to “purchase”, nevertheless we highlighted a lot of components that buyers have to pay shut consideration going ahead. These had been stock administration and the event of accounts receivable in relation to income development.

Right now, we’re going to try the macroeconomic surroundings to get a broad image about what to anticipate going ahead. We may even concentrate on among the dangers and their developments that we now have talked about earlier.

Macroeconomic surroundings

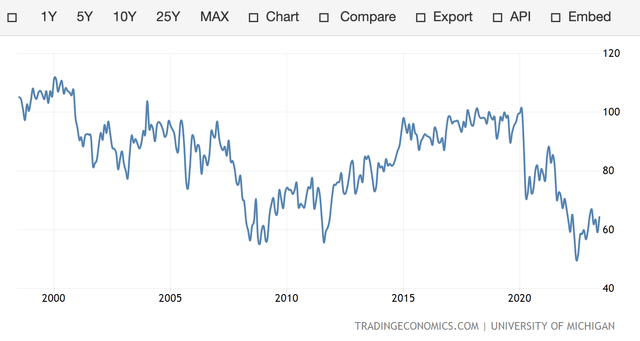

When writing about corporations within the shopper discretionary sector, usually we prefer to check with the buyer confidence to outline our expectations concerning the close to future. Client confidence is usually handled as a number one financial indicator, which goals to seize the buyer’s monetary outlook within the close to time period. Low readings are typically unhealthy as they point out that persons are much less assured in spending bigger sums on sturdy, discretionary objects as they’re extra unsure about their monetary future.

U.S. Client confidence (tradingeconomics.com)

Once we mentioned shopper sentiment in our earlier articles, the readings had been at historic lows. Since then sentiment has considerably improved, but it surely nonetheless stays across the lows seen in the course of the 2008-2009 monetary disaster.

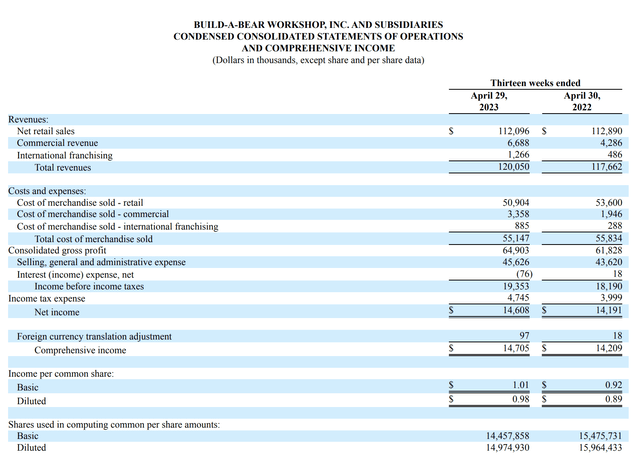

Regardless of the difficult surroundings, BBW’s monetary ends in the earlier quarter have been excellent, regardless of lacking analyst estimates by way of income:

Generates complete revenues of $120.1 million representing a file for this fiscal quarter Achieves pre-tax earnings of $19.4 million, a file stage for the third consecutive fiscal first quarter Delivers first quarter diluted earnings per share of $0.98, the very best in its historical past for the interval Fiscal year-to-date the Firm returned $28.6 million to shareholders by means of dividends and share repurchases

Earnings assertion (BBW)

From the earnings assertion it’s seen that regardless of the poor shopper sentiment, the demand for BBW’s merchandise stay excessive, resulting in sturdy income era.

Additional, the agency has additionally reiterated its steering for the total yr.

The retailer stated it expects 2023 income development of +5% to +7% year-over-year with development recording in all three of its segments. That steering vary works out to income of round $492M to $501M vs. $496M consensus. Construct-A-Bear additionally expects pre-tax earnings to extend 10% to fifteen% for the total yr. On the event entrance, 20 to 30 expertise areas are anticipated to be added this yr with capex spending focused at $15M to $20M.

This reiteration may give causes for additional optimism amongst buyers, as administration additionally seems to consider that the difficult macroeconomic surroundings isn’t going to have extreme impacts on the agency this yr.

For these causes, we stay bullish on BBW’s inventory within the close to time period.

Firm particular concerns

In our earlier writing we now have been elaborating on internet revenue margin, stock administration and the rise in accounts receivable. So allow us to have a look at these two subjects as soon as once more to see how the image has modified over time.

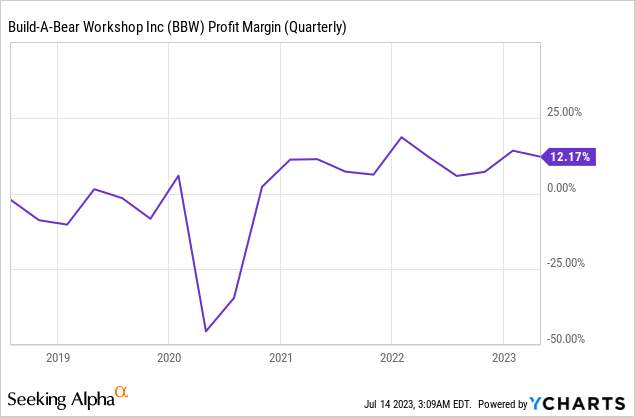

Internet revenue margin

Revenue margin has continued to be relative fixed, which is an effective signal within the present market surroundings. We consider that with a doubtlessly bettering macro surroundings, BBW will probably be capable of even increase its margins in the long term.

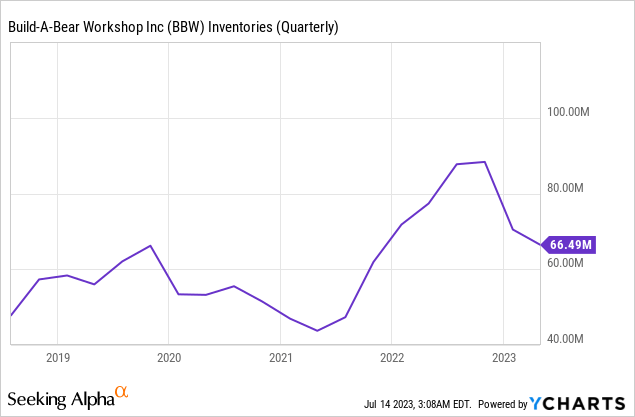

However, as talked about in our earlier article, extreme stock and the necessity to do away with extreme stock could require important discounting, resulting in a margin contraction within the close to time period. To evaluate this, allow us to have a look at the stock ranges.

Stock

Stock ranges have fallen considerably since late 2022, which is an effective signal. Even higher that the agency has managed to attain this discount with out hurting its internet revenue margin materially.

This improvement is unquestionably a optimistic one since our final writing and for these causes, we as soon as once more consider that sustaining our bullish view is justified.

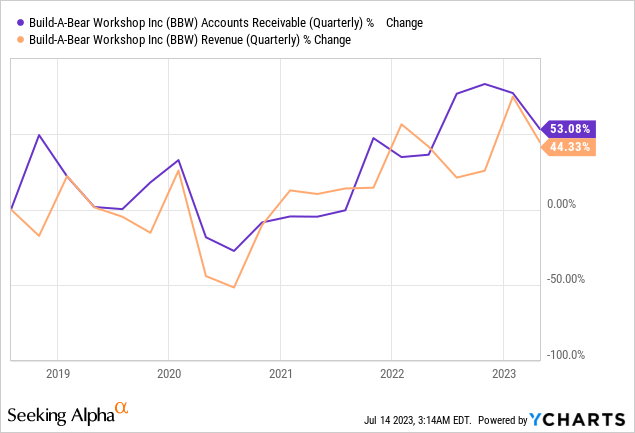

Accounts receivable

We usually have a look at accounts receivable development in relation to income development to gauge whether or not the corporate is inflating its gross sales figures or not. Generally, when accounts receivable develop a lot sooner than income, it’s probably that the agency is promoting extra on credit score to tug ahead demand from future intervals or has modified its income recognition coverage.

Fortuitously, we’re as soon as once more pleased to see the latest developments. Accounts receivable development has slowed considerably and it’s presently roughly in-line with income development. The divergence that we now have seen within the earlier quarters has virtually closed.

To sum up

The demand for BBW’s merchandise continues to stay sturdy regardless of the difficult macroeconomic surroundings. Though the agency has missed income estimates within the earlier quarter, the agency has delivered excellent outcomes, together with file gross sales and file pre-tax earnings.

The corporate has managed to maintain its profitability steady and has lowered its stock considerably from the 2022 highs. Accounts receivable development has additionally slowed, making us much less suspicious about income manipulation.

The agency has additionally reiterated its full yr steering.

For these causes, we preserve our “purchase” score.