Krezofen

Mazda Motor Company (OTCPK:MZDAY) is a good automotive choose to observe within the present atmosphere, because it advantages from some sensible strikes to premiumise, some current launches, restoration in volumes attributable to idiosyncratic provide points, and most significantly a depreciating Yen. The important thing factor to find out about Mazda is {that a} depreciating Yen would not create only a technical impact that would solely profit Yen denominated accounts, even the US listed models, listed in {dollars}, might proceed to profit because the depreciating Yen has a basic influence on the revenue profile of the corporate since it’s manufactured with Japanese components and bought in overseas markets. This argument is true for a lot of different Japanese automotive gamers as properly and is a crucial backstop for the Japanese inventory market, which is overwhelmingly automotive-exposed. Whereas Mazda is a holistically right choose, we nonetheless suppose there are different European automotive gamers with a extra pronounced margin of security, even when Mazda flows finest with the adjustments we’re seeing within the present market.

FY Outcomes

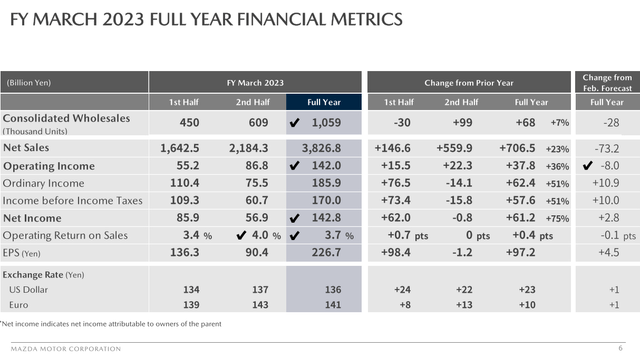

The models are up properly by 11% as the corporate recovers from points that hit volumes in Shanghai, inflicting normal manufacturing delays. China is down 50%, however that’s to be anticipated given their credit score and COVID-zero scenario that affected a lot of the yr. The gross sales have been up greater than volumes, as the corporate is benefiting each from current worth motion, but in addition from the truth that it has been premiumising over the past half-decade, and its ASPs are developing.

Precise Metrics 2023 (FY 2023 Pres) Forecast (FY 2023 Pres)

The working revenue grew additional as working leverage kicked in, helped by the CX-90 launch just lately in North America, which is Mazda’s most worthwhile market, in addition to from FX results, that are central to the story.

Since Mazdas are manufactured utilizing many Japanese components, and in factories which can be furnished meaningfully by Japanese industrial suppliers, a weaker Yen, which is the denomination of a lot of their value construction, is useful when the Yen is a a lot smaller proportion of their gross sales portfolio. The US market is essential for Mazda’s revenue and progress plans, and what appears to be a well-received launch of the CX-90 is essential.

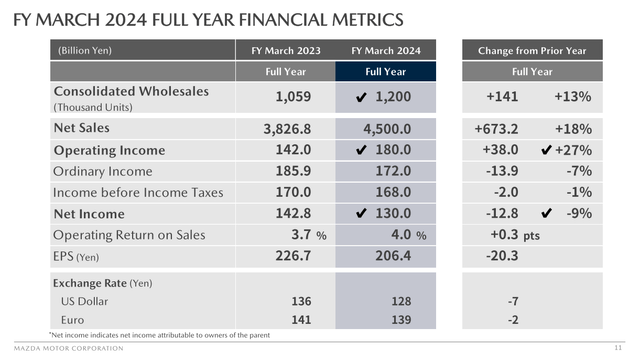

The Yen is prone to proceed to depreciate on robust jobs information. Jobs information are being affected by two structural forces: they lag the well being of the financial system, and they’re additionally presently being affected by fairly low ranges of labour participation, which nonetheless has a adverse influence on the general labour provide. We’re fearful a couple of recession, however we predict the setup lends itself to extra rate of interest hikes and extra belligerent labour figures till one thing provides. Mazda forecasts a Yen appreciation in 2024 which might be to their detriment, however we predict that this won’t occur but and that Mazda will profit for one more yr from a weak Yen. In different phrases, we predict outcomes can be a bit stronger than anticipated from the FX aspect, and likewise given the robust forecasts for models, particularly in a rebounding China.

Backside Line

Whereas Mazda has been executing properly, together with doing issues on the advertising and gross sales aspect to enhance gross margins and drive down among the overheads along with benefiting from economies of scale, volumes are the primary supply of concern for us. The Yen could also be reliably weaker than the USD in the meanwhile, however pent-up demand in automotive must be exhausted in some unspecified time in the future, and it is unclear if new automobiles financed by leverage are going to get purchased at increased charges than earlier than. Whereas the flexibility to compete on worth because of a Yen denominated value construction helps, in addition to the truth that Mazda was particularly impacted by Shanghai lockdowns and has these misplaced volumes to get well, macro is a priority for us. Some analysts suppose that Q2 would be the final quarter earlier than a plateau. Greater charges plus increased automobile costs are a harmful mixture for leveraged durables demand. Nonetheless, a big steadiness of Toyota Motor (TM) shares in addition to web money balances make the corporate low cost at an EV/EBITDA TTM of two.8x. Whereas compelling, we nonetheless suppose a extra aggressive margin of security could be present in Volkswagen (OTCPK:VWAGY) and its manufacturers after the current Porsche IPO and the potential worth in its different luxurious segments like Lamborghini contemplating Ferrari’s (RACE) valuation. Nevertheless, we select to not take positions in automotive in the meanwhile.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.