Adnan Ahmad Ali/iStock Editorial by way of Getty Photos

The market is just like the climate, it adjustments usually. The market’s fickle nature is partly why shares usually result in losses for retail traders. By going “all-in’ or “all-out,” particular person traders can usually be overexposed to the sudden adjustments the market brings. That is very true when the market has handled traders effectively because it creates a way of safety – or worse, complacency.

Our web site is exclusive in that we offer lively administration. This has helped us outperform throughout 4 audit intervals. Our stance is the climate will all the time change – from good occasions to unhealthy occasions, and from unhealthy occasions to good occasions. Subsequently, we aren’t over-exposed in both path.

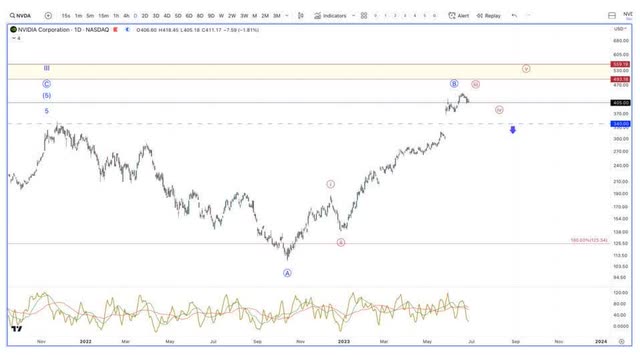

An instance of that is Nvidia Company (NASDAQ:NVDA), our largest place. Because the allocation grew effectively past 10%, we took positive factors. Even after taking positive factors, the corporate is at the moment at a 17% allocation. In Could and June, I acknowledged that our agency was not shopping for Nvidia at the moment. Properly, just like the climate, this has modified. My agency purchased a small tranche of Nvidia inventory yesterday for $410. This tranche will include a cease, which means if the inventory sells off, we are going to shut this 2% tranche whereas hedging the 15% unique place.

Our Present Nvidia Commerce:

With the money we raised all through 2022, NVDA was the first goal of deploying a few of this money as soon as our evaluation signaled a backside was in place. The beneath is a real-time commerce notification we despatched to our members on the October thirteenth.

Tech Insider Community

The above alert was 1 of 9 alerts we despatched out from 2021 – 2022 to purchase NVDA beneath $200. Nonetheless, since February of 2023, we now have been systematically taking positive factors at key ranges based mostly on technical and macro warnings. Even with logging sizable wins whereas elevating money, it within the prime place in 2023.

In our pre-earnings buy-plan for NVDA, we acknowledged that

“It’s our perception that NVDA is organising for a large pullback, which we imagine will open the door for higher long-term entries.”

Although we do imagine that decrease ranges will manifest in time, the current earnings report moved ahead expectations concerning AI, which is displaying up within the worth motion. We now have been discussing that Nvidia might be an AI chief for years with an allocation to match, but predicting the precise day and month the market would lastly worth on this thesis is inconceivable to foretell (and timing to this stage isn’t essential when holding a big longer-term place)

Relating to worth, we work in possibilities, and when the market adjustments, so will we. The important thing to NVDA in the present day is the massive hole from their earnings report. This hole is both a breakaway hole, or an exhaustion hole. If it’s a breakaway hole, which is represented by our pink rely beneath, then it’s the midway level on this push larger. Then again, if worth breaks beneath $340, seemingly on some sort of “occasion,” then the hole is an exhaustion hole, and can mark a bigger prime. That is represented by our blue rely.

Tech Insider Community

The $405 – $395 area will seemingly proceed to behave as robust assist for the pink rely. That is the place we added again in anticipation for a ~38% push larger. Our cease for this transfer might be a break beneath the $340 crucial assist area, which is ~14% decrease than our entry.

Not like many, we don’t imagine AI is a bubble, nor do we predict the valuations in a few of these names is stretched, as many imagine. What does concern us concerning doable “occasions” are: 1) geopolitical tensions forcing a ban of promoting NVDA’s chips to China – which Beth spoke about in Could with Bloomberg Asia; 2) the inevitable recession that can seemingly begin to be priced into equities in This autumn/Q1, however might get pushed ahead because of an unexpected occasion.

Due to these dangers, we’re shopping for with an exit plan for any new entries. It’s our perception, based mostly on the financial knowledge, {that a} recession is a extra seemingly than not for the U.S. financial system. Nonetheless, based mostly on present projections on timing, we might see a continued push in AI management via year-end. That is what we’re additional positioning our portfolio for, with the belief that we might prime out ahead of anticipated.

The Tech Insider Community has been beating the drum about AI for five years. Now that it’s right here, we’re concentrating on alternative mid-cap to mega-cap names within the coming pullback. As soon as this exuberance runs its course, and the market provides up on AI, we might be shopping for the dip for this once-in-a-lifetime tech development that’s simply beginning. Be part of us the week following the vacation, Thursday, 7/13, at 4:30 EST the place we are going to go over the precise AI shares we’re concentrating on. We’ll present the macro backdrop, together with entry costs.

Really helpful Studying:

Try Tech Insider Community

Try Tech Insider Community

We provide tech sector protection that mixes fundamentals and technicals. After recommending a inventory, we offer entries and exits.

Our audited 3-year outcomes of 47% show we’re a top-performing tech portfolio. This compares to fashionable tech ETFs at damaging 46% and the Nasdaq at 19%.

We’re the one retail group featured repeatedly in Tier 1 media, akin to Fox, CNBC, TD Ameritrade and extra.

Our companies consists of an automatic hedge, portfolio of 10+ positions, broad market evaluation, real-time commerce alerts PLUS a weekly webinar each Thursday at 4:30 pm Jap.

Study extra.