Knowledge up to date dailyConstituents up to date yearly

One of many challenges that self-directed retired buyers face is developing an funding portfolio that generates an identical quantity of dividend revenue every month.

This problem turns into way more manageable if buyers have entry to a database of shares that pay dividends in every calendar month.

That’s the place Positive Dividend is available in. We preserve an inventory of shares that pay dividends in July, out there for obtain under:

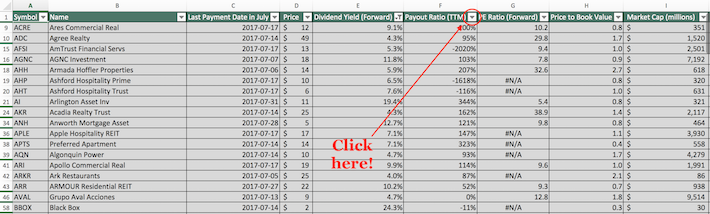

The database of shares that pay dividends in July out there for obtain above accommodates the next info for every inventory within the database:

Final cost date within the month of July

Dividend yield

Dividend payout rartio

Worth-to-earnings ratio

Worth-to-book ratio

Return on fairness

Market capitalization

Beta

Hold studying this text to be taught extra about how you should utilize our record of inventory that pay dividends in July to assist make higher portfolio administration selections.

Word: Constituents for the spreadsheet and desk above are from the Wilshire 5000 index, with information offered by Ycharts and up to date yearly. Securities outdoors the Wilshire 5000 index usually are not included within the spreadsheet and desk.

How To Use The Checklist of Shares That Pay Dividends in July to Discover Funding Concepts

Having an Excel doc that accommodates the title, ticker, and monetary info for each inventory that pays dividends in July might be fairly helpful.

This doc turns into much more highly effective when mixed with a working information of Microsoft Excel.

With that in thoughts, this tutorial will reveal how one can apply two helpful investing screens to our database of shares that pay dividends in July.

The primary display screen that we’ll implement will seek for shares with excessive dividend yields and huge market capitalizations. Extra particularly, we’ll display screen for shares with yields above 3% and market capitalizations above $10 billion.

Display 1: Dividend Yields Above 3%, Market Capitalizations Above $10 Billion

Step 1: Obtain your free record of shares that pay dividends in July by clicking right here.

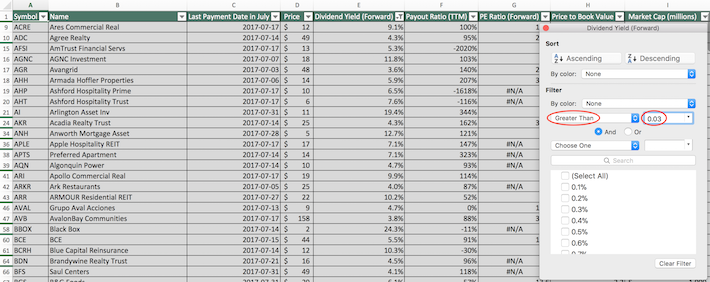

Step 2: Click on the filter icon on the prime of the dividend yield column, as proven under.

Step 3: Change the filter setting to “Higher Than” and enter 0.03 into the sector beside it, as proven under. This can filter for shares that pay dividends in July with dividend yields above 3%.

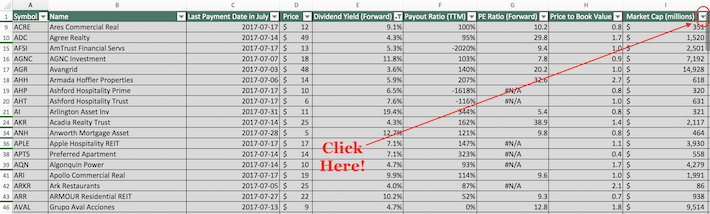

Step 4: Shut out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button within the backside proper nook). Subsequent, click on the filter icon on the prime of the market capitalization column, as proven under.

Step 5: Change the filter setting to “Higher Than” and enter 10000 into the sector beside it. Since market capitalization is measured in thousands and thousands of {dollars} on this spreadsheet, that is equal to filtering for shares with market capitalizations above $10 billion.

The remaining shares on this spreadsheet are shares that pay dividends in July with dividend yields above 3% and market capitalizations above $10 billion.

The subsequent display screen that we’ll reveal is for shares with dividend yields above 4% and payout ratios under 100%. This display screen is helpful for buyers who want dividend yield now however don’t wish to danger investing in firms with payout ratios above 100%.

Display 2: Dividend Yields Above 4%, Payout Ratios Under 100%

Step 1: Obtain your free record of shares that pay dividends in July by clicking right here.

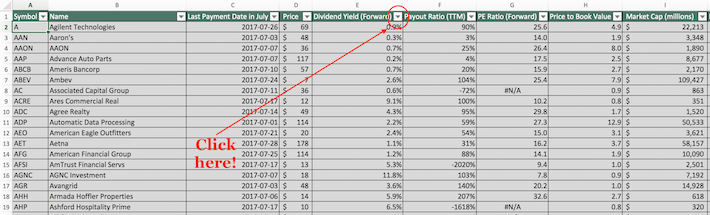

Step 2: Click on on the filter icon on the prime of the dividend yield column, as proven under.

Step 3: Change the filter setting to “Higher Than” and enter 0.04 into the sector beside it. This can filter for shares that pay dividends in July with dividend yields above 4%.

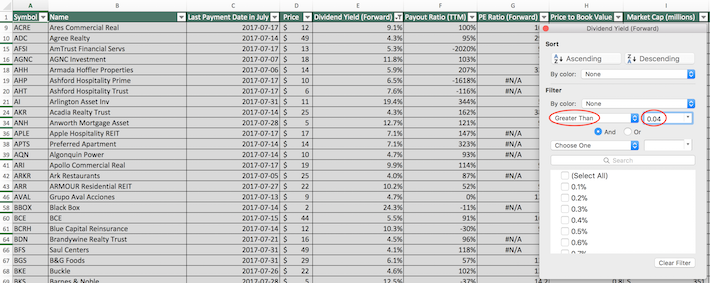

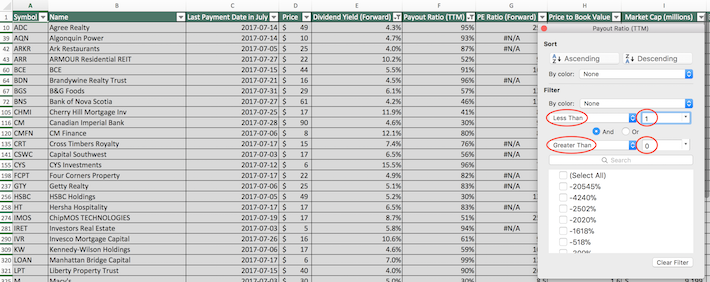

Step 4: Shut out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button within the backside proper nook). Subsequent, click on on the filter icon on the prime of the payout ratio column, as proven under.

Step 5: Likelihood the first filter setting to “Much less Than” and enter 1 into the sector beside it. This can filter for shares that pay dividends in July with payout ratios under 100%.

Moreover, change the secondary filter setting to “Higher Than” and enter 0 into the sector beside it. This can filter out shares which have detrimental payout ratios – which is even worse than shares with payout ratios above 100%.

The remaining shares on this spreadsheet are shares that pay dividends in July with dividend yields above 4% and payout ratios between 0% and 100%.

You now have a strong understanding of how you can use our database of shares that pay dividends in July to seek out funding concepts.

To conclude this text, we’ll introduce a number of different helpful investing databases that you should utilize to enhance your long-term investing outcomes.

Closing Ideas: Different Helpful Investing Sources

July is just not a very particular month of the 12 months in terms of dividend revenue. This text (and the related database) is a part of a complete suite of dividend calendar options. You may entry related databases for the opposite 11 calendar months under:

Diversifying your dividend revenue by calendar month is essential for retirees and different income-oriented buyers.

One other necessary element of diversification is having investments in each main sector of the inventory market.

With that in thoughts, Positive Dividend maintains databases of the next inventory market industries, which can be found for obtain under:

Diversification apart, our analysis means that the most effective place to seek out compelling funding alternatives is amongst shares with lengthy histories of steadily rising their dividend funds.

The next databases are helpful sources if this strategy sounds interesting to you:

The Dividend Aristocrats: the Dividend Aristocrats are a gaggle of elite S&P 500 dividend shares with 25+ years of consecutive dividend will increase

The Dividend Achievers: the requirement to be a Dividend Achiever is 10+ years of consecutive dividend will increase, which ends up in a universe of shares that’s much less inclusive however extra diversified than the Dividend Aristocrats

The Dividend Kings: thought of to be the best-of-the-best in terms of dividend development shares, the Dividend Kings are a gaggle of firms with 50+ years of consecutive dividend will increase

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].