hapabapa

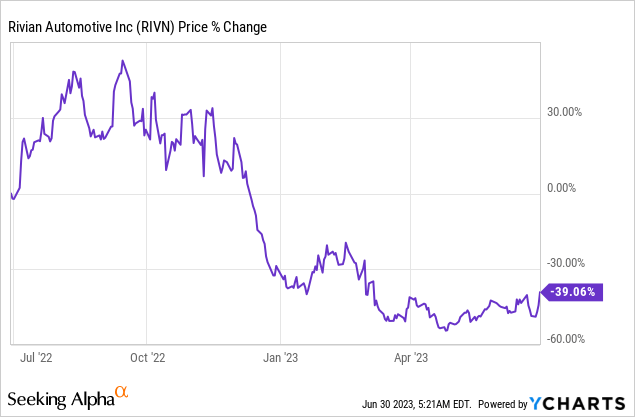

The U.S. electrical car trade within the U.S. has seen huge worth destruction within the final 12 months as buyers began to query the supply realities of corporations akin to Rivian Automotive (NASDAQ:RIVN) and lots of others. Rivian Automotive’s share worth has declined 39% within the final 12 months and in April made a brand new low at $11.68. Quite a lot of components have pushed Rivian’s share worth to new lows together with waning EV demand and decreased manufacturing targets as a consequence of provide chain dislocations. Brief-sellers have ramped up their publicity to Rivian because of this. Since Rivian has about 75% of its market cap in money, the hovering quick curiosity ratio doubtlessly signifies that the EV firm could possibly be a brief squeeze candidate!

EV trade experiences a shake-out, Lordstown information for chapter

Shares of electrical car producers haven’t precisely been robust performers within the final 12 months, largely as a result of provide chain issues and logistical challenges have brought about many EV makers to overlook manufacturing targets.

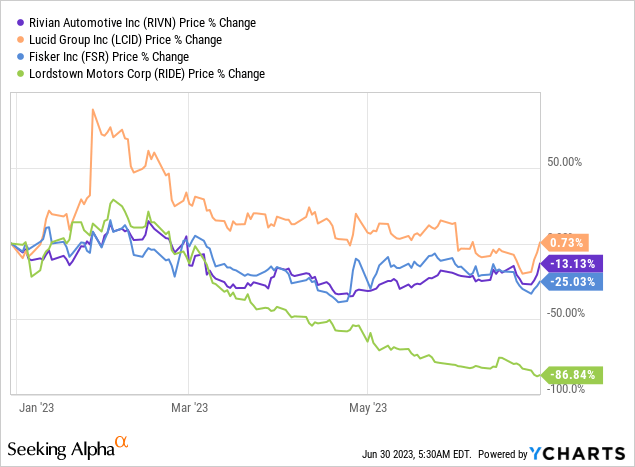

In 2023, a brand new subject began to have an effect on the sector, weakening client demand, which has brought about corporations like Lucid Group (LCID) to not report reservation numbers. One other EV-focused firm, Lordstown (RIDE) even filed for chapter this week because the enterprise ran out of money and the corporate is now suing its contract producer and investor Foxconn for $170M.

The chapter of electrical car start-up Lordstown has not served the EV trade as a complete and firms like Lucid, Rivian or Fisker (FSR), which all have reported disappointing supply numbers in latest quarters, have carried out terribly dangerous. Of all the businesses talked about right here, solely Lucid managed to squeeze out a optimistic YTD return of 0.73%, partly as a result of the corporate hinted at coming into the quickly increasing Chinese language EV market.

Rising quick curiosity ratios for EV corporations, hovering quick curiosity for Rivian

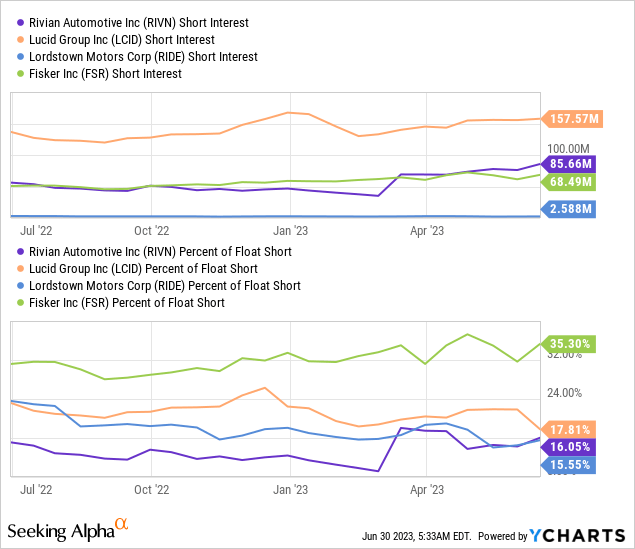

The decline in EV market valuations has coincided with an enormous enhance within the quick curiosity ratios of electrical car corporations. Rivian presently has about 86M of its excellent shares shorted which calculates to a brief curiosity ratio (based mostly on float) of 16%. Different EV producers even have sky-high quick curiosity ratios with Fisker presently having the very best: 35%.

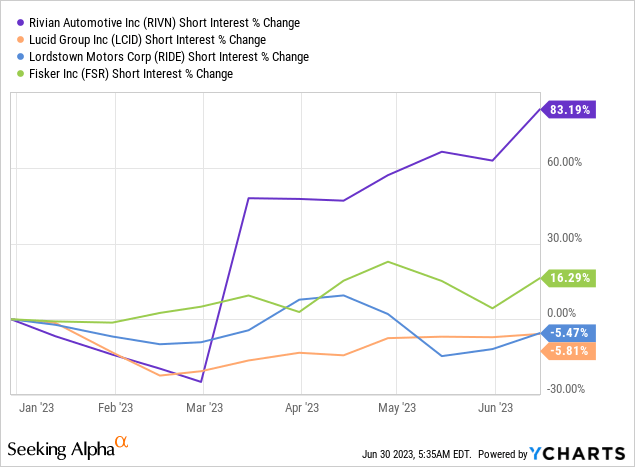

What stands out is that Rivian particularly has seen an enormous enhance in its quick curiosity ratio, a robust indication {that a} rising portion of the market believes that Rivian could have difficulties in assembly its manufacturing objectives for FY 2023. Rivian’s quick curiosity ratio has gone up probably the most within the trade group, YTD, by 83%… which is greater than 5 occasions increased than Fisker’s.

The big enhance in Rivian’s quick curiosity ratio makes Rivian a possible quick squeeze goal, particularly if the corporate reviews robust Q2’23 earnings, confirms its FY 2023 manufacturing goal or reviews some other excellent news… such because the adoption of Tesla (TSLA)’s NACS charging normal.

Rivian adopts NACS charging normal, rising attraction of Rivian’s EV portfolio

Earlier in June, Rivian mentioned that it’ll be a part of the North American Charging Commonplace which was developed by EV pioneer Tesla. Rivian joined the NACS charging normal after different corporations within the U.S. adopted Tesla’s charging normal as nicely: Ford (F) adopted the NACS normal in Could — Ford Hits A Homerun With Tesla Partnership — adopted by Basic Motors (GM) in June, thereby permitting patrons of a brand new EV to make use of Tesla’s 12 thousand superchargers within the U.S. and Canada. The adoption of Tesla’s NACS charging port harmonizes the electrical car charging infrastructure in North America and makes the acquisition of a Rivian EV extra engaging from a client standpoint. Because the announcement, shares of Rivian have revalued about 10% increased.

Rivian continues to be extremely valued, however excessive quick curiosity is a possible drawback

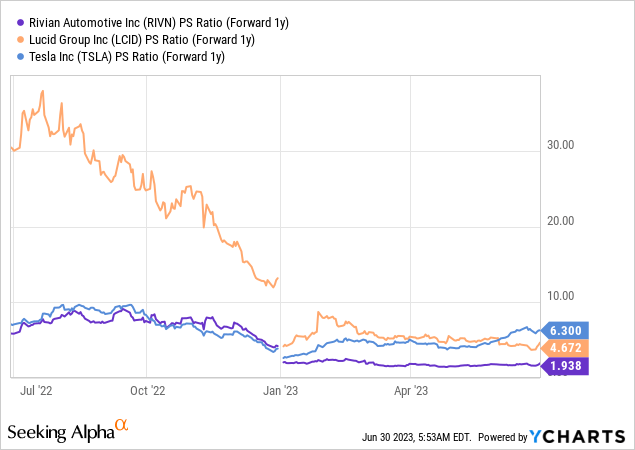

I’ve repeatedly written about Rivian and mentioned that I think about the EV firm to be overvalued, based mostly off of the place the corporate presently stands with its manufacturing: Rivian produced solely 24,337 electrical autos in FY 2022, though the corporate guided for a manufacturing quantity of 25,000… which itself was lowered from 50,000 EVs earlier that 12 months. Rivian continues to be extremely valued with a P/S ratio of 1.94X. Though Rivian’s EV potential shouldn’t be as costly as Tesla’s or Lucid’s. Nevertheless, given the big enhance in Rivian’s quick curiosity ratio recently, I truly see Rivian as a possible quick squeeze candidate. That is the primary purpose why I’m upgrading my promote score to a maintain score.

There are dangers with Rivian, however the steadiness sheet shouldn’t be considered one of them

Rivian has a really robust steadiness sheet with money sources of roughly $11.2B on the finish of March 2023 which calculates to about $12 per share in money (75% of Rivian’s market cap). Funding the EV ramp is subsequently not an actual threat that I see for Rivian. The most important business threat, in my view, pertains to Rivian’s manufacturing trajectory. Rivian lowered its manufacturing goal from 50,000 EVs to 25,000 EVs in 2022 and could possibly be prone to having to decrease its manufacturing steering for FY 2023 if EV demand continues to weaken. For the present 12 months, Rivian expects a doubling of manufacturing to roughly 50,000 EVs. A failure to fulfill this manufacturing goal might lead to a continuous uptick within the quick curiosity ratio.

Closing ideas

Rivian has had its honest quantity of challenges, together with softening client demand and a slower than anticipated manufacturing ramp, however what the corporate would not have is a money drawback. Rivian has the very best steadiness sheet within the trade, in my view, and the corporate’s excessive money per-share worth limits additional draw back potential. Contemplating that I nonetheless imagine shares of Rivian to be costly, I do not imagine an organization with 75% of its market cap tied up in money is a promising quick candidate. Fairly the alternative: the huge enhance in Rivian’s quick curiosity ratio now makes the corporate a possible quick squeeze candidate!

Editor’s Notice: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.