2023.06.30

Gold and silver costs have each seen spectacular jumps this yr, with gold coming inside cents of an all-time excessive, and silver additionally flirting with value ranges final seen a decade in the past.

However the valuable metals rally, in line with some, has solely simply begun. One analyst believes it’s solely a matter of time earlier than gold surpasses double digits on its solution to $12,000-15,000 an oz..

In a current interview, Adam Rozencwajg of Goehring & Rozencwajg (G&R), the Wall Avenue commodities funding agency, stated “We predict that gold has entered into a brand new part of this bull market.”

Rozencwajg bases this assertion on the agency’s first-quarter report, which discovered that two elements in 2020 prompted G&R to take a step again from gold: 1/ that the gold-oil ratio was favoring power, and a pair of/ that silver had “caught up” to gold.

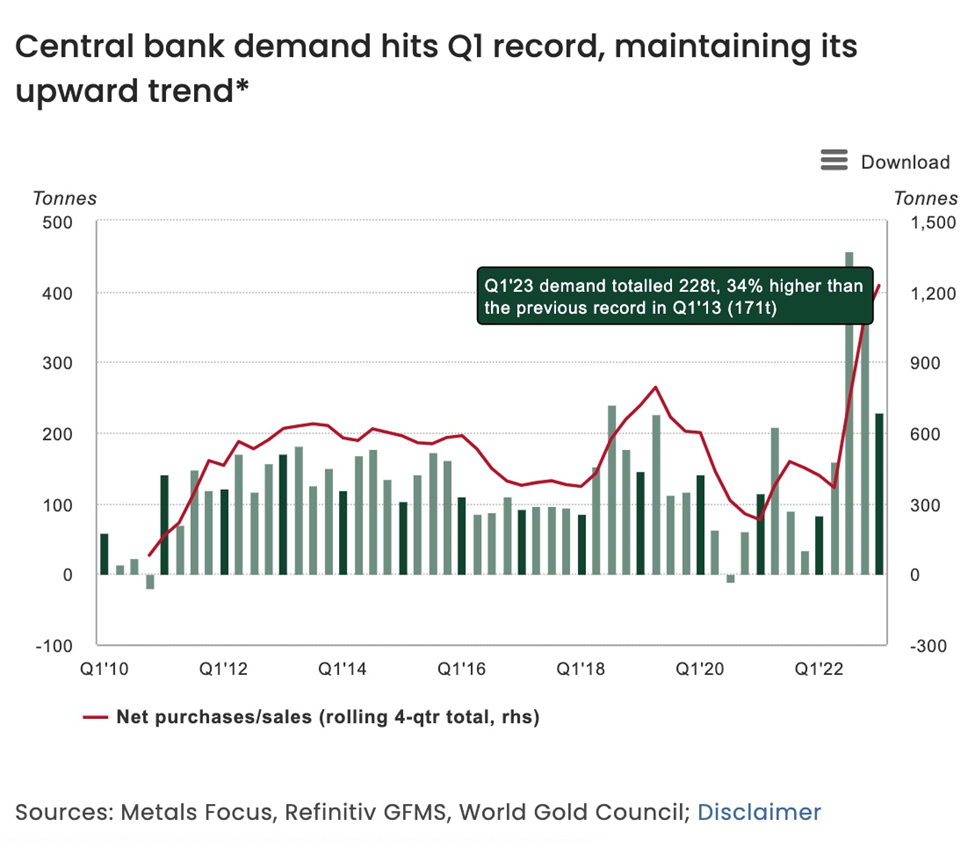

G&R now believes it’s time to step again in, principally attributable to demand for gold being pushed by central financial institution bullion purchases, which hit data in 2022 and the primary quarter of 2023, but additionally the results of elements resembling implied gold backing, referring to how a lot gold the federal government holds versus the variety of {dollars} in circulation. The worth of gold relative to different monetary belongings can also be essential. We focus on every of those ideas in flip.

Central financial institution shopping for

Rozencwajg says the brand new bull market part started within the third and fourth quarters of 2022, “and it actually revolves round central banks’ conduct as a lot as anything. I feel it’s going to propel gold a lot a lot greater on this leg of the bull market.”

Central banks truly stopping shopping for gold throughout covid, with some deciding to promote bullion to pay for social applications necessitated by virus-related financial slowdowns and enterprise closures.

After financial restoration in 2021-22, this conduct modified, with central banks within the combination shopping for extra gold within the fourth quarter of 2022 than that they had because the world went off the gold customary in 1971. Individually, some international locations purchased extra gold throughout this era than at another time. The development has carried ahead into 2023.

Within the first three months of the yr, central banks purchased a mixed 228 tonnes, probably the most ever seen in a primary quarter, World Gold Council information revealed.

This follows up on what was already a file yr in 2022, throughout which 1,136 tonnes of gold price some $70 billion have been added to the banks’ reserves. In comparison with the 450 tonnes purchased throughout 2021, that represents a whopping 152% year-on-year improve!

Purchases through the first quarter have been reported by each rising and developed-economy central banks, with 4 accounting for almost all: Singapore, China, Turkey and India.

WGC stated the torrid tempo of web shopping for in Q1 units the tone for a higher-midpoint of the council’s full-year estimate. Regardless of sizable web promoting in April, the group expects central banks to stay web gold purchasers in 2023.

It’s essential to grasp that central financial institution gold purchases are largely value insensitive, which means they don’t attempt to time the market to purchase low. “Now they’ve re-entered in a really materials trend they usually’re value insensitive, so I feel that’s gonna drive costs a lot a lot greater,” says Rozencwajg.

As for why central banks are shopping for gold, the reply nearly definitely has to do with a sense, notably amongst emerging-economy banks, that america goes to lose its reserve-currency standing, a place the US greenback has held because the finish of the Second World Battle.

In line with UBS analysts, this development of central financial institution shopping for is prone to proceed amid heightened geopolitical dangers and elevated inflation. In actual fact, the US choice to freeze Russian overseas trade reserves within the aftermath of the struggle in Ukraine could have led to a long-term influence on the conduct of central banks, the financial institution stated.

The geopolitical pressure additionally ties into the second cause as a result of it weakens the US greenback, as many rising economies look to diversify away from the USD of their reserve holdings and use gold instead. Russia, as a chief instance, can use gold to exchange the greenback and circumvent Western commerce sanctions.

Inside the US, the path of a weakening greenback is evident, with the Federal Reserve earlier this month pausing its tightening cycle after a sequence of rate of interest hikes over the previous 15 months. When the Fed cuts charges, it is going to weigh on each US Treasury yields and the dollar — each positives for gold.

Whereas there was loads of discuss over the previous few years of “de-dollarization”, the actual fact is there was no proof of nations utilizing currencies aside from the greenback for settling worldwide commerce transactions. Till now. Amongst current examples, France introduced it is going to promote LNG to China priced in renminbi, China will purchase soy and iron ore from Brazil denominated in Chinese language foreign money, and crude oil trades between Saudi Arabia and China might be settled exterior the greenback.

“Any time you’re going to get a significant financial shock like that, like the tip of a reserve foreign money system and bringing in a brand new system, I feel that’s going to be actually good for gold,” says Rozencwajg.

“Secondly when you have all these international locations begin buying and selling with China there’s going to be an accumulation, an imbalance. You’re going to finish up with renminbi that accumulates in Saudi Arabia or regardless of the commodity-exporting nation is…

“The indications are wanting like you’ll at the very least use some gold to attempt to stability any large commerce surpluses or deficits, which means that within the case of Brazil you’ll promote all of your soybeans to China, accumulate renminbi, purchase as many Chinese language items as your economic system may deal with, after which no matter leftover renminbi you had, you would trade at the very least a portion on the Shanghai Gold Change for gold and use that to repatriate your capital. That’s not a gold customary explicitly by any means, that’s nonetheless very a lot a fiat paper system, nonetheless it will use gold at the very least on the margins to assist stability commerce imbalances and deficits and surpluses and to me that might be very in keeping with the exercise that we’re now seeing amongst the central banks accumulating big positions in gold of their reserves.”

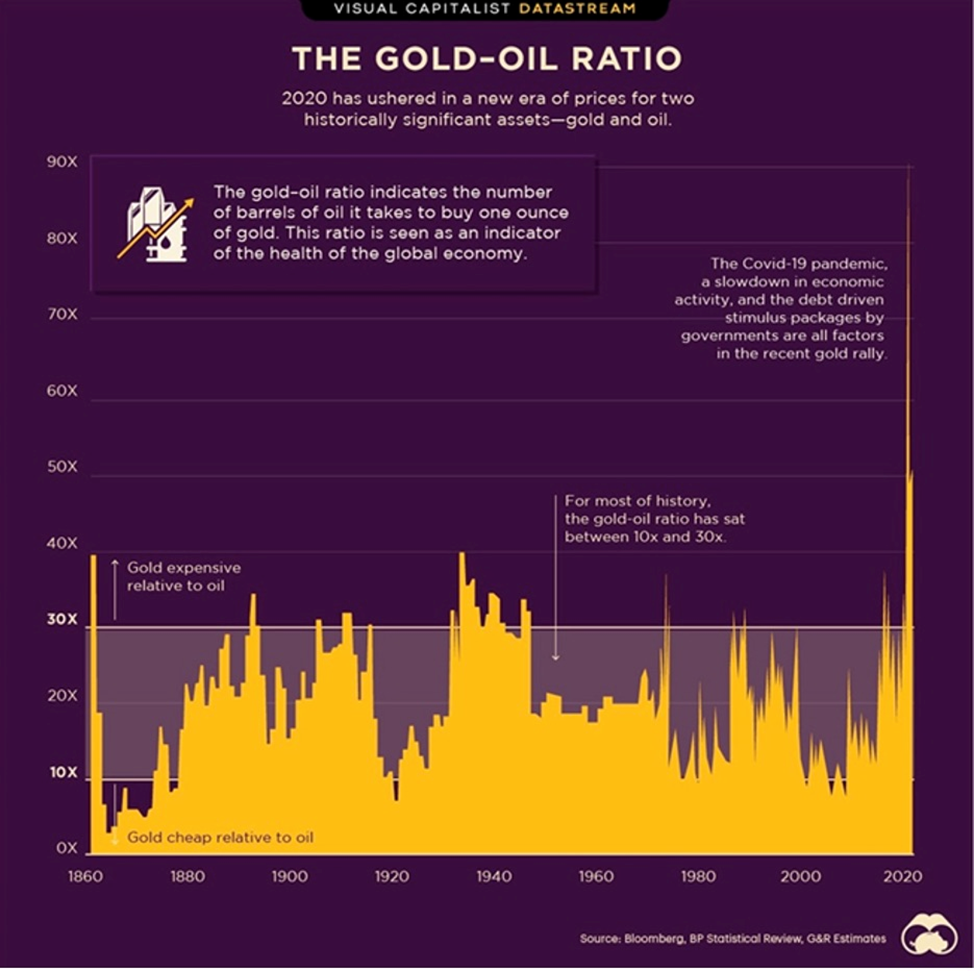

Gold-oil ratio

The gold-oil ratio is a crucial indicator of the worldwide economic system’s well being.

As a result of gold and crude oil are each denominated in US {dollars}, they’re strongly linked. That’s as a result of because the US greenback rises, commodities priced in USD fall, and vice versa. Because the greenback drops, commodities usually go up.

One other essential hyperlink between gold and oil is inflation. As a result of power includes about one-third of the Shopper Worth Index (CPI), when crude oil rises it impacts inflation. Gold being a standard inflation hedge, it follows that as greater oil costs result in elevated inflation, the gold value goes up, as extra buyers purchase gold to diversify out of inflation-losing belongings like bonds and money.

Gold and oil are additional associated in {that a} spike in oil costs dampens financial progress, as a result of so many industries depend upon it and its derivatives as a gasoline supply, i.e., pure gasoline, gasoline and diesel (Diesel gasoline is a significant enter for gold mining operations, subsequently as gasoline prices rise, so does a producer’s prices per ounce, which may result in decrease output. If this occurs throughout the business, decrease gold provide versus demand will hike costs).

A drop in world progress, notably within the two largest economies, america and China, may sign a recession is coming which is sort of all the time bullish for gold costs.

The chart beneath reveals the historic ratio between the gold value and West Texas Intermediate (WTI) crude. Merely put, the gold-oil ratio is what number of barrels of oil might be purchased with an oz. of gold.

The following chart by Visible Capitalist signifies that gold is dearer relative to grease when the gold-oil ratio is above 30. For many of historical past, the ratio has sat between 10 and 30.

The all-time ratio excessive of 91 in April 2020 was a mixture of plummeting WTI through the worst month of the coronavirus well being disaster, which at the moment was $16.80 towards a gold value of roughly $1,625. Keep in mind oil normally falls throughout recessions and gold rises. Nevertheless the covid-19 recession was extraordinarily short-lived. As economies recovered, progress and oil demand surged, thus reducing the ratio. When gold hit its all-time excessive of $2,074 in August 2020, WTI was nonetheless floundering at round $32. It took a greater than doubling of WTI over the subsequent 15 months, and gold to fall round $200, for the ratio to revert again to 25, a great distance from its historic excessive of 91 however nonetheless greater than its common 16.

Since 2020, Rozencwaj says G&R began to see a whole lot of indications that the gold-oil ratio had flipped in favor of power (it presently sits round 27). The fund subsequently exited gold.

“We acquired these two indicators on the identical time,” he says. “We had this concept that silver staged this catch-up rally, which up to now has been an indication that you just’re going to take a little bit of a breather, and also you had the truth that on a relative valuation foundation, the gold-oil ratio was so favorably skewed in the direction of power — we’ve by no means had a studying like that by which oil didn’t massively outperform gold.”

Silver catch-up

A typical knowledge is that silver outperforms gold in a powerful valuable metals market.

When valuable metals rallied in 2020, on the again of lockdowns, rates of interest slashed to zero, QE, and basic market concern, silver’s acquire was double that of gold. The worth ran up 43% from January to December, 2020, in comparison with gold’s mere 20.8% rise. Earlier within the yr, as gold punched above $2,000 an oz., a 39% acquire, silver rallied to just about $30 an oz., a 147% improve.

But throughout valuable metallic bulls, you typically have silver lagging gold earlier than the white metallic out of the blue spikes. For instance within the early Seventies, gold dramatically outperformed silver for the primary 24 to 30 months, earlier than silver staged a large rally, catching as much as gold and ultimately outperforming it. That is exactly what occurred in 2020, organising a cooling-off interval for valuable metallic costs that G&R thinks is nearly coming to an finish.

Worth goal

Goehring & Rozencwajg’s value goal for gold is between US$12,000 and $15,000, and whereas that will sound stunning to some, there are a couple of elements behind it.

They embody the connection between how a lot gold the federal government holds and the quantity of {dollars} in circulation, which G&R describes as an implied gold backing. Generally the greenback will get backed by a whole lot of gold and that normally implies that gold is overvalued relative to the greenback and vice versa.

Wanting on the value of gold relative to different monetary belongings is one other manner of calculating a gold value forecast.

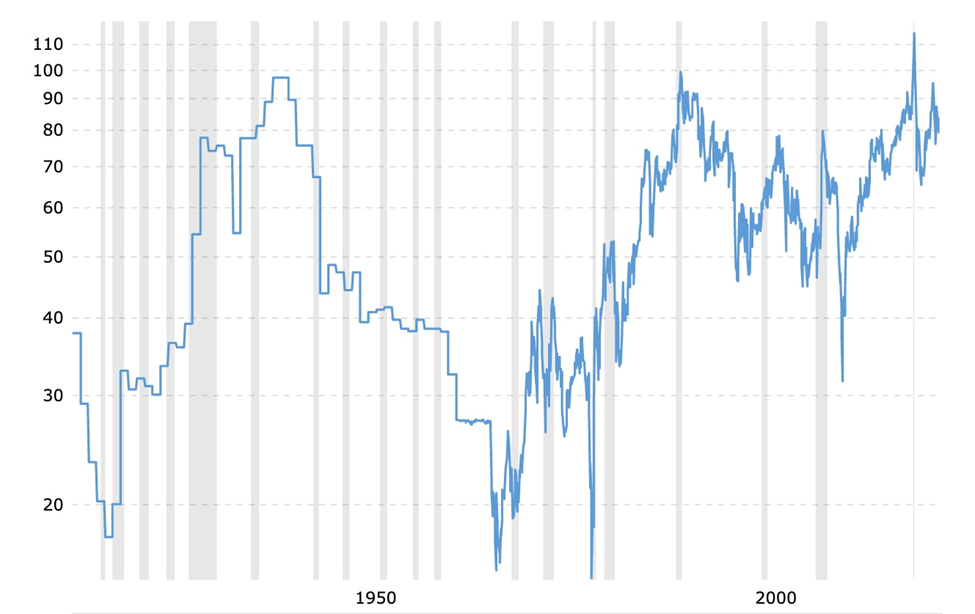

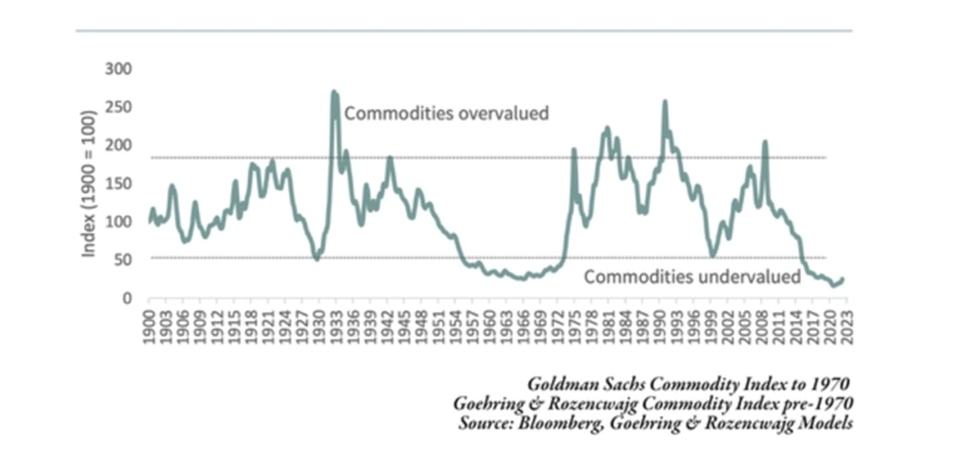

The managers of the Goehring & Rozencwajg Sources Fund say they’re typically requested, “Have I missed it? Is it too late to make an funding in pure assets?” Their reply is invariably, “Not solely is the commodity bull market not over, it has hardly begun.”

Their conclusion is predicated on the truth that commodities are presently valued far beneath monetary belongings, however they may shift to being overvalued, relative to financials, someday within the subsequent decade, which means there may be nonetheless a whole lot of upside to the sector.

If historical past is any information, the pendulum has to swing.

G&R presents a chart exhibiting during the last 130 years, there have been 4 instances when commodities grew to become very undervalued in comparison with the inventory market, measured by the Dow Jones Industrial Common.

These 4 intervals, equivalent to the bottom factors on the inexperienced line, have been 1929, the late Nineteen Sixties, the late Nineteen Nineties, and immediately. The important thing message is that after every stint of undervaluation, commodities entered giant bull markets, earlier than changing into overvalued.

Traders who have been sensible (and courageous) sufficient to speculate throughout undervalued intervals noticed big positive aspects, even within the Nineteen Thirties. For instance, investing in a pure useful resource portfolio (25% metals and mining, 25% valuable metals, 25% agriculture, 25% power) in 1929 would have returned 122% by 1940, clobbering the inventory market, which fell 50% throughout this time.

Rozencwajg notes that each time there was a significant change within the financial system, it corresponds to a low level within the charts of commodity costs relative to monetary belongings.

“So right here now we have one other backside, the most cost effective value commodities have ever been relative to monetary belongings, and we’ve been saying since 2018 there’s going to be a change within the world financial system and so I feel that we’re beginning to see that now.”

Such a change has already occurred thrice up to now century: in 1929, the tip of the classical gold trade customary; in 1971, when President Nixon took america off the gold customary; and in 1999, through the Asian foreign money disaster when a number of international locations within the area competitively devalued their currencies.

Conclusion

Regular demand from central banks confirms that valuable metals, specifically gold, deserve buyers’ consideration. Earlier this yr, the gold value flirted with the record-high $2,074.60, set on March 8, 2022.

Consultants stay bullish on gold (and silver) for the remainder of the yr, with a pivot within the Federal Reserve’s charge hike path appearing as the subsequent set off.

Long run, a “Black swan” occasion such because the dismantling of the US-dollar-led reserve foreign money system is well dismissed, however now we have to recollect a financial coverage shift is just not with out precedent — it’s occurred thrice within the final 100 years.

The tip of King Greenback doesn’t imply the US will implode however it will in all probability lead to an extended overdue re-balancing of actual belongings (commodities) to monetary belongings (shares and bonds).

Gold and gold shares are subsequently poised to do properly, in what seems to be the beginning of the second leg of a long-term secular bull market.

Richard (Rick) Millsaheadoftheherd.comsubscribe to my free e-newsletter

Authorized Discover / Disclaimer

Forward of the Herd e-newsletter, aheadoftheherd.com, hereafter often called AOTH.

Please learn all the Disclaimer rigorously earlier than you employ this web site or learn the e-newsletter. If you don’t comply with all of the AOTH/Richard Mills Disclaimer, don’t entry/learn this web site/e-newsletter/article, or any of its pages. By studying/utilizing this AOTH/Richard Mills web site/e-newsletter/article, and whether or not you truly learn this Disclaimer, you’re deemed to have accepted it.

Any AOTH/Richard Mills doc is just not, and shouldn’t be, construed as a suggestion to promote or the solicitation of a suggestion to buy or subscribe for any funding.

AOTH/Richard Mills has primarily based this doc on info obtained from sources he believes to be dependable, however which has not been independently verified.

AOTH/Richard Mills makes no assure, illustration or guarantee and accepts no duty or legal responsibility as to its accuracy or completeness.

Expressions of opinion are these of AOTH/Richard Mills solely and are topic to vary with out discover.

AOTH/Richard Mills assumes no guarantee, legal responsibility or assure for the present relevance, correctness or completeness of any info supplied inside this Report and won’t be held chargeable for the consequence of reliance upon any opinion or assertion contained herein or any omission.

Moreover, AOTH/Richard Mills assumes no legal responsibility for any direct or oblique loss or injury for misplaced revenue, which you will incur because of the use and existence of the data supplied inside this AOTH/Richard Mills Report.

You agree that by studying AOTH/Richard Mills articles, you’re appearing at your OWN RISK. In no occasion ought to AOTH/Richard Mills chargeable for any direct or oblique buying and selling losses attributable to any info contained in AOTH/Richard Mills articles. Info in AOTH/Richard Mills articles is just not a suggestion to promote or a solicitation of a suggestion to purchase any safety. AOTH/Richard Mills is just not suggesting the transacting of any monetary devices.

Our publications usually are not a advice to purchase or promote a safety – no info posted on this website is to be thought of funding recommendation or a advice to do something involving finance or cash apart from performing your individual due diligence and consulting together with your private registered dealer/monetary advisor.

AOTH/Richard Mills recommends that earlier than investing in any securities, you seek the advice of with knowledgeable monetary planner or advisor, and that you need to conduct an entire and impartial investigation earlier than investing in any safety after prudent consideration of all pertinent dangers. Forward of the Herd is just not a registered dealer, seller, analyst, or advisor. We maintain no funding licenses and should not promote, provide to promote, or provide to purchase any safety.