franckreporter

Second Half Playbook

On Friday, I joined Seana Smith on Yahoo! Finance the place I mentioned the playbook for the subsequent 6 months:

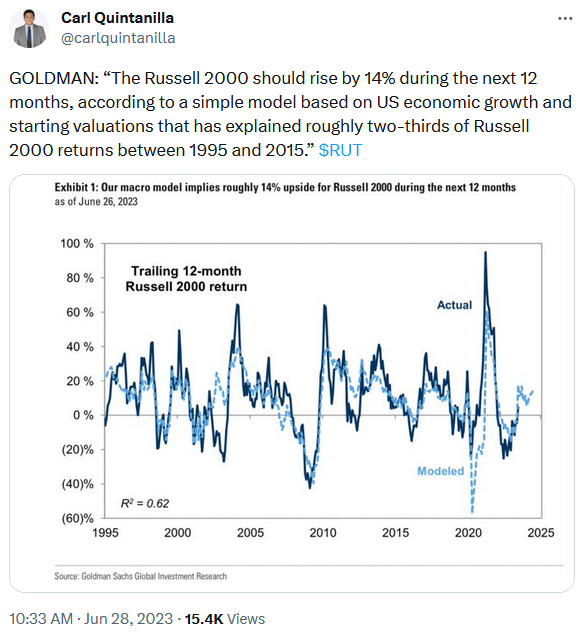

This chart ties in one of many key factors I made above:

Carl Quintanilla

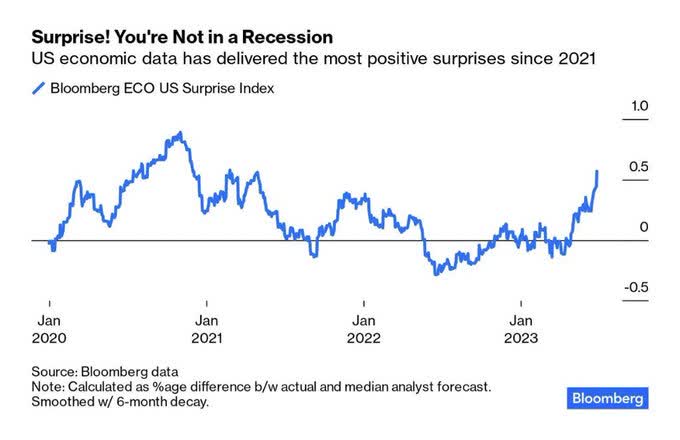

The aim of the next charts and tables is to remind skeptics that the information continues to come back in higher than anticipated. Whereas the again half of the 12 months returns for the indices could also be extra muted than the primary half, there’s nonetheless important alternative. Nevertheless, probably the most cash shall be made “beneath the floor” with dozens of particular person laggards that may be up 20, 30, 50 and even 100%+ in 2H.

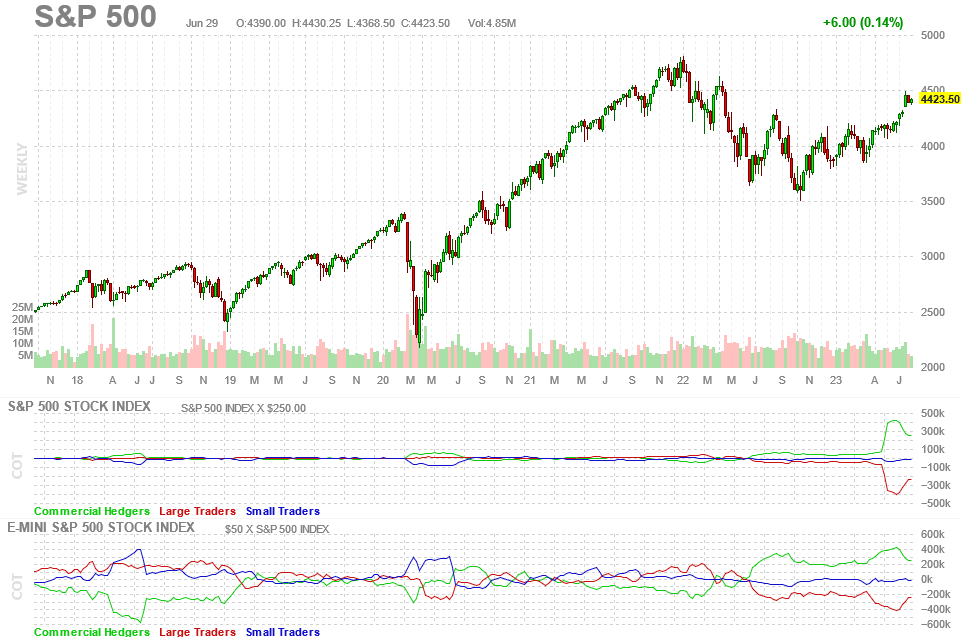

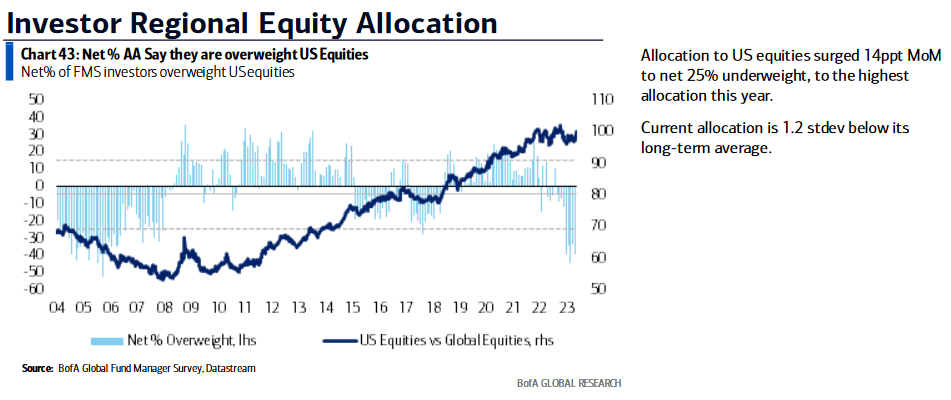

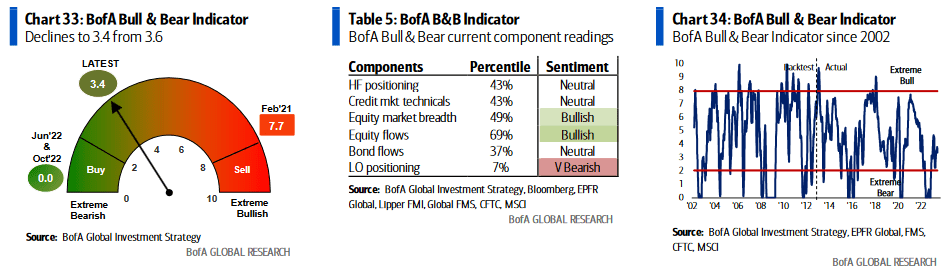

Positioning

Commercials nonetheless lengthy, Hedge Funds nonetheless brief the entire method up! We proceed to observe the commercials and ignore the big managers who advised you to promote on the October lows.

Finviz BofA

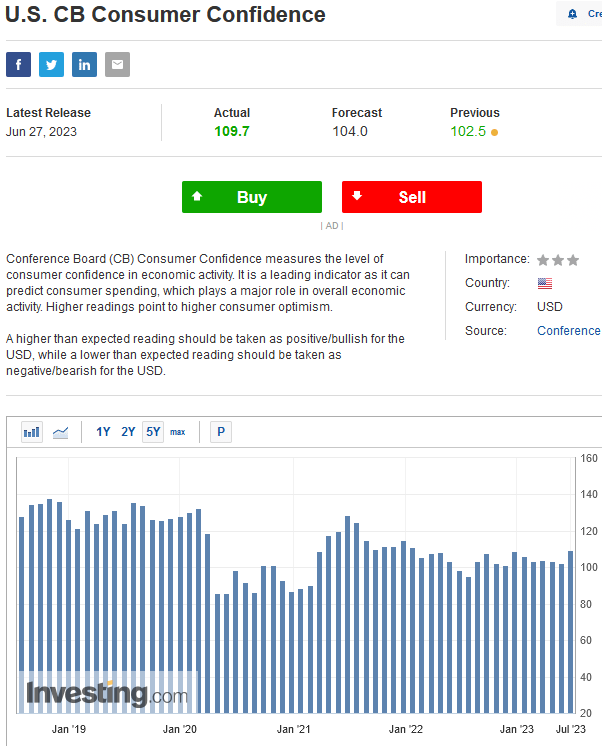

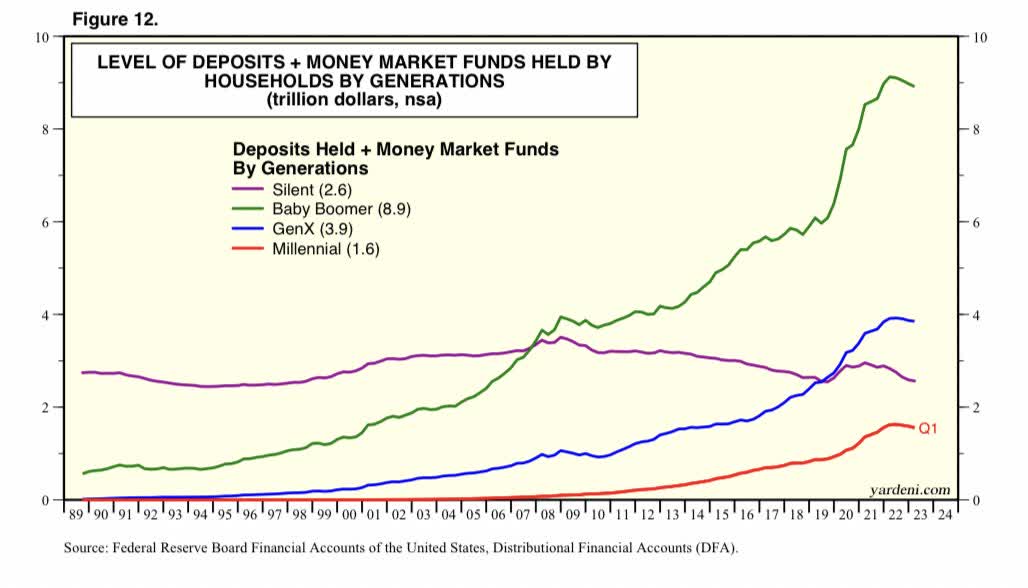

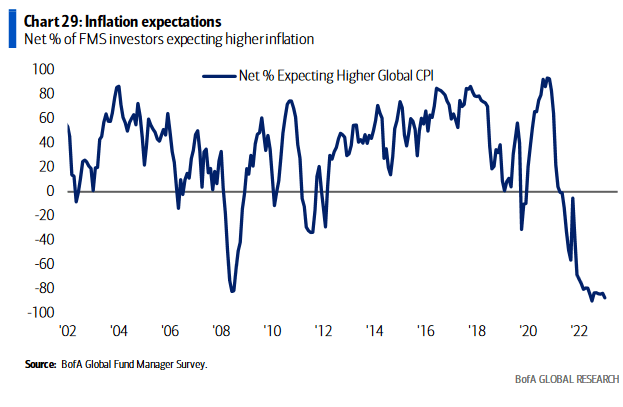

Sentiment

BofA BofA Investing.com Yardeni.com

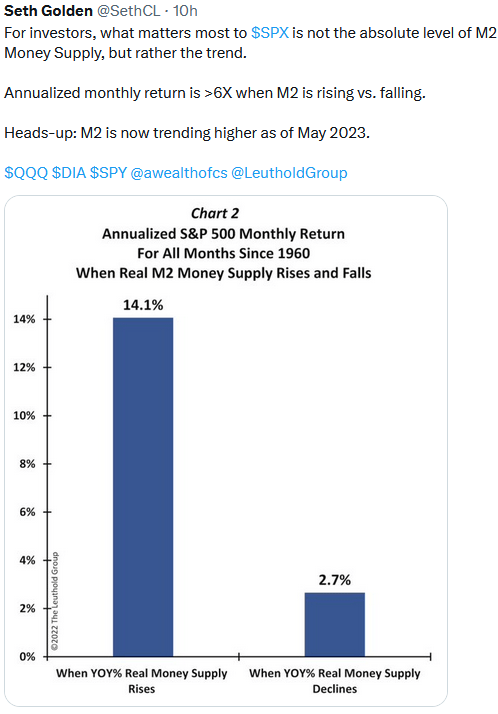

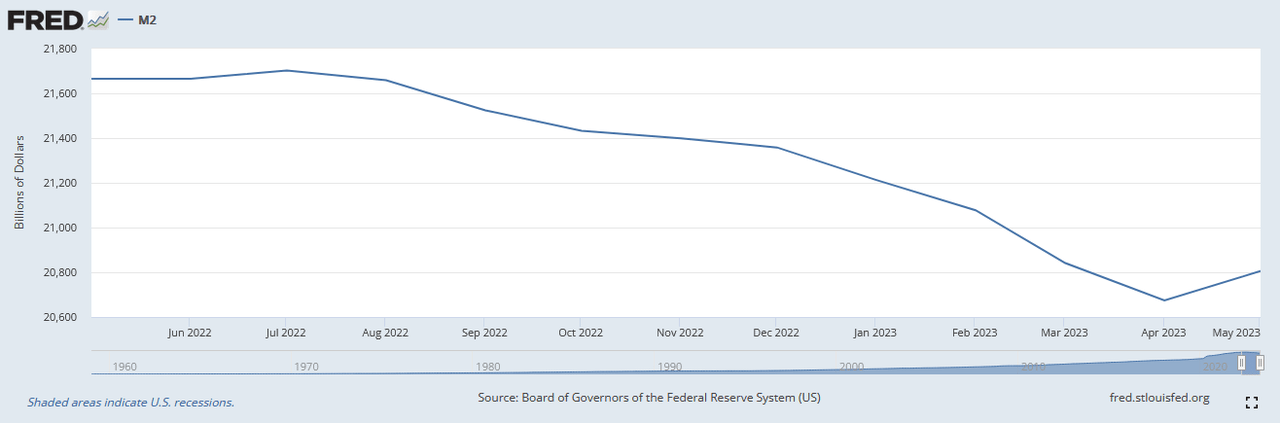

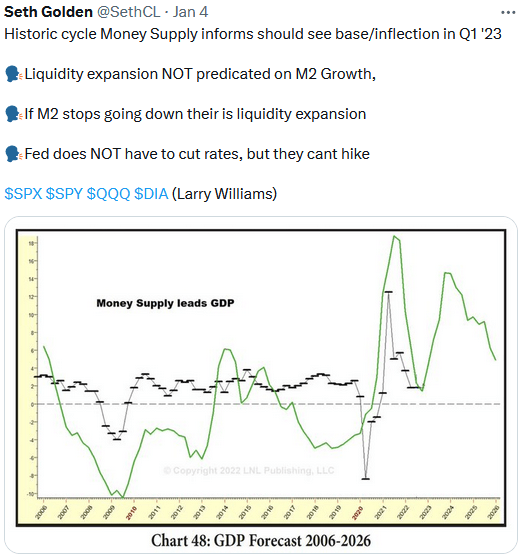

Cash Provide

Seth Golden fred.stlouisfed.org Seth Golden

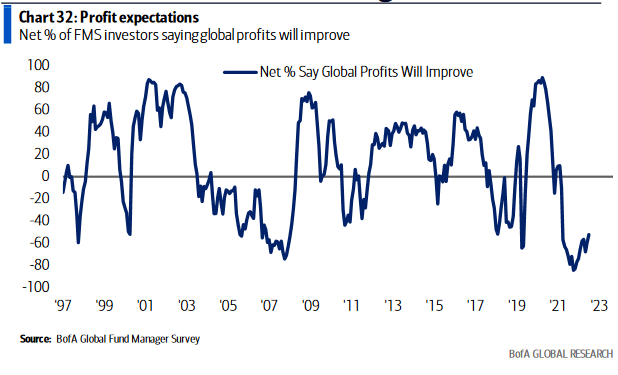

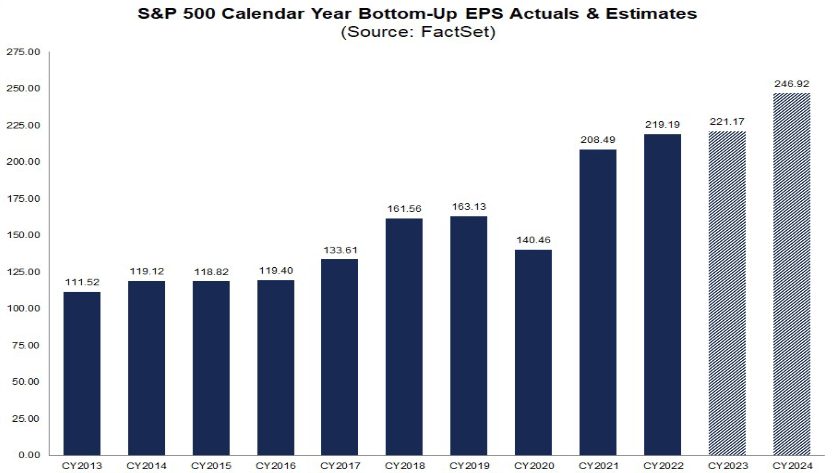

Earnings Expectations

Earnings: Arrange going into Q2 earnings season the identical as going into Q1.

-For Q2, the estimated earnings decline for the S&P 500 is -6.5%

-Q1 had the same set-up and wound up at -2%.

-Everybody has been calling for a 20% earnings decline since October. As an alternative, we obtained a 25% rally within the S&P 500.

-What now? 2024 estimates are going UP in current weeks to ~$247.

FactSet

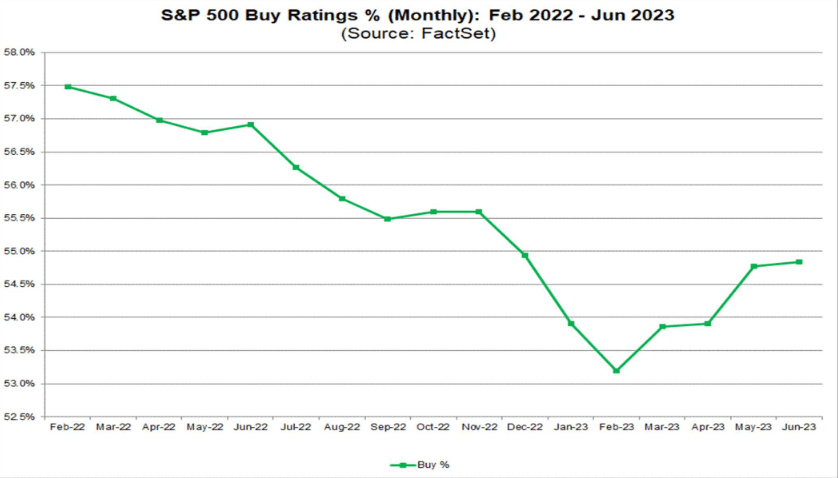

Analysts taking part in “catch up” on purchase scores:

FactSet

Financial Information

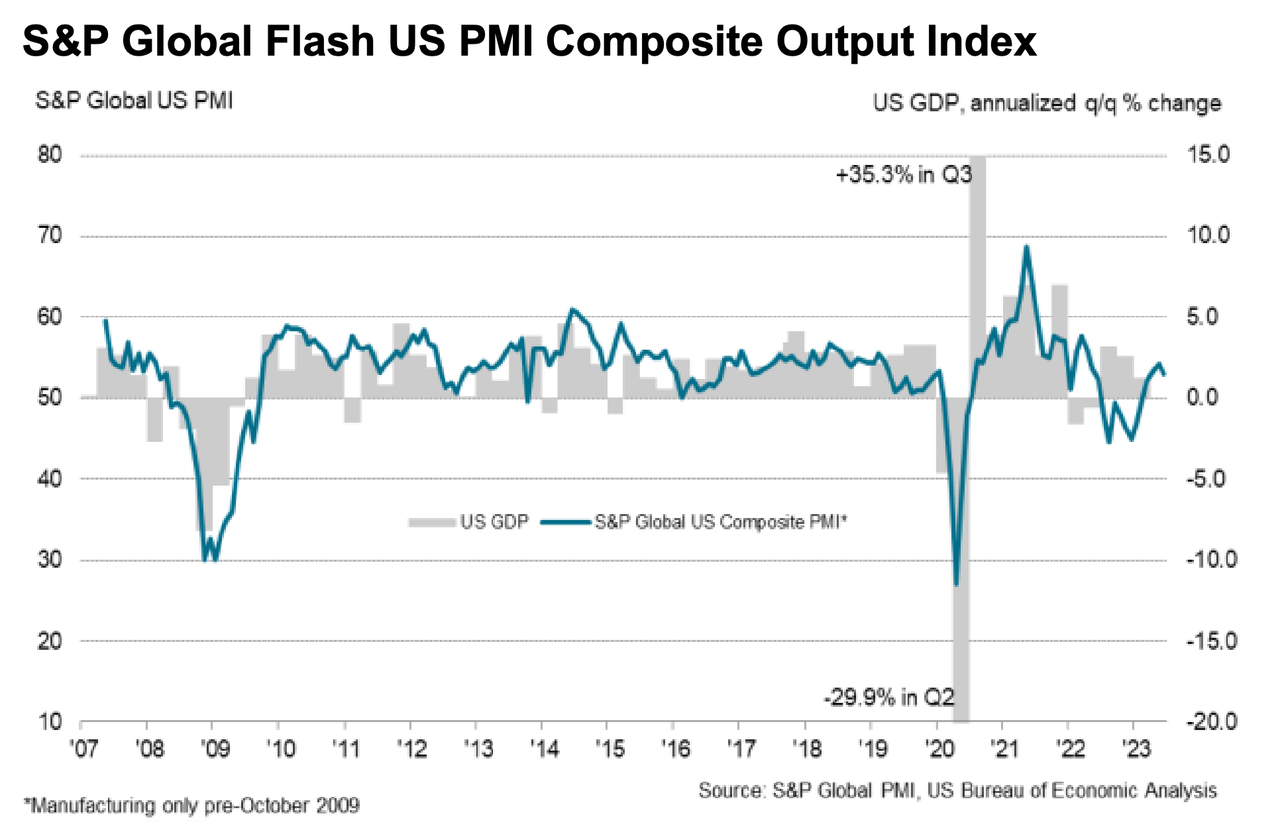

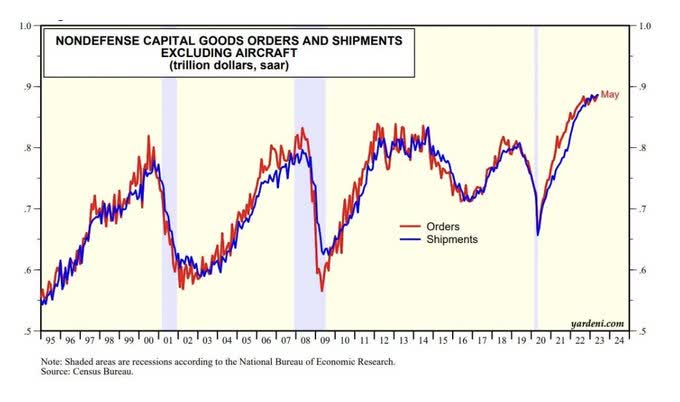

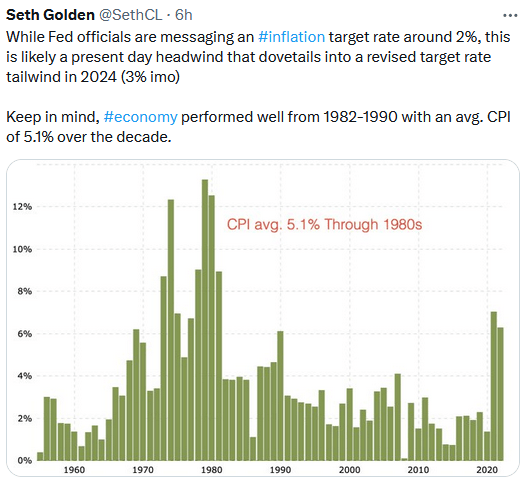

S&P World PMI Yardeni.com Seth Golden Bloomberg BofA Bloomberg

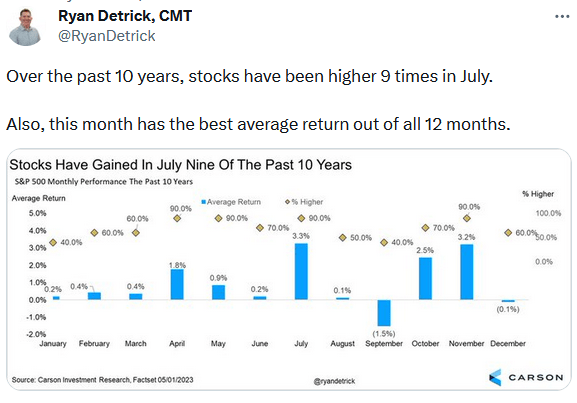

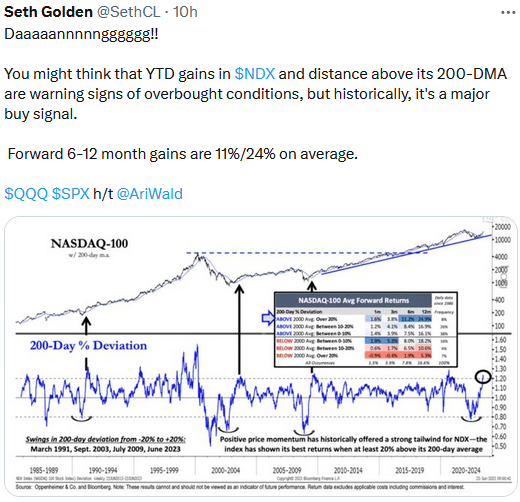

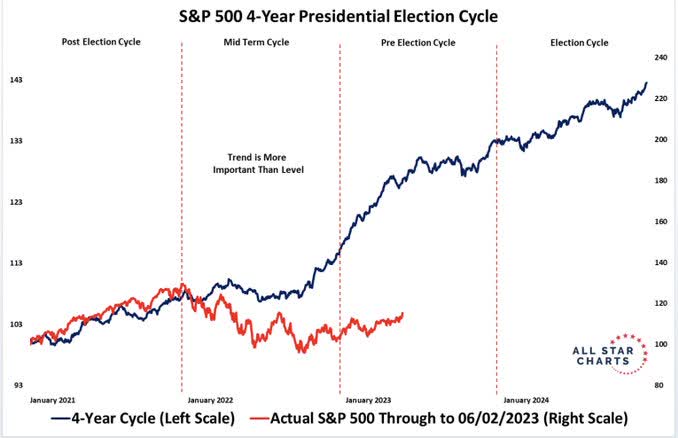

Seasonality

Ryan Detrick Seth Golden All Star Charts

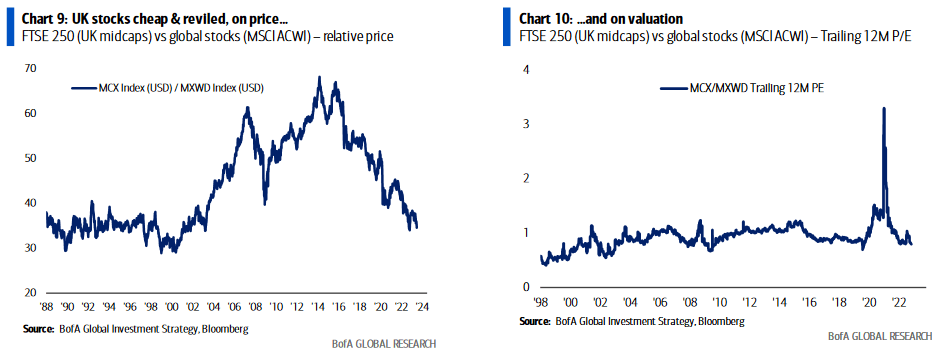

UK

BofA

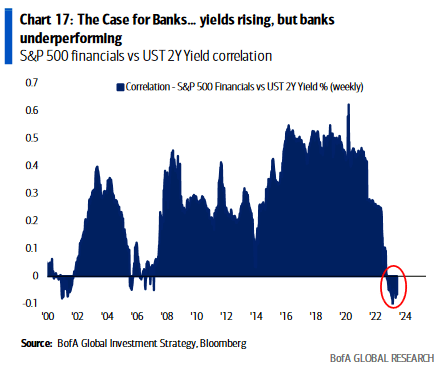

Banks

BofA

Now onto the shorter time period view for the Common Market:

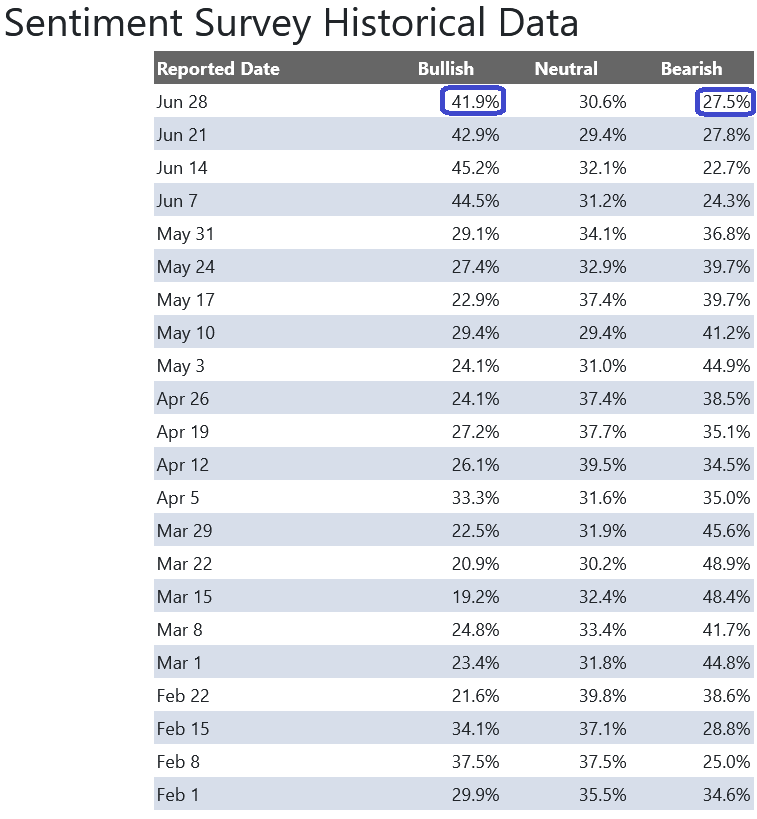

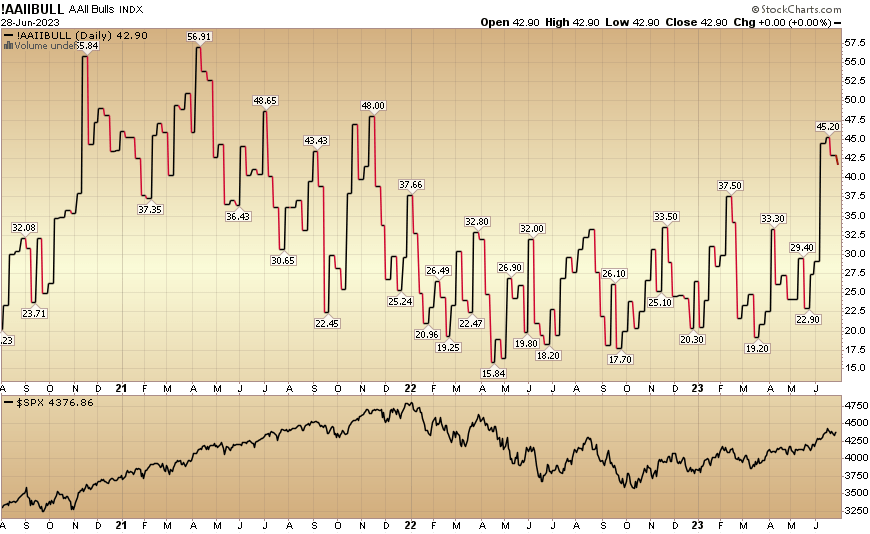

On this week’s AAII Sentiment Survey outcome, Bullish % ticked all the way down to 41.9% from 42.9% the earlier week. Bearish % flat-lined at 27.5% from 27.8%. The retail investor remains to be optimistic. This will keep elevated for a while primarily based on positioning coming into these ranges.

AAII.com Stockcharts.com

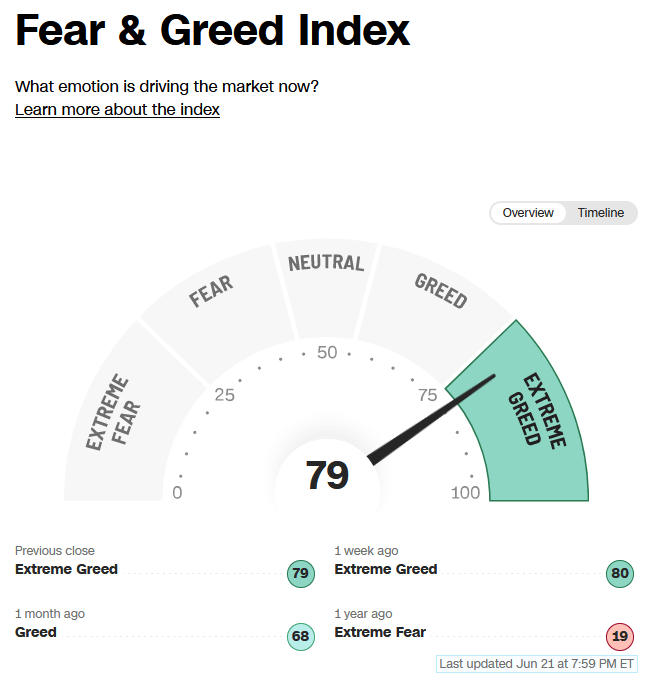

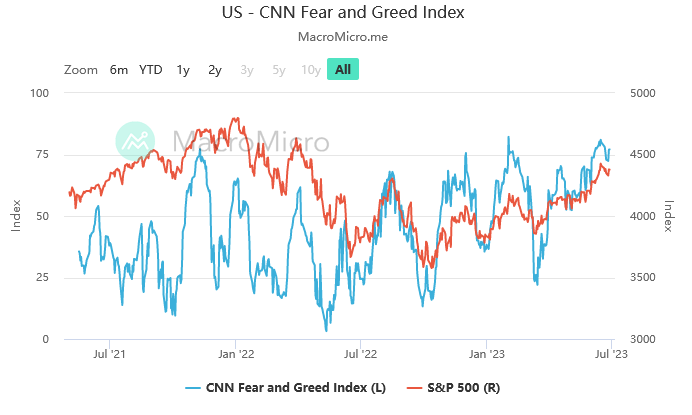

The CNN “Concern and Greed” flat-lined from 79 final week to 79 this week. Sentiment is scorching however it could not shock me if it stays pinned for a bit to pressure individuals out of their bunkers and again into the market.

CNN MacroMicro.me

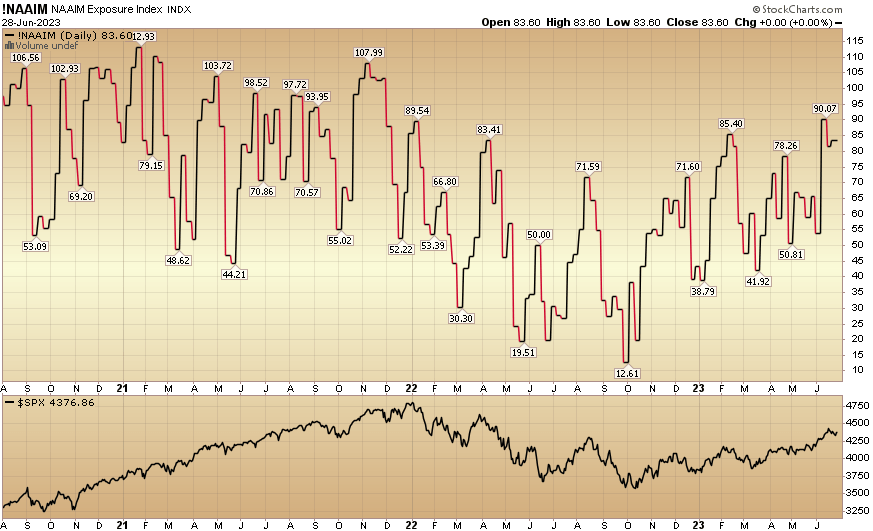

And eventually, the NAAIM (Nationwide Affiliation of Lively Funding Managers Index) ticked as much as 83.60% this week from 81.66% fairness publicity final week. Managers have been chasing the rally.

Stockcharts.com

*Opinion, not recommendation. See “phrases” at hedgefundtips.com.