David Becker

Superior Micro Units, Inc. (NASDAQ:AMD) is a semiconductor firm that designs chips for CPUs (Central Processing Models), GPUs (Graphic Processor Models), and different functions.

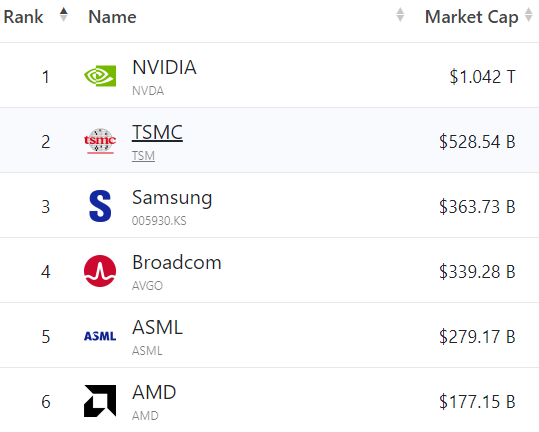

AMD is the sixth largest semiconductor firm on the planet by market worth.

companiesmarketcap.com

On this article, we are going to have a look at the explanation why AMD’s value has not continued its spectacular current climb that appeared obvious earlier than January 2021.

AMD Inventory Key Metrics

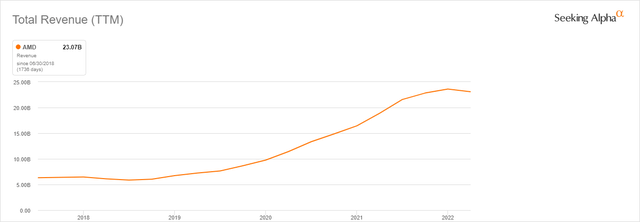

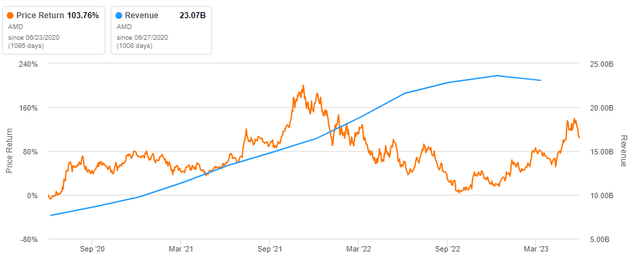

Within the final 5 years, AMD has grown its income by virtually 400 %, growing income from about $6 billion to $23 billion. This makes them one of many largest and fastest-growing semiconductor firms on the planet.

Searching for Alpha

Nevertheless, if you happen to have a look at AMD’s progress profile in comparison with their value over the identical interval it exhibits a rise of over 600% and since January 2021 you possibly can see that there was a big drop.

Searching for Alpha

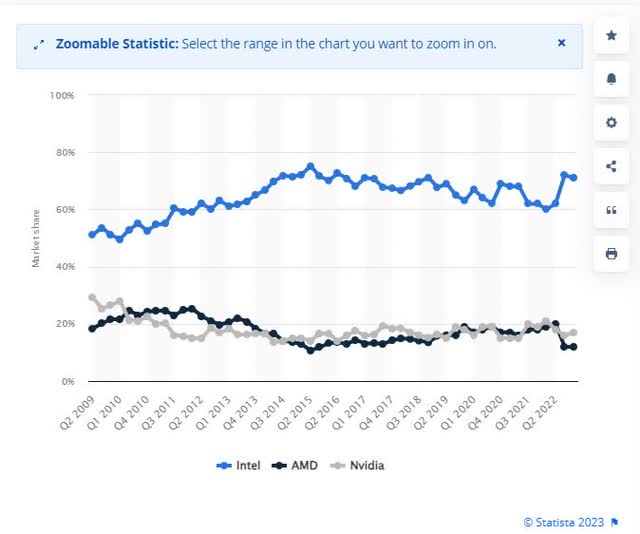

AMD’s two greatest rivals are Intel (INTC) within the CPU market and Nvidia (NVDA) in GPUs.

Listed here are 5 issues you might want to find out about AMD.

1. AMD Continues To Acquire Market Share From Intel And Will In all probability Do So In The Future

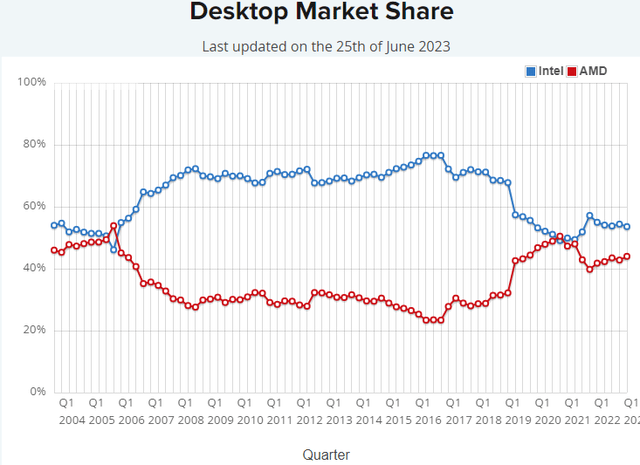

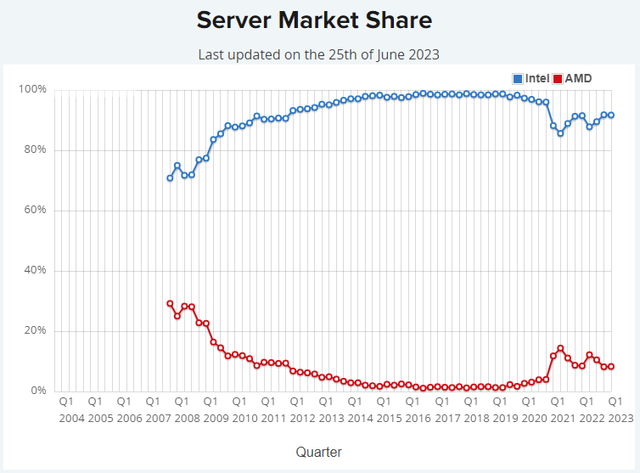

AMD has gained processor share on Intel over the previous few years, as might be seen from the next charts, each in desktop CPUs and particularly server CPUs.

PassMark Software program PassMark Software program

Curiously, discover that from 2007 to 2008 AMD truly had the next market share in server chips than they do now. In fact, the Server Market is way bigger now than it was in 2007.

Server chips are very worthwhile and have contributed to AMD’s fast income and share value positive factors during the last 3 years.

Searching for Alpha

2. In The GPU Market, AMD Is Not As Dominant As In The CPU market

AMD additionally competes with Nvidia within the GPU market, though Nvidia has been within the information nonstop since they introduced a superior quarter in March. Nvidia chips are the darling of the brand new AI (Synthetic Intelligence) market as a result of they’re utilized in very high-end servers particularly cloud servers to control such AI merchandise as chatbots.

A few of these GPU chips utilized in high-end servers can promote for as a lot as $10,000 apiece, and since Nvidia has the very best ones, not less than in the mean time AMD is compelled to spend extra time and analysis on GPUs.

AMD’s lower-power GPU chips shall be used to energy not solely AI but in addition graphics, which GPUs had been initially designed to do. And AMD Is nicely conscious of the curiosity in AI gadgets and actually, on the current Superior Micro Units, Inc. Financial institution of America 2023 International Expertise Convention, AI was talked about 19 instances.

In that lower-end market, AMD could be very aggressive and sells thousands and thousands of these chips yearly.

However curiously sufficient, Intel truly manufactures extra GPUs than Nvidia or AMD, although not the very high-end ones. Most of Intel’s GPU chips are mated with Intel’s desktop and laptop computer CPUs.

Statista

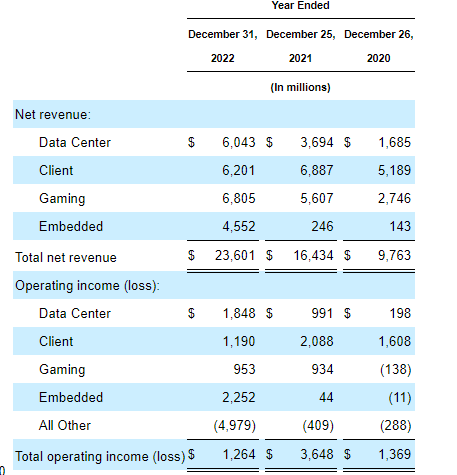

3. AMD’s Most Worthwhile Section Is Its Server Chips

As you possibly can see within the chart beneath, the servers aren’t solely the most important by income but in addition by margin. And AMD additionally makes chips for sport consoles for each Sony Group (SONY) and Microsoft’s (MSFT) Xbox, though these are likely to have a lot decrease margins due to the large volumes and decrease expertise necessities.

AMD 10-Ok

Notice in 2022, Gaming truly generated extra income than Information Middle

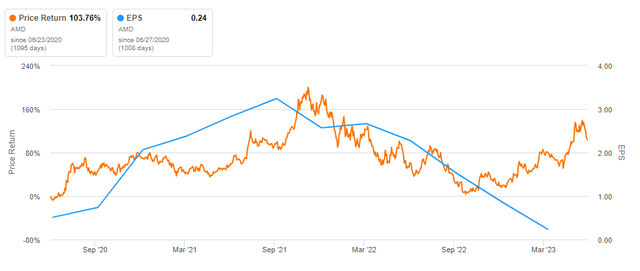

4. AMD’s EPS (Earnings Per Share) Has Dropped 60% Since 2020

AMD has struggled to make constant earnings over time, which can be a part of the rationale that the share value has been so unstable.

We will see that within the following chart as we evaluate earnings per share to the value per share.

Searching for Alpha

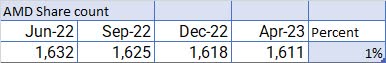

5. Regardless of $3 billion In Share Buybacks, The Share Depend Stayed About The Identical

If we have a look at this chart beneath, we will see that the share rely has gone down by only one% within the final 12 months, regardless that they’ve spent $3 billion on share buybacks and have simply licensed one other $8 billion on share buybacks.

Searching for Alpha

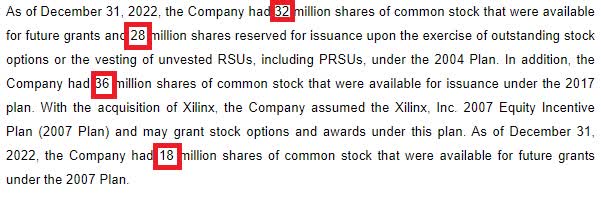

A part of the issue is AMD’s intensive use of SBCs (Inventory-Primarily based Compensation), totaling 114 million shares based on the newest 10-Ok.

AMD

Though I’m unable to seek out anyplace within the 10-Ok the place they are saying precisely what number of shares are getting used for SBC, simply including up the numbers in that one paragraph exhibits nicely over 100 million shares. So, a respectable query for traders is why AMD is spending billions of {dollars} on share buybacks for minuscule share discount.

Backside Line

Trying on the above and evaluating the numbers for every of the 5 objects, we will see that there are some critical funding questions on AMD, particularly current earnings per share and the substantial SBC price that’s mirrored within the share rely.

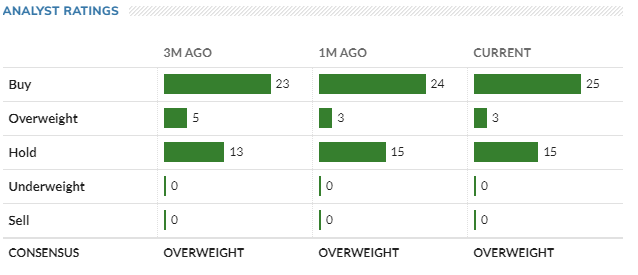

Regardless of these obvious points, AMD’s scores by Wall Road analysts are extraordinarily excessive, with the present rely being 25 buys 3 chubby, and nil, none, nada Sells.

MarketWatch

A few of this enthusiasm might be associated to the brand new AMD GPU high-end chip being thought of by Amazon’s (AMZN) AWS unit. That GPU chip is known as the MI 300 and though no detailed specs can be found, but the truth that Amazon is contemplating it’s spectacular, though apparently no ultimate determination has been made. On that very same observe, Amazon stated they weren’t working with Nvidia, so this may be an enormous plus for AMD’s share value if it seems to be true.

Ultimately, it’s fairly potential that AMD’s share value will proceed to rise regardless that the share rely is rising, particularly in the event that they get the Amazon contract.

Primarily based upon the price-performance comparability between AMD and Nvidia, the Amazon contract might drive AMD’s value upwards towards Nvidia’s lofty degree, regardless that I doubt it’s going to attain the extent of Nvidia. However successful the AWS contract would have a big constructive impact on AMD’s share value.

I charge AMD as a speculative purchase at this time limit.