Our thesis is easy as 1,2,3.

#DrainTheMint is Silversqueeze 2.0.

#DrainTheMint is Far Superior over Drain the Comex (which was the WSS silversqueeze which flamed out in complete shame.)

So let’s uncover collectively why #DrainTheMint is Most Superior over Drain the Comex (or Why silversqueeze 2.0 is best than the failed silversqueeze) ?

Silver is on the point of extinction. In response to USGS (United States Geological Society), we might run out of Silver for computer systems, cellphones, different electronics, industrial makes use of, transition to NetZero (electrical automobiles, batteries, photo voltaic panels) jewellery, sovereign cash, bullion, and funding as early as 2025 and be utterly out by 2034.

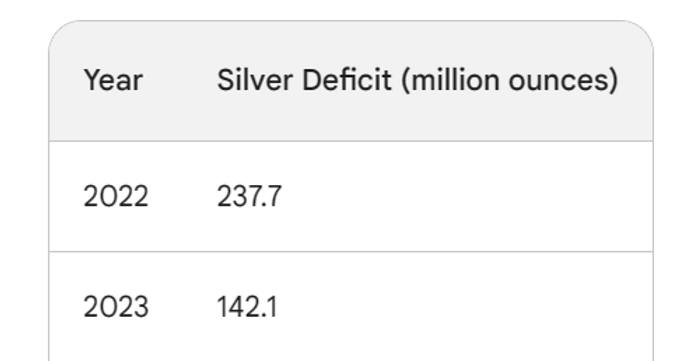

In response to the World Silver Survey 2023 by the Silver Institute, the silver market has been in deficit for the previous two years. The deficit in 2022 was 237.7 million ounces, and the deficit in 2023 is forecast to be 142.1 million ounces.

The primary causes for the silver deficit are:

Elevated demand

Demand for Silver has been rising in recent times, pushed by varied elements, together with the expansion of the photo voltaic and wind power industries, which use Silver of their parts.

The rising use of Silver in electronics, corresponding to smartphones and laptops.

The rising reputation of Silver as a hedge towards systemic threat and inflation.

Decrease mine manufacturing

Silver mine manufacturing has been declining in recent times as a result of many elements, together with:

The rising price of mining silver. (That is the Worthwhile Silver Returned on Vitality Invested (PSoEI) method.)

The rising environmental laws on mining.

Mexico simply banned open pit silver mining and Mexico has traditionally been the World’s #1 silver producing nation.

Ore high quality within the Forties (Idaho for instance) was 44 ounces per ton yield in comparison with beneath 1 ounce per ton yield. See the place it went from 43 to three.8 from 1937 to 1989. Nicely now in 2023, miners are fortunate to get 1 ounce per ton plus open pit mining is banned in locations like Mexico (World’s #1 Silver producing Nation.)

Grand Whole 379.8 Million ounces only for previous two years.

And this doesn’t seize what’s the bombshell you’ll learn under in including up what militaries and weapon techniques use in silver load.

Now allow us to add three extra compelling deathblows to our silver setup (on prime of mixing the aforementioned USGS reviews plus The Silver Institutes’ final two reviews (displaying monstrous provide deficits).

Reality 1: Just one/2 of 1 % of the inhabitants believes in stacking. It is because institutional traders (insurance coverage funds, pension funds, hedge fund managers) do not spend money on gold and Silver. In any case, brokers can’t “churn” these property for prime commissions in comparison with different monetary devices corresponding to shares, bonds, and actual property. This implies for many who have been sensible sufficient to stack they’re positioned earlier than the worry commerce kicks in. (however at that time silver can be unobtanium)

FACT 2 – BRICS are hoarding gold and Silver as a method to struggle US Greenback hegemony (All central bankers and their consumer international locations have been printing, particularly Japan, UK, ECB, and USA)

FACT 3 – With all these monumental silver provide deficits, nobody nonetheless discusses Silver’s use as a strategic metallic in warfare.

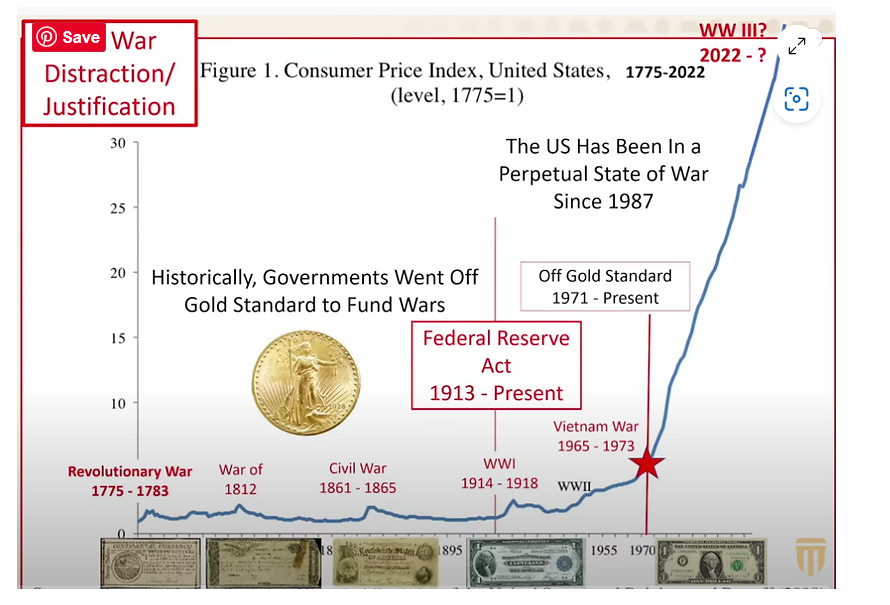

Each geopolitical skilled understands that when vital world energy shifts happen (corresponding to Portugal falling to Spain, Spain falling to the Dutch normal, the Dutch falling to the British Pound, and the British falling to US Greenback); these transition occasions drastically improve warfare.

It isn’t just like the dominant energy rolls over for the brand new World chief, which explains the 57 undeclared wars US has waged upon the World—all meant to prop up the US greenback because the World’s Reserve Forex.

A Nearer Look.

How a lot Silver do you assume the militaries of the world use?

In all probability 20% of All Silver Used, Perhaps Increased.

None of which is “on the report.”

NO ACCOUNTABILITY OR RECORDS KEPT. Has The Silver Institute Been Asleep for previous Decade?

AND REMEMBER THESE ENORMOUS USES OF SILVER ARE NOT CAPTURED IN THE DEPLETED INVENTORIES LISTED ABOVE. AND THESE INVENTORIES INDICATE HUGE DEFICITS ALREADY DOCUMENTED BY ALL AUTHORITIES (USGS, Silver Institue, et al)

Keep in mind that all issues associated to battle are prime secret.

The silver inventories are onerous to compile as a result of many subjects surrounding the Dept of Protection and Dept of Vitality are shrouded in secrecy beneath the catch-all “nationwide safety.” Identical to nobody is aware of how a lot gold is in Fort Knox the US by no means discloses how a lot Silver they use in battle however we have now an concept.

Using Silver in protection functions will continue to grow within the coming years because of the rising demand for extra refined and dependable weapon techniques and digital gadgets.

The event of recent applied sciences, corresponding to directed power weapons and hypersonic missiles, drives the demand for Silver in protection functions.

Using Silver in protection functions is a major issue within the international silver market. The protection sector is without doubt one of the largest customers of Silver, and the protection trade accounts for as much as 20% of world silver demand.

Using Silver in protection functions can also be a major driver of silver costs. When the demand for Silver from the protection sector will increase, it is going to result in a lot greater silver costs.

Listed below are some particular examples of Silver’s use in protection functions:

Silver is utilized in a wide range of navy functions, together with:

Bullets and shells: Silver is an efficient conductor of electrical energy, which makes it ultimate to be used in primers and percussion caps. It is usually immune to corrosion, making it a sensible choice for bullets and shells uncovered to harsh environments.

Missiles: Silver is used within the steering techniques of missiles, as it’s a good conductor of electrical energy and warmth. It is usually used within the batteries that energy missile techniques.

Radar: Silver is used within the radomes of radar techniques, as it’s a good reflector of radio waves. This enables radar techniques to detect objects at lengthy distances.

Evening imaginative and prescient goggles: Silver is used within the photocathodes of evening imaginative and prescient goggles, as it’s a good conductor of electrical energy and lightweight. This enables evening imaginative and prescient goggles to amplify the out there gentle in order that objects may be seen at nighttime.

Communication: Silver is used within the contacts of digital parts, as it’s a good conductor of electrical energy. This enables for dependable and environment friendly communication between navy personnel.

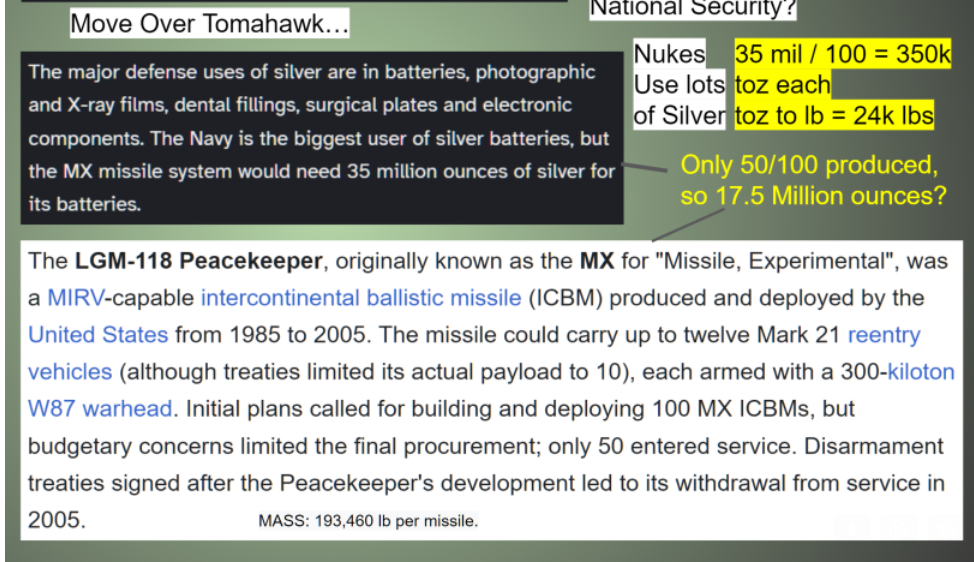

MX nuclear LGM peacekeeper missiles: Silver is used within the batteries that energy the MX nuclear LGM peacekeeper missiles. These batteries are designed to final a few years, even within the harsh circumstances of house.

Along with these particular functions, silver can also be utilized in varied different navy tools, corresponding to gun sights, sensors, and turbines.

Its conductivity, reflectivity, and resistance to corrosion make it a really perfect materials to be used in a variety of navy functions.

Listed below are some further particulars about how silver is utilized in every of those functions:

Bullets and shells: Silver is used within the primers and percussion caps of bullets and shells as a result of it’s a good conductor of electrical energy. When the primer is struck, it creates a spark that ignites the gunpowder, which propels the bullet or shell out of the gun. Silver can also be used within the jackets of some bullets, as it’s immune to corrosion and might help enhance the bullet’s accuracy.

Missiles: Silver is used within the steering techniques of missiles as a result of it’s a good conductor of electrical energy and warmth. The steering system makes use of electrical energy to ship alerts to the missile’s fins, which assist preserve the missile on track. Silver can also be used within the batteries that energy missile techniques. Silver is well-suited for this utility as a result of these batteries want to resist a whole lot of warmth and vibration.

Radar: Silver is used within the radomes of radar techniques as a result of it’s a good reflector of radio waves. The radome is a protecting cowl that surrounds the antenna of the radar system. It’s manufactured from a fabric reflecting radio waves so the antenna can ship and obtain radio waves with out interference. Silver is an efficient selection for this utility as a result of it’s a good reflector of radio waves and can also be immune to corrosion.

Evening imaginative and prescient goggles: Silver is used within the photocathodes of evening imaginative and prescient goggles as a result of it’s a good conductor of electrical energy and lightweight. The photocathode is a light-sensitive factor that converts gentle into electrical energy. This electrical energy is then amplified by the evening imaginative and prescient goggles in order that objects may be seen at nighttime. Silver is an efficient selection for this utility as a result of it’s a good conductor of electrical energy and lightweight, and it is usually immune to corrosion.

Communication: Silver is used within the contacts of digital parts as a result of it’s a good conductor of electrical energy. This enables for dependable and environment friendly communication between navy personnel. Silver can also be used within the connectors of digital cables, because it helps to make sure that the cables are correctly related.

MX nuclear LGM peacekeeper missiles: Silver is used within the batteries that energy the MX nuclear LGM peacekeeper missiles. These batteries are designed to final a few years, even within the harsh circumstances of house. Silver is an efficient selection for this utility as a result of it’s a good conductor of electrical energy and corrosion-resistant.

The US Navy is the most important consumer of silver batteries, however the MX missile system would want 35 million ounces of silver for its batteries. (See the graphic under indicating as much as 17.5 Million ounces for this one system.)

Now do you see why the US will not disclose silver inventories?

That is solely US navy. The US is just not the one nation with Nukes.

Under are the international locations on this planet which have nuclear weapons, together with some particulars about their nuclear arsenals:

Russia has the most important nuclear arsenal on this planet, with an estimated 5,977 warheads.

United States has the second largest nuclear arsenal on this planet, with an estimated 5,428 warheads.

China has the third largest nuclear arsenal on this planet, with an estimated 350 warheads.

France has the fourth largest nuclear arsenal on this planet, with an estimated 290 warheads.

United Kingdom has the fifth largest nuclear arsenal on this planet, with an estimated 225 warheads.

Pakistan has the sixth largest nuclear arsenal on this planet, with an estimated 165 warheads.

India has the seventh largest nuclear arsenal on this planet, with an estimated 160 warheads.

Israel is estimated to have 90 nuclear warheads, however the precise quantity is unknown.

North Korea is estimated to have 40-50 nuclear warheads, however the precise quantity can also be unknown.

These numbers are estimates, and the precise variety of nuclear warheads possessed by every nation could also be greater or decrease. Moreover, some international locations, corresponding to Israel, haven’t formally acknowledged their nuclear weapons program, so the precise variety of warheads they possess is unknown.

Keep in mind how lengthy the Arms race has been existence… Let’s face it, there’s no silver to talk of, is there?

Strategic Silver Reserves. Silver and Conflict.

A tragic unhappy story of Mendacity, Dishonest and Stealing. Using Silver in protection functions is a crucial a part of fashionable warfare. Silver’s distinctive properties make it a vital materials for varied weapons and digital techniques. The demand for Silver in protection functions will proceed to develop within the coming years as new applied sciences are developed and the worldwide safety panorama turns into extra advanced and violent.

Identical to Biden drained the SPR as a stunt to smash down oil costs for political and “nationwide safety” causes this has occurred lately in US Historical past with Silver.

US authorities, Central Bankers and different market riggers fiddle with manipulation and draining strategic stockpiles of silver.

Within the early Nineteen Eighties, the Hunt brothers, a rich American household, started to build up giant quantities of silver. They believed that the value of silver was going to go up, and so they wished to revenue from it. As they purchased increasingly silver, the value of the metallic started to rise.

The U.S. authorities was involved concerning the Hunt brothers’ actions. They feared that if the Hunt brothers have been capable of nook the silver market, it might intrude with their age outdated plans to handle silver. In any case, if the working class might use silver for commerce why would they purchase into the fiat forex lie? In an effort to stop this from occurring, the federal government started to promote silver from its US strategic stockpiles.

The federal government bought silver at a reduced value, which helped to drive down the value of the metallic. This had the impact of offsetting the Hunt brothers’ shopping for spree. The Hunt brothers have been finally pressured to promote their silver at a loss, and the federal government was capable of stave off a squeeze and preserve their shenanigans ongoing.

The episode with the Hunt brothers and the U.S. authorities is called the Silver Thursday disaster.

It occurred on January 27, 1980, when the value of silver crashed. The Hunt brothers have been unable to satisfy their margin calls, and so they have been pressured to promote their silver at a loss. This brought on the value of silver to plummet, and it led to a panic on the commodities markets.

The US authorities intervened in a number of methods to cease the Hunt brothers from cornering the silver market.

The Commodity Futures Buying and selling Fee (CFTC) issued a ruling that restricted the quantity of silver that anybody entity might maintain in futures contracts. This ruling successfully made it unattainable for the Hunt brothers to proceed their shopping for spree.

The US Treasury Division intervened available in the market by promoting silver from its personal reserves. This helped to extend the provision of silver available on the market and put downward stress on costs.

The Federal Reserve additionally intervened by offering loans to banks that have been going through margin calls from the Hunt brothers. This helped to stabilize the monetary system and forestall a wider panic.

These interventions have been profitable in stopping the Hunt brothers from cornering the silver market. The value of silver plummeted on March 27, 1980.

The Silver Thursday disaster had various penalties. It led to the collapse of the Hunt brothers’ empire, and it additionally brought on the U.S. authorities to lose billions of {dollars}.

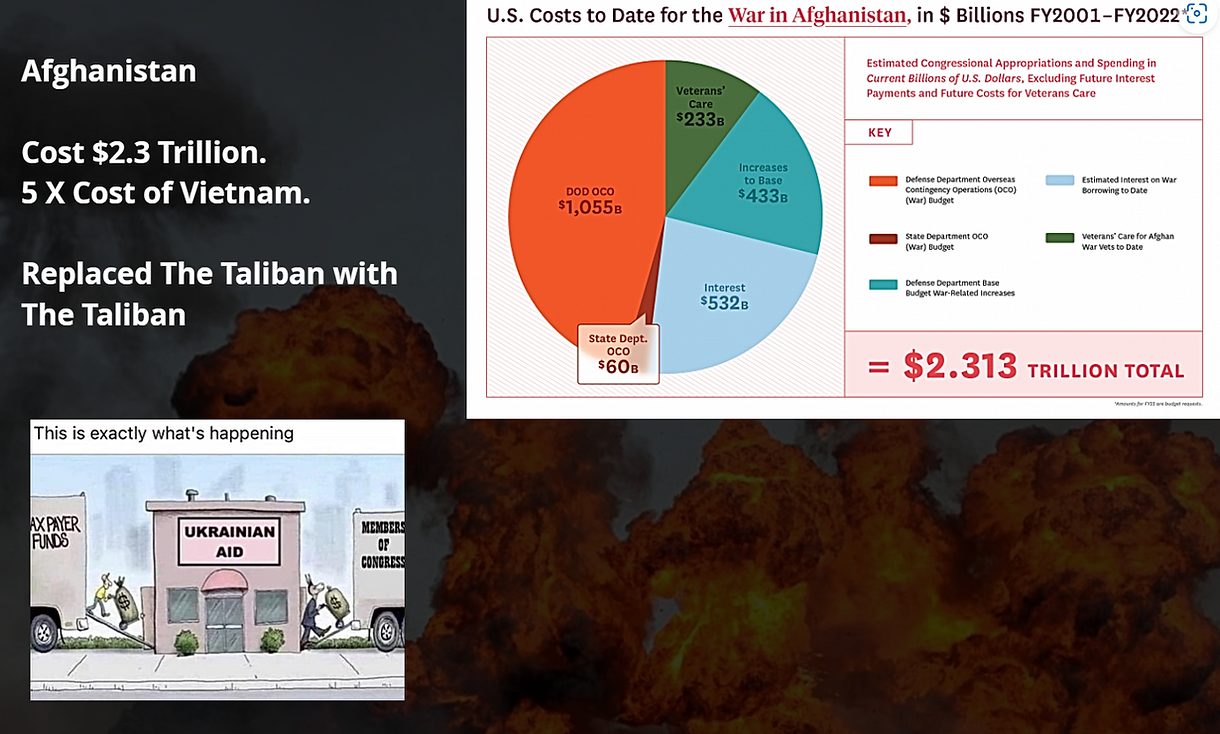

However the US authorities would not care about shedding billions of {dollars}. To them, it is cash effectively spent to maintain up with the rigging recreation. It may be “papered over.” Instance – simply look how a lot cash goes lacking in wars like Korea, Vietnam, Libya, Somalia, Iraq, Afghanistan or the 57 different US undeclared adventures.

Afghanistan was 5 occasions costlier than Vietnam with a pricetag of $2.3 trillion {dollars} in response to Brown College’s Watson Institute. All to interchange the Taliban with The Taliban

Have a look at what is going on on right this moment with the cash laundering in Ukraine.

Even economists like Dr. Mark Skidmore (whereas being an economics professor at Duquesne College) acknowledged US authorities has a blatant disregard and particular reward for misplacing, shedding or lacking cash.

Skidmore estimates that the full amount of cash lacking from the federal government’s books is about $21 trillion. This provides up Ben Norton has reported over 250 US secret navy operations since Sep 11. You’ve got heard the tales concerning the $700 hammer and the $500 rest room seat proper?

Catherine Austin Fitts, a former assistant secretary of Housing and City Growth, has alleged greater than $21 trillion {dollars} are lacking from the U.S. authorities. She has primarily based her estimates on an evaluation of presidency paperwork, together with the U.S. Treasury’s information of presidency spending and receipts.

Listed below are some further particulars about how the U.S. drained its silver stockpiles to offset the Hunt brothers:

The federal government bought about 600 million ounces of silver from its stockpiles between 1979 and 1980.

This was about half of the federal government’s silver stockpile on the time.

The gross sales helped to drive down the value of silver and forestall the Hunt brothers from cornering the market.

The federal government’s actions have been controversial as a result of it was seen as interfering with the rules of FREE MARKETS. In any case this again story we get to our thesis: Why #DraintheMint is a greater technique than the failed Drain the Comex. Introducing SilverSqueeze 2.0

Editors observe: a few of this part under particularly DrainTheMint included analysis help from the illuminated ape (moderator of Reddit’s SilverDegenClub that toppled over reddit’s WallStreetSilver in January 2022.)

Why COMEX ought to Not Be the Goal.

Identical to final yr’s Nickel Futures debacle, nobody is aware of what is going on on over on the COMEX.

The Chicago Mercantile Alternate (CME) was transitioned to COMEX in 2008. The merger was controversial as a result of it created a monopoly within the futures marketplace for metals.

The CME and COMEX have been two of the most important futures exchanges on this planet. The CME traded a wide range of futures contracts, together with agricultural commodities, rates of interest, and currencies.

COMEX traded a wide range of metals futures contracts, together with gold, silver, copper, and platinum.

The merger of the 2 exchanges created a monopoly within the futures marketplace for metals. This meant that the CME was the one alternate the place merchants might purchase and promote metals futures contracts. This gave the CME a whole lot of energy, and it raised issues that the alternate would use its energy to control the market.

The merger was additionally controversial as a result of it was seen as a approach for the CME to broaden its attain into the metals market. The CME was already a dominant power within the futures marketplace for agricultural commodities and rates of interest. The merger with COMEX gave the CME a foothold within the metals market, which is a rising market.

The merger of the CME and COMEX was finally accepted by the Commodity Futures Buying and selling Fee (CFTC). Nevertheless, the merger stays controversial, and there are nonetheless issues concerning the CME’s energy within the metals market.

Listed below are among the arguments towards the merger:

The merger would create a monopoly within the futures marketplace for metals.

The CME would use its energy to control the market.

The merger would give the CME an excessive amount of energy within the monetary markets.

In the end, the choice of whether or not or to not approve the merger was as much as the CFTC. The CFTC accepted the merger which isn’t any shock for the reason that US authorities likes to have an inside monitor on manipulation, managing, scheming and suppressing silver costs as a result of silver is the antithesis to the US greenback.

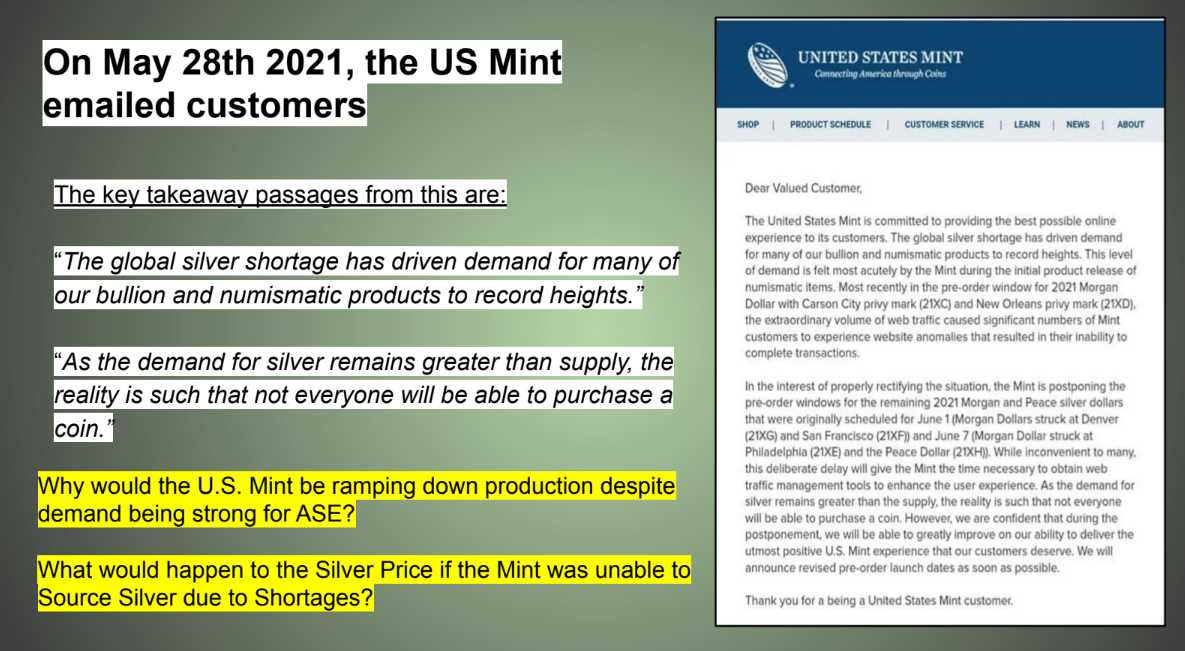

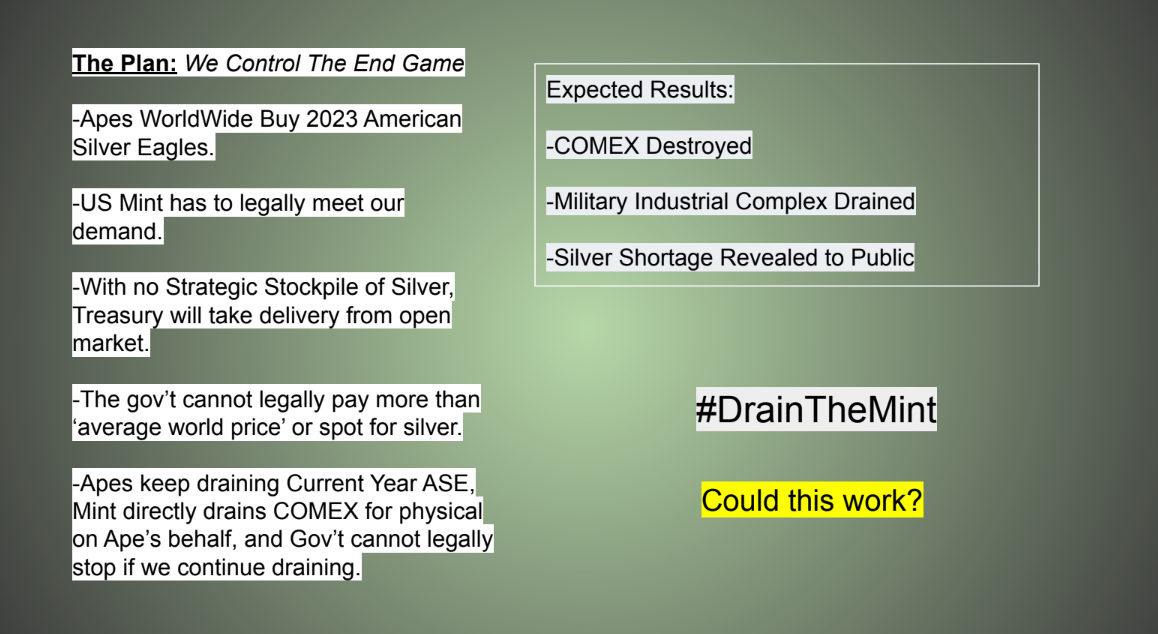

SilverSqueeze 2.0 #DrainTheMint

Goes proper to the Headline of this text

Drain The Mint is The Finest Option to inflict Ache on Banksters & Federal Reserve. A lot Higher than Drain the Comex

Why?

The US tamped the value of Silver in 1980-81 after the Hunt brother’s try to nook the market (see above).

The US’s strategic stockpile is presently depleted due to all of the factors outlined above. Silver utilized in warfare for instance.

The US mint has to mint eagles to satisfy public demand.

The US mint can not pay greater than the spot value (unable to win bids at Sunshine mint for *planchets).

The Sunshine mint is the only real provider of planchets for the time being that meet the unknown requirements that the US Mint requires for his or her *planchets.

The US Mint is extra susceptible to a squeeze for the time being, and when confronted would haven’t any counter.

It would power them to unrig the market or admit to a silver scarcity which is able to trigger worldwide panic and likewise be the very dream stackers have been ready for…

Furthermore, the US greenback could have rather more critical issues on their hand corresponding to shedding US greenback hegemony.

There is no such thing as a different choice for the US Mint, and that is the explanation for the excessive premiums.

It’s an entire bluff to keep away from being unable to produce.

#DrainTheMint Marketing campaign / Technique is taking motion and CALLING THEIR BLUFF.

* Do you know? In silver minting, planchets are the clean disks of metallic which might be struck to create cash. They’re usually manufactured from 99.9% pure silver, and they’re fastidiously machined to be the precise dimension and weight required for the precise coin being produced.

Planchets are made by melting silver after which pouring it right into a mildew to create a billet. The billet is then heated and fed by an extruder to kind an extended, flat strip of silver. This strip is then minimize into blanks, that are the ultimate form of the planchets.

The blanks are then fed right into a press, the place they’re struck with a die to create the coin’s design. The stress from the press causes the silver to stream into the die’s recesses, creating the coin’s raised design.

Planchets are a vital a part of the silver minting course of. They’re the muse upon which the coin’s design is created, and so they have to be of the best high quality with the intention to produce high-quality cash.

Listed below are among the elements which might be thought-about when making planchets:

Purity: The planchets have to be manufactured from 99.9% pure silver with the intention to meet the requirements of most coinage packages.

Dimension: The planchets have to be the precise dimension and weight required for the precise coin being produced. This ensures that the coin could have the right diameter, thickness, and weight.

End: The planchets will need to have a clean, even end with the intention to settle for the coin’s design. Any imperfections within the end can be mirrored within the coin’s design.

Planchets are an essential a part of the silver minting course of, and so they have to be of the best high quality with the intention to produce high-quality cash.