Leonid Sorokin

There’s nothing in Keynesian economics that might can help you remedy stagflation. However there’s nothing in neoclassical economics that might can help you remedy stagflation, both. – Paul Samuelson

Stagflation is an financial state characterised by a sluggish financial system, excessive inflation, and usually, excessive unemployment. In such a situation, the financial system experiences a paradoxical scenario the place the costs of products and providers enhance, at the same time as financial output slows down and unemployment rises.

These financial situations are significantly troublesome for policymakers to handle. Measures to stimulate financial progress typically exacerbate inflation, and steps to regulate inflation can additional hinder progress and enhance unemployment.

The Fed appears to be assured that it may break inflation sustainably with larger charges, however the issue finally is difficult to resolve long-term within the absence of competitors. More and more we discover ourselves in a world the place practically each business is an oligopoly.

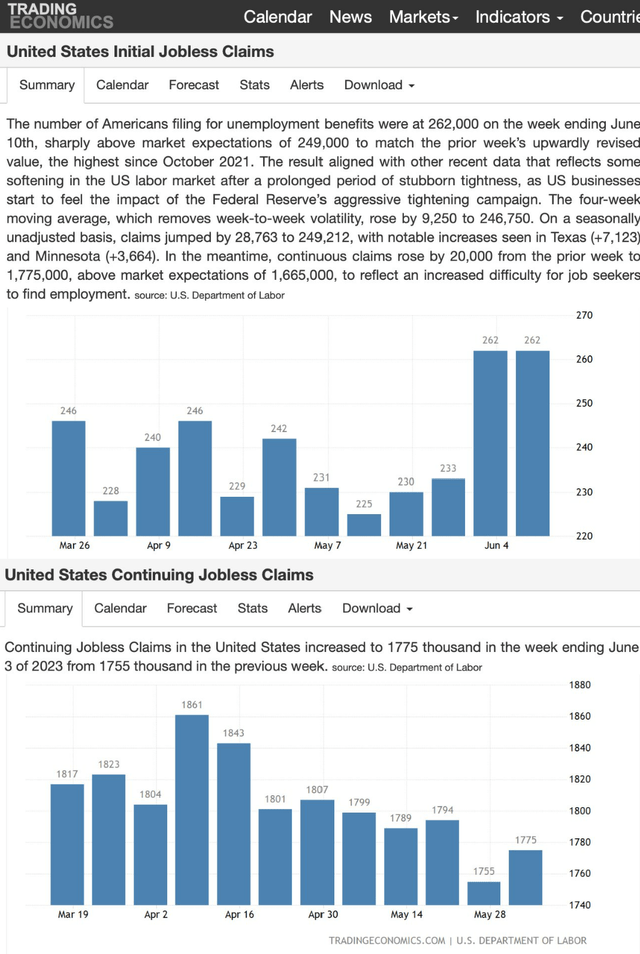

Competitors finally solves inflation whereas preserving unemployment low. It does not appear like that is going to occur for now, all whereas jobless claims are simply beginning to decide up.

TradingEconomics.com

Historic Context of Stagflation

Stagflation was as soon as thought of an impossibility by economists. The financial theories of the twentieth century, significantly the Phillips Curve inside Keynesian economics, described macroeconomic coverage as a trade-off between unemployment and inflation.

Nevertheless, the phenomenon of stagflation within the Seventies debunked these theories. The Seventies stagflation was primarily pushed by three elements: a dovish Federal Reserve coverage that accepted inflation for diminished unemployment; elevated authorities spending on social applications and the Vietnam Warfare; and cost-push inflation triggered by the oil embargo and rising commodity costs.

Stagflation within the Fashionable Context

Whereas the phenomenon of stagflation hasn’t repeated itself for the reason that Seventies, the specter of its reoccurrence stays. The worldwide financial system right this moment displays sure traits much like the Seventies. The Fed’s efforts to stimulate the financial system by financial coverage, elevated authorities spending because of the COVID-19 pandemic, and the rising costs of commodities attributable to supply-chain disruptions may probably set the stage for longer-term stagflation.

Furthermore, latest knowledge indicating slowing financial progress and elevated inflation have raised issues concerning the chance of stagflation. Though unemployment charges are at the moment low, they might probably rise if financial progress continues to sluggish, and at a a lot sooner charge of change than inflation dropping

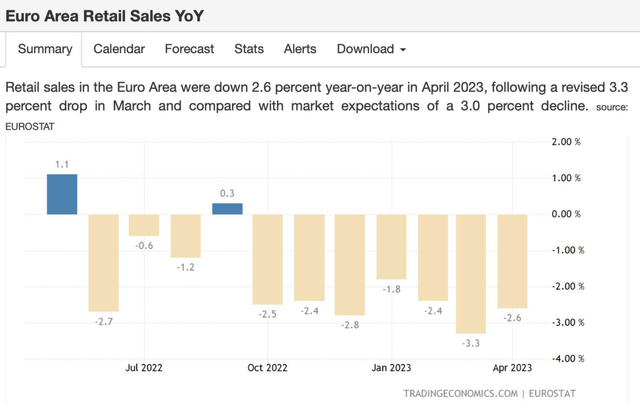

Europe (VEA) appears to be at most danger for this from a chronic cycle perspective as Lagarde repeatedly references the necessity to elevate charges regardless of the Eurozone being in recession now. Retail gross sales proceed to be weak, but there is not any coverage reversal imminent by the European Central Financial institution.

TradingEconomics.com

The Merk Stagflation ETF (STGF)

Are there methods of investing in stagflationary intervals? Sure – largely by Treasury Inflation Protected Securities (TIP), Actual Property (IYR), Gold (GLD), Oil, and the Greenback (UUP). Whereas TIPS weren’t round in the course of the stagflation of the Seventies, it is smart that they function a great hedge. One good all-encompassing asset allocation portfolio I am a fan of is the Merk Stagflation ETF (STGF), which tracks a portfolio divided between 55%-85% U.S. Treasury Inflation-Protected Securities (TIPS) and between 5%-15% actual property, gold, and oil. The fund is designed to rebalance as wanted to keep up these allocations.

Conclusion

The chance of stagflation stays a contentious subject. Whereas some indicators recommend an rising chance of stagflation, others argue that these indicators could also be deceptive. I’ve gone on report earlier than arguing that I are typically extra of a disinflation/deflationist given demographics, the wealth hole, and expertise, however stagflation is a really actual long term danger. And if that certainly is the route we’re headed, the “new bull market” will not be within the S&P 500 (SPY), however moderately elements of {the marketplace} that are inclined to get a lot much less media protection than shares.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you bored with being a passive investor and able to take management of your monetary future? Introducing The Lead-Lag Report, an award-winning analysis software designed to present you a aggressive edge.

The Lead-Lag Report is your every day supply for figuring out danger triggers, uncovering excessive yield concepts, and gaining invaluable macro observations. Keep forward of the sport with essential insights into leaders, laggards, and every part in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report right this moment.

Click on right here to achieve entry and take a look at the Lead-Lag Report FREE for 14 days.