Assume it’s too late to retire with actual property? Possibly you’re in your forties, fifties, or sixties and have determined that now’s the time to place passive revenue first. With retirement developing in a few many years (and even years), what are you able to do to construct the nest egg that’ll help you take pleasure in your time away from work? Is it even potential to retire with leases should you didn’t begin in your twenties or thirties? For these uninterested in the normal path to retirement, stick round!

You’ve hit the jackpot on this Seeing Greene present; it’s episode quantity 777! However, in contrast to a on line casino, all the pieces right here is free, and we’re NOT asking you to gamble away your life financial savings. As an alternative, David will contact on a number of the most vital questions on actual property investing. From constructing your retirement with leases to investing in “low-cost” out-of-state markets, shopping for cellular properties as trip leases, and why you CAN’T management money stream, however you possibly can management one thing MUCH extra vital.

Need to ask David a query? If that’s the case, submit your query right here so David can reply it on the subsequent episode of Seeing Greene. Hop on the BiggerPockets boards and ask different buyers their take, or observe David on Instagram to see when he’s going dwell so you possibly can hop on a dwell Q&A and get your query answered on the spot!

David:That is the BiggerPockets podcast present, fortunate quantity 777. You don’t have to purchase extra actual property. You need to regularly be energetic in including worth to the true property you could have, and once you’ve received to the purpose that you just’ve elevated the worth as a lot as you possibly can by doing the rehabs after you’ve already purchased it at an amazing value, promote it or maintain it as a rental. Transfer on to the subsequent one and proceed including worth to each single piece of property that you just purchase. That can flip into the retirement you need.What’s occurring everybody? That is David Greene, your host of the BiggerPockets Actual Property podcast right here as we speak with a Seeing Greene episode. In as we speak’s present, I take questions from you, our listener base, and I reply them for everyone to listen to. And you’ve got struck the jackpot with episode 777 as a result of it is a very enjoyable and informative present. At this time we get into a number of questions, together with learn how to know in case your property will work higher as a long-term rental or a short-term rental, the spectrum of cashflow and fairness and what which means, if the 4% rule of monetary independence nonetheless works as we speak and what could also be altering about it, in addition to what you are able to do should you get began investing later in life and you are feeling such as you’re behind. All that and extra on one other superior episode only for you.Earlier than we get to our first query, as we speak’s fast tip could be very easy. Take a look at actual property meetups in your space. Lots of you’re in sure markets within the nation that we don’t speak about on a regular basis on the present. In reality, I wager you the 80/20 rule applies. We speak about 20% of the markets 80% of the time, however what does that imply for the opposite 80% of the folks that dwell some other place? Effectively, you continue to have to get details about your market and alternatives you could have out there, and there’s no higher place to try this than , old school actual property meetup the place you possibly can meet different buyers and listen to what they’re doing that’s working, what challenges they’re having, and the way they’re overcoming them. If there isn’t one in your space, excellent news, you get to be the one which begins it, and also you get to construct the throne upon which you’ll sit as the true property king or queen of alternative. All proper, let’s get to our first query.

Sam:Hello, David. Thanks for answering my query. My identify’s Sam Greer from Provo, Utah, a current school graduate. My spouse and I herald about 180K a yr. We’ve got no debt, desirous to get into actual property, desire a three bed room as we each do business from home and have a one-year-old. Lease right here is about 2,200 for a 3 mattress. A mortgage with a 5% down fee could be about 2,800. We’re questioning if we should always proceed renting, shopping for actual property outdoors of Utah because it’s less expensive, purchase right here, attempt to home hack, though should you do a duplex, it’s about 2,800 accounting for the lease on the opposite facet. Issues are costly round right here. We’re questioning what we should always do if it’s finest to attempt to discover a deal right here or exit outdoors of Utah in a less expensive market. Any recommendation could be significantly appreciated. Thanks.

David:Hey there. Thanks, Sam. So let’s begin off with this. Actual property being cheaper some other place doesn’t essentially imply higher some other place. There’s a purpose that actual property is pricey in Provo, and that’s since you’re getting development. So I need you to have a look at the way in which that actual property makes cash. It actually makes cash in 10 completely different ways in which I’ve recognized, however there’s two principal sources, which is cashflow and fairness. Often, a market that’s stronger in cashflow will probably be weaker in fairness and vice versa. In order that doesn’t imply it’s a cashflow market or an fairness market, though more often than not it could lean in a single course or the opposite. Meaning there’s a spectrum, and on one finish of the spectrum you’ll have fairness. The opposite finish, you’ll have cashflow. And you bought to determine the place you’re comfy becoming in there.The Provo market is rising as a result of inhabitants is rising. Persons are transferring there, and individuals are transferring there from California and different states which have cash, which implies rents are going to proceed to extend. Values of actual property are going to proceed to extend. That could be a wholesome strong market that you just’re prone to do properly in, however as you’re seeing, which means it’s not inexpensive. Now, right here’s the place I need you to alter your perspective, and I need you to start out Seeing Greene. It’s not inexpensive proper now, however it’s going to develop into much more costly sooner or later. Now, I’m saying this as a result of should you don’t purchase in these high-growth markets, your lease continues to go up and up and up. So that you talked about that you would be able to lease for two,200 however personal for two,800. Proper off the bat, that makes it seem to be renting is cheaper.It’s all the time like that to start with. Bear in mind the story of the tortoise and the hare, the place the hare got here out the gates and was actually quick, and the tortoise was actually gradual? The hare all the time seems to be like they’re profitable the race to start with. That’s what it’s like when you concentrate on renting and as a substitute of proudly owning. However over time, rents proceed to go up. Your mortgage will probably be locked in place at 2,800. You really even have some potential upside that charges might return down and that 2,800 might develop into even much less on a refi. So that you may get some assistance on either side, each from rents going up and from the mortgage coming down should you purchase. So should you’re taking the long-term method, shopping for goes to be higher, and that is earlier than we even get into the fairness. We’re not even speaking about the home gaining worth and the mortgage being paid off. We’re solely speaking about the price of residing, which implies shopping for is healthier.One thing else to think about is that you just’re most likely going to get tax advantages should you personal that house. So should you get a advantage of say, $300, $400 a month in taxes that you just’re saving from with the ability to write off the mortgage curiosity deduction, that 2,800 now turns into 2,400 or 2,500, which is far nearer to the two,200 that you just’d be spending in lease. In order you possibly can see, it’s beginning to make extra sense to purchase. Now, that’s earlier than we even get into home hacking. Can you purchase a four-bedroom home or a five-bedroom home and lease out two of the bedrooms to household, mates? Possibly your spouse isn’t into that. She doesn’t need to share the residing house. Can you purchase a property that has the principle home that you just guys keep in and has an ADU, has a basement, has an attic, has a storage conversion, has one thing within the property the place you possibly can lease that out to any individual else?So your $2,800 housing fee is offset by accumulating 1,200 or 1,400 from a tenant, which is home hacking, making your efficient lease far more like 1,600. Now, that’s considerably cheaper than the two,200 that you just’d be spending on lease plus you get all the advantages of proudly owning a house. Now, I’ll provide you with slightly bonus factor right here. For each home hacker on the market that feels such as you’re not an actual investor, that’s rubbish. Let me inform you why home hacking is superior. Not solely do you keep away from rents going up on you yearly, in order that 2,200 that you just’re speaking about right here, Sam, that’s going to develop into 2,300, then 2,450, then 2,600, and it’s going to go up over time, however you additionally get to cost your tenants extra. So that you’re profitable on either side. Slightly than your lease going up by a $100 with each lease renewal on the finish of the yr, your tenant’s lease goes to go up by a $100 with the lease renewal on the finish of the yr, which implies a financial savings of $200 a month to you each single yr.Over 5 years, that’s the equal of a $1,000 a month that you should have added to your internet price to your finances. Now, how a lot cash do you must make investments to get a $1,000 return each single month at a 6% return, that’s $200,000. So home hacking and ready 5 years on this instance is the equal of including $200,000 of capital to go make investments and get a return, proper? It makes quite a lot of sense, so take the long-term method. Speak to your spouse, discover out what she must be comfy with this. Go over some completely different situations, whether or not it’s shopping for a duplex, or a triplex, or renting out part of the house, or altering part of the house so it could possibly be rented out. Possibly you guys dwell within the ADU, and also you lease out the principle home for $2,000. And now along with your fee of two,800, you’re solely popping out of pocket $800 a month.You save that cash, and also you do it once more subsequent yr. Once you first begin investing in actual property, it’s a gradual course of that’s okay. You’re constructing momentum similar to that snowball that begins rolling down the hill, it doesn’t begin huge. However after 5, 10, 15 years of this momentum of you constantly shopping for actual property in high-growth markets and preserving your bills low, that snowball is large, and you’ll take out huge chunks of the snow which have accrued that’s fairness and make investments it into new properties. Thanks very a lot for the query, Sam. I’m excited for you and your spouse’s monetary future. Get after it. All proper. Our subsequent query comes from Laura from Wisconsin.“My husband and I started investing in actual property in 2018. I’m 57. He’s 58. We received a late begin and are actually making an attempt to navigate our means via to get us to retirement in essentially the most environment friendly means potential. We weren’t all the time financially savvy, nor did we take into consideration retirement as we should always have, which has led to us now making an attempt to play catch-up. I started listening to podcasts and studying books to get educated and use that to take motion. We put money into B-class neighborhoods in Southeastern Wisconsin. Our marketing strategy has been to rehab these properties in order that we don’t should take care of capex or upkeep. My husband is a contractor. We bought our first single-family fixer in 2018 and totally rehabbed it to about 90% model new. We did a ‘burb however then bought it in 2021 to capitalize in the marketplace being in our favor. We 1031-ed that right into a 4 household, then bought our major residence that my husband constructed final fall and used that cash to purchase a single-family residence from a wholesaler and are actually doing a live-in flip.”“This has allowed us to personally dwell mortgage free. We do have a mortgage on the duplex and the 4 household. I don’t have a selected query. Simply what recommendation do you could have for these of us buyers who received a late begin? There haven’t been quite a lot of podcasts associated to this subject. Cashflow is vital to us, however appreciation is sweet too. We aren’t comfy investing in markets that present essentially the most cashflow. We additionally need ease of administration. We love property that we are able to reap the benefits of Jeff’s strengths and add worth to. We don’t need an enormous portfolio, however are hoping to have sufficient properties to make a distinction in our skill to retire comfortably. I notice it is a broad query, however possibly it’s a subject you possibly can deal with within the close to future. Thanks for all you do for the true property investing neighborhood.”Effectively, thanks Laura and I received some excellent news for you. You and Jeff have been really in a reasonably good state. What I can do right here is I can present you some perspective that you could be not be getting now. Most individuals take a look at actual property investing from the coaching wheel perspective they get once they first get launched to this. So once we at BiggerPockets have been first instructing folks learn how to put money into actual property, it was a quite simple method. “Right here is how you identify the cash-on-cash return. Right here is the way you just be sure you’re going to make more cash each month than it prices to personal it as a result of that’s the way you keep away from shedding actual property.” Now, this was vital as a result of BiggerPockets got here out of the foreclosures disaster the place all people was shedding actual property. So Josh Dorkin began this firm as a result of he had misplaced some actual property and he needed to assist different folks keep away from that very same mistake.At the moment, it was simply should you knew learn how to run numbers and you obtain a property that made cash not lose it, it was that straightforward. You have been going to do properly. And should you purchased something in 2011, ’12, ’13, 10 years later, you’ve achieved very properly. So that you perceive what I’m speaking about. Quick-forward to 2023, it’s a fast-moving, difficult, highly-stressful, strain cooker of a market, and we want a extra nuanced method to actual property investing that’s easy. Simply calculating for cash-on-cash return and that’s all-you-got-to-do method, it’s not reducing it anymore. So let’s escape of the coaching wheel method of simply purchase a single-family home, get some cashflow, try this once more, hit management C after which management V 20 occasions, you’ll have 20 homes, you possibly can retire.Actual property really makes you cash in multiple means. I’ve damaged this into 10 other ways, and a few them are shopping for fairness which implies getting a deal under market worth, paying much less for a property than what it’s price, forcing fairness which is simply including worth to the property, pure fairness which might be the truth that costs of actual property have a tendency to extend over time due to inflation, after which market appreciation fairness which is investing in markets which can be extra prone to admire at a higher charge than the areas which can be round them. Once more, it’s not assured, however it’s cheap to anticipate. When you purchase in a high-growth market with restricted provide, it’s going to understand greater than should you purchase in a low-growth market with loads of land and tons of properties in every single place, to allow them to’t go up in worth. Now you’re already doing the very first thing I might’ve advised you, which is reap the benefits of your aggressive benefit.In Lengthy-Distance Actual Property Investing, the primary guide I wrote for BP, I speak about this. Purchase in markets the place you could have a aggressive benefit. The place are you aware a wholesaler that may get you offers? The place are you aware a financial institution that may fund them? The place are you aware a contractor who’s actually good and fairly priced? That’s the market you need to reap the benefits of. Now, you occur to sleep in the identical mattress as an superior contractor, which is nice. He’s all the time going to take your jobs first, and he’s going to speak with you shortly. That’s the issue all the remainder of us are having, however your husband does this for a residing. You’re benefiting from that. You’re additionally shopping for fairness. You talked about that you just bought the home that you just lived in, and also you made the sacrifice, which was sacrificing your comfortability of loving that house that your husband constructed from the bottom up along with his personal palms to get deal from a wholesaler and begin over.Now, once you purchased that single-family residence from the wholesaler, you obtain fairness since you paid lower than it was price, and now you’re forcing fairness by having Jeff work on it. That’s precisely what you ought to be doing. I perceive you’re enjoying catch-up. That doesn’t imply it’s essential to take extra threat. That doesn’t imply it’s essential to hope offers work out and similar to purchase an entire bunch of property. It signifies that it’s essential to be extra diligent about getting extra out of each deal that you just purchase, which you’re already doing. You’re not paying honest market worth for properties, and also you’re not shopping for turnkey issues. That’s a mistake quite a lot of buyers make is they need comfort. They go purchase a turnkey property, or they go to a market, such as you stated, the place it seems that you’re going to get quite a lot of cashflow however you get no development. And so they find yourself both shedding cash or breaking even over a ten to 15-year interval.You could have already sacrificed comfortability within the identify of progress, and I like that you just’re making the appropriate monetary choices. Hopefully you guys are additionally residing beneath a finances, so maintain doing that. I like the thought of you guys doing the dwell and flip. Purchase a home that’s ugly, torn up, however in an amazing market. I name that market appreciation fairness, it’s B-class areas, A-class areas. Similar to you stated, these are going to understand at the next charge than C and D-class areas. Repair up the home. After two years, you’ll keep away from capital positive aspects taxes. You possibly can promote it, and you should purchase one other one and repeat that course of, or you possibly can maintain it as a rental, and you’ll put 5% down on the subsequent home. You aren’t going to wish a ton of capital. As a result of your husband does this work, you could have a bonus over different folks. As a result of your husband does this work, he has contacts within the trade.Possibly he’s too outdated or his physique can’t sustain with the calls for of it, he can oversee the work that another person is doing. Possibly he even mentors some youthful child that wishes to return in and study building, and your husband can use his mind as a substitute of his physique to convey worth into forcing fairness. That’s one other factor it’s best to take into consideration. As you do that, the fairness that you just’re rising with each deal ought to proceed to extend. At sure factors, rip off a piece of that. Go purchase your self one other 4 household. Go purchase your self one other triplex. You’re already doing the appropriate issues. So to sum this up, you don’t have to purchase extra actual property. You need to regularly be energetic in including worth to the true property you could have.And once you’ve received to the purpose that you just’ve elevated the worth as a lot as you possibly can by doing the rehabs after you’ve already purchased it at an amazing value, promote it or maintain it as a rental. Transfer on to the subsequent one and proceed including worth to each single piece of property that you just purchase that may flip into the retirement you need. Thanks very a lot, Laura. Love listening to this story and glad that we’ve got BiggerPockets are in a position that will help you out with that retirement.

Vince:Hey, David, thanks for taking my query. That is Vince Herrera from Las Cruces, New Mexico. I’m in the midst of closing on this property that I’m in proper now. It’s my mother and father’, I made a take care of them to repay the rest of what they owe. And so they signal it over to me, and I’m the proprietor free and clear. So proper now, it’s actually good. It’s solely 30,000. So I regarded up simply actually fast numbers on Rentometer and the areas round it, and it seems to be like I might most likely lease, this cellular house for round a $1,000 a month. It’s a 4 bed room, two tub. It’s in actually fine condition. It was just lately reworked. So I’m questioning, after I do that, ought to I attempt to use it as a short-term rental or long-term?Clearly, I do know I might most likely make extra as brief time period, however I don’t understand how profitable cellular properties are for brief time period, and I simply don’t know what components I ought to be taking a look at to make that willpower. When you might assist me out with that, that’d be nice. My general objective is to deal with hack small multifamily properties to construct up my portfolio. So when I’ve one thing achieved with this property, whether or not or not it’s short-term or long-term rental, I’d wish to get right into a small multifamily duplex, triplex, fourplex and home hack that, after which simply maintain going hopefully. So admire you taking my query and hope you could have day. Thanks.

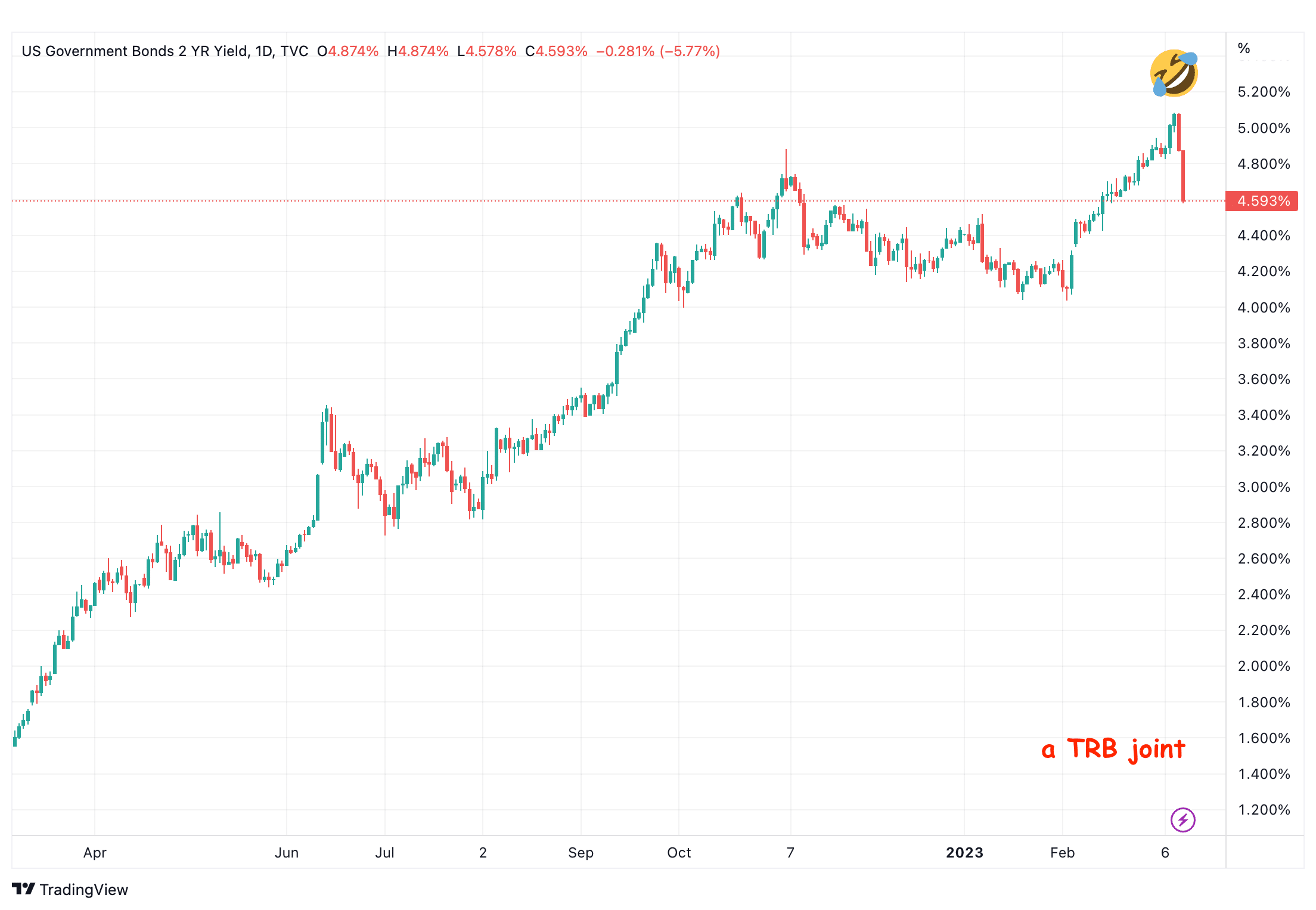

David:All proper, Vincent, thanks very a lot for that. This can be a good query. To go brief time period to go long run, that’s the query. All proper. Now, like I discussed earlier than, what I normally want to provide reply on that is an apples-to-apples comparability. So quite a lot of what I’m doing in actual property once I’m taking a look at two choices is making an attempt to transform the data into one thing that’s apples to apples. So what I needed was to know what would you make monthly as a long run? What might you make monthly as a brief time period? Then I might look to see, as a result of it’s going to be considerably extra work to handle the short-term rental, is the juice definitely worth the squeeze? If it’s an additional two grand or three grand a month, you may make as a brief time period rental, I’d examine that to what you’re making at work.And I’d attempt to determine would that make sense so that you can put the trouble into it versus if it’s one other $300 a month, and it’s going to be quite a lot of work? Possibly it doesn’t make sense. So I exploit the BiggerPockets Rental Estimator, which anyone can use in the event that they go to biggerpockets.com they usually go to Instruments after which Lease Estimator. And I regarded up four-bedroom, two-bathroom, cellular properties in Las Cruces, New Mexico, and I used the zip code 88001. I don’t know precisely what the deal with was, however that’s the one which I picked. And rents appeared like they have been wherever in between $1,100 and $1,700, proper? So we’re going to make use of a median above that, $1,300 for this property as a long-term rental. The subsequent factor I would want you to do is to ask round at property managers that do short-term leases on the market and learn the way a lot demand you could have for short-term leases?You’re going to need to discuss to both one other investor that does it or a property supervisor that manages short-term leases to determine it out. My guess is the folks that will be renting out a cellular house as a short-term rental would most likely be both a touring skilled that wants a spot to remain for a month or two or an individual that wishes a finances deal as a result of in any other case they might simply keep at a lodge. So at a $100 an evening, you’d mainly have to lease that factor out for round a median of 13 occasions a month to be able to get comparable income to the long-term rental. Now, after all there’s cleansing charges and different charges related to short-term leases, however it’s about half the month it’s going to should be rented for at a $100 an evening. Evaluate that to lodges. Can folks keep at a lodge for lower than that or extra?If a lodge out there’s $200 an evening, possibly you can get 150 or 125. That’s the method that you just need to take. I can’t reply your query on which means it’s best to go till I understand how a lot demand there’s and the way many individuals are touring to Las Cruces, however I’ve given you sufficient info that you can determine this out for your self with out a ton of labor. Additionally, congratulations on utilizing the assets you could have out there to you, which was your mother and father to get this property, repay the notice, and take it over free and clear. I might like to see what you’d do with this. This could possibly be an amazing constructing block, a foundational piece to get a number of the fundamentals of actual property investing down that will then provide help to shopping for the subsequent home, which is hopefully a daily, building, single-family house that you would be able to purchase with 5% down.Attain out to me should you’d wish to go over some lending choices and provide you with a plan for the way to try this, and hopefully we are able to get you on one other episode of Seeing Greene to provide progress on the subsequent property that you just purchase. Now, Vincent, in some unspecified time in the future it’s possible you’ll need to finance that cellular house, and also you’re going to search out that financing will not be the identical for cellular properties as it’s for normal building. You’re not going to get the identical Fannie Mae, Freddie Mac 30-year, fixed-rate merchandise, and that throws lots of people off. There are nonetheless financing choices out there to you although. You simply received to know the place to look. Take a look at BiggerPockets episode 771 the place I interview Kristina Smallhorn, who’s an professional on this, and we go over some financing choices in addition to different issues it’s best to know should you’re going to be shopping for cellular properties or pre-fabricated properties.All proper, this level of the present, I wish to go over feedback from earlier episodes that individuals left on YouTube. I discover it as humorous, I discover it’s insightful, and I discover it as difficult, and typically folks say imply stuff, however that’s okay. I’m a giant boy, I can take it, however I wish to share it with all of you as a result of it’s enjoyable to listen to what different individuals are saying in regards to the BiggerPockets podcast. Just remember to like, remark, and subscribe to this YouTube channel, however most significantly, depart me a touch upon as we speak’s present to let me know what you suppose. At this time’s feedback come from episode 759. Let’s see what we received. From PierreEpage, “You need to make turning on the inexperienced gentle a part of the present, after which will probably be tougher to neglect, nearly like a fast tip being stated in a sure means so constantly.”Pierre, that could be a nice thought. That is why I such as you guys leaving feedback. I couldn’t do that present with out you. It could possibly be that, like (singing). [inaudible 00:21:58] is that, isn’t that Sting or one thing that sings that? Is it Roxanne? (singing) Yeah. We might even make that the theme present for the Seeing Greenes, however we simply have inexperienced as a substitute of purple. Possibly I ought to try this. Once I begin the present, I’ve received the common blue podcast gentle behind me, after which we all know it’s time to get critical as a result of I flick it to inexperienced like Sylvester Stallone in that film, Over the High, the place he turns his hat backwards. And it’s like flipping a lightweight swap, and I am going into Seeing Greene mode. Might need to think about that, Pierre. Thanks very a lot for that remark. In reality, if I can keep in mind your identify, I’d even provide you with a shout-out once I try this for the primary time.Subsequent remark comes from Patrick James 1159. Earlier than I learn this, I simply need to ask everybody as a result of I do Instagram Lives on my Instagram web page, @DavidGreene24, and also you attempt to learn the particular person’s identify that has the remark. And it’s all the time Matt_Jones_thereal.76325, and I ponder is there that many Matt Joneses that they want this many? Patrick James, are there 1,159 of you, and that’s how far you needed to go? However as I learn this, I notice the hypocrisy of what I’m saying as a result of I’m DavidGreene24, and there most likely have been 23 earlier than me, however I picked a quantity. Nevertheless, my quantity was my basketball quantity in highschool. I don’t know what quantity 1159 could possibly be. It’s not a birthday. I’m curious, Patrick, should you hear this, depart us a YouTube touch upon as we speak’s present, so we all know why you selected to throw such a giant quantity on the finish of your identify.All proper, Patrick says, “I want the perfect for everybody, however I’m leery of inflation and better and better charges. Two issues that I can’t management, a grizzly burr.” Ooh, I see what you’re saying there like grizzly bear, however utilizing burr, and also you’re saying bear as a result of it’s a bear market which has you nervous, which is why you stated you’re leery of inflation at increased charges. Okay, you most likely meant this as a joke, however I’m going to run with this in a critical means. It’s an issue, my brother. That is actually why I believe the market is so laborious, and I received’t take the entire episode to elucidate it, however should you’re struggling discovering offers that make sense in comparison with what you’re used to seeing, you aren’t alone. We’ve got created a lot inflation that you just can not beat it by investing your cash in conventional and funding automobiles, bonds, CDs, checking accounts, ETFs, even most mutual funds. Except you’re an extremely proficient inventory picker, you’re not beating inflation proper now, and relying how inflation’s measured, that’s completely different, proper?The CPI suppose got here in at 4.9, however should you take a look at how a lot forex has been created, there’s folks that suppose inflation is nearer to 30% to 50% a yr. You’re not getting a 30% to 50% return on any of those choices I discussed. The place are you able to get it? With actual property, and that doesn’t imply a cash-on-cash return, I’m saying extra like an inner charge of return. When you take a look at shopping for fairness, forcing fairness, market appreciation fairness, pure fairness, pure cashflow, forcing cashflow, shopping for cashflow, all of the ways in which I take a look at how actual property can earn money once I’m Seeing Greene, you can begin to hit these numbers over a 10-year time frame. And that’s why everyone seems to be making an attempt to purchase actual property proper now, even with charges which can be excessive, even with cashflow that’s compressed. It’s laborious, however it’s nonetheless the cleanest shirt within the soiled laundry, and everybody’s combating for it.So I hear you, Patrick. It’s tough. Patrick then says, “There be a grizzly burr in them woods.” This can be a very corny Seeing Greene fan, and I adore it. Thanks. Guys, who can out corn Patrick? I need to know within the feedback. From Justin Vesting, “Hello, David. I simply need to contact on one thing that I’ve observed. You guys by no means interview or communicate on the Northeast market, New England particularly, the hardest market within the US and the place I’m positioned. I dwell in Rhode Island. Please do a present relating to the Northeast market, and should you might, Rhode Island could be implausible. Hope you may make it as I might love to listen to some perception in my market. Thanks.” All proper, Justin, as I learn this, I notice I neglect that Rhode Island is a state in our nation. I’m most likely not the one one. There’s different states like Vermont and Maine that I can very simply neglect exist. New England you hear about, however with Tom Brady gone, you hear about it a lot much less.So that you’re proper. We don’t do an entire lot of Northeast discuss. We don’t have company on which have achieved rather well in these markets. Possibly we have to get somebody to achieve out to BiggerPockets.com/David and let me know should you’re a Northeast investor, so we are able to get you on the podcast as a result of it’s robust. And I can see how you reside there, and also you’re making an attempt to determine what may be achieved to earn money in these markets, and also you’re not getting any info. So first off, thanks for listening though you’re in a forgotten a part of the nation that I don’t know exists. That is like once you undergo your closet, you discover that shirt that you just neglect you had. You’re like, “Oh yeah, I haven’t worn this factor in three years. I keep in mind I used to love this sweatshirt.’ Nevertheless it’s prefer it’s model new. You simply jogged my memory we’ve got 50 states and never simply 47.However on a critical notice, yeah, we do have to get some folks in to speak about that. I imagine that we had somebody from Bangor, Maine, it was like the primary BiggerPockets episode I ever co-hosted with Brandon. We interviewed any individual from that market, and it was very uncommon. So should you’re a Northeast investor, tell us within the feedback. And should you’ve received an honest portfolio, embrace your electronic mail, and our manufacturing staff will attain out to you and interview you to be on the present. All proper, a name to motion earlier than we transfer on to the subsequent query. Get entangled along with your native actual property investor affiliation or meetups. That is your finest option to join with buyers in your market and get real-time data about what’s working. When you’re investing in New England, please apply to be on the present at BiggerPockets.com/visitor.We even have an episode with Pamela Bardy developing, so maintain an eye fixed out for 785, and she or he is from Boston, and also you’ll adore it. So should you’re in a market just like the Northeast and also you’re not getting as a lot info as you’d like, it’s extra vital that you just make it to meetups and study from different buyers what they’ve occurring. All proper, we love and we admire your engagement, so please stick with it. Additionally, should you’re listening on a podcast app, please take a second to depart us an sincere assessment. We love these they usually’re tremendous, tremendous vital if we need to stay the most important, the baddest and the perfect actual property podcast on the earth.A current five-star assessment from Apple Podcast from Legendary. “Lastly took a second to jot down a assessment. Listened to you because the starting, saved me going once I needed to throw within the towel in my very own actual property biz. Sustain the good work.” And that’s from Jake RE in Minnesota. Thanks very a lot, Jake, for taking a second to depart us that assessment and particularly for being so variety. So glad you’ve been right here from the start. Love that we’re nonetheless bringing you worth, and thanks for supporting us. All proper, our subsequent query comes from Tomi Odukoya.

Tomi:Hey, David. My identify is Tomi Odukoya. I’m an investor in San Antonio, Texas. Behind me is my imaginative and prescient. I’ve a query. I’m additionally a Navy veteran. I like your thought and thanks a lot for pushing home hacking. I’m at present in my major residence. I used my VA mortgage. I’m on the point of shut on a brand new invoice duplex utilizing my VA mortgage once more. Present home, my major has rate of interest at 3.25%. I’m questioning once I shut on the duplex and transfer into it, my present major, ought to I switch the deed to my LLC, or how ought to I deal with that, so I can lease out the present major and in addition not have to fret in regards to the legal responsibility, however maintain onto the mortgage at 3.25%?

David:Thanks. All proper, Tomi, first off, thanks on your service, man. Actually admire that you just’re within the army, and love that you just’re listening to the present. If we’ve got different army members which can be BiggerPockets followers, ship me a DM on Instagram, @DavidGreene24 and let me know you’re both a primary responder or army. Would like to get to know you guys higher, and gals by the way in which. Okay, let’s break down your query. The excellent news is I believe you’re most likely overthinking it as a result of you could have the appropriate thought, and I can see that you just’re making an attempt to maintain your low rate of interest. However you’re wanting to maneuver out and get one other home, which frankly, if I might simply inform anyone what they need to do with actual property, I’d be telling them to do what you’re doing. Don’t overthink it. Home hack one home each single yr in the perfect neighborhood you possibly can probably get in with essentially the most alternatives to generate income, whether or not that’s essentially the most bedrooms potential or essentially the most models potential, no matter it’s. Simply maintain it easy. Put 5% down each single yr. So that you’re already on the appropriate path.Now, relating to your concern, should you’re saying that you could be need to transfer the title into a brand new car via a deed, so like beginning an LLC to take a home that was as soon as your major residence and take it out of your identify for legal responsibility causes, I’m not a lawyer. I can’t provide you with authorized recommendation. I can inform you if I used to be in your state of affairs, I wouldn’t be apprehensive about that. And I’m saying this from the attitude that LLCs will not be hermetic ensures, very like your bulletproof vest which you’re going to put on should you’re ready the place it’s essential to. It’s higher than not having it, however it’s removed from a assure, proper? The bulletproof vest doesn’t cease all the pieces that comes your means, and that.LLCs are like that. Folks have a tendency to have a look at them like these hermetic assured automobiles that you just’re protected in case you get sued they usually’re not. They’ll even have what’s referred to as the company veil pierced. If a choose seems to be at your LLC and says, “That’s not a enterprise. That was simply his home. It’s nonetheless him that owns it. He doesn’t have a legit actual property enterprise. He simply took his home and caught it on this LLC.” When you’re discovered negligent or at fault, they may nonetheless let that defendant come after you and take what they’re owed within the judgment. One factor folks don’t notice is that your common house owner’s insurance coverage will cowl you in case you’re sued as much as a certain quantity. I might simply discuss to the insurance coverage firm, and I might just be sure you’re lined for an quantity that’s in proportion to what a choose may award any individual if you find yourself getting sued.That’s one of many causes I’m beginning an insurance coverage firm is to assist buyers in conditions like this in addition to to make sure my property. So attain out to me if you need us to provide you a quote there. However the properties that I purchased in my identify, I didn’t transfer all of them into an LLC. The primary properties I purchased, they’re nonetheless in my identify, they usually’re simply protected by insurance coverage. So I believe lots of people assume LLCs are safer than they’re. Doesn’t imply they’re not secure, doesn’t imply they’re not vital. They’ve their function. However oftentimes the folks that I do know which can be placing their properties into authorized entities, it’s not all the time for cover. It’s extra so for tax functions. And the final piece that I’ll say is that this turns into extra vital to place them in authorized entities like LLCs when there’s quite a lot of fairness, or you could have a excessive internet price.When you’re within the army, you’re grinding away, you’re getting your second property, you’re most likely not in an enormous threat of being sued. Once you get a $1 million of fairness in a property or inside an LLC, now, there’s incentive for somebody to go after you and attempt to sue. However till you get a much bigger internet price, it’s not as vital. As a result of should you solely have $50,000, $60,000, $70,000 of fairness in a property, after authorized charges, it doesn’t make sense for a tenant to attempt to sue you for one thing except you actually, actually screw up as a result of there’s not an entire lot for them to get. So don’t overthink it. I believe you’re doing nice. Just remember to’re properly insured. Purchase the subsequent property. After you’ve received a number of of this stuff, we are able to revisit if you wish to transfer their title into LLCs.Another excuse that I’m not leaning in direction of it’s once you try this, most occasions, you set off a due on sale clause in your settlement with the lender that they’ve the appropriate to return and say, “Now, we would like you to pay our mortgage again in full.” They don’t all the time try this, however they will. And right here’s my worry that isn’t talked about fairly often. When charges have been at 5% they usually went down to three%, for a lender to set off the due on sale clause and make you pay the entire mortgage off, they might lose the 5% curiosity that they’re getting from you, they usually must lend the cash out to a brand new particular person at 3%, which is inefficient. So after all, they don’t try this. However what have charges been doing? They’ve been rising.So now I’m warning folks, should you’re getting fancy with this sort of factor, should you’re assuming any individual else’s mortgage and the lender finds out about it, or should you’re doing this the place you’re transferring the title from one factor into the subsequent and hoping they don’t discover out in case your mortgage is at 3% or three to quarter, no matter it was you stated it was at, and charges go to 7%, 8%, 9%, 10%, now the lender can triple their cash by calling your notice due and lending that cash to another person at 9% or 10% as a substitute of you at 3%. You may really see banks going via their portfolio of loans and saying, “I’m calling this one, I’m calling this one, I’m calling this one.” That might make sense to me.So now with charges going up as a substitute of down will not be the time to attempt to transfer issues out of your identify and right into a authorized entity if there’s a due on sale clause. Hope that my perspective is sensible there. Once more, I’m not a lawyer, however that’s the Greene perspective that I’m seeing. You guys have been asking nice questions as we speak. Our subsequent query comes from Jeff Shay in California, the place I dwell. Aspect notice for all of you that don’t dwell in California, first off, nobody calls it Cali in California. I don’t know the place that began, however everybody outdoors of California refers to as Cali, however none of us name it that. It will be like calling Texas, Texi or Arizona, Ari. I don’t know the place that began. It’s simply quite a lot of syllables possibly, however you’re guaranteeing that individuals will know you’re not from California should you say Cali.And when somebody says they’re from California, your subsequent query ought to be, which half, Northern or Southern? As a result of they’re mainly two completely different states. They’ve hardly something to do with one another. So I’m unsure the place Jeff is from in California, but when it’s in Northern California, it may be close to me. Jeff says, “I’m 31, and my spouse is 33. We’ve been investing in actual property. Our properties are extra appreciation heavy, and ultimately the plan is to dump to buy extra cashflow-heavy properties or dividend shares to maximise passive revenue. How do we start to calculate once we can begin doing this? Does the 4% rule nonetheless work in as we speak’s monetary panorama? Thanks very a lot.”Jeff. I like this query. You’re doing it the appropriate means. Let me give some background into why I believe you’re taking the appropriate method right here. So normally, actual property makes cash in a number of methods, however the two principal focuses are cashflow and fairness, and it tends to function on a spectrum. So it’s not prefer it’s cashflow or fairness. It’s quite a lot of cashflow and fewer fairness or quite a lot of fairness and fewer cashflow, however there’s some markets that match proper within the center. Dave Meyer refers to those as hybrid markets. If you need to know extra about that, take a look at the larger information reveals that I do with James right here on the BiggerPockets podcast community.However the level is you could have much less management over cashflow. This is without doubt one of the methods I train wealth constructing for actual property. After all, all of us need cashflow, and for you, Jeff, you’re making an attempt to maximise how a lot cashflow that you just’re going to get in retirement as a result of that’s when it issues. Once you’re not working anymore is the place you want that cashflow. However I don’t management cashflow. The market controls that. I’m on the mercy of what the market will permit me to cost for lease. That’s the one means I can improve cashflow is both elevating lease or lowering bills, and it’s very laborious to lower bills. You possibly can solely lower them a lot. Paying off the mortgage is a method, making an attempt to maintain emptiness low, making an attempt to maintain repairs low. However when issues break in homes, your tenant controls that rather more than you do.So what I’m getting at is you could have lots much less management over the result of cashflow. You could have extra management over the result of fairness. You should buy properties under market worth. You should buy them in areas they’re prone to admire. You should buy at occasions when the federal government is printing extra money. You possibly can power fairness by including sq. footage, fixing the properties up, doing one thing to extend the worth. See what I’m getting at? Fairness permits much more flexibility, however it’s not cashflow. So the recommendation I give is to concentrate on fairness once you’re youthful, develop it as a result of you could have extra affect over that. And what I imply is you possibly can add $50,000 of fairness to a property a lot simpler than it can save you $50,000 of cashflow. I imply, take into consideration how lengthy it takes to avoid wasting $50,000 of cashflow after surprising bills come up. That’s a very long time.Throughout that time frame, you most likely mill much more than $50,000 of fairness. I imply, it may be 10 years earlier than you get $50,000 of cashflow, however fairness doesn’t provide help to once you need to retire. It’s a quantity on paper. It’s not money within the financial institution. So the recommendation, similar to Jeff is doing right here, is to construct your fairness, develop it as a lot as you possibly can. Then once you’re able to retire, convert that into cashflow. Now, Jeff, you stated, “Does the 4% work rule nonetheless work in as we speak’s monetary panorama?” I’m assuming what you’re that means is it’s best to make investments your cash to earn a 4% return since you’re going to dwell for a sure time frame, and that then your cash ought to final you for the way lengthy you’re going to dwell. All proper, so what’s the 4% rule?In response to Forbes, the 4% rule is simple to observe. Within the first yr of retirement, you possibly can withdraw as much as 4% of your portfolio’s worth, in case you have 1 million saved for retirement, for instance, you can spend $40,000 within the first yr of retirement following the 4% rule. Now, I’m assuming what this implies is should you can earn a 4% return on that cash and solely withdraw 4% of stated cash, you received’t run out of cash in retirement. If that’s not precisely the 4% rule, I’m positive the FI individuals are going to be screaming. Let me know within the feedback on YouTube. Nevertheless it’s not tremendous vital if I’ve the rule down. What’s vital is that Jeff is asking, “How a lot cash do I want earlier than I can begin withdrawing it, so I don’t run out of cash in retirement? And at what level do I need to convert this fairness into cashflow?”So the excellent news is you’ve received the fairness to transform, that means you’ve run the race properly. Good job, Jeff and your spouse. You guys are 31 and 33, so it doesn’t have to occur anytime quickly. Okay? Hold investing in these growth-heavy markets. Hold shopping for underneath market worth and maintain including worth to all the pieces that you just purchase. I might wait till you not need to work or take pleasure in working. When you might discover a job that you just work till you’re 60 or 65 and also you prefer it, it’ll be lots much less tense to only maintain working than it could be to attempt to retire at 50 and all the time surprise what’s going to occur. Now, right here’s one thing that I believe are headwinds which can be working towards you. Inflation is rising so extremely quick. If I gave you a $1 million 30 years in the past, you’d really feel an entire lot safer than with a $1 million as we speak.What’s it going to be like 30 years from now once you’re in your early 60s? Is that million {dollars} going to be definitely worth the equal of a $100,000 or $200,000 in as we speak’s {dollars}? You wouldn’t really feel superb retiring with a 100 grand. That may be what a $1 million is price 30 years from now. It may be worse than that. I do know that is laborious to think about, however should you went again 30 years and also you checked out how a lot homes price, you’d most likely discover that they have been like $80,000, $90,000, a $100,000 in areas that they’re now $600,000, $700,000. They’ve gone up lots, and we’ve printed extra money just lately than we’ve got over the past 30 years. So I’m anticipating inflation to be a beast. Now, that is good should you personal belongings. That is good in case you have quite a lot of debt. That is very dangerous should you don’t need to work anymore.In reality, once I first realized this, my plan of retiring at 35 and by no means working once more evaporated as a result of I spotted the $7,000 of passive revenue that I had accrued at the moment was not going to be sufficient to maintain me for the remainder of my life due to inflation. My rents weren’t rising on the identical tempo of the price of residing and all of the issues that I needed to do. That’s once I realized, “I suppose, I received to maintain working, however I’d reasonably be a enterprise proprietor than work at W-2. I received out of being a cop. I received into beginning an actual property gross sales staff, a mortgage firm, shopping for extra rental properties, doing consulting, the stuff that I do now, writing books.Can you discover one thing like that, Jeff, that you just like doing, so you possibly can maintain working? As a result of my worry could be that the $40,000 that you just may be residing on proper now, should you had a $1 million and also you have been utilizing the 4% rule, could be the equal of $8,000 once you really need to retire, not sufficient to dwell on in a yr except you progress to a Third World nation. So it’s a transferring goal is mainly how I’m going to sum this up. By the point you retire, I don’t know if the 4% rule goes to work in as we speak’s monetary panorama, however I’m betting on, no. I’m betting on inflation being actually, actually dangerous and cashflow being laborious to search out for a major time frame. So reasonably than investing to attempt to earn money so I can retire, I’m investing to attempt to preserve the worth of the cash that I’ve already earned.So if I earn a $100,000, I need to put that $100,000 in a car like actual property the place it’ll lose much less, even when it doesn’t maintain tempo with inflation. If inflation is at 30% to 50%, I’m not bleeding as a lot as if I put it in a special funding car. I notice that this isn’t a horny idea, however it’s protection, and I believe extra folks ought to be considering defensively, together with you and your spouse. So maintain doing what you’re doing, however we’re not going to make our determination on once you take out that fairness and convert it into cashflow till a lot later in life, once you’re not in a position to work anymore. Now, what you continue to might do is you can take off some chunks. Let’s say you develop to $2 million of fairness investing in California actual property, possibly you rip off 400,000, 500,000. Put that right into a market that money flows extra closely or an asset class that money flows extra closely like a brief time period rental.After which to get some cashflow coming in from that whilst you maintain a 1.5 million in fairness, let that snowball to a different 2 million. At that time, rip off 500,000. Repeat the method. You may most likely do three, 4, 5 cycles of that earlier than you retire should you do it each 5 – 6 years. All proper, Jeff and Jeff’s spouse, thanks a lot for submitting this query. It was an amazing one to reply, and I received to spotlight what I see occurring with our economic system and the long run. And that’s our present for as we speak. I’m so grateful that you just all be part of me for an additional Seeing Greene episode. I like doing these, and I like your questions. When you’d wish to be featured on the Seeing Greene Podcast, submit your questions at BiggerPockets.com/David as a result of that’s my identify, aptly titled, and hopefully we are able to get you on right here too, particularly should you can maintain it underneath two minutes, one minute. These are even the perfect.And once we first began doing the present, we received a pair complaints that we had folks submitting seven-minute questions, so we’ve achieved a a lot better job of getting these narrowed down. However we couldn’t do the present with out you, the listener base, so thanks very a lot for being right here. If you need to know extra about me, you could find me on-line at DavidGreene24, or you can observe me on Instagram, Fb, Twitter, no matter your fancy is at DavidGreene24. Ship me a DM there, and we are able to get in contact. All proper, should you’ve received a minute, take a look at one other BiggerPockets video, and if not, I’ll see you subsequent week. Thanks, guys, and I’ll see you then.

Assist us attain new listeners on iTunes by leaving us a score and assessment! It takes simply 30 seconds and directions may be discovered right here. Thanks! We actually admire it!

Concerned with studying extra about as we speak’s sponsors or turning into a BiggerPockets associate your self? E mail [email protected].

Word By BiggerPockets: These are opinions written by the writer and don’t essentially symbolize the opinions of BiggerPockets.