Abdullah Durmaz

Jumia’s (NYSE:JMIA) inventory is up modestly off current lows, though the corporate’s valuation stays modest as a result of considerations in regards to the viability of the enterprise mannequin and the energy of the corporate’s stability sheet. Whereas Jumia has decreased losses considerably in current quarters, most of this got here from choosing low-hanging fruit. Additional price reductions are more likely to be tougher, that means the corporate might want to return to development in an effort to attain breakeven.

Jumia continues to face a difficult macro atmosphere, with excessive inflation undermining client spending energy. Sellers are additionally discovering it tough to supply items. That is problematic for Jumia, each as a result of the corporate must proceed rising in an effort to attain breakeven, and the truth that the expansion narrative wants to stay intact in an effort to finance losses.

Weak development within the first quarter was additionally the results of disruptions in Nigeria, which have been associated to the withdrawal of high-denomination forex notes and safety considerations round elections. Overseas change charges are one other headwind for Jumia, with 9 out of 10 native currencies depreciating towards the USD within the first quarter.

Whereas the macro atmosphere is hard, a few of Jumia’s present rising pains are self-inflicted, as the corporate is taking actions which might be impacting utilization within the brief time period. Jumia is transferring away from much less engaging classes, in an effort to cut back losses.

Jumia is pulling again from first-party in most international locations and has considerably decreased promotional depth for a lot of providers on the JumiaPay app. JumiaPay app providers accounted for over 25% of GMV decline and over 40% of order decline within the first quarter. The FMCG class, together with grocery merchandise, was additionally liable for a big portion of the decline in objects offered within the quarter.

The corporate is shifting focus to classes, that are higher suited to ecommerce (telephones, electronics, residence home equipment, vogue and wonder), which is essentially associated to merchandise worth relative to weight/measurement. This could assist ease the burden of achievement bills, however is presently weighing on development.

Jumia additionally needs to additional develop JumiaGlobal, a platform that enables abroad sellers to promote on Jumia. Jumia believes that ecommerce in Africa is primarily restricted by provide relatively than demand, and that rising the provision of inexpensive merchandise will assist to unlock the market. Associated to this, Jumia can also be engaged on bettering vendor administration instruments and processes to boost the expertise of sellers.

Jumia’s addressable market stays underpenetrated and that is one thing the corporate needs to right. Underpenetration is largely as a result of giant swimming pools of customers positioned exterior of main cities, that are usually underserved by retail. To succeed in these customers, Jumia should increase its logistics community, however it’s questionable whether or not this may be achieved in a cheap method. Jumia goals on using current infrastructure operated by third-party companions, working below strict tips and supervision. Jumia additionally needs to increase its attain by way of a shift in advertising technique. Reasonably than relying totally on digital promoting, Jumia will leverage native channels to succeed in customers exterior of huge cities.

Monetary Evaluation

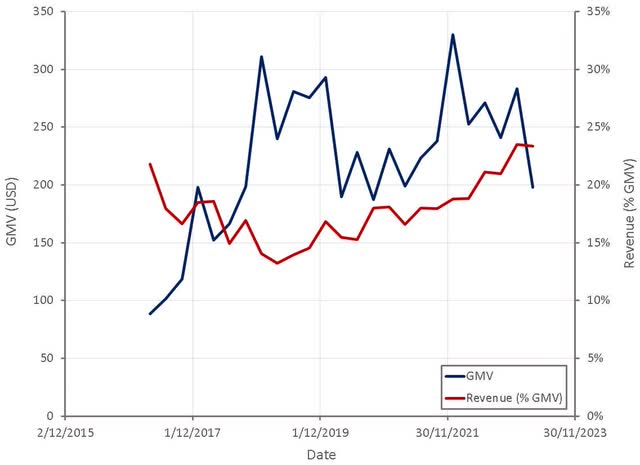

Orders and GMV declined by 26% and 22% YoY within the first quarter, respectively. Market income development was 4%, and 21% on a continuing forex foundation, though offset by first-party income decline. Different income was down 68% YoY, primarily as a result of suspension of Jumia’s logistics-as-a-service providing in most markets. Jumia reportedly needs to enhance its logistics capability and effectivity earlier than taking over third-party volumes. These headwinds have been considerably offset by a rise in fee take charges, which have been carried out in 2022.

Whereas a whole lot of this seems damaging, it’s essential if Jumia goes to create a sustainable enterprise. The corporate had been pursuing development in any respect price, and because of this had expanded into companies with poor economics. Income development can also be being made to look worse by international change charges, which have been a big headwind.

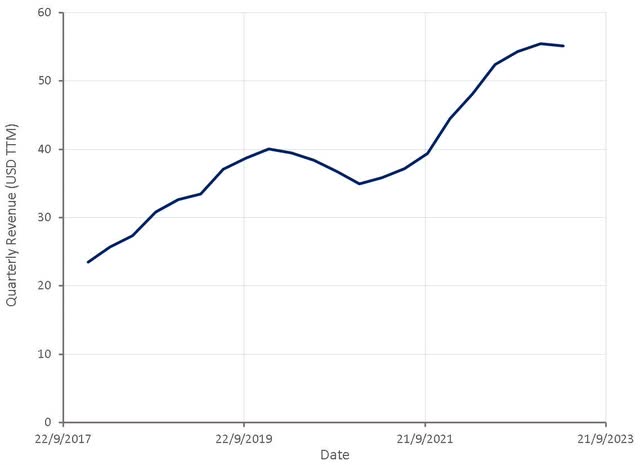

Determine 1: Jumia Income (supply: Created by creator utilizing information from Jumia) Determine 2: Jumia GMV (supply: Created by creator utilizing information from Jumia)

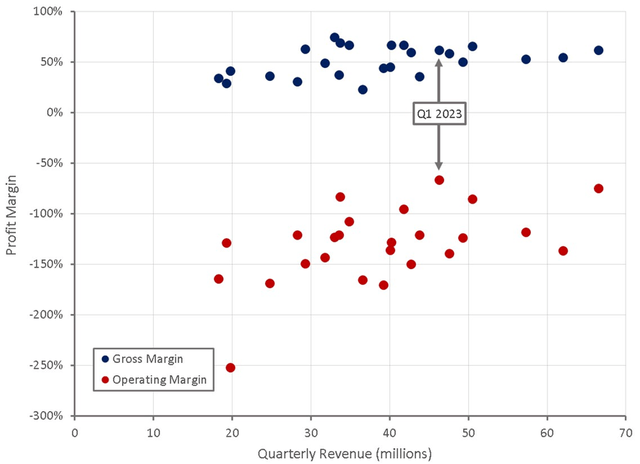

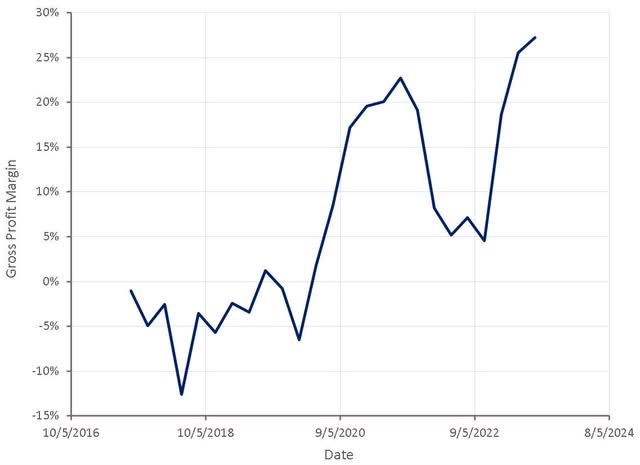

Gross revenue margins have usually been bettering as Jumia abandons poor companies and will increase its take price. Working revenue margins have additionally been bettering as the corporate cuts again on frivolous spending and prioritizes profitability over development. Administration now expects EBITDA loss in 2023 to be between 100 and 120 million USD.

Determine 3: Jumia Revenue Margins (supply: Created by creator utilizing information from Jumia)

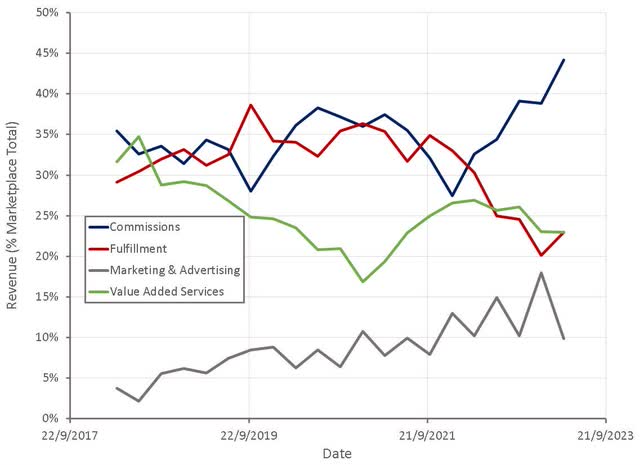

The relative contribution of commissions and advertising and promoting to income continues to extend. These are higher high quality sources of income, that are supportive of margins. Achievement and worth added providers are seemingly loss-leaders, and Jumia continues to maneuver away from these.

Determine 4: Jumia Income (supply: Created by creator utilizing information from Jumia)

Together with achievement bills within the calculation of gross income offers a greater image of Jumia’s enterprise. Jumia’s adjusted gross revenue margin has improved in current intervals, though stays comparatively low.

Determine 5: Adjusted Gross Revenue Margin (supply: Created by creator utilizing information from Jumia)

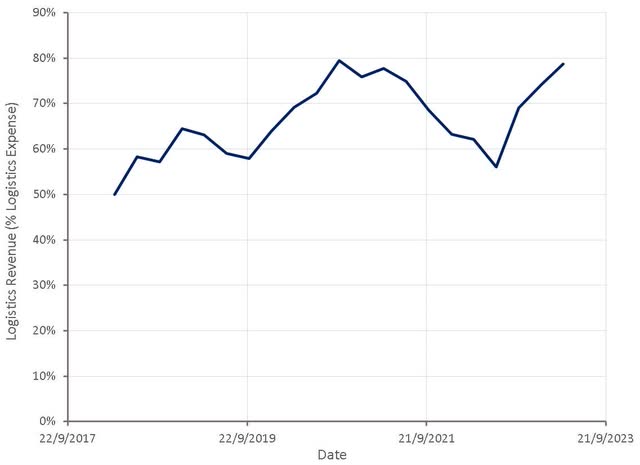

Jumia is making an attempt to enhance the monetization of its logistics providers and the pass-through of achievement prices, though logistics stays an issue. Worth-added providers income and achievement income have been declining, pushed principally by declining volumes. Logistics income from sellers constitutes nearly all of value-added providers income.

Jumia can also be making an attempt to enhance the effectivity of its provide chain. Initiatives embody:

Footprint optimization Route optimization Lowered packaging prices Improved warehouse workers administration

Determine 6: Worth-Added Companies + Achievement Income as a Proportion of Achievement Bills (supply: Created by creator utilizing information from Jumia)

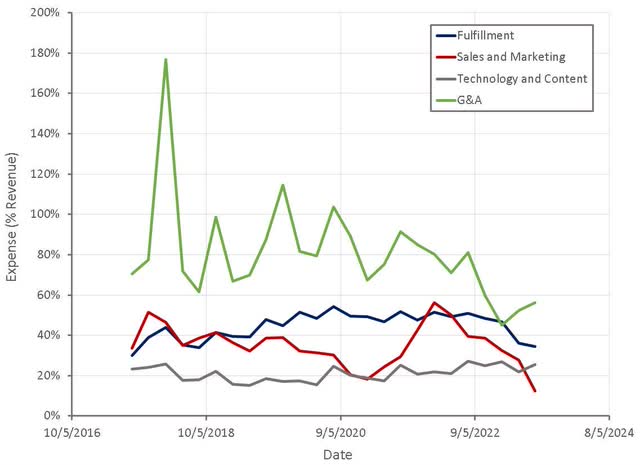

The burden of overhead bills has declined considerably in current quarters on the again of cost-cutting efforts. Normal and administrative bills stay excessive, although, and do not look like set to fall. Whereas Jumia has ongoing initiatives, like workplace area rationalization, and Q1 bills are but to totally replicate headcount reductions, G&A (excluding share-based compensation) continues to be anticipated to be 90-105 million USD in 2023.

Determine 7: Jumia Overhead Bills (supply: Created by creator utilizing information from Jumia)

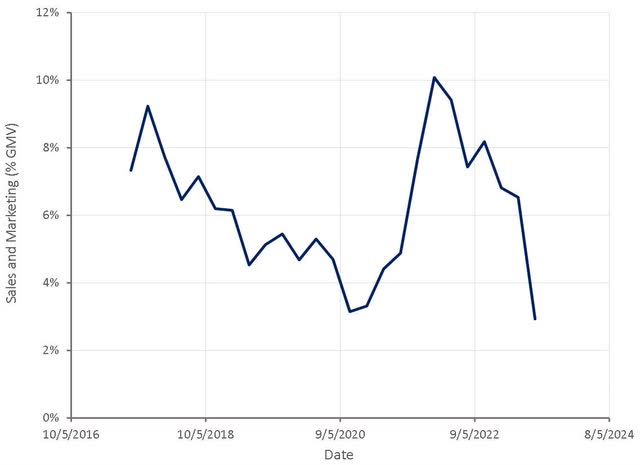

Gross sales and promoting bills have been an space of specific enchancment for Jumia. Whether or not this can influence development stays unclear, although. Jumia’s administration appear assured that improved advertising effectivity will permit them to succeed with a smaller advertising price range.

Determine 8: Gross sales and Advertising and marketing Expense as a Proportion of Income (supply: Created by creator utilizing information from Jumia)

Conclusion

Jumia’s share worth depends on the corporate demonstrating the viability of its enterprise mannequin and the power of administration to boost capital on engaging phrases if essential. Whereas losses have been dramatically decreased, a lot of this got here from simple wins. Going ahead, will probably be more and more tough for Jumia to proceed chopping prices. Because of this Jumia will seemingly must develop the enterprise considerably in an effort to attain breakeven. A tough activity when prices are being minimize.

Jumia presently has round 119 million USD in time period deposits and different monetary property and 87 million USD in money and money equivalents. This could present one thing like an 18-month money runway earlier than Jumia might want to return to capital markets for extra funding.

Even when Jumia can obtain profitability with out considerably diluting current shareholders, the inventory might not be the house run that many individuals assume it’s. Longer-term, it’s questionable whether or not Jumia has a aggressive benefit, given the corporate’s asset gentle method and small person base.