Armed with some information from our associates at CrunchBase, I broke down the biggest NYC Startup funding rounds in New York for Could 2023. I’ve included some extra info resembling business, description, spherical kind, and complete fairness funding raised to additional the evaluation of the state of enterprise capital in NYC.

Are you elevating capital? 43North’s utility is now open for a restricted time! Apply for $1M in funding, plus entry to mentors, buyers, connections to clients, and extra. At 43North, the funding is barely the start. Apply to hitch 43North’s yr 9 cohort in the present day!

*** Be taught extra and apply earlier than 6/23 at 43North.org/program ***

9. Hyro $20.0M

Spherical: Collection BDescription: Hyro is a plug & play conversational AI platform enabling enterprises to simply add voice & textual content capabilities to their digital channels. Based by Israel Krush and Rom Cohen in 2018, Hyro has now raised a complete of $35.0M in complete fairness funding and is backed by Twilio, Intel Ignite, Macquarie Capital, Hanaco Enterprise Capital, and Mindset Ventures.Buyers within the spherical: Black Opal Ventures, K20 Fund, Liberty Mutual Strategic Ventures, Macquarie CapitalIndustry: Synthetic Intelligence, B2B, Pure Language Processing, SaaS, Digital AssistantFounders: Israel Krush, Rom CohenFounding yr: 2018Total fairness funding raised: $35.0M

Are you elevating capital? 43North’s utility is now open for a restricted time! Apply for $1M in funding, plus entry to mentors, buyers, connections to clients, and extra. At 43North, the funding is barely the start. Apply to hitch 43North’s yr 9 cohort in the present day!

*** Be taught extra and apply earlier than 6/23 at 43North.org/program ***

8. Prognos Well being $23.3M

Spherical: VentureDescription: Prognos Well being creates a healthcare analytics platform that makes use of patient-level information to generate scientific insights. Based by Destry Sulkes, Jason Bhan, and Sundeep Bhan in 2010, Prognos Well being has now raised a complete of $65.8M in complete fairness funding and is backed by Hunt Holdings, Merck, LabCorp, Safeguard Scientifics, and Cigna.Buyers within the spherical: Cigna, Hikma Ventures, Hunt Holdings, LabCorp, Marshall Wace, Maywic Choose Investments, Merck, Purple & Blue Ventures, Safeguard ScientificsIndustry: Analytics, Well being Care, Well being DiagnosticsFounders: Destry Sulkes, Jason Bhan, Sundeep BhanFounding yr: 2010Total fairness funding raised: $65.8M

Are you elevating capital? 43North’s utility is now open for a restricted time! Apply for $1M in funding, plus entry to mentors, buyers, connections to clients, and extra. At 43North, the funding is barely the start. Apply to hitch 43North’s yr 9 cohort in the present day!

*** Be taught extra and apply earlier than 6/23 at 43North.org/program ***

7. Kindbody $25.0M

Spherical: VentureDescription: Kindbody is a fertility clinic community and family-building advantages supplier for employers. Based by Gina Bartasi and Joanne Schneider in 2018, Kindbody has now raised a complete of $206.3M in complete fairness funding and is backed by Alumni Ventures, NFP, What If Ventures, Google Ventures, and Winklevoss Capital.Buyers within the spherical: Morgan HealthIndustry: Worker Advantages, Fertility, Well being Care, MedicalFounders: Gina Bartasi, Joanne SchneiderFounding yr: 2018Total fairness funding raised: $206.3M

Are you elevating capital? 43North’s utility is now open for a restricted time! Apply for $1M in funding, plus entry to mentors, buyers, connections to clients, and extra. At 43North, the funding is barely the start. Apply to hitch 43North’s yr 9 cohort in the present day!

*** Be taught extra and apply earlier than 6/23 at 43North.org/program ***

6. Wellthy $25.5M

Spherical: VentureDescription: Wellthy is a household care concierge service that brings reduction to households managing complicated or ongoing care conditions. Based by Kevin Roche and Lindsay Jurist-Rosner in 2014, Wellthy has now raised a complete of $78.0M in complete fairness funding and is backed by FJ Labs, Cercano Administration, Hearst Ventures, HearstLab, and Citi Affect Fund.Buyers within the spherical: Cercano Administration, Citi Affect Fund, Eldridge, Hearst Ventures, Rethink Affect, Stardust EquityIndustry: Well being Care, Medical, WellnessFounders: Kevin Roche, Lindsay Jurist-RosnerFounding yr: 2014Total fairness funding raised: $78.0M

Are you elevating capital? 43North’s utility is now open for a restricted time! Apply for $1M in funding, plus entry to mentors, buyers, connections to clients, and extra. At 43North, the funding is barely the start. Apply to hitch 43North’s yr 9 cohort in the present day!

*** Be taught extra and apply earlier than 6/23 at 43North.org/program ***

5. Campus.edu $29.0M

Spherical: Collection ADescription: Campus.edu supplies on-line studying providers. Based by Tade Oyerinde in 2016, Campus.edu has now raised a complete of $32.6M in complete fairness funding and is backed by Attain Capital, Betaworks, Metropolis Gentle Capital, Founders Fund, and Lachy Groom.Buyers within the spherical: AirAngels, Bloomberg Beta, Dylan Area, Founders Fund, Jason Citron, Lachy Groom, Precursor Ventures, Attain Capital, Rethink Schooling, Sam Altman, Scribble Ventures, Spacecadet VenturesIndustry: EdTech, Increased EducationFounders: Tade OyerindeFounding yr: 2016Total fairness funding raised: $32.6M

Are you elevating capital? 43North’s utility is now open for a restricted time! Apply for $1M in funding, plus entry to mentors, buyers, connections to clients, and extra. At 43North, the funding is barely the start. Apply to hitch 43North’s yr 9 cohort in the present day!

*** Be taught extra and apply earlier than 6/23 at 43North.org/program ***

4. % $30.0M

Spherical: Collection BDescription: % is a platform for sourcing, structuring, syndicating, monitoring, and servicing non-public credit score transactions. Based by Nelson Chu in 2018, % has now raised a complete of $48.5M in complete fairness funding and is backed by Edward Lando, Nomura, Coinbase Ventures, BDMI, and B Capital Group.Buyers within the spherical: B Capital Group, BDMI, Evolution VC Companions, Forte Ventures, International Monetary Know-how Ventures, Susquehanna Development Fairness, Vectr, White Star CapitalIndustry: Credit score, Monetary Providers, FinTech, Data ServicesFounders: Nelson ChuFounding yr: 2018Total fairness funding raised: $48.5MAlleyWatch’s unique protection of this spherical: % Raises $29.7M for its Non-public Debt Market That Brings Enhanced Liquidity Choices

Are you elevating capital? 43North’s utility is now open for a restricted time! Apply for $1M in funding, plus entry to mentors, buyers, connections to clients, and extra. At 43North, the funding is barely the start. Apply to hitch 43North’s yr 9 cohort in the present day!

*** Be taught extra and apply earlier than 6/23 at 43North.org/program ***

4. Kelvin $30.0M

Spherical: Collection ADescription: Kelvin is an power administration and electrification platform for radiator-heated buildings. Based by Marshall Cox in 2013, Kelvin has now raised a complete of $34.3M in complete fairness funding and is backed by Nationwide Science Basis, Columbia College, Third Sphere, Partnership Fund for New York Metropolis, and 2150.Buyers within the spherical: 2150, Partnership Fund for New York Metropolis, Schmidt Household FoundationIndustry: Vitality Effectivity, Vitality Administration, Web of Issues, SustainabilityFounders: Marshall CoxFounding yr: 2013Total fairness funding raised: $34.3M

Are you elevating capital? 43North’s utility is now open for a restricted time! Apply for $1M in funding, plus entry to mentors, buyers, connections to clients, and extra. At 43North, the funding is barely the start. Apply to hitch 43North’s yr 9 cohort in the present day!

*** Be taught extra and apply earlier than 6/23 at 43North.org/program ***

3. Duetti $32.0M

Spherical: Collection ADescription: Duetti is a music fintech firm that gives monetary options. Based by Lior Tibon and Christopher Nolte in 2022, Duetti has now raised a complete of $39.0M in complete fairness funding and is backed by Viola Ventures, Roc Nation, Presight Capital, Viola Credit score, and UNTITLED.Buyers within the spherical: Presight Capital, Roc Nation, UNTITLED, Viola Credit score, Viola VenturesIndustry: Monetary Providers, FinTech, MusicFounders: Lior Tibon, Christopher NolteFounding yr: 2022Total fairness funding raised: $39.0M

Are you elevating capital? 43North’s utility is now open for a restricted time! Apply for $1M in funding, plus entry to mentors, buyers, connections to clients, and extra. At 43North, the funding is barely the start. Apply to hitch 43North’s yr 9 cohort in the present day!

*** Be taught extra and apply earlier than 6/23 at 43North.org/program ***

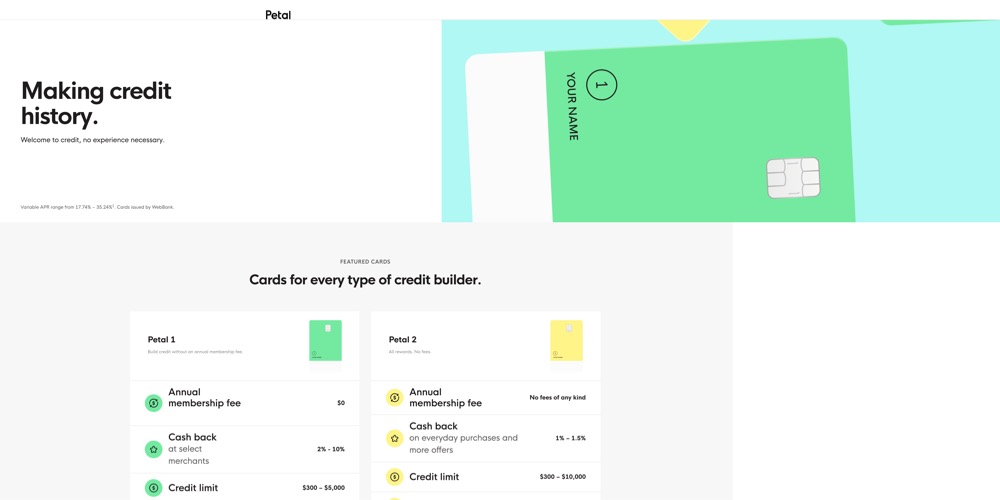

2. Petal $35.0M

Spherical: VentureDescription: Petal is a monetary expertise firm that gives three Visa bank card merchandise for underserved shoppers. Based by Andrew Endicott, David Ehrich, Jack Arenas, and Jason Gross in 2016, Petal has now raised a complete of $289.6M in complete fairness funding and is backed by Gaingels, Trinity Capital, Silicon Valley Financial institution, Dylan Area, and Jefferies.Buyers within the spherical: Core Innovation Capital, RiverPark Ventures, Story Ventures, Valar VenturesIndustry: Credit score Playing cards, Monetary Providers, FinTech, Machine LearningFounders: Andrew Endicott, David Ehrich, Jack Arenas, Jason GrossFounding yr: 2016Total fairness funding raised: $289.6M

Are you elevating capital? 43North’s utility is now open for a restricted time! Apply for $1M in funding, plus entry to mentors, buyers, connections to clients, and extra. At 43North, the funding is barely the start. Apply to hitch 43North’s yr 9 cohort in the present day!

*** Be taught extra and apply earlier than 6/23 at 43North.org/program ***

2. OpenFin $35.0M

Spherical: Collection DDescription: OpenFin supplies monetary establishments with a unified workspace and developer platform constructed for productiveness. Based by Chuck Doerr and Mazy Dar in 2010, OpenFin has now raised a complete of $79.0M in complete fairness funding and is backed by JP Morgan Chase, Financial institution of America, HSBC, Wells Fargo, and JP Morgan.Buyers within the spherical: Bain Capital Ventures, Financial institution of America, Barclays Funding Financial institution, CME Ventures, CTC Enterprise Capital, DRW Enterprise Capital, HSBC, ING Ventures, JP Morgan, Nyca Companions, Pivot Funding Companions, SC Ventures, Tribeca Early Stage Companions, Wells Fargo Strategic CapitalIndustry: Finance, Monetary Providers, FinTech, Working SystemsFounders: Chuck Doerr, Mazy DarFounding yr: 2010Total fairness funding raised: $79.0M

Are you elevating capital? 43North’s utility is now open for a restricted time! Apply for $1M in funding, plus entry to mentors, buyers, connections to clients, and extra. At 43North, the funding is barely the start. Apply to hitch 43North’s yr 9 cohort in the present day!

*** Be taught extra and apply earlier than 6/23 at 43North.org/program ***

1. Avenue One $100.0M

Spherical: VentureDescription: Avenue One supplies expertise platform for property administration providers. Based by William Martiner and Ryan Stroker in 2020, Avenue One has now raised a complete of $100.0M in complete fairness funding and is backed by WestCap and MetLife Funding Administration (MIM).Buyers within the spherical: William Martiner and Ryan StrokerIndustry: Asset Administration, Dwelling Renovation, Property Administration, Actual EstateFounders: William Martiner, Ryan StrokerFounding yr: 2020Total fairness funding raised: $100.0M

Are you elevating capital? 43North’s utility is now open for a restricted time! Apply for $1M in funding, plus entry to mentors, buyers, connections to clients, and extra. At 43North, the funding is barely the start. Apply to hitch 43North’s yr 9 cohort in the present day!

*** Be taught extra and apply earlier than 6/23 at 43North.org/program ***