GamePH/iStock by way of Getty Pictures

Initially revealed on Could 27, 2023

By Ryan McMaken

Again in 2002, then-Vice President Dick Cheney claimed, “Reagan proved deficits do not matter” and went on to push for tax cuts mixed with extra federal spending. After 2003, the economic system gave the impression to be rising, and after the 2008 monetary disaster hit, all that actually mattered was bailing out Wall Avenue to “save” the worldwide economic system.

In reality, for greater than thirty years, stern warnings in regards to the federal debt and annual deficits have come from wet-blanket curmudgeons who insisted that working up big money owed would change into an issue. They have been proper, however the time-frame has confirmed to be fairly a bit longer than most anticipated. Many vital world political and financial modifications intervened to ease the method of incurring an infinite nationwide debt, whilst the overall debt exploded from $5.6 trillion to $22.5 trillion between 2000 and 2019. These modifications included rising world productiveness, a brand new globalized workforce, and stable world demand for {dollars} – which fueled apparently limitless demand for for US authorities bonds. This ensured the debt remained straightforward sufficient to handle. For a time.

Issues are altering, nonetheless, and within the coming 5 years we’ll start to see how a newly accelerating debt, declining demand for {dollars}, and rising value inflation will lastly reveal how and why deficits do matter in spite of everything.

How A lot Debt Are We Speaking About?

The US’s nationwide debt is now projected to exceed $32 trillion in 2023. That is up by practically ten trillion {dollars} since January 2020. Practically eight trillion of that got here in 2020 and 2021 alone. Since 2019, the speed at which the US authorities has taken on new debt has considerably accelerated past what was already a stunning price of deficit spending. Again in 2019, I famous that the Trump administration had added practically a trillion {dollars} to the deficit in a single 12 months of what was thought of an financial enlargement. That was exceptional on the time. In fact, what occurred beneath each Trump and Biden through the Covid panic made a trillion {dollars} appear to be spare change.

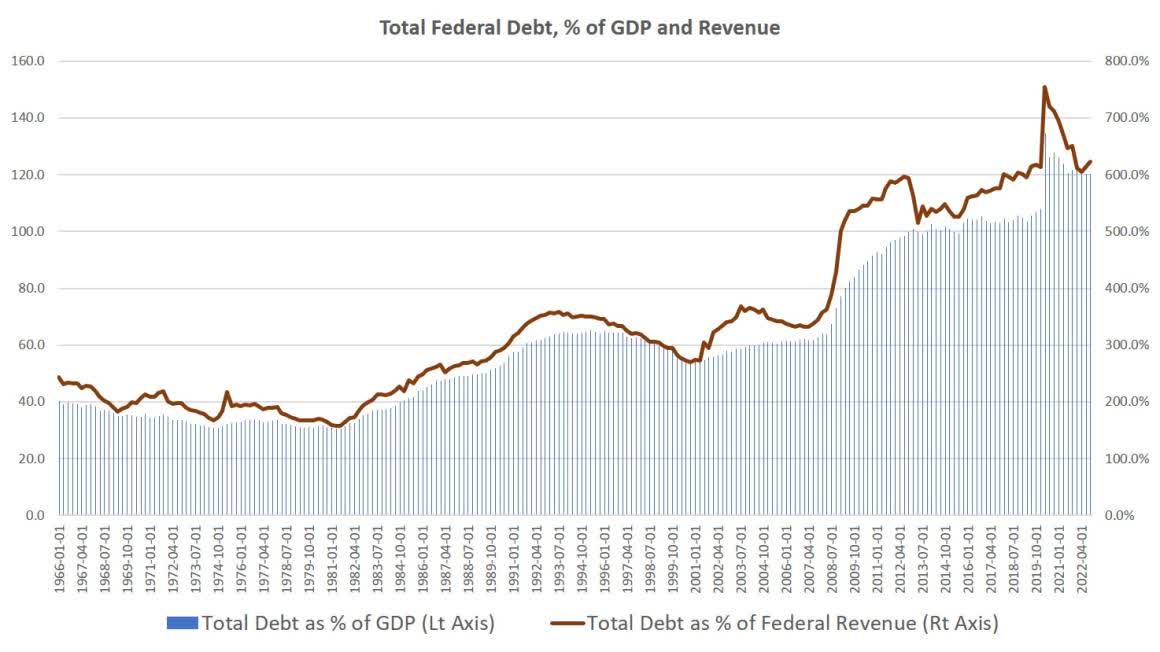

Furthermore, the debt has reached new post-World Conflict II highs in proportion to the general measurement of the economic system. In 2020, complete federal debt as a proportion of nationwide GDP shot as much as 120%. This places the US at beforehand unseen peacetime debt ranges.

Evaluating debt to GDP would not inform us a lot in regards to the authorities’s capability to pay and repair its debt, nonetheless. A extra lifelike measure is complete debt in comparison with federal revenues. By this measure, we additionally discover debt has accelerated to peacetime highs. Complete federal debt is now greater than 6 instances the dimensions of annual federal receipts.

This Interprets Right into a Lot of Curiosity Funds

The issue with a big nationwide debt is not that it is huge or tough to repay. An infinite debt could be sustained indefinitely by a authorities as long as it might handle paying the curiosity on the debt. For a lot of the previous three a long time, the US authorities had it very straightforward on this respect. It might run up big annual deficits, incur trillions of {dollars} in new debt, but curiosity funds on that debt remained remarkably secure and didn’t rise to “uncontrolled” ranges.

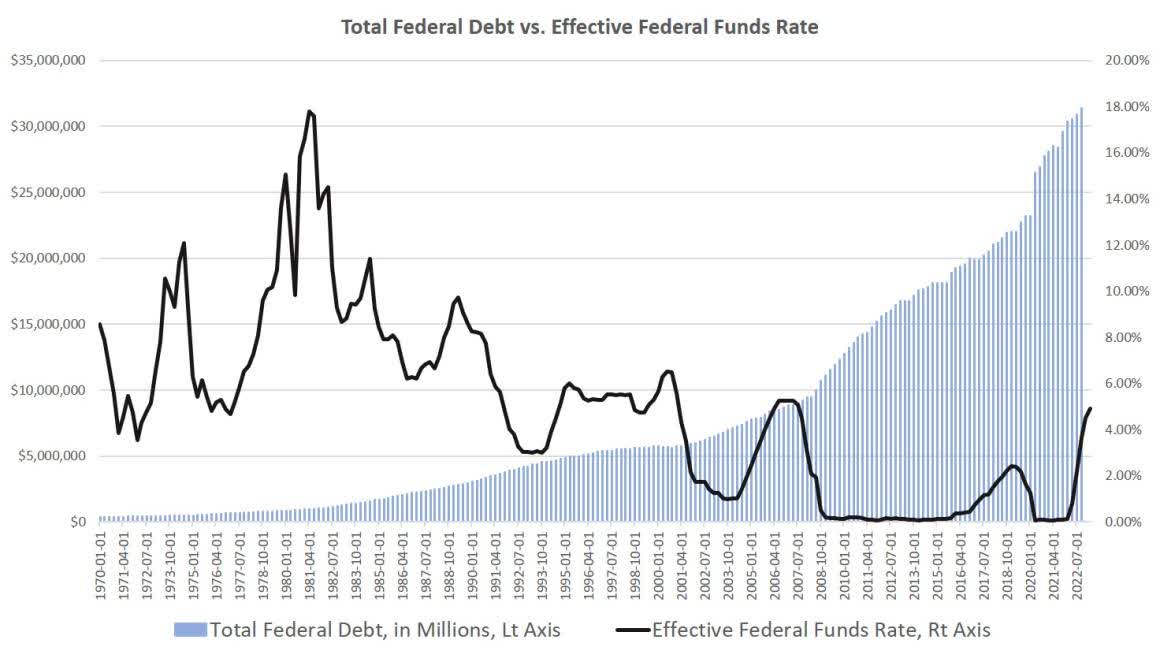

This was made potential by the truth that rates of interest trended downward repeatedly for a lot of the previous 35 years. If we take a look at the federal funds price – which tends to pattern with common curiosity ranges paid on federal debt – we will see that debt ranges surged on the similar time that rates of interest have been falling. This fall in rates of interest prevented curiosity funds from surging upward as nicely.

Why this charges fall? Throughout a lot of the Nineteen Nineties, the US grew to dominate the worldwide economic system within the wake of the tip of the Chilly Conflict. This drove far higher want for {dollars} worldwide, and all these greenback holders put most of the {dollars} into shopping for US authorities debt. This pushed down the price of issuing new federal debt significantly. Even after the rise of the euro after 1999, globalization helped maintain world demand for US debt, as did the eurodollar economic system.

After 2008, rates of interest on US debt have been pushed down even additional because the US central financial institution purchased up practically six trillion {dollars}’ value of US bonds. As this synthetic demand for federal bonds rose, the rate of interest sank additional. So, even because the federal authorities was including trillions to the nationwide debt after 2009, curiosity funds remained manageable.

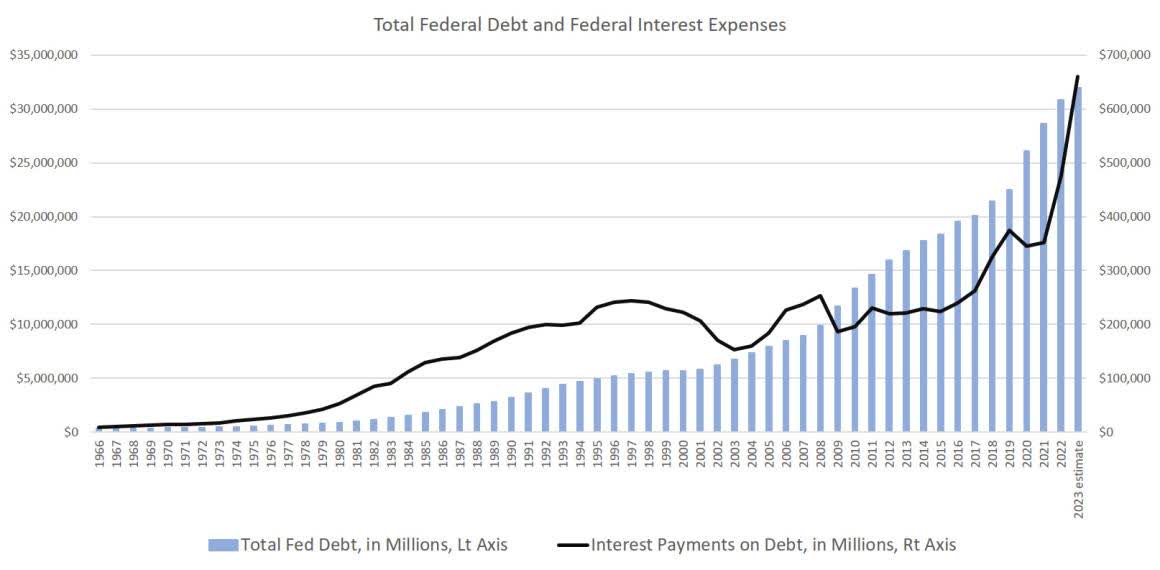

We will see how from 1998 to 2015, complete debt service prices barely budged regardless of an ever-growing nationwide debt. This lastly started to develop after 2017 with the rising mega-deficits and efforts on the Federal Reserve to lastly enable rates of interest to extend over fears of value inflation. After 2020, in fact, curiosity funds on the debt then surged above half a trillion {dollars}, and are projected to extend additional:

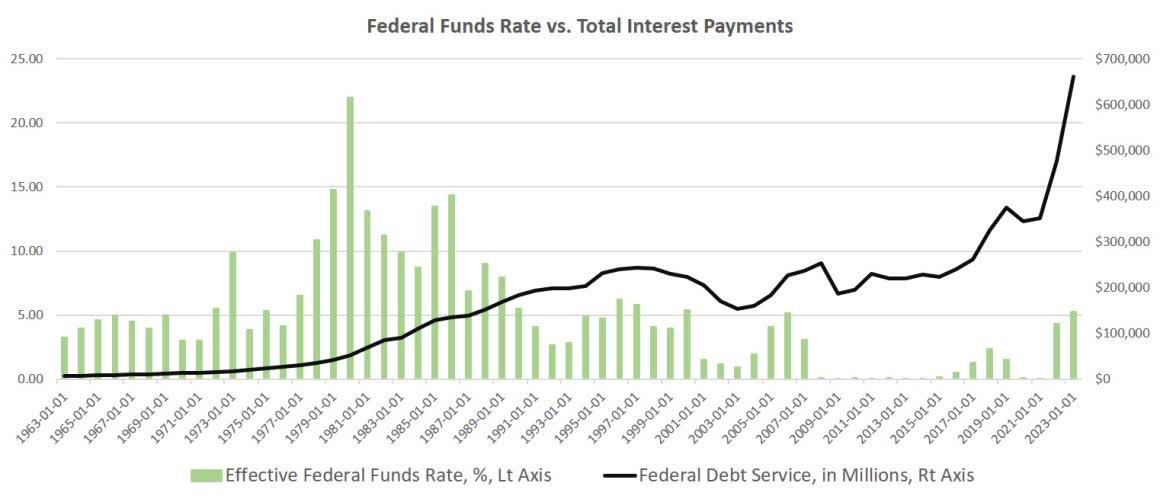

Curiosity Funds Will Progressively Devour the Federal Funds

It’s right here the place we start to see the issue with such big debt ranges. An infinite debt makes complete debt funds way more delicate to actions in rates of interest. In 2007, when the nationwide debt was at a “mere” 9 trillion {dollars}, the federal funds price might rise above 5 p.c with out a ensuing surge in curiosity funds. Greater than a decade later, with debt ranges at $30 trillion, an analogous enhance within the federal funds charges results in a a lot bigger elevated in debt service funds.

In sensible phrases, which means a authorities with huge debt ranges seemingly can’t maintain any sizable will increase in curiosity. Below these situations, debt funds will step by step develop bigger and bigger till they devour a lot of the nation’s federal spending.

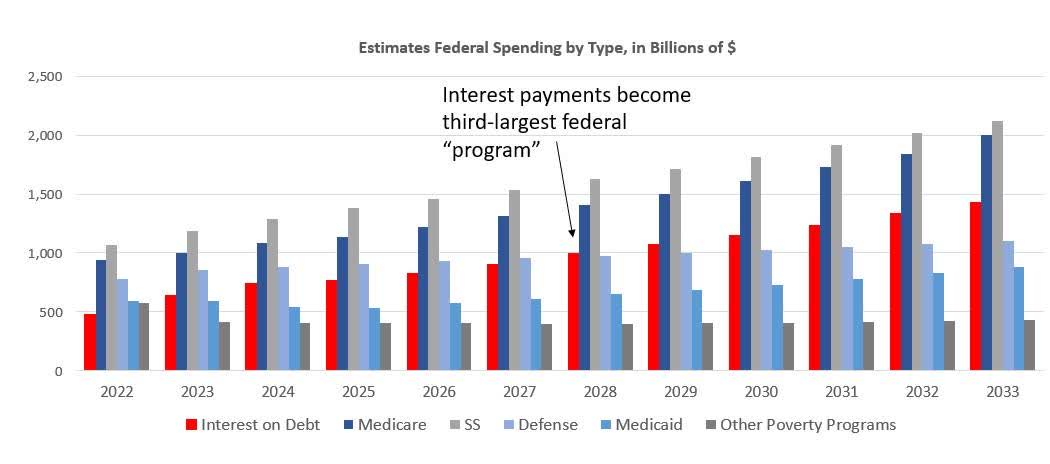

We will see this in even the official federal initiatives for debt funds shifting ahead. For instance, in accordance with the Workplace of Administration and Funds (OMB), the federal authorities will owe $660 billion in debt service in 2023. However it will enhance to $960 billion by 2028, in 5 years. For comparability, we will observe that the OMB additionally initiatives the whole protection finances in 2028 will probably be $966 billion.

The OMB’s projections are fairly conservative in comparison with forecasts in a February report from the Congressional Funds Workplace. In keeping with the CBO report, curiosity funds will attain practically a trillion {dollars} in 2028 and can proceed to climb after that. In a decade, complete curiosity funds will exceed $1.4 trillion and would be the third-largest federal “program” behind Social Safety and Medicaid. At the moment, curiosity funds will exceed protection spending by $300 billion.

On a per capita foundation, this isn’t precisely trivial. In 2030, for instance, the $1.4 trillion owned in curiosity funds will work out to roughly $4,000 per American grownup of working age (adults between ages 18 and 65).

In different phrases, inside six years, American taxpayers will probably be pressured to pony up greater than a trillion {dollars} yearly to simply to cowl long-past federal spending on numerous misplaced wars and failed social packages.

Remember, nonetheless, that that is all a “best-case state of affairs.” CBO and OMB estimates assume there will probably be no recessions in coming years, and so they additionally assume comparatively secure rates of interest. The CBO estimates forecast curiosity on US federal debt will common about 2.7 p.c in 2023, however is not going to enhance considerably after that, rising solely to three.2 p.c by 2031.

That is potential, in fact, however present traits suggests the CBO is just too optimistic. Geopolitical realities level to a relative decline in demand for the greenback – which will even result in a decline in demand for US bonds. The US insists on isolating itself each politically and economically because it wages sanction wars – or threatens to take action – on most of the world’s key economies. It will all drive up rates of interest. As we have proven right here on Mises.org, the greenback is unlikely to vanish as an essential world foreign money, however it’s prone to face extra competitors. That may imply increased rates of interest for federal debt as greenback demand wanes.

One other key improvement right here is that the central financial institution now not has the liberty to drive down rates of interest because it did a decade in the past. Again then, the Fed might merely purchase up new authorities debt to prop up demand and maintain down rates of interest. This has required the central financial institution to interact in giant quantities of financial inflation. For a time, that appeared to work, however then value inflation rose to 40-year highs and has remained stubbornly excessive. The Fed can now not merely print up a further trillion {dollars} to purchase up US authorities debt – after which simply hope no value inflation seems. Slightly, as a result of value inflation is so politically unpopular, the Fed has to deal with evenly on new financial enlargement. This ties the fingers of Fed in how a lot it might intervene to maintain rates of interest low.

Thus, the very gentle will increase in rates of interest predicted by the CBO might tremendously understate the true dangers.

Furthermore, this all assumes that limitless will increase to debt service will probably be politically tenable ten years from now. Will voters actually be satisfied that they should endure more and more giant cuts to in style authorities packages as a way to maintain paying cash to bondholders endlessly and ever?

Sooner or later, the voters are prone to say “sufficient” on the subject of escalating debt funds. And that is when a rustic will get both hyperinflation or a sovereign debt disaster. Within the meantime, that curiosity invoice is simply going to maintain getting greater.

Disclosure: No positions.

Authentic Submit

Editor’s Notice: The abstract bullets for this text have been chosen by Looking for Alpha editors.