EUR/USD PRICE, CHARTS AND ANALYSIS:

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX staff

Subscribe to E-newsletter

Most Learn: Debt Ceiling Blues, Half 79. What Occurs if the US Defaults?

The Euro didn’t take pleasure in its best week as losses in opposition to the buck continued whereas fluctuating between losses and positive aspects in opposition to the Pound. EUR/USD nonetheless remained the pair of curiosity, placing in a fourth week of losses in opposition to the US Greenback in succession.

The European Central Financial institution (ECB) policymakers have maintained a hawkish rhetoric for a lot of the week but failing to supply the Euro any vital assist. This will lie in the truth that markets are already viewing the ECB as probably the most hawkish Central Financial institution transferring ahead. Markets seem to have already priced within the hawkishness spouted by ECB policymakers of late with a major change required for bulls to return.

The rally within the US greenback in the meantime continues as a deal on the US debt ceiling stays elusive as we head towards the brand new week. US Treasury Secretary Yellen did nonetheless regulate the date she believes the US may default as early as June 5 and not using a debt ceiling hike, earlier date was June 1. The Treasury will make greater than $130 bln of scheduled funds in first two days of June, together with funds to veterans, social safety and Medicare recipients. The brand new date does purchase negotiators extra time but the longer this rumbles on the extra volatility we might even see in Markets.

Advisable by Zain Vawda

The way to Commerce EUR/USD

Fridays US PCE knowledge got here in higher than anticipated leading to additional assist for the US greenback as we noticed a hawkish repricing of Federal Reserve (FED) Fee hike possibilities for June. Markets at the moment are pricing in a 71% likelihood of a 25bps hike from the Fed in June, up from 17% per week in the past.

Supply: CME FedWatch Instrument

EURO CPI, NFP AND US DEBT CEILING

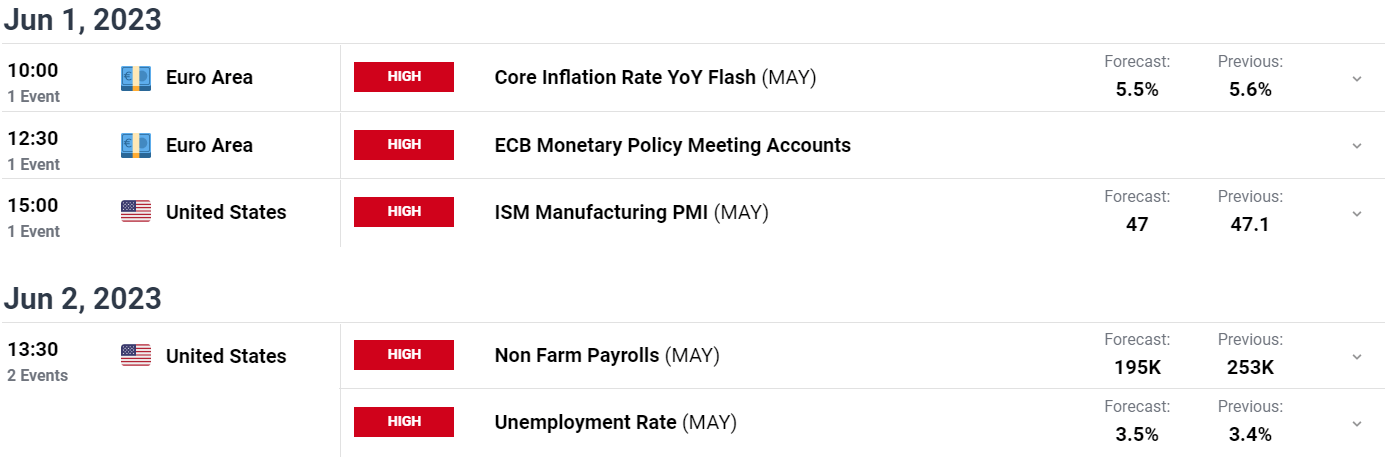

Heading into the brand new week, and we do have some Euro Space knowledge with the flash CPI launch of specific significance. Nonetheless, even with a shock from the CPI launch I don’t anticipate any materials change to the Euros outlook.

The week forward guarantees to be dominated as soon as extra by the US greenback narrative across the debt ceiling. This will likely be coupled with Fridays NFP jobs report with which can little question be of significance following the sturdy PCE knowledge. A deal on the debt ceiling nonetheless may see the greenback proceed on its longer-term downtrend since peaking in September 2022.

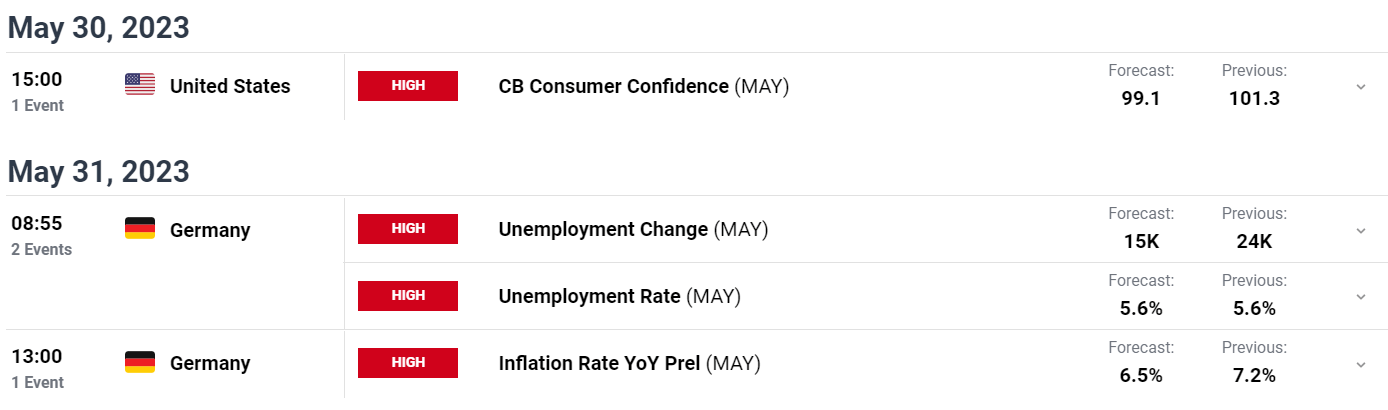

ECONOMIC CALENDAR FOR THE WEEK AHEAD

The week forward on the calendar stays busy with a few ‘excessive’ rated knowledge releases, and a number of ‘medium’ rated knowledge releases anticipated.

Listed below are among the key excessive ‘rated’ danger occasions for the week forward on the financial calendar:

For all market-moving financial releases and occasions, see the DailyFX Calendar

TECHNICAL OUTLOOK

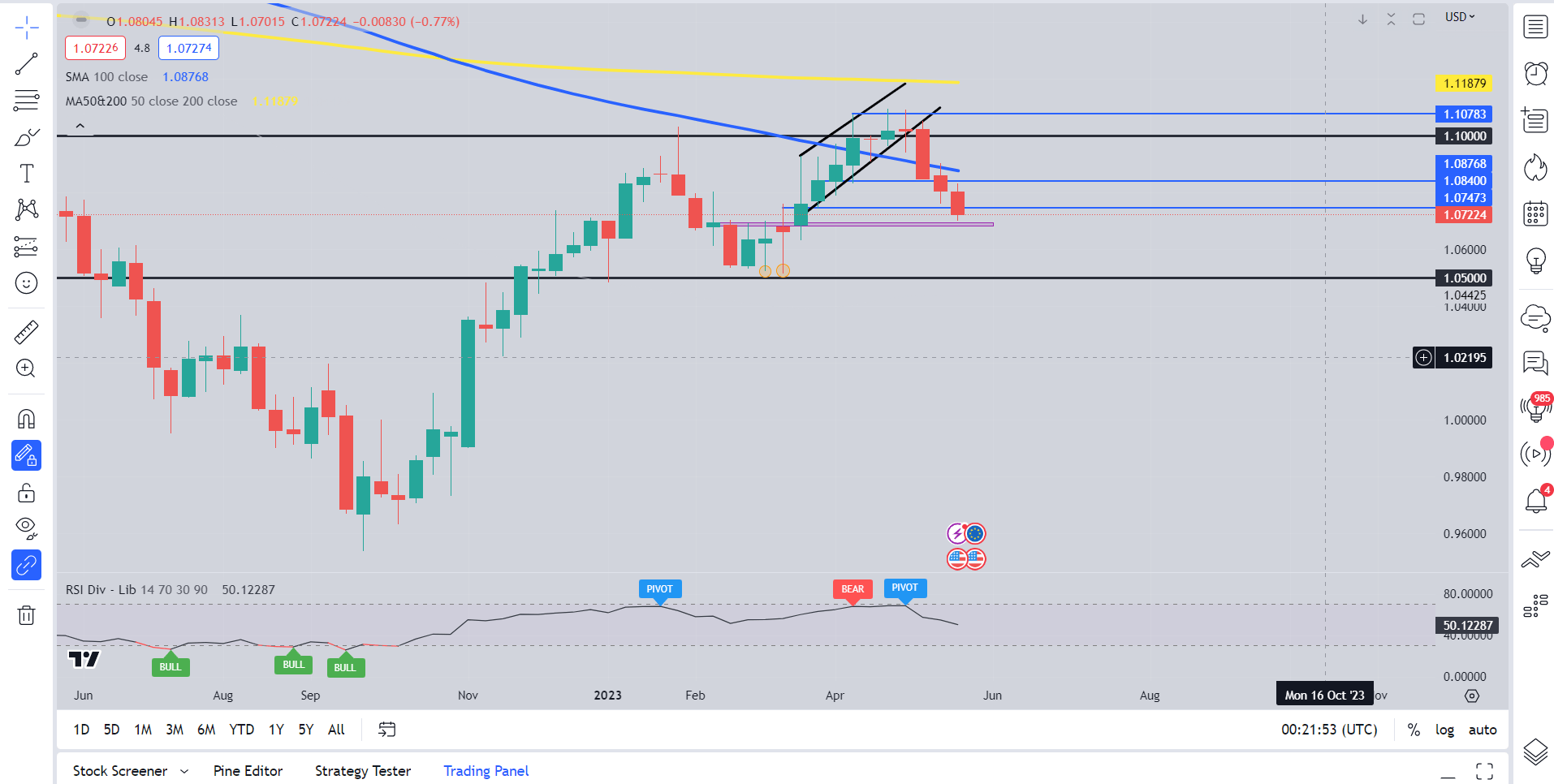

The weekly chart for EUR/USD above and we are able to see that value has pushed right down to a key assist degree. The 1.0700 degree is the place the earlier breakout occurred in early March earlier than EUR/USD rallied to its YTD Excessive.

EUR/USD Weekly Chart – Could 26, 2023

Supply: TradingView

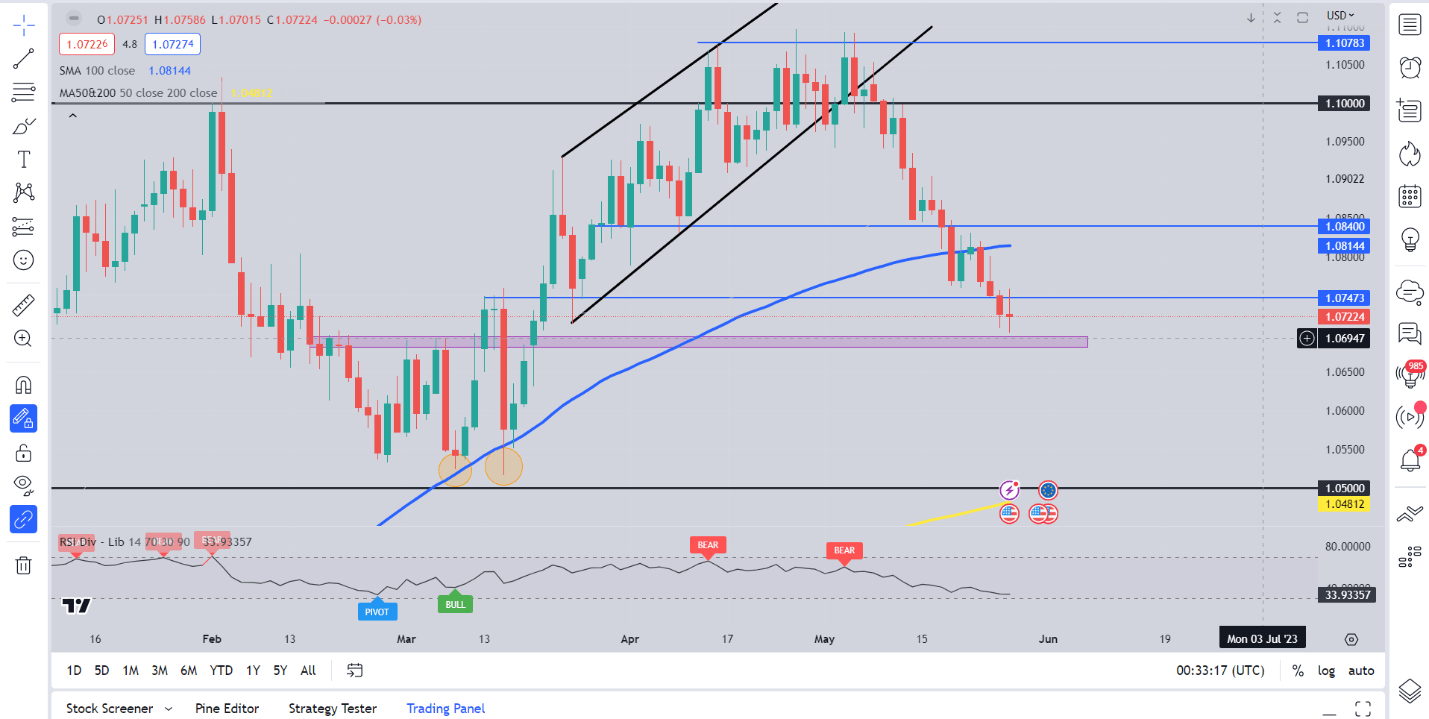

Dropping right down to a day by day timeframe and we are able to see that indecision across the 1.0700 mark has already begun. Friday’s day by day candle closing as a doji candlestick hinting on the potential for restoration heading into the brand new week. Monday is in fact a financial institution vacation with liquidity and volatility anticipated to be low barring any surprises on a debt ceiling deal.

A break of the important thing 1.0700 degree may open up retest of the 1.0600 mark earlier than focus shifts towards the psychological 1.0500 mark. A push greater from right here has the powerful process of breaking again above resistance and the 100-day MA at round 1.0800. The 100-day MA may show cussed as EURUSD had been caught above the MA since November 2022.A break of the 1.0800 deal with brings 1.0900 into focus and probably the psychological 1.1000 degree. Little question an fascinating week forward for the Euro and EURUSD particularly.

EUR/USD Every day Chart – Could 26, 2023

Supply: TradingView

Written by: Zain Vawda, Market Author for DailyFX.com

Contact and comply with Zain on Twitter: @zvawda

ingredient contained in the ingredient. That is most likely not what you meant to do!

Load your utility’s JavaScript bundle contained in the ingredient as a substitute.

Source link