Marzia Camerano/iStock Editorial through Getty Pictures

Funding thesis

Our present funding thesis is:

F1 is a implausible enterprise on a development trajectory as its present house owners look to quickly speed up curiosity within the sport. Margins are enhancing as sponsorship/TV offers improve in worth. Regular Lengthy-term appears cheap given the big fanbase, breadth of constructors, and historic significance of F1 as a sport. Our valuation suggests there isn’t a materials upside remaining, suggesting warning.

Firm description

Method One Group (NASDAQ:FWONK) engages within the motorsports enterprise internationally. It holds industrial rights for the world championship, a nine-month-long motor race-based competitors by which groups compete for the constructors’ championship and drivers compete for the drivers’ championship.

Method One is taken into account the head of motorsport, with over 70 annual seasons and a few of the world’s main producers, together with Ferrari (RACE), McLaren, Aston Martin (OTCPK:AMGDF), Renault (OTCPK:RNSDF), Honda (HMC), and Mercedes (OTCPK:MBGAF) (With Porsche (OTCPK:POAHY) because of be a part of and Volkswagen (OTCPK:VWAGY) strongly rumored). This has allowed the game to garner a big fan base which is extremely sticky, making it profitable for each possession and groups.

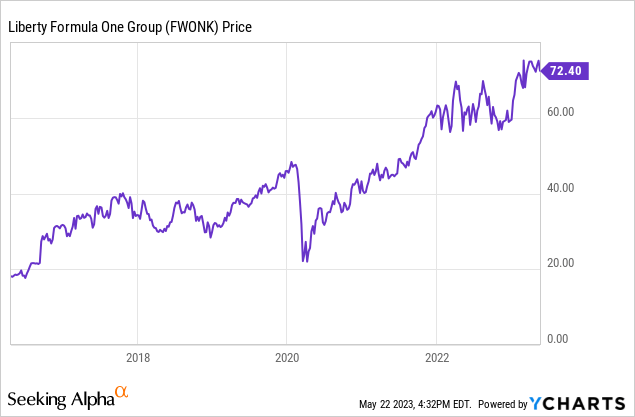

Share worth

F1’s share worth has gained over 250% since its itemizing, reflecting a fast improve within the sport’s recognition and an aggressive enlargement below new possession.

Monetary evaluation

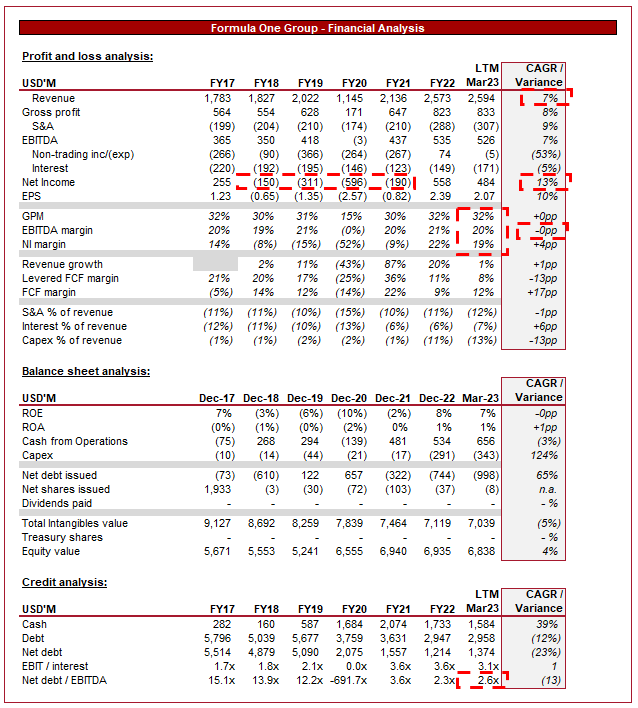

F1 Financials (Tikr Terminal)

Introduced above is F1’s monetary efficiency for the final decade.

Income

F1’s income has grown at a CAGR of seven%, which partially displays the affect of Covid-19, however is nonetheless a powerful efficiency given the maturity of the game.

F1 earns income primarily by means of internet hosting races, sponsorships, and TV rights. For that reason, the important thing industrial consideration of this enterprise is knowing how curiosity is being developed, in addition to the worth per race.

F1 has been in a transitionary interval because it was acquired by Liberty Media. Bernie Ecclestone ran F1 fantastically properly for many years, propelling it to the head of motorsport. Nonetheless, he might be criticized for not doing extra to develop the game within the final decade of this tenure, primarily by means of concentrating on new clients. F1 was seen as a sport for the wealthy, which Liberty clearly noticed as a possibility.

Digital transformation has had a profound affect on F1. The rising use of digital platforms, social media, and streaming companies has remodeled fan engagement, content material consumption, and sponsorship alternatives. For the reason that acquisition, F1 has launched a YouTube pre/put up present, it uploads highlights to YouTube following races and creates intensive content material on Instagram/TikTok, amongst many different issues. The most important issue, and in our view the most important development driver in recent times has been the launch of the hit Netflix (NFLX) present “Drive To Survive”. This has captured a big fanbase who developed an curiosity in F1 by means of personalities. Netflix has primarily turned F1 right into a actuality TV present and because the historical past of TV has proven, the informal shopper is glued to their seats.

Moreover, we’ve got seen product innovation as a method of driving curiosity. F1 has launched “Dash races”, that are shorter races earlier than the “foremost race”, at a number of circuits all year long. The intention of that is clear, entice informal followers who’re unable/keen to look at a feature-length race. Additional, we’ve got seen rule adjustments concentrating on harmonization amongst groups, the target being to create tighter motion between groups.

F1 has historically targeted on its European roots, racing at historic tracks throughout the area, which has the affect of proscribing races past this. In recent times, F1 has chosen to develop to areas / tracks that lack historic significance, for industrial causes. A obtrusive instance of that is the Center East, which now has a number of races. The technique is logical, European tracks are run for profitability and so can’t come near matching the monetary would possibly of Petro nations investing of their home tourism business. Additional, the game can profit from reaching new markets that will not have a race within the area. Liberty has continued this technique, including a number of new US races, in addition to increasing additional globally. Administration now appears extra targeted on the US than beforehand, which is logical given the success of Drive To Survive and the greenback measurement of the market.

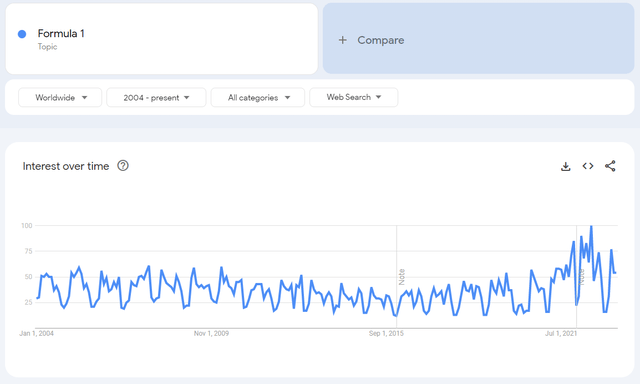

The advantages of the assorted enlargement methods are illustrated within the following graph, with F1 reaching a peak Google (GOOG) recognition score in recent times. Additional, we see the decline on the finish of the Bernie period, and the following improve following the takeover.

F1 curiosity (Google Developments)

Our concern right here is that followers/groups are turning in opposition to this technique. Given the finite variety of races that may be held (because of logistics amongst different issues), administration should change present tracks so as to add new ones. This has labored as far as poor-performing / unpopular tracks have been eliminated and Administration has incentivized groups to permit the variety of races to extend. We consider a restrict has been reached, nonetheless. No extra races might be added with out a revolt by groups (particularly given the dash races added) and the subsequent observe which appears to fall off the calendar is the historic Spa Francorchamps, which is among the many biggest circuits on the calendar.

The impacts of this are far-reaching and sophisticated. Firstly, if the variety of races can’t improve, income to an extent is capped. Administration should discover rising good points from different avenues whereas enhancing take from present races. That is extraordinarily troublesome to do past an inflationary degree. Secondly, nearly all of these new tracks are inferior to those they’re changing. The Florida GP is implausible for advertising and the funds of F1, however the races are extremely boring because of a foul observe. The upcoming Las Vegas GP will likely be extra of the identical (Avenue Circuits are simpler to construct however troublesome for overtaking). This will result in followers changing into disillusioned and strolling away.

From our evaluation, it’s clear that Liberty is searching for a number of avenues to develop F1’s revenue-earning capabilities. We have now solely touched on a number of particular examples however they’re seemingly working. Our solely concern is that with restrictions across the variety of races, there’s stress to repeatedly develop an curiosity within the sport to extend the worth of TV rights/sponsorships.

Margin

F1’s present margins are fairly enticing, with an EBITDA-M of 20% and a NIM of 19%.

Outdoors of selling and the variety of races, F1’s value base is comparatively mounted. Provided that we’ve got reached a near-term most for the variety of races, worth creation might be extremely accretive. That is particularly the case provided that TV rights/Sponsorships are bought for a number of years at a time. With the elevated recognition in F1, the approaching renewals will likely be at considerably larger ranges whereas the associated fee to ship doesn’t materially deviate from inflation.

For that reason, we count on EBITDA evolution within the area of 3-8% within the coming years. Within the close to time period, we may see a dip because the Imola GP was canceled final week, leading to one-off prices to the enterprise and decreased income from the race. Conversely, we are going to see an uptick in subsequent yr’s outcomes assuming no different cancellations.

Steadiness sheet

F1 is reasonably financed, with a ND/EBITDA ratio of two.5x. This reduces any solvency danger, with enough money to cowl any draw back danger. Capex commitments have elevated in recent times, which can act as a drag on near-term money whereas F1 continues enlargement.

Outlook

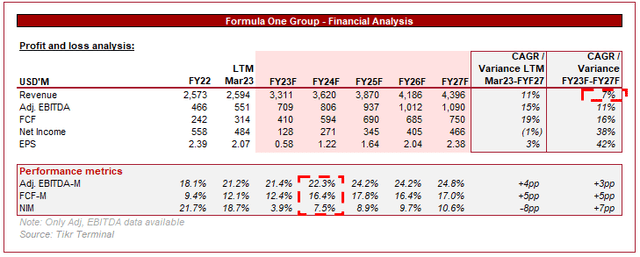

Wall Avenue outlook (Tikr Terminal)

Introduced above is Wall Avenue’s consensus view on the approaching 5 years.

Progress is predicted to stay on its present trajectory, which given the industrial profile of the enterprise, appears cheap.

Margin enchancment can be forecast, with Adj. EBITDA enhancing from 18.1% to 24.8% by FY23. Once more, this aligns with our present expectations.

Valuation

F1’s present valuation is racey, with an LTM EBITDA a number of of 34x and an NTM EBITDA a number of of 26x (Unclear if NTM EBITDA displays the missed Imola race).

This valuation displays constructive sentiment across the enterprise, with traders anticipating continued sturdy development and margin enchancment. For that reason, we have to be cautious to evaluate if any upside stays.

To be able to worth F1, we’ve got performed a DCF valuation. Our key assumptions are:

Income development between 7-10% within the coming 5 years, earlier than a perpetual development price of three%. Margin and FCF enchancment towards the 25% degree according to analyst forecasts. An exit a number of of 22x, reflecting what will likely be a extremely worthwhile, resilient enterprise. A reduction price of 9%.

Based mostly on this, we suggest an upside of 5%, which has similarities to analyst’ goal upside of 8.3%.

Last ideas

I’ve been a fan of F1 for many of my life and I can safely say the game has by no means been so common or “cool” as it’s now. From a industrial perspective, Liberty has performed a implausible job, with a lot of its technique being a modernization train. We see good scope for future development because the improved curiosity is additional monetized with accretive returns. The important thing danger we see is that if curiosity begins to gradual, we might even see a share worth response as traders cut back future money stream expectations.

With solely a 5% upside at its present worth, we propose warning, with restricted upside visibility at the moment.