Neydtstock

Funding Thesis

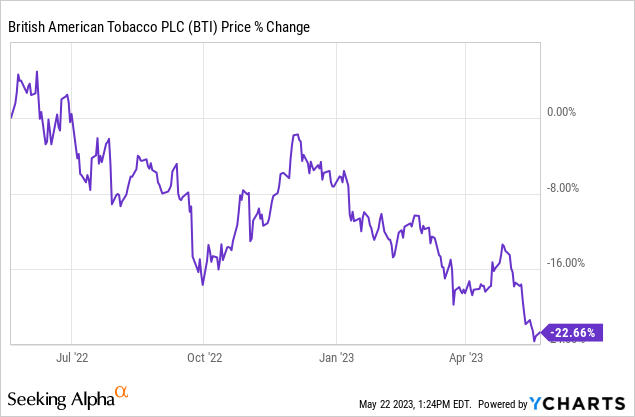

British American Tobacco (NYSE:BTI) has dropped one other 16% since my final protection in January, as buyers proceed to fret concerning the declining smoking charges and combustibles quantity. Whereas flamable merchandise are anticipated to be weak, most buyers appear to be overlooking the corporate’s pricing energy and its important progress within the RRP (reduced-risk product) section.

I consider total income can proceed to rise even with the continued drop in flamable quantity, which I’ll elaborate extra on later. Quite a lot of buyers are additionally unaware of the corporate’s large stake in ITC, which may unlock substantial shareholder worth transferring ahead. With such a compressed valuation, I consider BTI inventory has significant upside potential and I’m reiterating my purchase ranking on the corporate.

Debunking The Unwarranted Concern Of Declining Combustibles Quantity

Most skepticism in regard to British American Tobacco has been about its slowing flamable section, as quantity continues to say no amid tighter laws throughout the globe. In response to the CDC (Facilities for Illness Management and Prevention), the smoking charge within the US not too long ago reached its lowest stage in practically 60 years. There isn’t any denying that the amount of flamable merchandise ought to proceed to sluggish, however this additionally doesn’t imply the income of British American Tobacco will decline both.

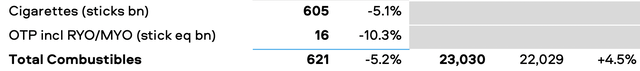

Throughout FY22, combustibles income accounted for roughly 85% of complete income, however it will probably change within the coming years because of the emergence of RRPs. Earlier than I am going into RRP, I wish to discuss a bit extra concerning the resistance of the flamable section, as I consider a whole lot of buyers are overlooking the pricing energy of conventional flamable merchandise. Whereas their quantity dropped by 5.2% in FY22, the section’s income truly grew by 4.5%. Given the addictiveness of those merchandise, ongoing worth will increase ought to be sustainable and may assist offset the weak point in quantity.

British American Tobacco

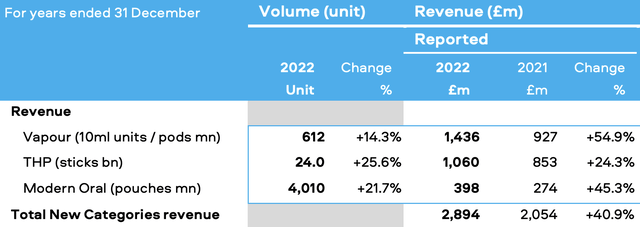

Whereas the non-combustible section (comprised of conventional oral merchandise and RRPs) solely accounts for round 15% of complete income, I consider it ought to be the primary emphasis of the corporate transferring ahead. Altria’s (MO) hefty $2.8 billion acquisition of NJOY in March clearly demonstrates the significance and worth of RRPs within the present surroundings.

As an illustration, British American Tobacco’s RRP section grew income by 40.9% in FY22, with total quantity up over 20%. As talked about in my earlier article, the marketplace for vapor, heated tobacco, and nicotine pouches is forecasted to develop at a CAGR (compounded annual development charge) north of 30%. The market growth ought to proceed to help the exponential development of the RRP section.

British American Tobacco

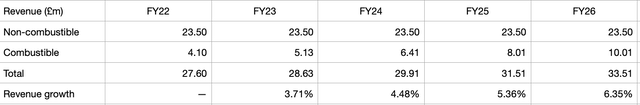

Primarily based on the backdrop mentioned above, I made a projection of British American Tobacco’s potential development trajectory for the approaching few years. I count on income from the flamable section to be flat, with constant worth will increase (5% to 10% yearly) offsetting the continued decline in quantity (~5% yearly). This estimate is fairly conservative as pricing outpaced quantity by 970 foundation factors in FY22, and the corporate themselves count on international flamable quantity to be down solely 2% for FY23. I count on the income from the non-combustible section to develop at a CAGR of 25%, which can also be very conservative when contemplating the market’s CAGR north of 30%.

From the chart under, you possibly can see that these assumptions translate to a mid-single-digit income CAGR from FY22 to FY26 (on a relentless foreign money foundation) even with combustibles quantity dropping 5% a yr. If the non-combustible section is ready to publish a 30% CAGR (the identical because the market’s development), the general income development charge may improve by one other 100-150 foundation factors every year. The section also needs to have a a lot stronger presence by then, accounting for roughly 31% of complete income. I perceive buyers’ fear concerning the projected decline in flamable quantity however I believe the latest concern is basically exaggerated.

Creator’s Projection

The Huge Stake In ITC Might Unlock Immense Shareholder Worth

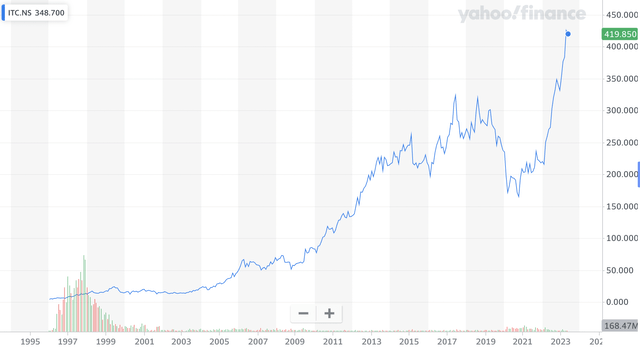

Quite a lot of buyers is probably not conscious, however British American Tobacco truly has a notable 29.1% possession in ITC Restricted, an Indian conglomerate firm engaged in packaged meals, motels, and different industries. The stake is now turning into more and more essential as the corporate’s share worth continues to drop whereas ITC’ continues to develop. The NSE-listed firm has been rising steadily up to now decade and its market cap is now standing at RS 5.22 trillion, or $62.9 billion in {dollars} time period. This makes British American Tobacco’s stake value an enormous $18.3 billion, or 22.5% of its present market cap.

I consider this stake may find yourself being an unprecedented game-changer because it offers the corporate much more monetary flexibility. In the event that they promote their entire possession (which is probably going given the enticing incentives), they’ll use the proceeds to pay down practically half of their excellent debt or purchase again 1 / 4 of their excellent shares, which ought to unlock immense shareholder worth given the compressed valuation for the time being.

Share Value Of IDC (Yahoo Finance)

Traders’ Takeaway

Whereas there may be a whole lot of pessimism surrounding British American Tobacco’s future, the information and numbers are portray one other story. Contemplating the corporate’s upbeat RRP development, deleveraged steadiness sheet, and improved profitability, Fitch Scores not too long ago revised the corporate’s outlook to constructive with a ranking of “BBB”, which additional validates its strong fundamentals.

The corporate’s mid-single-digit income CAGR alongside the enhancing profitability of the RRP section ought to translate to a high-single-digit EPS CAGR for the approaching few years. This additionally excludes the affect of any potential share buyback, which may additional increase EPS development particularly in the event that they determine to promote their ITC stake. The corporate’s present FCF yield is roughly 15%, which is the best up to now decade and this doesn’t even account for the potential return from the growth in valuation. With an fwd EV/EBITDA of simply 7.6x, I consider the present worth ought to current an ample margin of security with significant upside potential.