sdecoret

This text was printed on iREIT at Alpha on Thursday, Could 18, 2023.

It was no shock this morning after I woke as much as see the information that Regency Facilities Company (REG) was searching for to purchase Urstadt Biddle Properties Inc. (UBA) in an all-stock transaction valued at ~$1.4B, together with the belief of debt and most well-liked inventory. The mixed firm is predicted to have a professional forma fairness market capitalization of ~$11B and a complete enterprise worth of ~$16B.

The mixed portfolio will probably be comprised of 481 complete properties encompassing greater than 56 million sq. ft of gross leasable space, validating the highly effective scale benefits of Regency Facilities.

In REIT-dom, we’ve got seen different examples just lately by which the larger fish get devoured up by the smaller ones:

Simon Properties Group, Inc. (SPG) and Taubman Facilities American Tower Company (AMT) and Coresite Prologis, Inc. (NYSE:PLD) and Duke Realty Kimco Realty Company (KIM) and Weingarten Realty Healthcare Realty Belief Included (HR) and Healthcare Belief of America Additional House Storage Inc. (EXR) and Life Storage (LSI) VICI Properties Inc. (VICI) and MGM Properties

As I replicate on the most recent Regency / Urstadt Biddle information, it dawned on me that now is a superb time for the bigger well-capitalized REITs (like Regency) to pursue M&A.

Shares in most REITs are overwhelmed down, which makes it tougher for the mid-size corporations to transact.

Thus, we count on to see continued consolidation throughout the REIT sector, which consequently drives the returns of the dominant names like Realty Earnings Company (NYSE:O) and Prologis.

Realty Earnings vs Prologis

Final week we did an article evaluating Prologis, Inc. to STAG Industrial, Inc. (STAG), and this supplied an fascinating distinction between the 2 corporations as a result of distinction in dimension and funding methods.

Per the subscribers’ request, we are going to now have a look at Realty Earnings in comparison with Prologis, which also needs to be an fascinating comparability.

Whereas the 2 actual property funding trusts (“REITs”) function in numerous sectors, each are the leaders of their area, and each are high-quality REITs. What do I imply by top quality?

I imply each have wonderful debt metrics and huge quantities of liquidity, each have high-quality tenants and are very diversified by each tenant and geographic location, each have wonderful administration groups, and each have a robust dividend observe report and low payout ratios.

I might go on however suffice it to say that each corporations might simply be thought of the highest two blue-chip REITs. There are only a handful of REITs that I might put in the identical ballpark when it comes to high quality and security.

Realty Earnings Company

Realty Earnings is a triple-net lease REIT that focuses on buying single-tenant retail properties by means of sale-leaseback transactions. Leases which are structured on a triple-net foundation have favorable attributes for the proprietor of the true property as a result of the tenant is chargeable for property bills together with property taxes, constructing insurance coverage, upkeep, and another capital expenditures which are incurred.

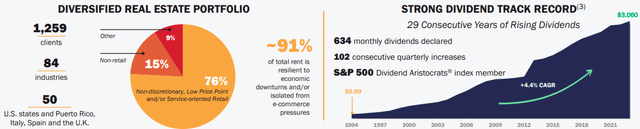

Realty Earnings owns or has an possession curiosity in 12,237 properties which are positioned in all 50 U.S. states, the UK, Spain, and Italy. In complete, Realty Earnings’s properties cowl 236.8 million sq. ft of leasable area, has an occupancy fee of 99.0%, and have a weighted common lease time period (“WALT”) of 9.5 years.

Their properties are leased to 1,259 tenants that function in 84 industries, and nearly all of their tenants function in industries which are proof against e-commerce.

Whereas Realty Earnings has many robust options, they’re in all probability finest recognized for his or her month-to-month dividend, which has been elevated for 29 consecutive years.

All-in-all, they’ve paid 634 month-to-month dividends and have elevated the dividend for 102 consecutive quarters. This wonderful dividend observe report makes Realty Earnings one of many few REITs that may declare the title of a Dividend Aristocrat.

Realty Earnings – Investor Relations

Prologis, Inc.

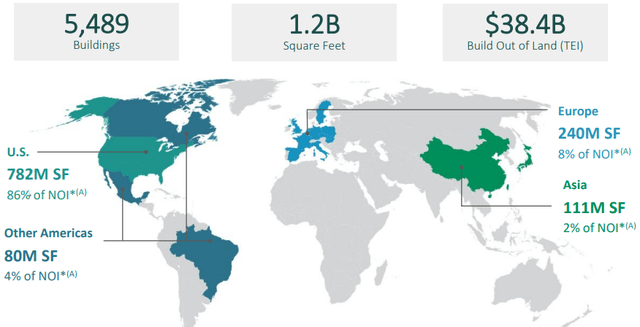

Prologis is an industrial REIT that focuses on logistics actual property positioned in high-growth markets with excessive limitations to entry. PLD owns or has an possession curiosity in 5,489 properties that embody 1.2 billion sq. ft throughout 19 nations. PLD has 6,600 prospects, an occupancy fee of 98.0%, and a weighted common lease time period of roughly 5 years.

Moreover, they’ve $39 billion invested in land banks that they will use for future growth. To provide you an thought of how massive and significant PLD is to world commerce, $2.7 trillion (2.8% of worldwide GDP) flows by means of their distribution facilities.

Prologis additionally generates ancillary earnings by means of its Necessities Platform, which incorporates companies that allows its tenants to optimize the properties they lease. By means of this platform, PLD is ready to present forklifts, turbines, workforce coaching, robotics, automation, and EV charging stations.

With the anticipated development of e-commerce, industrial actual property and distribution facilities ought to see growing demand, making industrial actual property one of many extra engaging sectors to put money into at present.

PLD – Investor Relations

Tenants

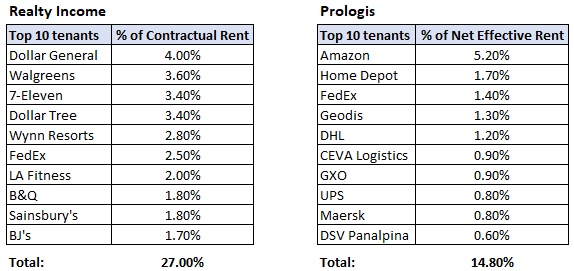

Realty Earnings and Prologis each have a well-diversified tenant base that features recognizable and well-established companies. Prologis has probably the most focus in its high tenant (Amazon), which makes up 5.2% of their efficient lease, whereas Realty Earnings’s high tenant (Greenback Basic) contributes 4% of their contractual lease.

Nonetheless, when taking a look at their high 10 mixed, Prologis has much less focus. Prologis’ high 10 tenants make up 14.8% of their efficient lease in comparison with Realty Earnings’s high 10 tenants that contribute 27% of their contractual lease.

If I needed to decide a winner right here, I might select Prologis, since their general high 10 tenant focus is about half of the focus that Realty Earnings has in its high 10.

O / PLD – Investor Relations (compiled by iREIT)

Credit score/Debt Metrics

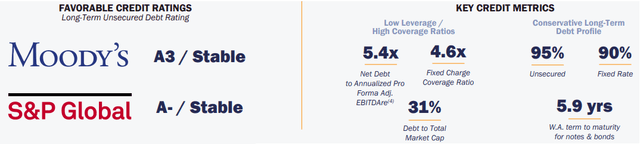

Realty Earnings has an A- investment-grade credit standing and powerful debt metrics, with a internet debt to professional forma adjusted EBITDAre of 5.4x, a long-term debt to capital of 41.21%, and a hard and fast cost protection ratio of 4.6x.

Their debt is 95% unsecured and 90% fastened fee with a weighted common rate of interest of roughly 3.47% and a weighted common time period to maturity of 5.9 years. Moreover, that they had $3.1 billion in complete liquidity as of the top of the primary quarter.

Realty Earnings – Investor Relations

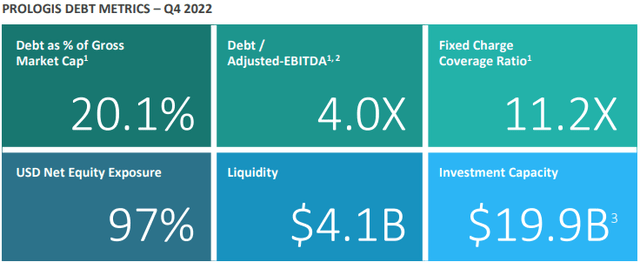

Prologis has a credit standing of A from S&P World, rating them one notch above Realty Earnings. PLD has wonderful debt metrics. They’ve a debt-to-adjusted EBITDA of 4.0x, a long-term debt-to-capital of 32.77%, and a hard and fast cost protection ratio of 11.2x as of year-end 2022.

PLD’s debt is 85% fastened fee, with a weighted common rate of interest of two.5% and a weighted common time period to maturity of 9.4 years. Moreover, PLD had $6.7 billion in complete liquidity as of April of this yr.

PLD – Investor Relations

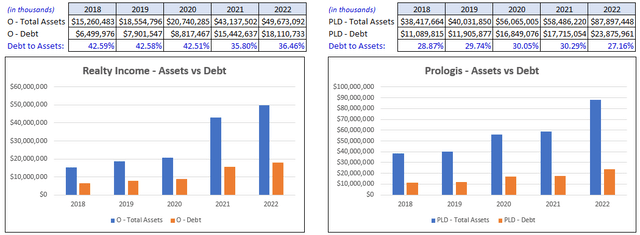

Each Realty Earnings and Prologis have conservative debt ranges because it pertains to their complete belongings. Realty Earnings’s debt-to-asset ratio has averaged roughly 40% over the past 5 years and was 36.46% as of the top of 2022. Prologis’ stage of debt is much more conservative, averaging a debt-to-asset ratio of roughly 30% over the past 5 years and a debt-to-asset ratio of 27.16% on the finish of 2022.

Each corporations have nice credit score and debt metrics, however general I’d say that Prologis beats Realty Earnings on this entrance. PLD has a decrease debt-to-EBITDA ratio, a decrease debt-to-asset ratio, and the next fixed-charge protection ratio. Plus, they’ve a barely higher credit standing and a considerable quantity of liquidity.

O/PLD – Type 10-Ok (compiled by iREIT)

Profitability

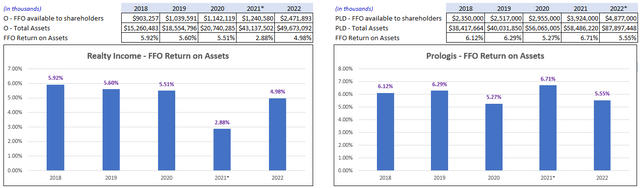

One in all my favourite methods to entry the profitability of a REIT is its funds from operations (“FFO”) Return on Belongings (“ROA”). The first driver of earnings for REITs are tangible belongings, or extra particularly actual property belongings. I like to have a look at the FFO ROA to check between REITs to see which one is using their belongings extra successfully.

I additionally like to have a look at historic returns on the identical firm to see if there are diminishing returns as their asset base grows. Over the interval from 2018 to 2022, Realty Earnings’s FFO ROA has ranged between roughly 5% to six%, except 2021. Prologis FFO ROA has ranged between roughly 6% to six.5% over this similar time interval.

O/PLD – Type 10-Ok (compiled by iREIT)

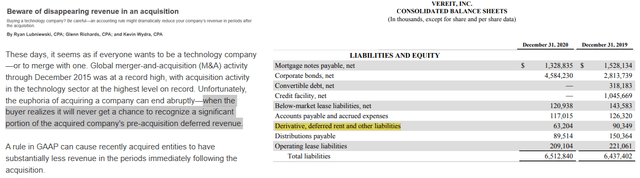

As beforehand talked about, 2021 was an outlier for Realty Earnings’s FFO ROA because it got here in a lot decrease than its common. The decrease FFO ROA could partly be the results of the VEREIT acquisition that closed on November 1, 2021.

I’m not an accountant, so I’m not going to behave like I do know all of the nuances concerned, however pre-acquisition deferred income is commonly marked to truthful worth post-acquisition and never absolutely acknowledged as income by the buying firm per GAAP accounting guidelines.

The VEREIT acquisition greater than doubled Realty Earnings’s asset base, however some or all the deferred income on VEREIT’s books could not have been acknowledged by Realty Earnings.

Once more, I’m not an accountant so I can’t say with 100% certainty that that is what triggered the drop, however their FFO ROA rebounded nearer to its historic common the next yr, so I’m not too involved with the return in 2021. This one is shut, however all in all, I’d have to present this one to Prologis since they’ve traditionally generated the next fee of return on their belongings.

Journal of Accountancy / VEREIT 10-Ok

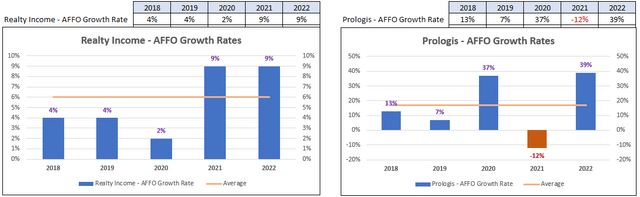

AFFO Development

AFFO, or adjusted FFO, Development is an fascinating comparability between Realty Earnings and Prologis.

Realty Earnings has extra constant development charges, whereas Prologis has extra uneven development charges. Prologis grew AFFO by 7% in 2019, 37% in 2020, however then AFFO fell by -12% in 2021 earlier than rebounding to 39% in 2022.

Realty Earnings grew AFFO in annually from 2018 to 2022, however on common grew AFFO by 6%, in comparison with Prologis, which grew AFFO by 17% over the identical interval. Whereas PLD’s AFFO development is extra unstable, I might give them the win on this metric since their common development fee far exceeds that of Realty Earnings.

O/PLD – Type 10-Ok (compiled by iREIT)

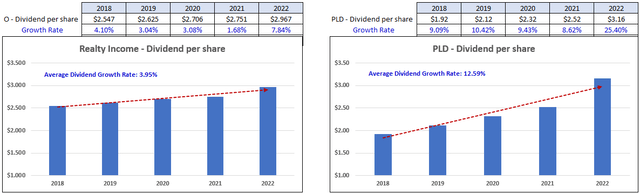

Dividend

Realty Earnings pays a 5.08% dividend yield in comparison with Prologis’ dividend yield of two.87%. Nonetheless, PLD has a lot larger dividend development charges than Realty Earnings. Realty Earnings has averaged a dividend development fee of three.95% since 2018, whereas PLD has averaged a dividend development fee of 12.59%.

One other facet to contemplate is the dividend historical past.

Realty Earnings has elevated its dividend for 29 consecutive years. Prologis, then again, lower their dividend in 2008 and 2009 and didn’t enhance the dividend till 2014. I’d say Realty Earnings wins on this metric. They don’t have the dividend development fee that PLD has delivered, however they pay the next yield and have been extra constant through the years.

FAST Graphs (compiled by iREIT)

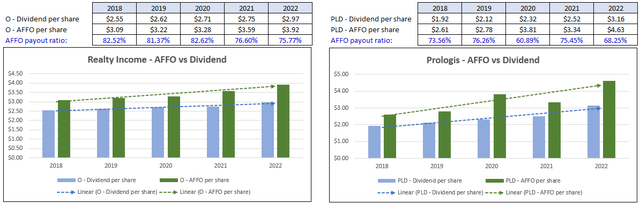

Dividend Security

When accessing dividend security, the perfect measure to make use of is the AFFO payout ratio. Each corporations have a conservative payout ratio that simply covers the dividend, and each corporations have typically improved this metric since 2018.

If I needed to decide a winner right here, I’d give it to Prologis as they’ve a extra conservative payout ratio, however to be clear each corporations have sound payout ratios and the dividend is properly lined by each.

FAST Graphs (compiled by iREIT)

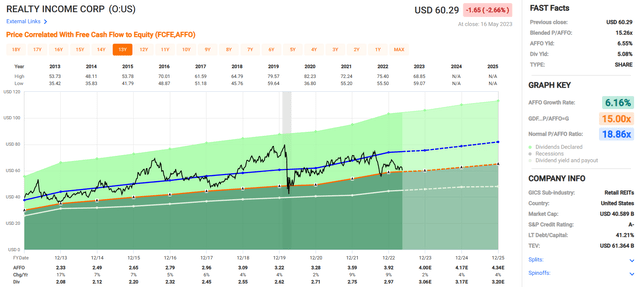

Valuation

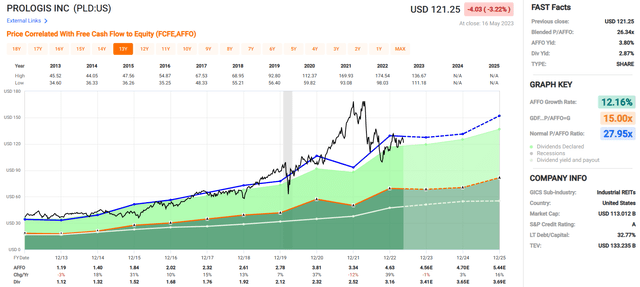

Realty Earnings at present trades at a P/AFFO a number of of 15.26x, which is properly under their regular P/AFFO a number of of 18.86x. Prologis trades at a P/AFFO of 26.34x, which is simply barely under their regular a number of of 27.95x.

It is a clear win for Realty Earnings, as they commerce for a decrease a number of in absolute phrases and commerce at a bigger low cost when in comparison with their regular a number of.

Ultimate Ideas

I wish to reiterate that each corporations are blue-chip REITs and each have stellar fundamentals.

Prologis beats Realty Earnings on development and debt metrics, however Realty Earnings has the next yield and a greater dividend observe report. Plus, Realty Earnings trades at a greater (cheaper) valuation.

Cheap individuals might disagree on which REIT has delivered higher efficiency, however I say why not personal each?

Each corporations are two of the perfect REITs you’ll be able to personal and would complement one another when mixed in a portfolio. They’re in numerous sectors, so if e-commerce begins to have a significant affect on brick-and-mortar retailers it could negatively affect Realty Earnings however would probably have a optimistic affect on Prologis.

In distinction, if e-commerce doesn’t develop as anticipated (or if Amazon sneezes), it could have a destructive affect on Prologis however would probably have a optimistic affect on Realty Earnings. I don’t suppose this comes all the way down to an “both or” resolution and suppose each can be an amazing addition to an investor’s portfolio.

FAST Graphs FAST Graphs

Realty Earnings and Prologis are two of my high holdings, representing near 10% of my complete REIT holdings.

These anchor positions are a great cause that I sleep like a child…

…how about you?