whitebalance.oatt/iStock by way of Getty Photographs

Thesis

With the hashish trade nonetheless growing, funding alternatives are plentiful. Sadly a lot of the operators in the US usually are not worthwhile, and will not be even after the removing of the 280e tax obligation.

Verano Holdings Corp (OTCQX:VRNOF) is able the place as soon as the oppressive tax obligation is eliminated, they usually have been allowed to pay taxes like a traditional firm, they change into web revenue constructive. I presently fee Verano as a Maintain, however this adjustments to a Purchase as soon as rescheduling arrives.

Firm Background

Verano Holdings was based in 2014 by George Archos. They presently function 14 cultivation services and 126 dispensaries in 14 states.

VRNOF Nationwide Footprint (Investor Reality Sheet Q1 2023)

The newest earnings name signifies they achieved over $8M of free money move for the quarter, and reiterate their free money move steerage of $50M to $75M. In addition they tightened the vary of capital expenditure steerage to $35M to $50M.

Verano Financials

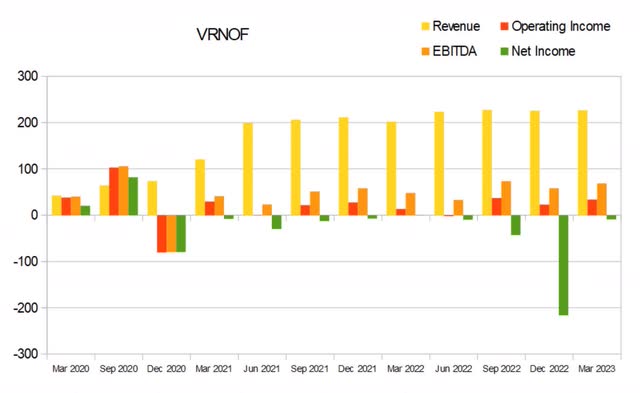

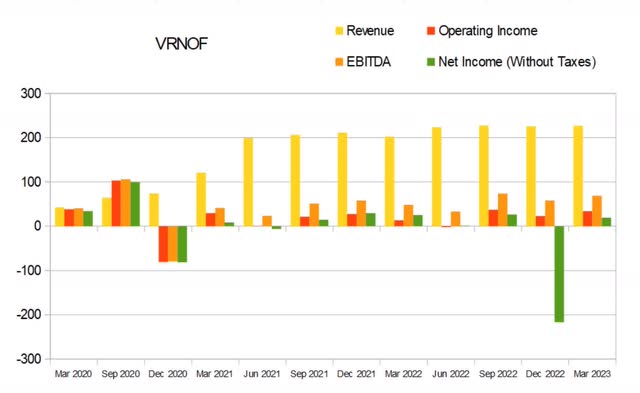

Verano skilled vital income progress in 2020 and early 2021, however progress has slowed considerably since then.

VRNOF Quarterly Income (By Creator)

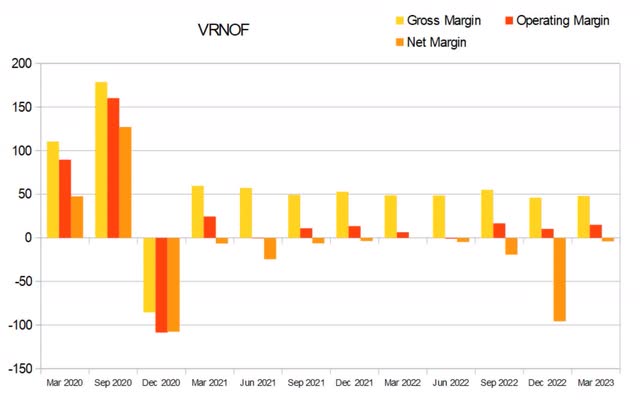

Gross margins have stabilized out within the excessive 40’s and low 50’s, and got here in at 47.99% in the latest quarter. Working margins seem to have some seasonality; aside from Q1 2021 and Q2 2022, are typically within the low teenagers. This most up-to-date quarter’s working margins have been at 14.93%. Web margins are suppressed, due to their brutal tax obligation and are constantly destructive, and this most up-to-date quarter got here in at -3.96%.

VRNOF Quarterly Margins (By Creator)

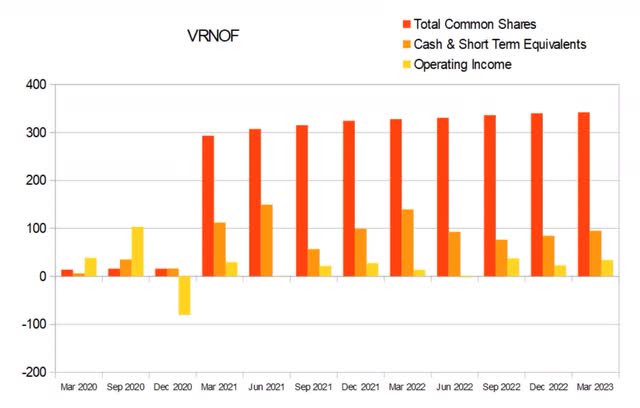

Money appears to be comparatively secure. Whole frequent shares excellent went from 293.2M in Q1 2021, to 342.3M this most up-to-date quarter. This represents a 16.75% rise.

VRNOF Quarterly Share Rely vs. Money vs. Working Earnings (By Creator)

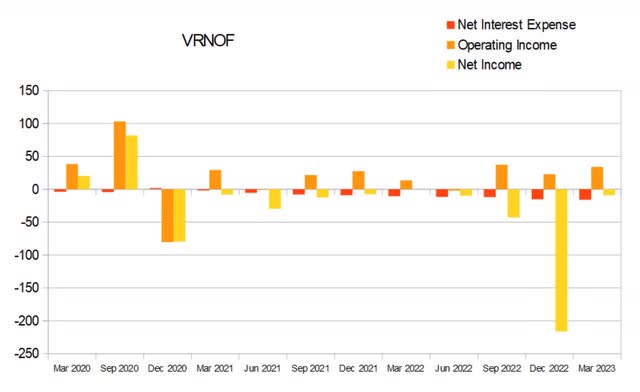

Web curiosity expense is slowly rising. On this most up-to-date quarter, their complete debt to quarterly working revenue is 21.68x. Dividing this by 4 to provide an estimate for debt to annual working revenue of 5.42x. Whereas not presently alarming, I sometimes search for corporations the place that is under 3x.

VRNOF Quarterly Web Curiosity Expense (By Creator)

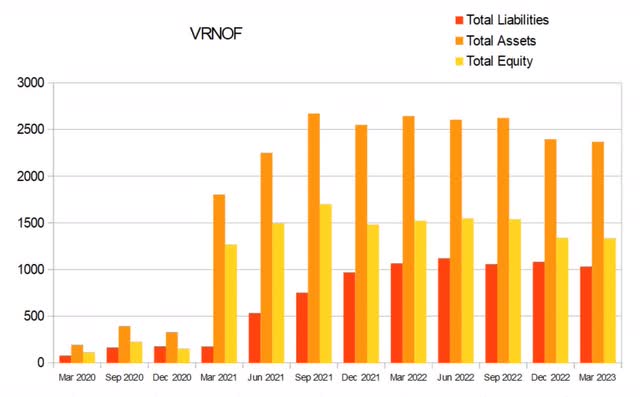

Whole fairness has been comparatively stagnant during the last a number of quarters.

VRNOF Quarterly Whole Fairness (By Creator)

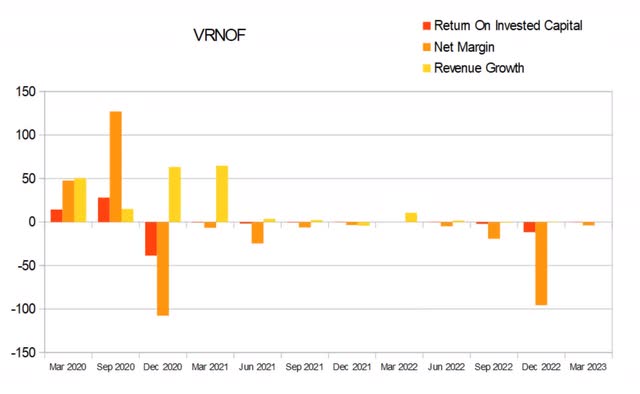

Verano’s capacity to provide enticing return on invested capital values has been restricted by its tax obligations.

VRNOF Quarterly Return On Invested Capital (By Creator)

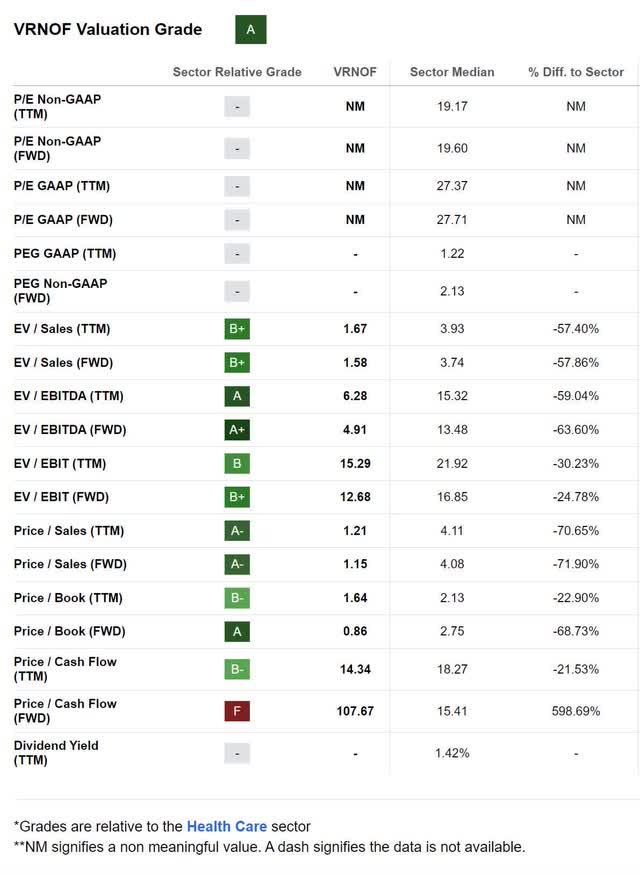

Verano inventory valuation

As of Might eleventh 2023, Verano had a market capitalization of $1.10B and was buying and selling for $2.99 per share. With a trailing Worth/Gross sales of 1.21x, a ahead Worth/Gross sales of 1.15x, and a ahead EV/EBITDA of 4.91x, I view the corporate as comparatively near truthful worth. If the 280e tax obligation have been eliminated, they usually have been allowed to pay taxes like a traditional firm, Verano would immediately seem undervalued.

VRNOF Valuation (Searching for Alpha)

Catalysts

When Biden requested the DHHS to look into rescheduling hashish, he set in movement the gears of paperwork. Whereas I have no idea how lengthy it is going to take for them to make an announcement, when it’s made the whole hashish trade will possible expertise one other euphoria-driven sector large rally. Extra importantly for Verano, their tax obligations will shift to that of a traditional firm.

Dangers

Though unlikely, the DHHS might resolve to maintain hashish as a schedule-1 substance. If this occurs, the tax reduction that Verano and the remainder of the hashish trade is hoping for is not going to materialize. Sentiment in an already bitter sector will dip into new lows, and valuations are more likely to comply with.

Conclusions

By income, Verano is presently the fourth largest hashish firm in the US. The removing of the 280e tax obligation would go away Verano web revenue constructive. In the event that they did not should pay any taxes in any respect, they might have posted $19.3M in web income and had a web margin of 8.50%.

VRNOF Quarterly Income With out Taxes (By Creator)

This firm is just one of a number of which can be poised to do properly within the post-rescheduling atmosphere. Whereas they don’t presently have enticing financials, I consider they are going to as soon as the legal guidelines change. As a result of they need to have the flexibility to exit their place for a major acquire in the course of the subsequent sector-wide rally, anybody who desires to purchase Verano now locations themselves at comparatively low threat. Verano even made my record of potential long run winners for the hashish sector. I’ve no plans to purchase Verano within the fast future, however when rescheduling arrives I’ll have a look over my notes on the sector and purchase the businesses which can be more likely to thrive within the post-rescheduling atmosphere. Verano will possible be one of many ones I purchase into.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.