Up to date on Might eleventh, 2023 by Aristofanis Papadatos

Uranium performs a pivotal position in producing nuclear energy. Consequently, buyers seeking to capitalize on the long-term progress potential of nuclear power is perhaps all in favour of studying extra about uranium shares.

Uranium shares are extremely dangerous–most have low market caps, beneath $1 billion, and just a few pay dividends to shareholders.

Nonetheless, like many commodities sectors, uranium shares may present enticing long-term progress, as demand for nuclear energy rises world wide.

With this in thoughts, we created an inventory of 40 uranium shares. You may obtain a duplicate of the uranium shares record (together with necessary monetary metrics comparable to dividend yields and P/E ratios) by clicking on the hyperlink beneath:

This text will give an summary of the uranium trade, and the highest 7 uranium shares now.

Desk of Contents

You may immediately bounce to a selected part of the article by clicking on the hyperlinks beneath:

Trade Overview

Uranium was found in 1789. It’s a metallic chemical aspect, primarily discovered naturally in soil, rock and water. Within the mid-Twentieth century, uranium was discovered to have potential use as an power supply.

Right now, uranium’s main industrial software is to energy business nuclear reactors that produce electrical energy. Uranium can also be used to supply isotopes for medical, industrial, and protection.

Till a couple of years in the past, most nations have been making an attempt to shift from nuclear power to different clear power sources, comparable to wind and photo voltaic power, as a way to remove the chance of a nuclear accident. There have been good causes behind the extraordinarily unfavourable sentiment that was prevailing about uranium. The nuclear accidents at Chernobyl (Russia) in 1986 and Fukushima (Japan) in 2011 brought about hundreds of thousands of deaths and devastating air pollution to the atmosphere (soil) in these areas.

Nonetheless, as a result of Ukrainian disaster, the costs of oil and pure gasoline skyrocketed to 13-year highs final 12 months. Consequently, hundreds of thousands of households world wide struggled to pay for his or her power payments and thus a extreme world power disaster confirmed up. In response to that disaster, most nations at the moment are doing their greatest to shift away from fossil fuels. Most of them are investing closely in photo voltaic and wind energy however the power disaster has improved the sentiment about uranium as properly.

In 2021, the complete world manufacturing quantity of uranium from mines was 48,332 metric tons. This compares with world manufacturing of 54,742 metric tons in 2019.

Kazakhstan is the biggest uranium producer on the earth, with a manufacturing quantity of 21,819 metric tons in 2021. This output was down from roughly 22,808 metric tons in 2019.

Against this, the U.S. produces little or no uranium. In accordance with Statista, U.S. uranium manufacturing totaled simply eight metric tons in 2021. In 2012, manufacturing was 1,596 metric tons of uranium within the U.S.

Nonetheless, the U.S. is the biggest shopper of uranium, as nuclear power use is widespread. In 2020, the U.S. consumed about 18,300 metric tons of uranium, practically twice as a lot because the next-highest shopper. After the U.S., the biggest shoppers of uranium are China and France, with annual consumption of 10,800 and eight,700 metric tons, respectively.

Uranium doesn’t commerce on an open market like different commodities. As an alternative, consumers and sellers negotiate contracts privately. Costs are printed by unbiased market consultants. Current publications present the value of uranium round $53/pound.

The value of uranium has greater than doubled over the previous 5 years, from about $21 per pound to $53.4 per pound, partly because of geopolitical points at Kazakhstan, which is the highest world producer, and Russia. The rally of the value of uranium signifies the potential funding case for getting uranium shares.

It’s also necessary to notice that the value of uranium remains to be properly beneath its peak of about $70 per pound, which was recorded simply earlier than the accident in Japan, in 2011. Since then, the value of uranium has not approached that stage however the optimistic fundamentals of provide and demand sign that there could also be vital upside potential within the upcoming years.

Certainly, the expansion potential of uranium shares is evident. First, roughly one-third of the worldwide inhabitants lives in “power poverty”, that means lack of entry to dependable electrical energy. Subsequent, the world faces the problem of local weather change, making thermal alternative a strategic precedence for a lot of developed nations. Electrification of a number of industries that beforehand relied on coal for power is a serious job.

Not surprisingly, world demand for electrical energy is predicted to rise by 75% from 2020 to 2050, in line with the 2021 IEA World Power Outlook.

That is the place uranium shares are available. The next part will focus on the highest 7 uranium shares right this moment.

Uranium Inventory #7: Uranium Royalty (UROY)

Uranium Royalty was integrated in 2017 and is headquartered in Vancouver, Canada. It operates as a pure-play uranium royalty firm. It acquires, accumulates, and manages a portfolio of geographically diversified uranium pursuits.

Uranium Royalty has royalty pursuits in Canada, Arizona, Wyoming, New Mexico, South Dakota and Colorado in addition to a undertaking in Namibia.

Supply: Investor Presentation

The geographical diversification of Uranium Royalty could lead some buyers to suppose that the corporate is considerably resilient to the cycles of its enterprise. Nonetheless, that is removed from true. The corporate has posted working losses yearly since its formation. It additionally has a small market capitalization, which at present stands at $204 million and will increase the chance of the inventory even additional.

As a result of losses and the excessive danger of Uranium Royalty, its inventory value is markedly risky. Even worse, whereas uranium costs have gained 4% during the last 12 months, the inventory has slumped 30% throughout this era.

On the intense facet, Uranium Royalty has a pristine, debt-free stability sheet. It could actually thus endure intervals of hostile enterprise situations and wait patiently for a rally of uranium costs. Nonetheless, the inventory is extremely speculative and appropriate just for the buyers who’ve nice conviction in larger uranium costs within the close to future.

Uranium Inventory #6: Ur-Power (URG)

Ur-Power engages within the acquisition, exploration, growth, and operation of uranium mineral properties. The corporate holds pursuits in 12 initiatives positioned within the U.S. Its flagship property is the Misplaced Creek undertaking, which contains a complete of roughly 1,800 unpatented mining claims and three Wyoming mineral leases that cowl an space of roughly 48,000 acres positioned within the Nice Divide Basin, Wyoming. Ur-Power, which has a market capitalization of solely $260 million, was based in 2004 and is headquartered in Littleton, Colorado.

The Misplaced Creek undertaking, which is the flagship undertaking of the corporate, has been in operation for the previous 10 years and has produced roughly 2.7 million tons of uranium all through this era. Sadly, its manufacturing slumped near zero in recent times because of low uranium costs.

Supply: Investor Presentation

Nonetheless, due to a rally of uranium costs, Ur-Power has begun to ramp up its manufacturing. Furthermore, the corporate estimates a 14-year remaining mine life, with out considering the quite a few unexplored roll fronts.

Then again, buyers ought to pay attention to the excessive danger of this small-cap inventory. About three months in the past, the corporate introduced a secondary providing, which triggered a plunge of the inventory to a virtually 2-year low stage.

It’s also value noting that the inventory has underperformed the S&P 500 by a large margin during the last decade, because it has gained solely 9%, whereas the index has rallied 146%. General, Ur-Power is extraordinarily delicate to the value of uranium. It’s thus a high-risk (at low uranium costs), high-reward (at excessive uranium costs) guess on uranium costs.

Uranium Inventory #5: Power Fuels (UUUU)

Power Fuels engages within the extraction, restoration, exploration, and sale of standard and in situ uranium restoration within the U.S. The corporate owns and operates the Nichols Ranch undertaking, the Jane Dough property, and the Hank undertaking positioned in Wyoming; and the Alta Mesa undertaking positioned in Texas, in addition to White Mesa Mill in Utah. It additionally holds pursuits in uranium and uranium/vanadium properties and initiatives in numerous phases of exploration, allowing, and analysis. The corporate was previously referred to as Volcanic Metals Exploration and altered its identify to Power Fuels in 2006.

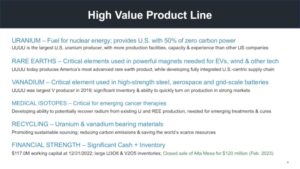

Power Fuels has a high-value product line, which incorporates uranium, uncommon earths, vanadium and different merchandise.

Supply: Investor Presentation

These merchandise are utilized in quite a few functions and luxuriate in secular progress of demand. Nonetheless, the core product of Power Fuels is uranium. This helps clarify the ticker of the inventory.

Identical to most uranium corporations, Power Fuels has incurred working losses in each single 12 months during the last decade, primarily because of low uranium costs. Nonetheless, due to the rally of uranium costs, the corporate is predicted to slender its losses per share from -$0.38 to -$0.16 this 12 months and change into worthwhile subsequent 12 months.

Furthermore, Power Fuels has an exceptionally robust stability sheet, with none debt and a web money place of $90 million. As this amount of money is 9% of the market capitalization of the inventory, it’s evident that the corporate has a rock-solid stability sheet. Then again, income-oriented buyers must be conscious that Power Fuels is much from initiating a dividend, primarily as a result of risky nature of its enterprise.

Uranium Inventory #4: Uranium Power (UEC)

Uranium Power engages within the exploration, pre-extraction, extraction, and processing of uranium and titanium concentrates within the U.S., Canada, and Paraguay. The corporate was previously referred to as Carlin Gold and altered its identify to Uranium Power in early 2005. Uranium Power was integrated in 2003 and is predicated in Corpus Christi, Texas.

Uranium Power has targeted its property acquisition program primarily within the southwestern U.S. states of Texas, Wyoming, New Mexico, Arizona and Colorado. This area has traditionally been essentially the most concentrated space for uranium mining within the U.S. With using historic exploration databases, Uranium Power has been capable of goal properties for acquisition which have already been the topic of serious exploration and growth by senior power corporations previously.

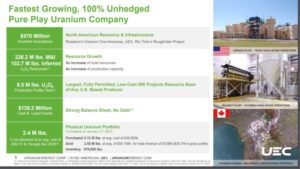

Uranium Power doesn’t hedge its manufacturing and therefore it could possibly reap the total profit from the rally of uranium costs.

Supply: Investor Presentation

As well as, due to its promising progress initiatives and its rock-solid stability sheet, it has vital upside potential whereas it could possibly endure patiently the downturns of its enterprise.

Uranium Inventory #3: NexGen Power (NXE)

NexGen Power is an exploration and growth stage firm engaged within the acquisition, exploration and analysis and growth of uranium properties in Canada. The corporate was integrated in 2011 and at present has a market capitalization of $2.0 billion.

NexGen, like most uranium shares, is extremely speculative. As an exploration and growth stage firm, the corporate doesn’t have revenues and has reported working losses for no less than 10 consecutive years. Consequently, as of the top of the primary quarter of 2023, NexGen had fairness of solely $330 million.

Subsequently, investing in NexGen is basically a guess on the corporate’s property. To make certain, the corporate does possess high quality uranium property. A notable instance is the corporate’s Rook I Undertaking, the biggest low-cost uranium mine on the earth.

Supply: Investor Presentation

This undertaking is unhedged and therefore it has 100% publicity to future uranium costs. It’s going to thus show extremely worthwhile if uranium costs stay on an uptrend.

Furthermore, NexGen has a rock-solid stability sheet, with money of $106 million and complete liabilities of solely $68 million, as of the top of the 2023 first quarter. Which means the corporate is debt-free, with a web money place of $38 million.

Then again, buyers all in favour of security or stability shouldn’t purchase the inventory. Solely essentially the most risk-tolerant buyers searching for publicity to uranium shares ought to take into account NexGen.

That mentioned, the inventory may present enticing returns, within the type of capital beneficial properties, if it is ready to execute on its progress initiatives.

Uranium Inventory #2: Cameco Corp. (CCJ)

Cameco is likely one of the largest uranium producers on the earth. It has the licensed capability to supply greater than 53 million kilos (100% foundation) of uranium concentrates yearly, backed by greater than 464 million kilos of confirmed and possible mineral reserves.

It’s also a provider of uranium refining, conversion and gas manufacturing providers. Its land holdings, together with exploration, span about 2 million acres of land.

Cameco has a dominant place within the largest uranium mine on the earth, McArthur River, and is ideally positioned to make the most of the rising demand for uranium amid restricted provide.

Supply: Investor Presentation

In 2022, the corporate vastly benefited from favorable uranium costs and grew its revenues 27% over the prior 12 months. It additionally enhanced its adjusted earnings per share from $0.06 in 2021 to $0.09 in 2022.

Enterprise momentum has accelerated this 12 months. Because of favorable uranium costs and powerful manufacturing, Cameco expects to develop its revenues to $2.22-$2.37 billion in 2023, a lot larger than the consensus of $1.75 billion. On the mid-point, this steering implies 64% progress over the prior 12 months. Furthermore, the corporate is predicted to just about triple its earnings per share this 12 months, from $0.25 to $0.72, with extra progress anticipated within the subsequent few years.

Cameco inventory pays a dividend. Nonetheless, this dividend is negligible for the shareholders, as the present yield is standing at 0.3%. Subsequently, Cameco inventory is extra of a possible progress inventory than a dividend inventory.

Uranium Inventory #1: BHP Group (BHP)

Uranium shares are extremely dangerous and will be risky. Consequently, the highest spot goes to BHP Group. Whereas BHP isn’t the biggest uranium producer on the earth, it affords buyers the largest scale and relative stability. BHP is a worldwide big with a market cap of $153 billion.

BHP is headquartered in Melbourne, Australia. The corporate has a diversified manufacturing portfolio. It explores, produces, and processes iron ore, metallurgical coal, copper, and extra. Nearly two-thirds of the corporate’s annual EBITDA is derived from Iron Ore manufacturing, however BHP can also be concerned in uranium.

BHP produced roughly 2.4 million metric tons of uranium in the latest fiscal 12 months, which ended on June 30, 2022. This marked a lower from 3.3 million metric tons of uranium in 2021, however nonetheless makes BHP a serious uranium producer.

In late February, BHP reported monetary outcomes for the primary half of fiscal 2023. Its income and its earnings decreased 16% and 32%, respectively, over the prior 12 months’s interval because of a 25% decline in iron ore costs and a 19% decline in copper costs.

Iron ore is an important product for BHP, because it generates about 50% of its earnings. It comprised 70% of earnings in 2021 however its share in earnings fell in 2022 because of a rally in coal and copper costs. On the intense facet, iron ore costs have rallied to an 8-month excessive these days due to the continued financial restoration of China from the pandemic. Because of this tailwind, we count on BHP to develop its earnings per share by about 8% on this fiscal 12 months, from $4.71 to $5.10.

Along with its dimension and aggressive benefits, BHP is the highest choose as a result of it has the very best dividend yield of all uranium shares.

With a dividend yield of 6.0%, BHP is a excessive dividend inventory.

Click on right here to obtain our most up-to-date Positive Evaluation report on BHP Group (preview of web page 1 of three proven beneath):

Last Ideas

Uranium shares are dangerous, and buyers ought to fastidiously weigh the varied danger elements earlier than shopping for uranium shares. Many uranium shares are small corporations with unsure futures. Extraordinarily few uranium shares pay dividends to shareholders.

Nonetheless, for buyers prepared to take the chance, the long-term potential may very well be rewarding. Uranium shares are set to learn from continued long-term progress of nuclear power world wide. Subsequently, the highest uranium shares may generate enticing returns over the long term.

You might also be seeking to put money into dividend progress shares with excessive possibilities of continuous to lift their dividends annually into the long run.

The next Positive Dividend databases comprise essentially the most dependable dividend growers in our funding universe:

If you happen to’re searching for shares with distinctive dividend traits, take into account the next Positive Dividend databases:

In case you are all in favour of discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases will probably be helpful:

The most important home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].