AndreyPopov/iStock through Getty Pictures

One of many largest beneficiaries of climate-related legislation modifications since 2020 has been Hudson Applied sciences (NASDAQ:HDSN). The corporate primarily recycles “freon” (fluorinated hydrocarbons) and different refrigerant gases/chemical compounds for air conditioners and cooling tools. Hudson’s merchandise/providers embody refrigerant and industrial fuel gross sales, plus administration providers consisting primarily of reclamation of refrigerants, re-usable cylinder refurbishment, and hydrostatic testing providers.

Actually, Hudson has outperformed totally 98% of all U.S. fairness investments over the previous three years, with a +700% worth rise from beneath $1 a share in the course of 2020. The excellent news is a consolidation from the $12 peak in late 2022 into this week’s sub-$7 worth could also be offering one other wonderful entry level for a double or triple in worth over the following 18-24 months.

YCharts – Hudson Applied sciences, Weekly Value Adjustments, 3 Years

Bullish Working Background

Throughout 2020-21 EPA laws within the U.S. modified with the AIM Act, clamping down on the categories and portions of refrigerants acceptable to make use of within the business, all an effort to battle carbon emissions thrown into the ambiance by tens of hundreds of thousands of air conditioners and cooling towers within the nation. Simply this week Hudson was added to the EPA’s GreenChill Emissions Discount Program, a refrigerant sustainability partnership.

Firm Web site – Might fifth, 2023 Firm Web site – Might fifth, 2023

By way of recycling, the corporate holds a 35% market share of this enterprise within the U.S. Plus, the hydrofluorocarbon (HFC) market is projected to expertise a good higher scarcity of provide beginning in 2024, as one other 30% discount in newly produced (virgin) gases takes impact.

April 2023 Investor Presentation April 2023 Investor Presentation April 2023 Investor Presentation April 2023 Investor Presentation April 2023 Investor Presentation April 2023 Investor Presentation

Valuation Story

So, if shortages of refrigerant HFCs proceed, costs ought to stay excessive, and Hudson must be rerated on this actuality! Nope, the inventory is appearing like 2022 was the height in its enterprise, regardless of Wall Road analyst projections of a robust 2023, and even higher 2024 for the working enterprise. This disconnect opens the purchase proposition, in my opinion.

Searching for Alpha Desk – Hudson Applied sciences, Analyst Estimates for 2023-24, Made on Might fifth, 2023

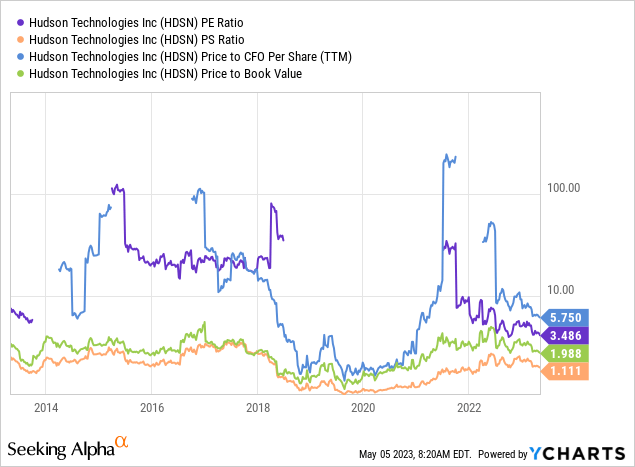

On primary worth to trailing earnings, gross sales, money movement, and e book worth, Hudson stays in a traditional to undervaluation setup for brand new buyers. Under is a 10-year graph of this elementary ratio evaluation.

YCharts – Hudson Applied sciences, Elementary Valuation Ratios, 10 Years

After we embody debt and subtract money holdings from Hudson’s fairness capitalization, enterprise worth stats are equally interesting. The place else can you discover an business chief, with pricing developments blowing in the appropriate route for years to come back, sitting at an EV to money EBITDA variety of 3x to 4x? I can not find an equal worth and progress setup elsewhere.

YCharts – Hudson Applied sciences, Enterprise Valuation Ratios, 3 Years

Assuming HFC costs keep elevated or rise additional, the sturdy progress in revenues since 2020 ought to proceed till at the very least 2025. Little doubt, Wall Road expectations might even show on the low aspect of actuality in a large scarcity state of affairs subsequent yr.

Searching for Alpha Graph, Annual Revenues Trailing & Projected, 2018-24

Technical Momentum Turnaround Due?

After I evaluation my favourite momentum indicators and the chart sample, a blended technical score is my readout. Indicators just like the Accumulation/Distribution Line and On Stability Quantity are in downtrends (not pictured). Plus, worth is buying and selling under its 50-day and 200-day shifting averages. For me, worth beneath each MAs is the only definition of a bearish pattern.

On the optimistic aspect of the equation, a super-low 21-day Common Directional Index rating beneath 10 the previous week has often opened a good time to purchase during the last 18-months (circled in inexperienced). The present 8 studying signifies a transparent low-volatility steadiness between patrons and sellers during the last month of buying and selling. So, the following worth transfer both greater or decrease might be a key inform.

The Detrimental Quantity Index pattern greater is highlighting appreciable buying-on-weakness curiosity. And, the oversold 14-day Relative Energy Index shut to twenty in March might have pinpointed a crest in promoting strain (circled in crimson).

By way of a worth reversal, the very first thing to search for might be a number of days of closing quotes above the 50-day shifting common. You can not expertise a significant worth advance with out taking some minor steps in the appropriate route to begin.

StockCharts.com – Hudson Applied sciences, Creator Reference Factors, 18 Months of Every day Value & Quantity Adjustments

Last Ideas

In the long run, a scarcity of quick upside momentum is why I take into account Hudson extra of a backside fishing expedition. For positive, the valuation story turns into extra compelling on worth weak point. My suggestion is initiating a stake now makes loads of sense, whereas cost-averaging down stands out as the smartest method to purchase a full place.

I’d be aware heavy insider promoting of shares befell final yr within the $10 to $11 vary. Nevertheless, over the newest three months, no sells and one purchase from director Vincent Abbatecola at $8.27 have appeared. A part of the change in sentiment could also be based mostly on expectations for subsequent yr’s HFC mandated discount in new product gross sales. Anticipated shortages might hold recycled costs and margins for the corporate at heightened ranges for a lot of years. My forecast is low valuation multiples on present working outcomes and a stronger steadiness sheet every quarter might act as a springboard for future inventory quote appreciation.

With its 2-year shifting common at this time at $6.60 appearing as highly effective worth assist, and a cut price valuation backstop limiting draw back potential, I don’t foresee tons of danger outdoors of a inventory market crash state of affairs. If worst-case state of affairs draw back is -20% and best-case upside is a double (+100%) or triple (+200%) into 2025, the purchase argument isn’t laborious to grasp. Assuming EPS of $1.50 in 2025 and investor acceptance of a shiny long-term future, a repeatable valuation a number of of 12x appears truthful. That will get worth to $18 a share in 18-24 months. I price shares a Purchase round $8.

Thanks for studying. Please take into account this text a primary step in your due diligence course of. Consulting with a registered and skilled funding advisor is beneficial earlier than making any commerce.