insta_photos/iStock through Getty Photographs

Thesis

DocuSign, Inc. (NASDAQ:DOCU) is a number one software program firm within the contract-lifecycle administration market, identified for its main eSignature resolution that has revolutionized the business. The corporate skilled a surge in development throughout the pandemic as companies quickly transitioned to digital signatures and contracts. Nonetheless, because the pandemic-related tailwinds subside and near-term development slows, DocuSign’s future development will depend on increasing its current buyer base and selling its broader suite of Settlement Cloud merchandise. Though DocuSign operates in an enormous whole addressable market (TAM) estimated at over $50 billion, its short-term billing and income development could decelerate because it grapples with establishing a sustainable development trajectory in a post-pandemic panorama. I imagine the chance/reward ratio at this level is tilted towards the draw back, and therefore maintain a promote score on the inventory.

DOCU inventory value motion (Looking for Alpha)

A number of Causes To Be Bearish

After offering a preliminary FY24 outlook throughout its earnings name that traders possible seen as conservative and setting an achievable development bar, DocuSign supplied full-year steerage that falls a bit brief on the highest line and PF working margin steerage that doesn’t appear to permit for a lot of the current headcount reductions to movement by way of. I proceed to respect the corporate’s logical and accountable steps to recalibrate the enterprise, however the mixture of deteriorating demand developments, clear aggressive presence of Adobe (ADBE), and the probability of rising competitors from Microsoft (MSFT), CFO departure, publicity to challenged end-markets in actual property and VC-based fundraising areas, and draw back comps that commerce at materially decrease multiples appear to tilt the chance/reward profile downward.

The core eSignature enterprise of DocuSign, which represents over 90% of the corporate’s income, is going through a difficult aggressive atmosphere. The rising notion of primary digital signatures as commoditized instruments for comparatively easy use instances has made prospects much less conscious of premium choices, which is why prospects might be trying to swap to Adobe resulting from extra favorable pricing. With DocuSign’s core enterprise going through strain and its potential development areas like Contract Lifecycle Administration nonetheless within the early phases, it’s unlikely to see a significant acceleration of development within the close to to medium time period that will help a excessive free money movement a number of within the 20s.

DocuSign has acknowledged a more difficult macro atmosphere, stating that it has not improved and may need even worsened. This aligns with expectations of a moderation in development for the broader eSignature market in comparison with the elevated ranges throughout the pandemic. Particular verticals, equivalent to VC-based fundraising and actual property, which closely depend on doc workflows, are experiencing pockets of softness as a result of macro influence. DocuSign’s enterprise displays these challenges by way of a decline in greenback internet retention and a rise within the variety of prospects with an annual contract worth (ACV) better than $300,000, albeit at a slower tempo.

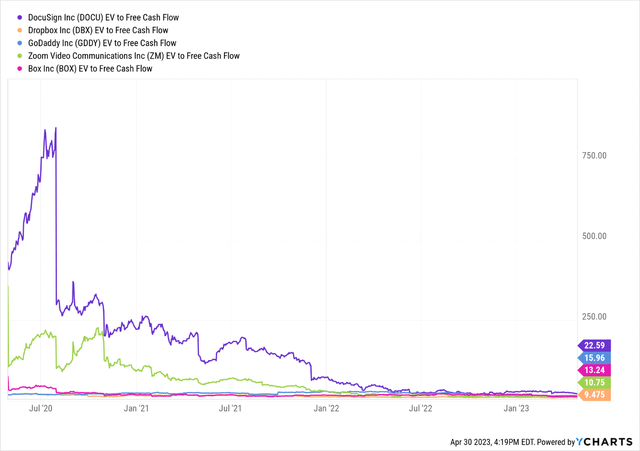

Contemplating the present valuation ranges, there are draw back dangers for DocuSign. Comparable firms commerce at decrease money movement multiples for the calendar 12 months 2023 whereas providing related resilience of their high traces or superior free money movement profiles. Some examples embody Dropbox, Inc. (DBX), GoDaddy Inc. (GDDY), Zoom Video Communications, Inc. (ZM), Field, Inc. (BOX), amongst others. Moreover, there are sturdy compounders that commerce at decrease growth-adjusted multiples, equivalent to Salesforce, Inc. (CRM), HubSpot, Inc. (HUBS), ServiceNow, Inc. (NOW), ZoomInfo Applied sciences Inc. (ZI), and others. General, the chance/reward setup for DocuSign shares is perceived as unfavorable within the close to time period, as the corporate wants time to reveal the effectiveness of its investments and regain investor confidence.

DOCU valuation a number of vs Friends (YCharts)

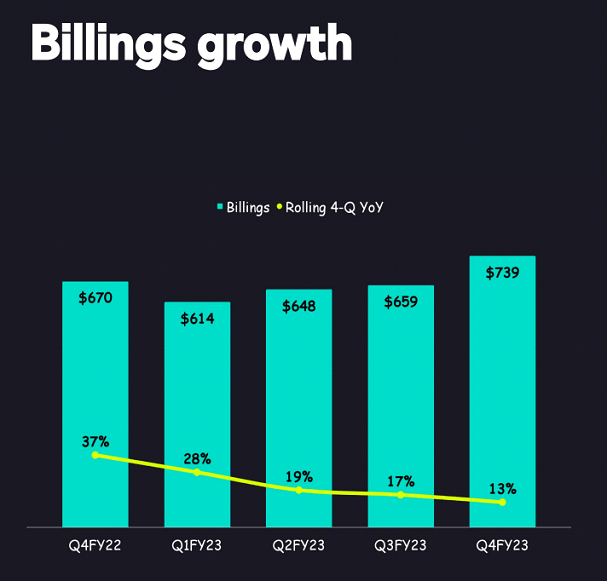

Weak Financial Exercise Results in Decrease Billings

DocuSign’s billings development may sluggish to low- to mid-single digits in 2023 after averaging 15% up to now two quarters, stemming from decrease financial exercise. On condition that DocuSign’s product is priced on utilization (or exercise), any drop within the tempo of transactions hurts gross sales development. Elongation of gross sales cycles is one other issue that would harm new-business signings. DocuSign’s billings development spiked throughout the pandemic as enterprises rushed to embrace digital-signature capabilities. This led to a substantial pull-forward in demand for its merchandise.

DocuSign may expertise a gentle decline in its internet greenback retention price over the subsequent 12 months, which is a key driver of billings and gross sales development. This metric is an effective indicator of shopper retention and growth and spiked from a historic common of 114-119% to round 125% throughout the pandemic. Previously two quarters, it has averaged 109%, however I count on it to fall much more, to about 105%, over the subsequent 4 quarters. As macroeconomic circumstances enhance, the speed may rebound to 110- 115%, almost definitely in fiscal 2025.

Firm’s Presentation

Dangers

DocuSign’s development in prospects with excessive annual contract values has slowed down because it faces robust comparisons and undergoes a gross sales reorganization. Nonetheless, there’s potential for a reacceleration in giant buyer additions if the corporate executes effectively on demand era post-pandemic and successfully upsells its core eSignature providing by increasing into wider use instances and enhancing penetration of latest merchandise. This might result in elevated gross sales diversification, lowering reliance on the cyclicality of small enterprise spending patterns.

Moreover, DocuSign goals to attain better income diversification by increasing its suite of contract-lifecycle administration choices. This broader platform method may improve buyer retention and enhance common income per person. The corporate estimates that its Settlement Cloud, which encompasses eSignature, CLM, perception, doc era, and platform options, has a complete addressable market of over $50 billion. The breakdown consists of roughly $26 billion attributed to eSignature, $4 billion to broader signing choices, $17 billion to the broader Settlement Cloud, and $3 billion to Platform options.

Last Ideas

DocuSign is a number one utility software program firm that has dominated the contract-lifecycle administration market, primarily pushed by its eSignature providing, which holds the most important market share. Nonetheless, because the pandemic-induced tailwinds subside, DocuSign’s future development depends on efficiently upselling its current buyer base and increasing the adoption of its broader suite of Settlement Cloud merchandise. Whereas DocuSign continues to be within the early phases of tapping into its huge $50 billion whole addressable market, its short-term billings and income development could face challenges because it seeks to determine a sustainable development trajectory in a post-pandemic atmosphere. DocuSign’s core eSignature enterprise, which accounts for over 90% of its income, is going through a difficult aggressive panorama. The marketplace for digital signatures is changing into commoditized, with prospects displaying much less responsiveness to premium choices. Consequently, prospects are more and more contemplating switching to Adobe for extra favorable pricing. I imagine the chance/reward ratio at this level is tilted towards the draw back, and therefore maintain a promote score on the inventory.