Eric Francis

By Hyun Kang

The Oracle of Omaha is upping the stakes in his wager on Japan, bringing his investments in every of Japan’s 5 largest buying and selling firms from 5% to 7.4%.

Berkshire Hathaway (BRK.A)(BRK.B) revealed in August 2020 that it had invested over $6 billion in main Japanese normal buying and selling firms Sumitomo (OTCPK:SSUMF, SSUMY), Marubeni (OTCPK:MARUY, OTCPK:MARUF), Mitsui & Co. (OTCPK:MITSY, OTCPK:MITSF), Mitsubishi (OTCPK:MSBHF) and Itochu (OTCPK:ITOCF, OTCPK:ITOCY); establishing a 5% stake in every.

These buying and selling firms, or sogo sosha, are family names not solely in Japan however all over the world, and their myriad enterprise actions vary from buying and selling pure fuel to manufacturing cruise ships.

Buffett already went for seconds (or extra) following his preliminary plunge and had elevated his possession to between 6.2% and 6.8% throughout the businesses by November final 12 months. And the billionaire investor is displaying no indicators of slowing down.

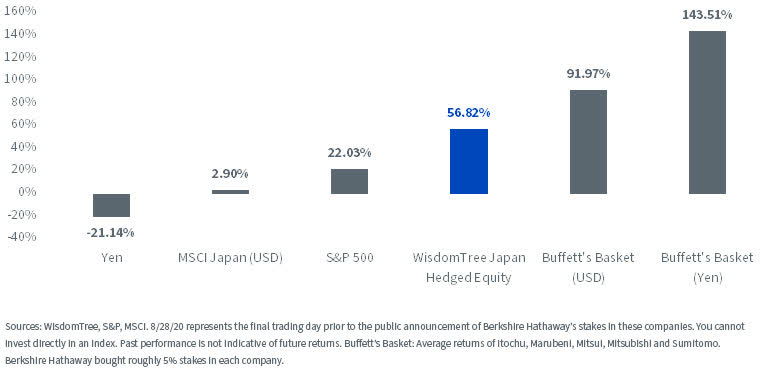

We beforehand mentioned Buffett’s technique to difficulty yen-denominated bonds to hedge towards unfavorable yen-dollar actions: a objective shared by the WisdomTree Japan Hedged Fairness Index.

Since then, the yen slid additional because the Index and Buffett’s Japanese basket noticed larger returns, having put to full use their foreign money hedging mechanisms.

Annualized Returns, 8/28/20–4/10/23

In an interview throughout his April journey to Japan, Buffett instructed Nikkei, “We’d love if any of the 5 [companies] would come to us ever and say, ‘We’re pondering of doing one thing very huge or we’re about to purchase one thing and we wish a associate or no matter.’”

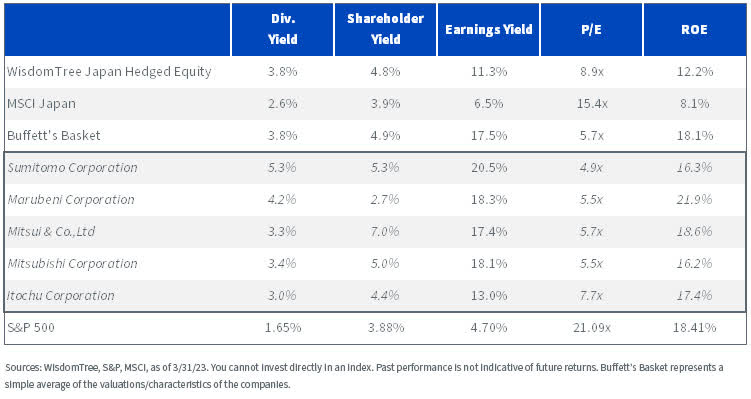

Fundamentals

In one other interview with CNBC’s Becky Fast throughout his Tokyo journey, Buffett successfully mentioned he was placing his stamp of approval on investing in Japan. He went on to explain how the 5 firms he had acquired had 14% earnings yields on the time of his buy when rates of interest had been successfully zero.

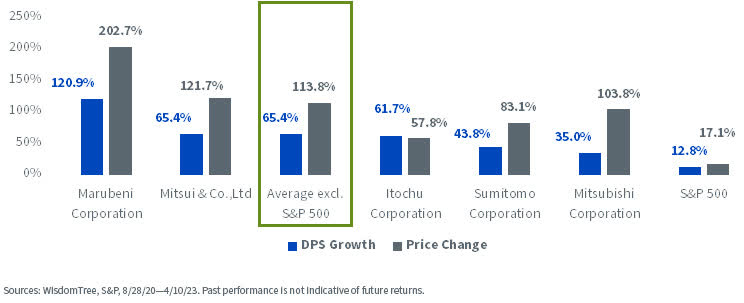

Buffett mentioned the businesses reportedly grew dividends by 70%. “It has labored out even higher than anticipated,” he mentioned. Japan is now Berkshire’s largest nation by way of investments outdoors the U.S.

Marubeni Company grew its dividends by a whopping 120% since August 2020. Mitsubishi Company noticed a modest progress of 35%. By comparability, the S&P 500 elevated its dividends by 12.8% via the identical interval.

Dividends per Share and Value Enhance of Buffett’s Japanese Shares Since Preliminary Funding

These 5 buying and selling firms elevating their dividends is emblematic of what’s occurring throughout Japan as pressures to enhance shareholder returns pile on, as we mentioned on this weblog about actions the Tokyo Inventory Change is taking up firms buying and selling at costs under their guide values.

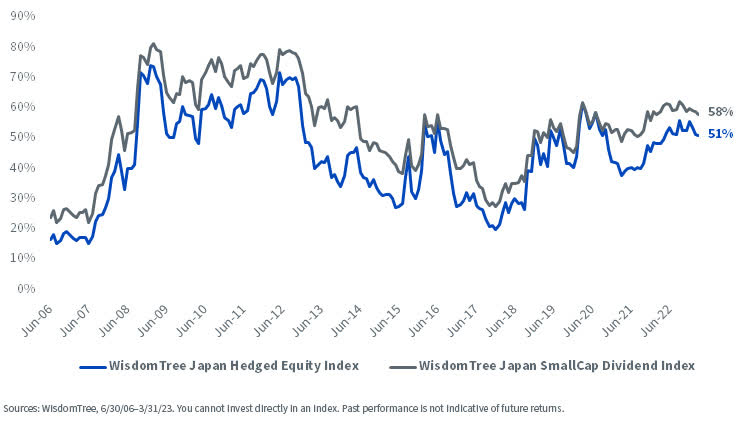

Share of WisdomTree Index Constituents with a Value-to-E-book below 1.0

Japanese firms have among the highest ranges of money on their steadiness sheets, which depresses returns on fairness in comparison with firms within the U.S. This money, nonetheless, can also be the driving power behind sustained dividend progress.

The combination dividend yield on the WisdomTree Japan Hedged Fairness Index is sort of 4%—near that of the highest-dividend subset of the U.S. market–whereas the S&P 500 Index at present has an combination dividend yield of round 1.6%.

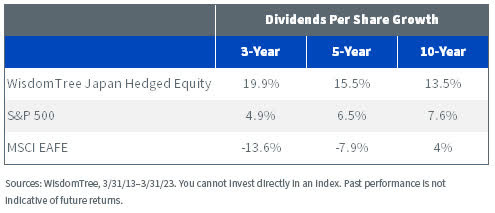

Over the past decade, the WisdomTree Japan Hedged Fairness Index’s dividends per share elevated by 13.5% yearly, in comparison with extra modest will increase for the S&P 500 and the MSCI EAFE index.

The WisdomTree Japan Hedged Fairness Index’s dividends surged forward of the S&P 500’s within the final three years and within the final 5 years, whereas developed markets noticed important combination decreases.

Index Dividends Per Share Development Over the Final 10 Years, Annualized

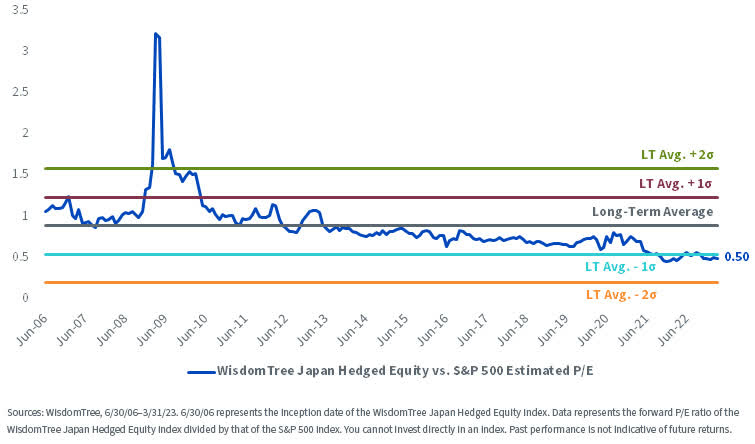

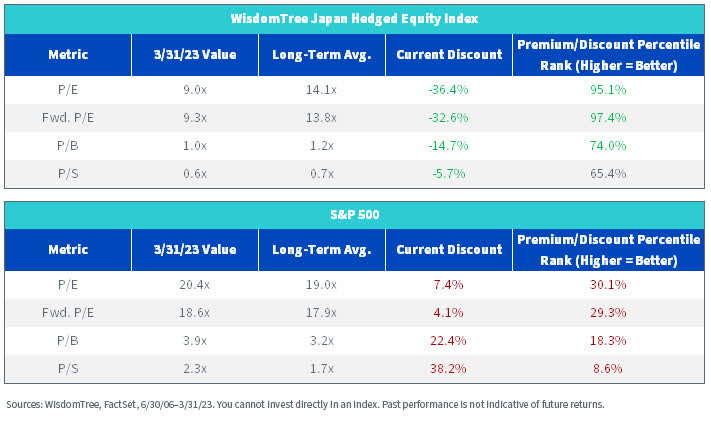

The WisdomTree Japan Hedged Fairness Index has additionally been buying and selling at a reduction to the S&P 500 for the final decade and at present trades at half of the S&P 500’s ahead P/E.

WisdomTree Japan Hedged Fairness vs. S&P 500 Ahead P/E Since Inception

WisdomTree Japan Hedged Fairness vs. S&P 500 Valuation Reductions

Hyun Kang, Analysis Analyst

Hyun Kang joined WisdomTree in July 2022 as a Analysis Analyst. As part of the Index staff, he assists with the creation and upkeep of the agency’s indexes and helps the group’s analysis initiatives throughout numerous methods. Hyun graduated from Carnegie Mellon College, with a B.S. in Enterprise Administration and an extra main in Statistics and Machine Studying.

Unique Submit

Editor’s Notice: The abstract bullets for this text had been chosen by Searching for Alpha editors.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.