Diy13

Introduction

Within the unsure occasions we’re at the moment residing in, with sky high-inflation, geopolitical tensions, coverage errors, the housing bubble, and rather more, folks search for safe-haven belongings to park their hard-earned cash. On this article, we talk about why an allocation in valuable metals could possibly be sensible in a possible recession. We’ll talk about every kind of funding alternatives within the valuable metals sector with a possible funding for every particular person investor and his or her private danger urge for food.

We’ll check out the next on this article:

Key Moments in Historical past Key Drivers For A Treasured Metals Bull Cycle 2021 Silver Squeeze and Treasured Metals Group Which Kind of Funding Suits Your Danger Profile?

Key Moments in Historical past

Let’s get this out of the way in which first. Why put money into Gold and Silver? You would possibly ask your self: “Inventory Data, valuable metals have been underperforming for such a very long time, why will this time be totally different?”

Effectively, you’re fully proper. Sure, PM’s have underperformed, however valuable metals have additionally protected traders for hundreds of years and when timed proper they may give you a major return in a comparatively brief period of time. For instance, Silver rose over 150% from backside to prime in 2020. Some silver junior miners rose over 1000% in the identical time-frame. Sure, 10x+ in 4 to five months. The historical past of valuable metals is essential to know the thesis for investing in them.

Now let’s get into the important thing moments in historical past for valuable metals.

Gold Normal Abandonment: A few of you would possibly keep in mind U.S. President Nixon’s announcement in 1971 that the U.S. greenback would not be pegged to Gold anymore. This was the top of the Gold Normal, which led to a interval of financial uncertainty and excessive inflation. (Needless to say a key mechanism of the gold normal was that the worldwide provide of gold rises comparatively sluggish, which in principle, would preserve inflation and cash creation in examine.) In consequence, the gold value rose dramatically throughout that point. That decade the gold value went up over 2200%, not dangerous for an underperforming asset, to place that into perspective, the Dow Jones Industrial Common returned lower than 10% over that point.

2008 Monetary Disaster: The worldwide monetary disaster of 2008 was a interval of financial uncertainty and elevated volatility within the inventory market. This brought on a flight in direction of protected haven belongings reminiscent of gold and silver. Whereas the inventory market plummeted, the valuable metals flourished and noticed a major enhance in value throughout that point.

Moreover, the quantitative easing insurance policies carried out by central banks everywhere in the world to stimulate the struggling economies worldwide brought on a interval of low rates of interest and free financial coverage, which additional fueled the rise of valuable metals.

The Hunt Brothers Silver Market Manipulation: The gold and silver bugs studying this text will learn about this phenomenon, however for others, it would sound much less acquainted. Within the late 70’s and early 80’s the Hunt Brothers tried to nook the silver market by shopping for up massive quantities of bodily silver.

At one level, the Hunt brothers owned as much as 200 million ounces of silver, which was round 30% of the world’s provide. This led to a major enhance in silver costs. However, the Commodity Futures Buying and selling Fee often known as the CFTC stepped in and issued rules that restricted the quantity of silver futures contract anybody investor might maintain. Ultimately, the Hunt brothers needed to promote their holdings to fulfill margin calls, this present day is often known as Silver Thursday, which brought on the silver value to plummet and took a major chunk out of their household fortune.

Key Drivers for a Treasured Metals Bull Cycle

Protected Haven Asset and Recession Fears: In occasions of financial uncertainty traders usually flip to gold and silver as safe-haven belongings. As well as, valuable metals have a confirmed observe document in durations of excessive market volatility and financial uncertainty.

A recession is a time when there’s numerous uncertainty and concern within the markets, for instance within the monetary disaster of 2008 when banks had been crumbling, folks flock into safe-haven belongings reminiscent of valuable metals to guard themselves and put away massive sums of cash into comparatively protected belongings. As well as, now we have seen banks fall as effectively this 12 months with Silvergate Capital (SI) and Signature Financial institution (OTC:SBNY).

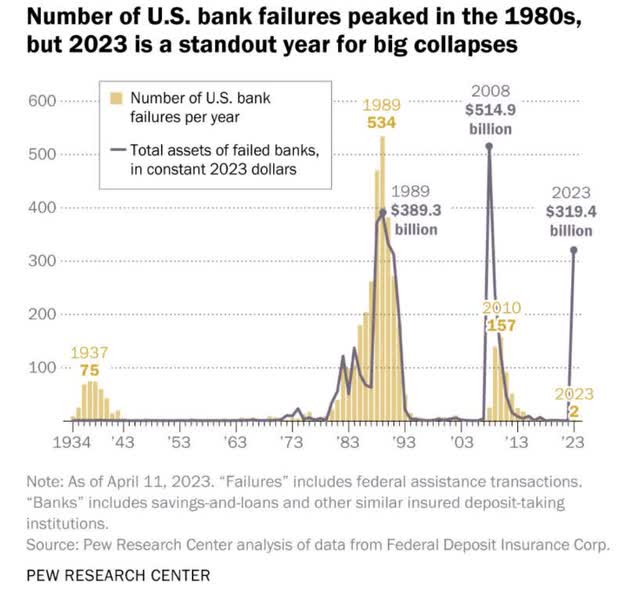

One regarding factor I wish to point out right here is that financial institution failures more often than not are available massive batches. As of now, the 2023 banking disaster had 2 failures, for a complete of $319 billion in belongings. In the meantime between 2007 and 2014 over 500 banks collapsed, with an inflation-adjusted $960 billion in belongings. Between 1980 and 1995 near 3000 banks failed with $2.2T in belongings.

We are able to now use the favored meme phrase. “This time it’s totally different,” however is it actually totally different this time? Time will inform, let’s hope we’ll defy historical past this time.

Pew Analysis Heart

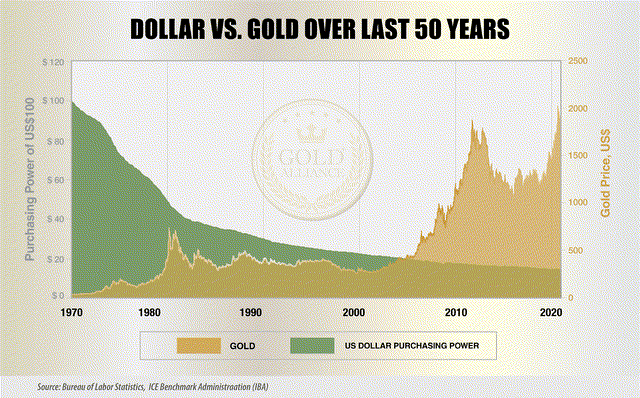

Inflation Issues: When inflation is on the rise or stays elevated for some time (as we’re seeing proper now), buying energy of currencies such because the U.S. greenback or the euro tends to lower. Much like the precept of “the flight in direction of safe-haven belongings,” traders have a tendency to hunt various shops of worth to guard their buying energy. When you find yourself studying this text you’re already forward of the curve, as most individuals have a lot of fiat currencies within the financial institution and see their buying energy lower 12 months after 12 months. The chart beneath clearly illustrates the lack of buying energy of the greenback over time.

Bureau of Labor Statistics

Moreover, traditionally there was a powerful correlation between valuable metals and inflation. The Seventies is probably the most used interval in time after we search to match durations of excessive inflation. Within the Seventies each Gold and Silver costs went up considerably as inflation soared in the USA. Immediately, we see one thing related because the gold value is near an all-time excessive and in case of a recession, it’s doubtless that the value goes a lot greater. Silver nonetheless has some catching as much as do, however we’ll talk about gold vs silver as an funding extra in-depth in one other paragraph.

Geopolitical Uncertainty: Geopolitical issues may be one other main driver for valuable metals. Once more, in unsure occasions gold and silver are seen as protected havens as they’ve a protracted historical past of retaining their worth throughout occasions of disaster. In in the present day’s world, there are numerous geopolitical issues on the market.

We’ve got a really unlucky state of affairs with the Russia-Ukrainian struggle, rising pressure between the US and China, the additional growth of BRICS, and the inner issues the West is having. For instance, the political pressure between Republicans and Democrats could be very excessive at this second in time, with allegations in opposition to Trump and turmoil throughout the political events.

Alternatively, we received protests in opposition to the federal government in France as a result of determination to extend the pension age. As well as, China has been rising its gold reserves during the last 12 months.

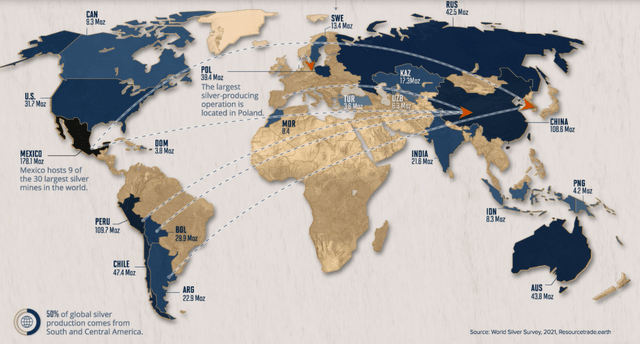

Moreover, numerous silver may be present in South America, which has seen numerous political unrest during the last many years. This might put strain on the silver provide sooner or later if conflicts would occur in these areas.

World Silver Survey

All in all, polarization on the planet is at elevated ranges with folks sad with their governments as a consequence of a lack of buying energy, the overheated housing market, and remaining cultural points reminiscent of racism and rising inequality. Whereas all this polarization and uncertainty is unhappy and we sincerely hope these issues might be solved quickly, it’s a important driver for gold and silver costs.

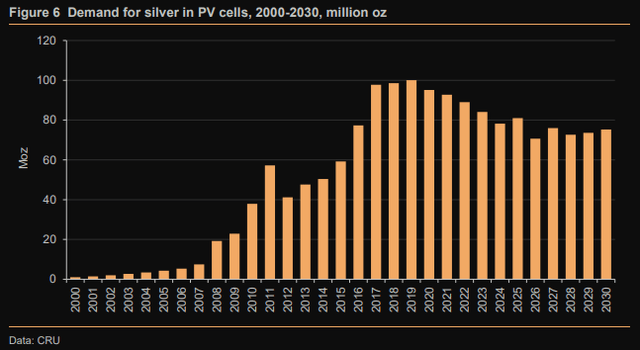

Funding Demand and Industrial Demand: Gold has restricted, very particular industrial demand, with 5% to six% of gold being utilized in electrical contacts and electrical elements. Alternatively, silver has many various industrial makes use of, reminiscent of photo voltaic panels, medical tools, and within the manufacturing of electronics. This implies silver demand just isn’t solely pushed by funding, but additionally by industrial demand. Silver is a essential element within the transition in direction of clear vitality as a result of it’s a vital materials in some key elements of renewable vitality methods.

For instance, photo voltaic panels use photovoltaic cells to transform daylight into electrical energy, and these cells include silver as a conductor that helps to transmit electrical currents. The utilization of Silver in these photovoltaic elements is predicted fluctuate between 70 to 80M ounces per 12 months between 2024 and 2030, in line with the Silver institute. Within the chart beneath, we will see the demand in PV cells in million ounces from 2000 till 2030.

Silver’s necessary function in Photo voltaic Energy (silverinstitute.org)

As well as, Silver just isn’t solely utilized in photo voltaic panels; but additionally in clear vitality applied sciences, reminiscent of batteries and electrical automobiles (EVs). Silver is a key element within the manufacturing of lithium-ion batteries, that are utilized in vitality storage methods and EVs. We count on the demand for EVs and renewable vitality will proceed to develop, as we mentioned on this article in regards to the renewable vitality sector, which makes it cheap to imagine that the demand for silver will develop alongside it.

Downfall of the U.S. Greenback: Final however not least on this paragraph we should talk about the downfall of the U.S. Greenback, as this generally is a main driver of valuable steel costs. Initially, folks would grow to be extra involved in regards to the stability of the worldwide economic system as a complete, because the U.S. Greenback is seen because the reserve forex throughout the globe. A e-book surrounding the cycles within the world economic system I might advocate everyone seems to be Ray Dalio’s Ideas for Coping with the Altering World Order.

We’ve got seen a number of totally different international locations selecting to decrease their reliance on the U.S. and its forex. For instance, Saudi Arabia is formally open to commerce oil in different currencies than the USD, this may be seen on this article from Bloomberg about Saudi Arabia’s determination to simply accept Chinese language Yuan, strengthening the Saudi-Sino relationship.

As well as, French President Emmanuel Macron overtly talked about that he believes Europe should scale back its dependency on the USA and as well as keep away from getting dragged right into a confrontation between China and the U.S. over Taiwan. This does not solely present the weak spot of Europe but additionally reveals that Europe is not that assured in regards to the U.S.’ decision-making currently.

2021 Silver Squeeze and Treasured Metals Group

You may be asking your self: “why does the neighborhood matter?” Effectively, the valuable metals neighborhood is a really educated neighborhood the place you’ll be able to study from, however there are additionally grifters who use retail traders to pump illiquid mining shares or promote small mining firms for a revenue. As we might be discussing junior mining on this article as effectively, it is very important get a brief overview of how the neighborhood is, and the way it can affect a mining inventory.

The Silver Squeeze motion has taken the valuable metals neighborhood by storm. After the brief squeezes in each GameStop Corp. (GME) and AMC Leisure Holdings, Inc. (AMC), some retail traders banded collectively on social media platforms, most notably Twitter and Reddit to drive up the value of silver. This brought on hundreds of recent traders to start out investing in valuable metals and as folks all the time chase the best returns this causes them to look into illiquid mining firms, which they heard about on the web.

The roots of this motion may be traced to frustration with the monetary system and a need to stay it to the large banks and hedge funds who’ve lengthy dominated the silver market. We will not deny that huge banks and hedge funds have a historical past of manipulating commodity costs. For instance, JPMorgan Chase (JPM) settled for a $920 million high quality again in 2020 as they admitted to market manipulation of metals futures.

The motion has most notably tapped into the deep-seated need amongst many traders to take management of their monetary futures and problem the established order. The dear metals neighborhood, that are often known as gold bugs or silver bugs are folks from all walks of life. This makes it an exquisite neighborhood, which regularly tries to assist one another by sharing firms they imagine are fraudulent and by sharing their insights on assay outcomes (that are exhausting to learn for folks simply entering into mining investing).

Sadly, there are additionally grifters as talked about above, which prey on these retail traders and sometimes use the frustration of retail merchants to achieve followers and promote dangerous investments to revenue themselves. As ultimately, it is very important keep in mind that most junior miners in the end have the purpose to promote their mine rights (or at the very least a part of it) to an intermediate or main miner, reminiscent of Barrick Gold (GOLD) or First Majestic (AG).

One of the vital outstanding figures that made cash on the again of retail traders and the Silver Squeeze motion is Jim Lewis of Wallstreet Silver. That is unlucky as Wallstreet Silver was one of many accounts that truly fueled this motion. This malpractice is defined very effectively on this thread by @TheHappyHawaiian on Twitter. I might advise everybody that follows Wallstreet Silver on Twitter to provide this a fast learn.

We all know this would possibly make you cautious earlier than following folks, however there are undoubtedly some good accounts to observe relating to valuable metals as effectively. We’ll title a couple of who we think about fascinating and can shortly talk about why.

Initially, fellow Searching for Alpha contributor Lyn Alden Schwartzer. Lyn is a fully sensible thoughts, with an incredible understanding of macro evaluation. This makes her a superb contributor to observe as gold and silver are extremely influenced by macroeconomic components. As well as, Michael Maloney is an fascinating on to observe, he’s a legend within the valuable metals neighborhood.

Secondly, Gold Ventures. GV is an fascinating account to observe relating to concepts on junior mining firms. Remember to all the time do your individual DD, and keep in mind to by no means use articles or tweets as funding recommendation. Moreover, we received StigvdA, he’s extremely targeted on commodity investing and owns a really concentrated portfolio of mining firms, which he considers “deep worth.” As he owns such a concentrated portfolio, he stays up to date on all the pieces relating to his positions.

Final however not least, now we have Junior Mining Community, an incredible account to observe to remain updated on all of your favourite junior miners.

Which Kind of Funding Suits Your Danger Profile?

Now let’s check out the alternative ways you’ll be able to put money into valuable metals.

Bodily Bullion

One option to put money into Gold and Silver is by shopping for bodily bars or cash. However, as a few of you may be conscious, there’s a important premium in comparison with the paper value for gold and silver cash. For instance, let’s check out one of many typical funding cash, the one-ounce Silver Maple Leaf. That is from jmbullion.com.

In the intervening time of writing the paper silver value is sitting at $25 per ounce. As you’ll be able to see within the image beneath, these cash are going for $35, which suggests a premium of $10 per coin, or a premium of 40%. This is not a uncommon prevalence, by the way in which, this value distinction may be seen on numerous totally different funding cash.

Silver 1 Ounce Cash (Jmbullion)

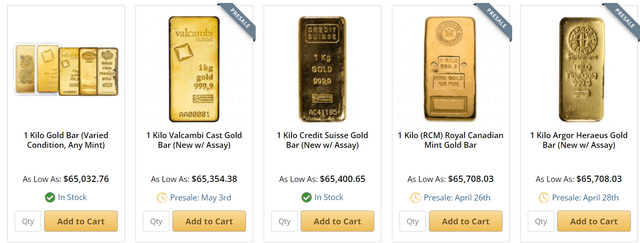

However, for the large traders, it may be higher to purchase bars or gold cash. Sadly, there’s nonetheless a premium on these as effectively, though it’s fairly a bit decrease in comparison with these silver cash. In comparison with the massive distinction between the paper value and the precise value per ounce of silver, bodily gold usually trades at a a lot smaller premium, round 1% or much less. Sadly, shopping for bullion may be fairly costly. If you want to purchase 1 kilogram of gold, this is able to value you a minimal of $65,000, as may be seen within the image beneath.

1 kg Gold Bars (Jmbullion)

We perceive bodily bullion is not for everybody as it may be fairly costly and necessitates discovering a safe option to retailer it. Some folks would retailer it at house, which is ok, however you would want to purchase a protected and even then there’s clearly nonetheless a danger that it will get stolen.

Alternatively, storing it at a financial institution or one other licensed depository will value you a small payment. Even with the problems that storing gold entails, one has to confess it has one thing magical to it. So whereas bodily bullion may not be for everybody, we imagine it definitely has its place and it’s a good option to diversify your wealth throughout a number of totally different belongings, with out having all of your investments in brokerage accounts.

ETFs

For individuals who do not like the trouble of bodily bullion, you may be extra enthusiastic about shopping for some ETF’s. First, we’ll talk about probably the most well-known gold ETF, the SPDR Gold Belief (GLD). GLD might be probably the most well-known valuable metals ETF. GLD might be the most secure means (other than bodily bullion) to put money into gold. Compared to junior miners, this ETF could be very liquid, so you will not have any liquidity points when shopping for or promoting. Moreover, it’s doable to purchase derivatives on GLD, which may be fascinating for some readers with some extra danger urge for food.

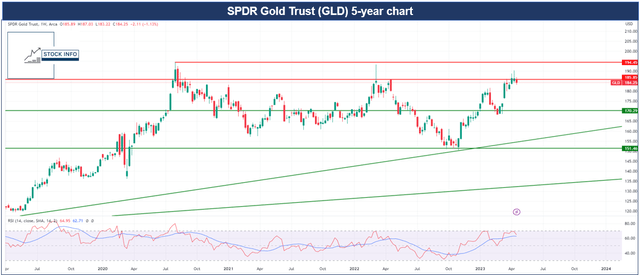

As may be seen within the chart beneath, GLD is at the moment combating an necessary resistance zone. The all-time excessive stays at $194, which was the excessive of August 2020. Nonetheless, one must understand that an funding in gold needs to be seen as a means of diversification and never essentially to get the largest returns. Nonetheless, a break above the ATH might give some very bullish value motion within the the rest of 2023 and 2024.

Inventory Data with Tradingview

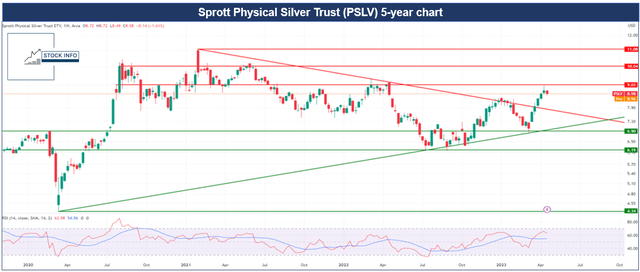

When looking at Silver, most individuals take into consideration the iShares Silver Belief (SLV), however as many silver traders know, the Sprott Bodily Silver Belief (PSLV) is definitely a greater possibility regardless of the upper expense. As a result of the silver market is extra simply manipulated by hedge funds or huge banks SLV is not the most effective funding as they are not absolutely backed by unencumbered bodily silver. For gold, there’s additionally the Sprott Bodily Gold Belief (PHYS), which is an fascinating alternative, however much less crucial as gold just isn’t as simply manipulated as silver. Nonetheless, you’re extra sure your gold is definitely secured when investing in PHYS.

That is the place PSLV is available in, so why PSLV it’s possible you’ll ask? PSLV is backed solely by unencumbered, absolutely allotted bodily silver. Because of this for each PSLV that will get purchased, they purchase an equal quantity of bodily silver, which is saved on the Royal Canadian Mint, and has just one claimant: Sprott.

In distinction to PSLV, SLV’s custodian is JPMorgan (JPM), Not like PSLV, the custody settlement SLV has with JPM permits for the holding of unallocated silver, which suggests SLV is means simpler to govern. As well as, PSLV would not have derivatives accessible, in the meantime, SLV does have derivatives accessible.

Within the chart beneath, you’ll be able to see that PSLV nonetheless has numerous room left earlier than reaching its all-time excessive once more. Whereas it has damaged out of its 2-year downtrend a few weeks in the past, we will count on some consolidation in Silver costs proper now, earlier than anticipating it to maneuver up greater.

Inventory Data with Tradingview

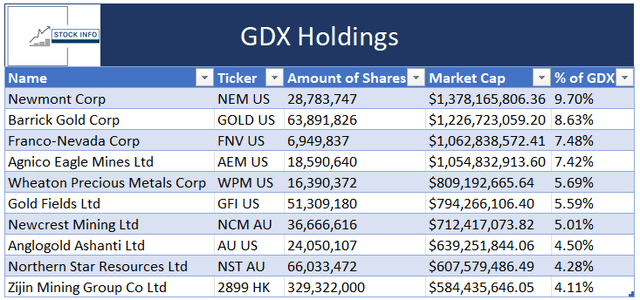

Along with each gold and silver ETFs, we have additionally received some miner ETFs, that are value taking a look at. We’ve got the VanEck Gold Miners ETF (GDX). The GDX is a basket of a number of the largest gold miners on the planet. Within the desk beneath, you’ll be able to see the ten largest holdings of GDX, which embrace Newmont (NEM), Barrick Gold (GOLD), and Agnico Eagle Mines (AEM), to call a couple of. This desk is with the most recent information (18th of April 2023), with the ten largest positions accounting for 58.54% of the whole holdings.

Inventory Data with VanEck

Investing in gold miners is a extra aggressive means of investing in gold, as these firms’ income should not solely depending on gold costs however on many different variables inherent to mining, reminiscent of vitality costs. Whereas GDX rose over 180% from backside to prime in 2020-2021, gold rose round 43%. We might argue that GDX, thus acts as a leveraged gold place so to talk. Nonetheless, it’s essential to maintain all of the totally different variables in thoughts and never solely the gold value when investing in GDX.

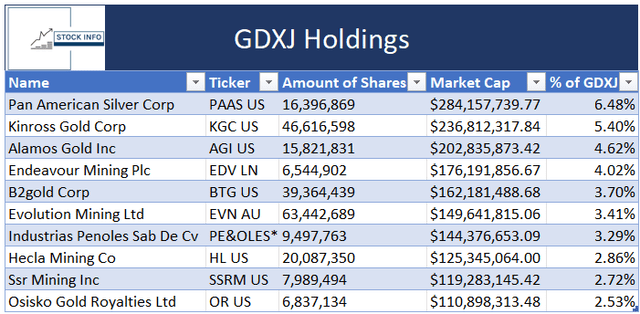

Along with the GDX, VanEck additionally has the VanEck Junior Gold Miners ETF (GDXJ). Compared to the GDX, the GDXJ is invested in smaller miners. These positions embrace Pan American Silver (PAAS), Kinross Gold (KGC), and Endeavour Mining plc (OTCQX:EDVMF), to call a couple of.

The desk beneath reveals the ten largest positions of the GDXJ as of the thirteenth of April 2023. The highest 10 holdings of the GDXJ make up a complete of 35.66M of the fund’s internet belongings.

Inventory Data with VanEck

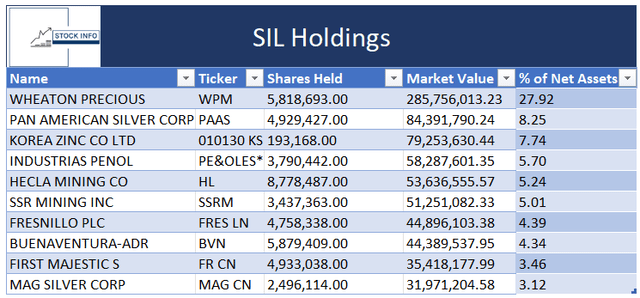

Much like Gold, Silver additionally has ETFs for each the most important miners and small miners. First, allow us to talk about the International X Silver Miners ETF (SIL) by International X. The ten largest positions of the SIL embrace Wheaton Treasured Metals (WPM), Pan American Silver (PAAS), First Majestic Silver (AG), and Polymetal Worldwide plc (OTCPK:POYYF), to call a couple of.

As of the twenty first of April 2023, these prime 10 positions make up near 75% of the ETF. Lets say that this ETF is pretty concentrated in direction of its 10 largest holdings.

Inventory Data with International X

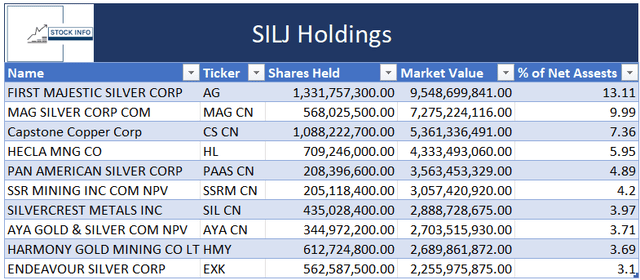

The ETFMG Prime Junior Silver Miners ETF (SILJ) might be probably the most leveraged one can go together with publicity to valuable metals by means of ETFs. As of the twenty first, the highest 10 holdings make up a complete of 58.10% A few of these prime holdings embrace Magazine Silver Corp. (MAG), Capstone Copper (OTCPK:CSCCF), Hecla Mining (HL), and Fortuna Silver Mines (FSM), to call a couple of.

It is very important word that after an organization will get added or dropped off the SILJ it will possibly have an enormous impact on the underlying. Some smaller mining firms are fairly illiquid, which may trigger an addition or drop to trigger an enormous surge or fall in value. These can create big alternatives for speculators, betting on an addition to the index.

Inventory Data with ETFMG

To conclude this half on the totally different ETFs, it is very important word that specifically these ETFs for smaller miners definitely aren’t for everybody, however, we imagine it is very important talk about these alternatives as for some traders with some danger urge for food these are nice alternatives.

Nonetheless, most firms throughout the SILJ listing are of respectable high quality, these aren’t small explorers, which we’ll talk about beneath, however greater producers, reminiscent of Hecla (HL) or First Majestic.

Mining Shares

Above we mentioned a couple of totally different ETFs, however one can also decide to purchase particular person firms. You might purchase a mixture of smaller and larger miners. For instance AG, GOLD, and WPM. This is able to set you up with some huge valuable metals firms. For the folks with some extra danger urge for food, you can begin trying into some actually small firms, however to start with, there are a couple of totally different lessons of junior miners, which is necessary to know earlier than investing.

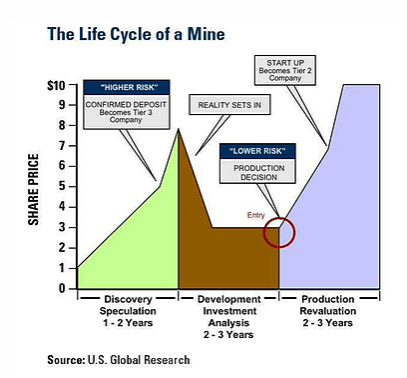

A junior mining story usually begins on the exploration stage, however the street to changing into a significant, often known as a production-stage firm is kind of a protracted street. If you’ll be able to determine an explorer, which makes it to a significant you’ll have an funding, which might be a 10-bagger or perhaps a 100-bagger. Nonetheless, there are numerous bumps alongside the way in which, which may hinder this journey, or a buy-out alongside the way in which occurs fairly often as effectively.

The three levels we’ll talk about on this paragraph are:

Exploration Stage Growth Stage Manufacturing Stage

U.S. International Analysis

Exploration Stage: The exploration stage may be thought of to be solely speculative. The success depends solely on making a brand new mineral discovery by means of drill applications. A wonderful drill assay could make a junior’s share value soar. Equally, dangerous exploration outcomes could cause important downward strain.

As well as, exploration-stage miners are sometimes in steady want of money, as drilling and shopping for grounds may be fairly costly, and in the intervening time, these miners aren’t making any income. When the corporate achieves sufficient leads to one array, the corporate turns into a Tier 3 firm.

Growth Stage: The event stage may be labeled into 2 separate levels. The primary class is the “post-discovery”. Firms on this stage have made a discovery, however aren’t fairly certain how massive the deposit is. On this stage, the inventory value often goes down, as now one has to attend till the corporate produces a useful resource estimate, to see how huge the useful resource is. If they’re profitable at this, the following step is discovering out if the valuable metals may be mined economically, as a result of, it’s one factor to discover a huge useful resource, but when it is just economical at $2000 gold or $30 silver, it makes it lots more durable to grow to be a profitable main ultimately.

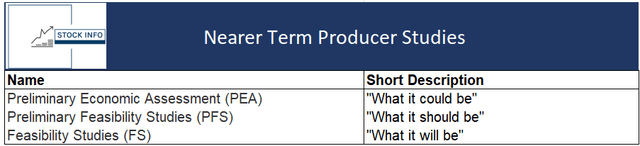

If the useful resource may be mined economically, the corporate turns into a “near-term producer” or most likely higher labeled as nearer-term, as an organization on this stage nonetheless has numerous hurdles to beat. When an organization is on this stage there are three financial research the corporate has to undergo, every with an rising degree of confidence relating to the useful resource estimates and the economics of the challenge. Within the desk beneath, I made a fast overview of every one of many 3 levels.

Inventory Data

The PEA examines a number of totally different mining eventualities and financial parameters. Afterward, the PFS follows. The PFS is extra detailed than the PEA and is generally used to find out whether or not or to not proceed with an much more detailed feasibility examine. This examine is considerably of a actuality examine for many firms, because it usually reveals sure flaws and areas which should be improved.

Final however not least, now we have the FS, which is the ultimate determination relating to whether or not or to not proceed with the challenge. This offers funds figures, reveals a transparent AISC (All-in sustaining prices), usually proven because the greenback value per ounce mined.

Firms on this stage clearly have much less danger than firms within the exploration stage. Nonetheless, most firms might be caught on this stage and will not be capable of transfer ahead on their very own. On this stage, the miner usually will get purchased out by a significant firm, as it is rather costly to open a mine, which would come with a big elevate of capital to do it on their very own. Nonetheless, if you’re an investor and journey an organization from the exploration stage till the buy-out, you’ll have made an distinctive return.

Sadly, numerous firms will fail on this stage as effectively, otherwise you get diluted into oblivion as an investor. For instance, Aurcana Silver (AUN:CA) was some of the promising firms again in 2020, with nice prospects, however sadly dangerous administration and steady dilution brought on the corporate to fail.

Manufacturing Stage: Congratulations, your junior made it into manufacturing stage. Not many juniors are capable of accomplish this. Many of the firms inside this stage are firms with operations everywhere in the world and offering regular money flows (that is debatable although). A significant mining firm may be valued in the same means as a big oil firm, with profitability metrics, however with a mining twist to them.

To conclude this paragraph, it is very important repeatedly observe up in your junior mining investments, as one dangerous assay can change the entire story and go away you with an enormous loss in your preliminary funding, which could not get well in any respect. Moreover, there’s numerous dilution danger, which one has to have in mind as administration doesn’t all the time have the shareholders’ greatest curiosity in thoughts.

Conclusion

To conclude this text, I hope you realized one thing extra about gold and silver and junior mining as a complete. We mentioned numerous alternative ways to put money into gold and silver and hope you discovered one thing helpful on your personal private type of investing.

We imagine gold and specifically silver, have some catching as much as do, however are at the moment a purchase. We imagine that valuable metals are an effective way to diversify your portfolio or to even profit from a possible recession within the subsequent few years.

Editor’s Word: This text was submitted as a part of Searching for Alpha’s Greatest Funding Thought For A Potential Recession competitors, which runs by means of April 28. This competitors is open to all customers and contributors; click on right here to seek out out extra and submit your article in the present day!

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.