Up to date on April 14th, 2023 by Bob Ciura

Revenue traders are all the time on the hunt for high-quality dividend shares. There are numerous methods to measure high-quality shares. A method for traders to seek out nice dividend shares is to deal with these with the longest histories of elevating dividends.

With this in thoughts, we created a downloadable listing of all 150 Dividend Champions.

You possibly can obtain your free copy of the Dividend Champions listing, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink beneath:

Buyers are possible accustomed to the Dividend Aristocrats, a bunch of 65 shares within the S&P 500 Index with 25+ consecutive years of dividend will increase. In the meantime, traders must also familiarize themselves with the Dividend Champions, which have additionally raised their dividends for at the least 25 years in a row.

Whereas their size of dividend will increase is identical, resulting in some overlap, there are additionally some vital variations between the Dividend Aristocrats and Dividend Champions. Because of this, the Dividend Champions listing is rather more expansive. There are numerous high-quality Dividend Champions that aren’t included on the Dividend Aristocrats listing.

This text will focus on massive cap shares, and an evaluation of our high 7 Dividend Champions, ranked in accordance with anticipated complete returns within the Positive Evaluation Analysis Database.

Desk of Contents

You possibly can immediately leap to any particular part of the article by clicking on the hyperlinks beneath:

Overview of Dividend Champions

The requirement to change into a Dividend Champion is easy: 25+ years of consecutive annual dividend will increase. The Dividend Aristocrats have the identical requirement with regards to variety of years, however with just a few extra necessities.

To be a Dividend Aristocrat, an organization should even be included within the S&P 500 Index, should have a float-adjusted market cap of at the least $3 billion, and should have a mean day by day worth traded of at the least $5 million. These added necessities preclude many corporations that possess a adequate observe document of annual dividend will increase, however don’t qualify primarily based on market cap or liquidity causes.

Because of this, whereas there may be some overlap between the Dividend Aristocrats and the Dividend Champions, there are additionally many Dividend Champions that aren’t Dividend Aristocrats. Revenue traders would possibly need to take into account these shares on account of their spectacular histories of annual dividend will increase, so now we have compiled them within the downloadable spreadsheet above.

As well as, now we have ranked the highest 7 Dividend Champions in accordance with complete anticipated annual returns over the subsequent 5 years. Our high 7 Dividend Champions proper now are ranked beneath.

The Prime 7 Dividend Champions To Purchase Proper Now

The next 7 shares symbolize Dividend Champions with at the least 25 consecutive years of dividend will increase, however additionally they have sturdy aggressive benefits, long-term development potential, and excessive anticipated complete returns.

Shares have been ranked by anticipated complete annual return over the subsequent 5 years, from lowest to highest.

Prime Dividend Champion #7: Arrow Monetary (AROW)

5-year anticipated returns: 16.7%

Arrow Monetary Company is a multi-bank holding firm. The corporate operates by means of two predominant subsidiary banks, the Glens Falls Nationwide Financial institution and Belief Firm, and the Saratoga Nationwide Financial institution and Belief Firm. Arrow Monetary Company can be the father or mother firm of North Nation Funding Advisers and Replace Company, an insurance coverage company. The corporate produces simply over $150 million in annual income. Arrow Monetary has elevated its dividend for 27 consecutive years.

Arrow reported fourth quarter and full-year earnings on January thirtieth, 2023, and outcomes have been fairly weak, lacking estimates on each the highest and backside strains. Earnings-per-share got here to 73 cents, however that missed estimates by seven cents. Income was $37.7 million, up 8.5% year-over-year, however lacking expectations by $1.3 million.

Web revenue for the 12 months was $48.8 million, a decline of $1.1 million, or simply over 2%, in comparison with 2021. Earnings-per-share rose in This fall from 62 cents to 73 cents year-over-year. Web curiosity margin for the 12 months was 3.03%. Complete belongings have been practically $4 billion on the finish of 2022. Complete loans have been $2.98 billion, and complete deposits have been $3.5 billion.

That places the financial institution’s loan-to-deposit ratio among the many highest in our protection universe, as that leaves Arrow with little room for mortgage development. Ebook worth ended the 12 months at $21.36 per share, down about 5% year-over-year, which was the results of unrealized losses within the financial institution’s available-for-sale portfolio, which in flip was pushed by larger rates of interest.

Click on right here to obtain our most up-to-date Positive Evaluation report on AROW (preview of web page 1 of three proven beneath):

Prime Dividend Champion #6: First of Lengthy Island Corp. (FLIC)

5-year anticipated returns: 17.4%

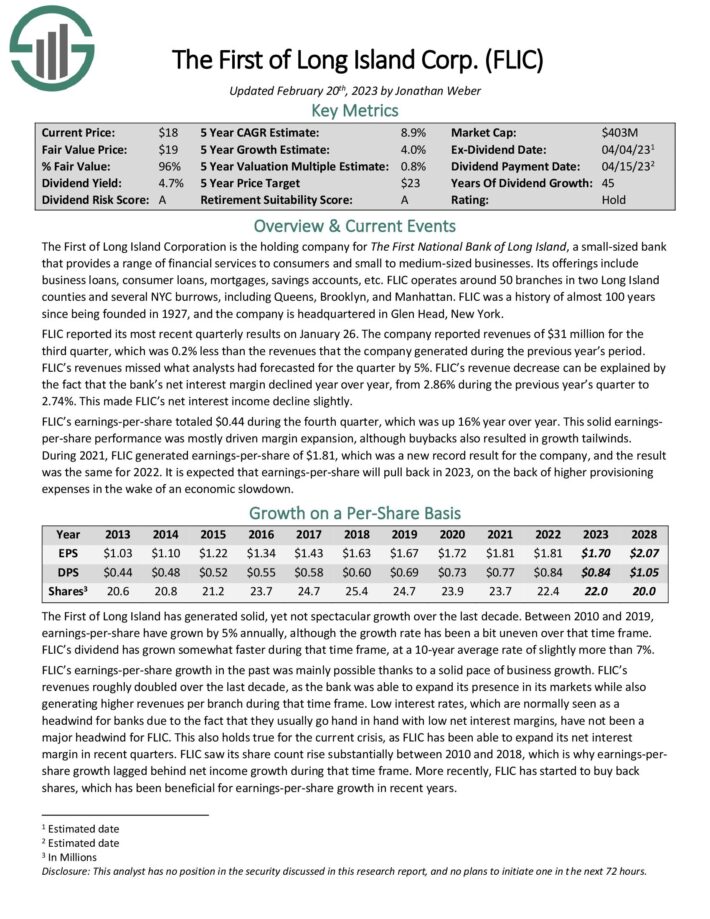

The First of Lengthy Island Company is the holding firm for The First Nationwide Financial institution of Lengthy Island, a small-sized financial institution that gives a variety of monetary companies to customers and small to medium-sized companies. Its choices embrace enterprise loans, client loans, mortgages, financial savings accounts, and so forth.

FLIC operates round 50 branches in two Lengthy Island counties and several other NYC burrows, together with Queens, Brooklyn, and Manhattan. FLIC has a historical past of virtually 100 years, because it was based in 1927, and the corporate is headquartered in Glen Head, New York.

Because of its disciplined and conservative administration, FLIC has exhibited an admirable efficiency document. The corporate has persistently grown its earnings per share each single 12 months over the past 9 years.

Supply: Investor Presentation

Because of its constant earnings development document, FLIC has raised its dividend for 45 consecutive years. That is undoubtedly a powerful dividend development streak.

Furthermore, the inventory is at present providing a virtually 10-year excessive dividend yield of 6.6%, with a stable payout ratio of 49%. Given the sturdy enterprise mannequin of the corporate, its dividend is secure.

Click on right here to obtain our most up-to-date Positive Evaluation report on First of Lengthy Island Company (preview of web page 1 of three proven beneath):

Prime Dividend Champion #5: Carlisle Firms (CSL)

5-year anticipated returns: 17.6%

Carlisle Firms is a diversified firm that’s energetic in a big selection of area of interest markets. The segments by which the corporate produces and sells merchandise embrace building supplies (roofing, waterproofing, and so forth.), interconnecting applied sciences (wires, cables, and so forth.), fluid applied sciences, and brake & friction.

Supply: Investor Presentation

Carlisle Firms reported its fourth quarter earnings outcomes on February 7. The corporate reported revenues of $1.45 billion for the quarter, which was up 4% in comparison with the revenues that Carlisle Firms generated throughout the earlier 12 months’s quarter. Carlisle’s revenues have been larger than the analyst consensus estimate. Carlisle’s income efficiency was weaker than throughout the earlier quarter, when the year-over-year development fee totaled greater than 30%. The comparability to the fourth quarter of 2021 was harder than throughout the earlier quarter, nevertheless.

Carlisle Firms generated earnings-per-share of $3.92 throughout the fourth quarter, beating the consensus analyst estimate by $0.29. Carlisle Firms’ earnings-per-share have been up 34% from the earlier 12 months’s degree, due to larger margins and the upper revenues the corporate generated throughout the quarter.

Carlisle’s cost-saving measures that have been began throughout 2020 have been liable for a few of the margin enchancment, and share repurchases additionally had a constructive affect on the corporate’s earnings-per-share development fee throughout the interval. It’s anticipated that profitability will enhance barely this 12 months versus 2022.

Click on right here to obtain our most up-to-date Positive Evaluation report on Carlisle (preview of web page 1 of three proven beneath):

Prime Dividend Champion #4: Financial institution OZK (OZK)

5-year anticipated returns: 17.8%

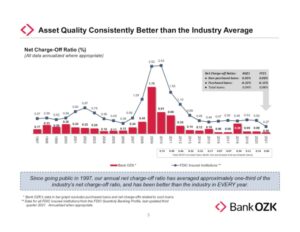

Financial institution OZK, beforehand Financial institution of the Ozarks, is a regional financial institution that gives companies resembling checking, enterprise banking, business loans and mortgages to its prospects in Arkansas, Florida, North Carolina, Texas, Alabama, South Carolina, New York and California. Financial institution OZK is the most important financial institution in its house state of Arkansas.

The important thing aggressive benefit of Financial institution OZK is its exemplary administration. The corporate has proved exceptionally resilient to recessions due to its rock-solid enterprise execution, which leads to superior asset high quality.

Supply: Investor Presentation

Because of its excessive asset high quality and robust enterprise execution, Financial institution OZK has raised its dividend for 27 consecutive years. When most banks incurred extreme losses and lower their dividends within the Nice Recession, Financial institution OZK continued elevating its dividend. Notably, the financial institution has raised its dividend in each single quarter since 2010. It’s also providing a 3.6% dividend, with an exceptionally low payout ratio of 25%. Subsequently, the financial institution is more likely to hold elevating its dividend for a lot of extra years.

Financial institution OZK had grown its earnings per share in nearly yearly because the monetary disaster. Over the last decade, the corporate has grown its common earnings per share by 16% per 12 months. Financial institution OZK has not solely been rising organically, nevertheless it has repeatedly carried out high-return acquisitions. Nonetheless, because of the excessive comparability base shaped by its all-time excessive anticipated earnings per share of $5.40 this 12 months, we anticipate simply 3.0% development of earnings per share going ahead.

Primarily based on anticipated earnings per share of $5.40 this 12 months, Financial institution OZK is buying and selling at a ahead price-to-earnings ratio of seven.0, which is far decrease than a typical earnings a number of of 11.0 for a financial institution. If the inventory trades at its honest valuation degree in 5 years, it can get pleasure from a 9.3% annualized achieve in its returns. Given additionally the three.6% dividend of the inventory and three.0% development of earnings per share, Financial institution OZK can supply a 15.2% common annual complete return over the subsequent 5 years.

Click on right here to obtain our most up-to-date Positive Evaluation report on Financial institution OZK (OZK) (preview of web page 1 of three proven beneath):

Prime Dividend Champion #3: Norwood Monetary (NWFL)

5-year anticipated returns: 17.9%

Norwood Monetary is a financial institution holding firm that operates by means of its subsidiary, Wayne Financial institution. The corporate is an impartial neighborhood financial institution with over 14 places of work in Northeastern Pennsylvania and roughly 16 places of work in Delaware, Sullivan, Ontario, Otsego and Yates Counties, New York. It provides a variety of private and enterprise credit score companies, belief and funding merchandise, and actual property settlement companies to the customers, companies, nonprofit organizations and municipalities in every of the communities that the corporate serves.

As of December 31, 2022, Norwood Monetary had complete belongings of $2.05 billion, loans excellent of $1.47billion, complete deposits have been $1.73 billion and complete capital of $167.1 million.

On January twenty seventh, 2023, Norwood Monetary Corp. launched its fourth quarter 2022 outcomes for the interval ending December thirty first, 2022. For the quarter, the corporate reported web revenue of $7.1 million which represents a 7.6% improve in comparison with $6.6 million earned in the identical interval of 2021. Reported earnings per diluted share for a similar intervals have been $0.88 and $0.81, a rise of 8.6%.

The rise in web revenue was due primarily to a $736,000 improve in web curiosity revenue. The complete 12 months 2022 outcomes replicate an rising web curiosity spreads on account of rising rates of interest, the next degree of curiosity incomes belongings, and decreased mortgage loss provisions associated to improved credit score high quality metrics.

For the 12 months ended December 31, 2022, web revenue totaled $29,233,000, a rise of $4,318,000 from web revenue of $24,915,000 earned in 12 months 2021. The rise features a $3,084,000 improve in web curiosity revenue and a $3,300,000 discount within the provision for mortgage losses. For the 12 months ended December 31, 2022, earnings per share on a completely diluted foundation have been $3.58, in comparison with $3.04 for the 12 months 2021.

Click on right here to obtain our most up-to-date Positive Evaluation report on NWFL (preview of web page 1 of three proven beneath):

Prime Dividend Champion #2: Westamerica Bancorp (WABC)

5-year anticipated returns: 22.8%

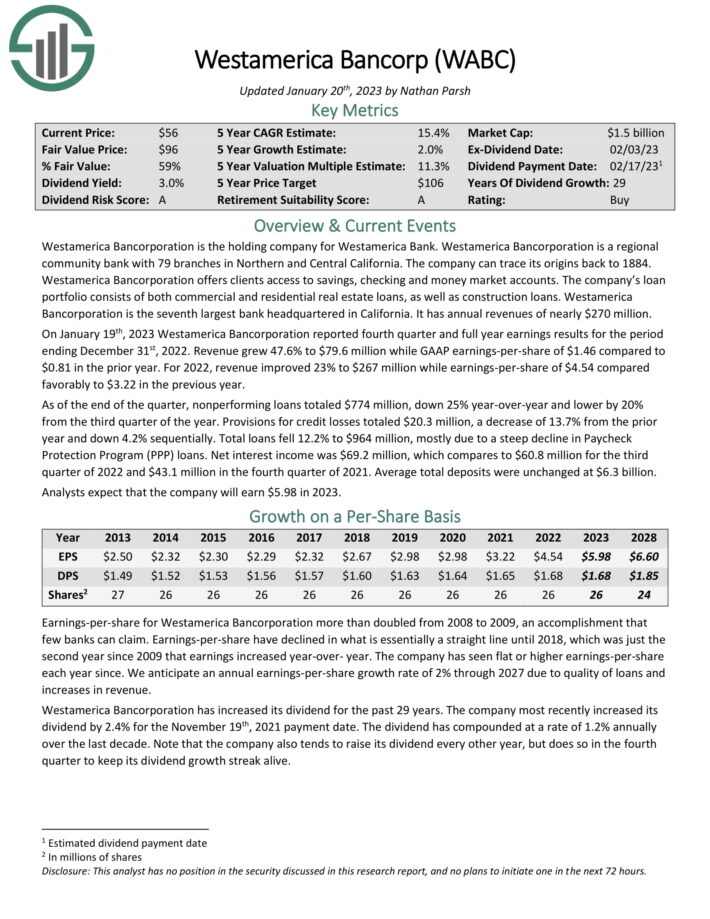

Westamerica Bancorporation is the holding firm for Westamerica Financial institution. Westamerica is a regional neighborhood financial institution with 79 branches in Northern and Central California. The corporate can hint its origins again to 1884. Westamerica provides purchasers entry to financial savings, checking and cash market accounts.

The corporate’s mortgage portfolio consists of each business and residential actual property loans, in addition to building loans. Westamerica is the seventh largest financial institution headquartered in California. It has annual revenues of practically $270 million.

On January nineteenth, 2023 Westamerica reported fourth quarter and full 12 months earnings outcomes. Income grew 47.6% to $79.6 million whereas GAAP earnings-per-share of $1.46 in comparison with $0.81 within the prior 12 months. For 2022, income improved 23% to $267 million whereas earnings-per-share of $4.54 in contrast favorably to $3.22 within the earlier 12 months.

As of the tip of the quarter, nonperforming loans totaled $774 million, down 25% year-over-year and decrease by 20% from the third quarter of the 12 months. Provisions for credit score losses totaled $20.3 million, a lower of 13.7% from the prior 12 months and down 4.2% sequentially. Complete loans fell 12.2% to $964 million, principally on account of a steep decline in Paycheck Safety Program (PPP) loans.

Web curiosity revenue was $69.2 million, which compares to $60.8 million for the third quarter of 2022 and $43.1 million within the fourth quarter of 2021. Common complete deposits have been unchanged at $6.3 billion. Analysts anticipate that the corporate will earn $5.98 in 2023.

The corporate has a protracted historical past of paying dividends and has elevated its payout for 29 consecutive years. Shares at present yield 3%. We anticipate 2% annual EPS development, whereas the inventory additionally seems to be considerably undervalued. Complete returns are estimated at 15.2% per 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on WABC (preview of web page 1 of three proven beneath):

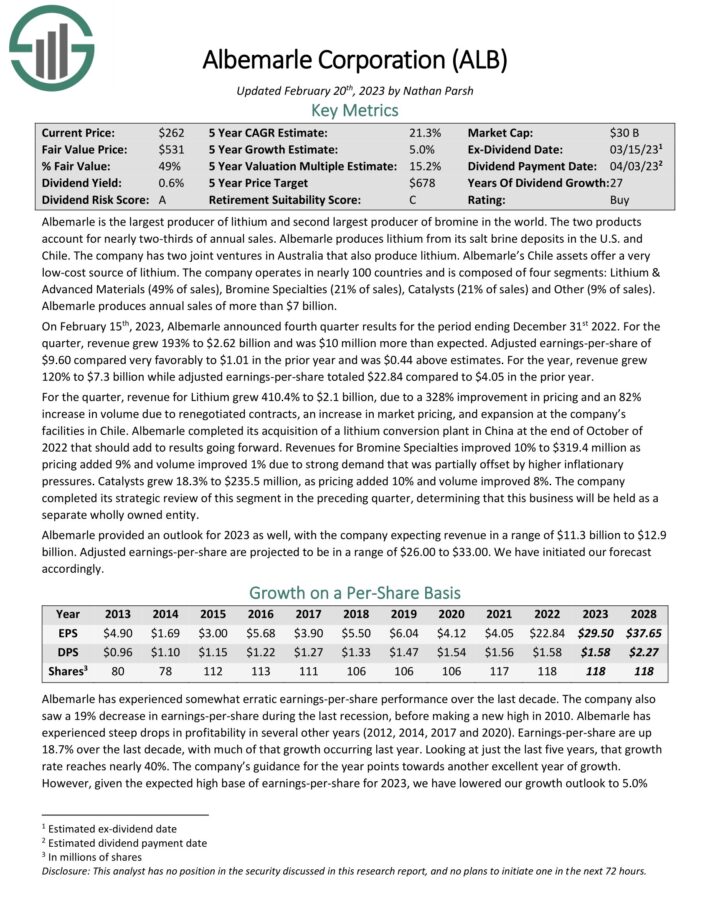

Prime Dividend Champion #1: Albemarle Company (ALB)

5-year anticipated returns: 27.6%

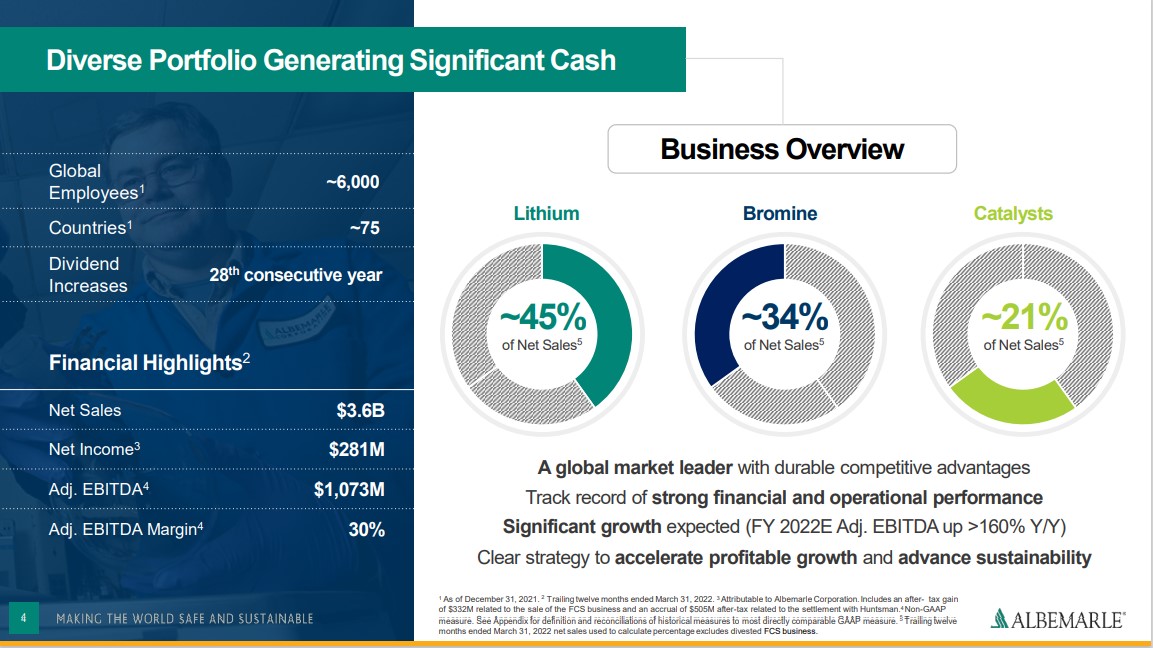

Albemarle is the most important producer of lithium and second largest producer of bromine on this planet. The 2 merchandise account for practically two-thirds of annual gross sales. Albemarle produces lithium from its salt brine deposits within the U.S. and Chile. The corporate has two joint ventures in Australia that additionally produce lithium. Albemarle’s Chile belongings supply a really low-cost supply of lithium.

Associated: 2023 Lithium Shares Listing

The corporate operates in practically 100 international locations and consists of 4 segments: Lithium & Superior Supplies (49% of gross sales), Bromine Specialties (21% of gross sales), Catalysts (21% of gross sales) and Different (9% of gross sales). Albemarle produces annual gross sales of greater than $7.5 billion.

Supply: Investor Presentation

Albemarle produces annual gross sales of $7.3 billion. It is without doubt one of the high lithium shares.

On February fifteenth, 2023, Albemarle introduced fourth quarter outcomes for the interval ending December thirty first 2022. For the quarter, income grew 193% to $2.62 billion and was $10 million greater than anticipated. Adjusted earnings-per-share of $9.60 in contrast very favorably to $1.01 within the prior 12 months and was $0.44 above estimates.

For the 12 months, income grew 120% to $7.3 billion whereas adjusted earnings-per-share totaled $22.84 in comparison with $4.05 within the prior 12 months. For the quarter, income for Lithium grew 410.4% to $2.1 billion, on account of a 328% enchancment in pricing and an 82% improve in quantity on account of renegotiated contracts, a rise in market pricing, and enlargement on the firm’s amenities in Chile.

Albemarle accomplished its acquisition of a lithium conversion plant in China on the finish of October of 2022 that ought to add to outcomes going ahead.

Click on right here to obtain our most up-to-date Positive Evaluation report on Albemarle (preview of web page 1 of three proven beneath):

Last Ideas

The varied lists of shares by size of dividend historical past are a superb useful resource for traders who deal with high-quality dividend shares.

To ensure that an organization to lift its dividend for at the least 25 years, it should have sturdy aggressive benefits, extremely worthwhile companies, and management positions of their respective industries.

In addition they have long-term development potential and the flexibility to navigate recessions whereas persevering with to lift their dividends.

The highest 7 Dividend Champions introduced on this article have lengthy histories of dividend development, and the mixture of excessive dividend yields, low valuations, and future earnings development potential make them enticing buys proper now.

The Dividend Champions listing just isn’t the one method to shortly display screen for shares that often pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].