Marlon Trottmann

Flight To High quality

The good inventory market “tech wreck” of 2022 modified the playbook for a lot of buyers. Within the zero-interest charge surroundings of yesteryear, when funding was plentiful and low-cost, it appeared that anyone with an concept might launch an organization, take that firm public, and watch themselves develop rich (whether or not their firm made any cash or not was typically inappropriate).

Oh, how issues have modified. In 2023, the dominant theme for buyers appears to be a flight again to fundamentals with regards to fairness investing. Lengthy gone are the times of the high-flying, money-losing enterprise–today, buyers need to know that the businesses they spend money on are secure, regular, and earn a living.

To that finish, right this moment we are going to cowl a inventory with a powerful monitor document of delivering worth and executing on its plans with ruthless effectivity: Oracle Company (NYSE:ORCL).

Overview

Based in 1977 by Larry Ellison (who nonetheless retains fairly a big stake within the firm), Oracle Company is a behemoth within the enterprise software program world. It operates in three segments, with the lion’s share of income coming by way of the corporate’s Cloud & License enterprise unit, adopted by Providers, and {Hardware}.

The Cloud & License unit delivers companies to buyer by way of the cloud and thru on-premise deployment. Providers come largely within the type of buyer help and consultations to assist clients get probably the most out of their Oracle platforms, whereas {Hardware} consists largely of servers and data-storage. (It is a high-level overview, after all. Every enterprise unit is kind of a bit extra advanced than what’s described right here.)

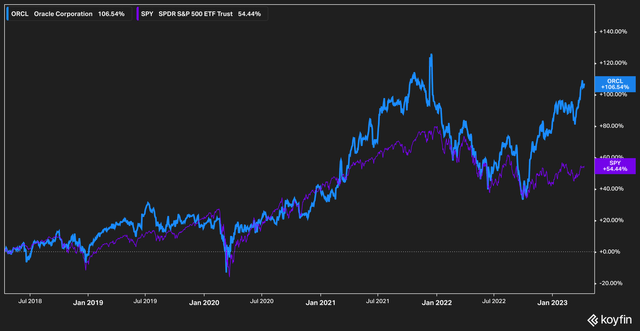

With a beta of precisely 1, Oracle’s inventory just about strikes with the broader market. Nonetheless, over the previous few months, this appears to have modified.

Koyfin

After a short run-up and value decline in late 2021, Oracle inventory has as soon as once more pulled away from the S&P 500 (SP500) during the last 4 months. The large query for buyers, and people seeking to provoke an funding, is why has this firm damaged away from its historic relationship with the broader index, and is it one thing that will proceed?

Expectations

We imagine a purpose for this pulling away from the market has lots to do with Oracle’s earnings prospects within the close to time period. Throughout the S&P 500, firms have seen their income and revenue estimates slashed.

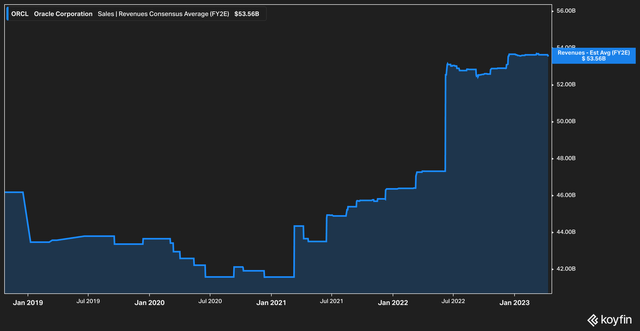

Oracle, in the meantime, has seen its common analyst estimates for income stay slightly regular.

Koyfin

Within the above chart you possibly can see that common analyst income estimates for FY 2024 have solely steadied slightly than fallen. In right this moment’s surroundings of falling expectations, conserving issues degree is a win.

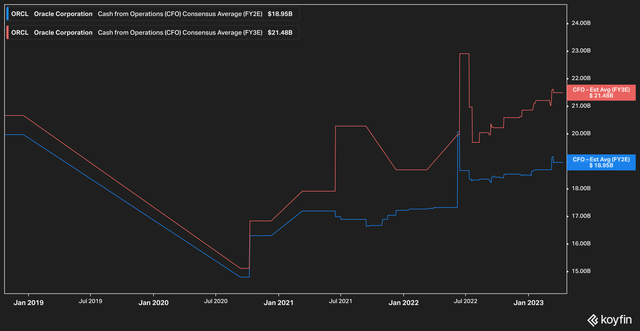

In fact, income is only one element. Managing price and producing money flows is the true key. On this entrance as nicely, Oracle shines.

Koyfin

Working money circulate expectations for Oracle searching two years (blue line) and three years (purple line) have steadily climbed. That is, we predict, a testomony to the character of Oracle’s enterprise. As rates of interest climb and corporations look to seek out methods to chop prices, it appears clear that one place they really feel they can not afford to stint on are the sorts of companies provided by Oracle.

The AI Alternative

Very like earlier the earlier hype-cycles surrounding blockchain or the metaverse, it is tough right this moment to learn an article associated to tech with out getting some perspective on how firms are adapting (or failing to adapt) to the regular rise of Synthetic Intelligence.

In Oracle’s case, nonetheless, we imagine that there could also be extra substance than hype within the AI alternative case.

AI is an extremely data-hungry enterprise. It takes lots of computing energy and really particular experience to facilitate all of the back-end coaching and machine studying wanted to supply a program like ChatGPT, for instance.

On the corporate’s final earnings name, Larry Ellison offered thrilling and necessary perception into the corporate’s AI capabilities, stating that the prevailing cluster scale of Oracle’s Gen 2 Cloud allows it to extra effectively clear up advanced AI issues.

To this finish, Ellison said that:

We predict — so our platform runs AI very, very nicely as a result of we create these clusters of GPUs that we — that may assault huge issues in a short time. We do it economically, then we construct the functions on prime of that. We offer the service to lots of the startups within the AI world. That is one instance of the place we’re simply means forward of the opposite hyperscalers by way of our community and our capacity to do AI.

Whereas it could be tough presently to estimate what the complete market potential of AI might be and the general impression it is going to have, we really feel that the addressable market is clearly giant. On this surroundings, any first-moved benefit an organization can take is more likely to pay dividends sooner or later.

The Backside Line

Oracle Company is, in our opinion, a powerful and stalwart firm with an extended and profitable enterprise monitor document. Firm administration has over time remained versatile and able to transfer on new concepts, as evidenced by the corporate’s fast growth into supporting AI ventures.

For that reason, we predict that the current separation from the market could also be indicative of one thing like a sea change how the market views Oracle Company inventory. We imagine buyers ought to hold an in depth eye on Oracle Company, as any dip could current an excellent shopping for alternative.