2022 GMC Hummer EV on a mud street Wirestock/iStock Editorial by way of Getty Photos

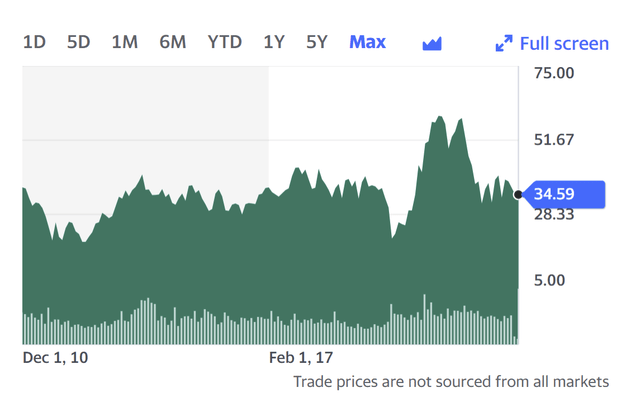

Normal Motors’ (NYSE:GM) Mary Barra has obtained a lot laudatory protection since taking on because the automaker’s CEO in 2014. But 9 years on, the worth of GM inventory stays the identical as when her tenure started. In truth, they’re roughly on the identical worth as they have been on the time of 2010 preliminary public providing, a yr following the corporate’s chapter.

A post-bankruptcy consensus amongst Wall Avenue analysts held that newly-reorganized GM wouldn’t show to be a worthwhile funding till the automaker established a powerful monetary place that would stand up to the automotive trade’s periodic downturns. At a matter of truth, GM has maintained a reasonably stable monetary footing – however the context has modified, notably the worldwide pandemic and the onset of a wholly new propulsion know-how: battery electrification.

GM inventory worth 2010-2023 (Yahoo finance)

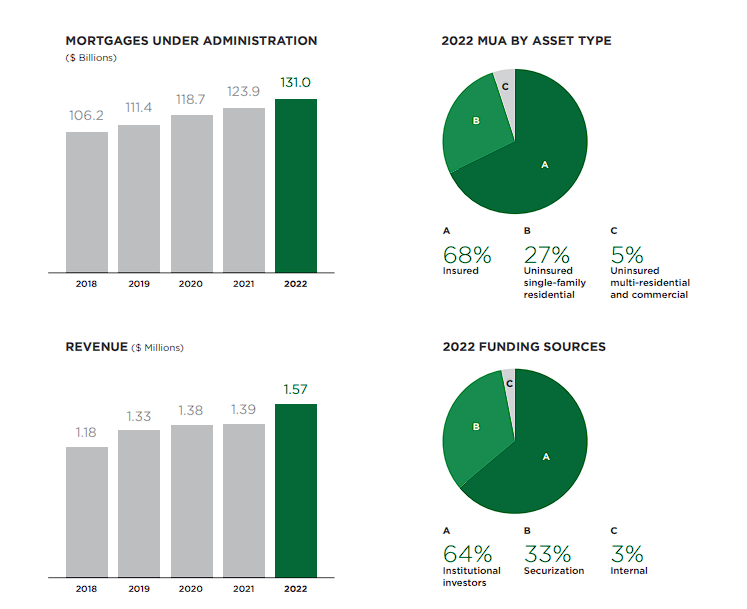

Constant earnings?

A lot of GM’s share worth stagnation over greater than a decade is perhaps blamed on the issue of posting constantly rising earnings, which – in any case – most inventory pundits would insist is the bedrock of a rising share worth. The worldwide automotive trade stays viciously aggressive. Though the pandemic tended to average the trade’s power over-production of autos and enhance earnings, buyers could legitimately suspect that automakers, together with GM, are poised to boost output and are headed to towards massive inventories that may depress pricing.

GM web revenue since 2010 reorganization (Macrotrends.web)

Normal Motors annual/quarterly web revenue historical past and development price from 2010 to 2022. Web revenue may be outlined as firm’s web revenue or loss in any case revenues, revenue objects, and bills have been accounted for.

Normal Motors web revenue for the quarter ending December 31, 2022 was $1.984B, a 16.98% enhance year-over-year. Normal Motors web revenue for the twelve months ending December 31, 2022 was $8.915B, a 9.37% decline year-over-year. Normal Motors annual web revenue for 2022 was $8.915B, a 9.37% decline from 2021. Normal Motors annual web revenue for 2021 was $9.837B, a 57.47% enhance from 2020. Normal Motors annual web revenue for 2020 was $6.247B, a 5.08% decline from 2019.

As if competitors to promote inner combustion fashions such because the Chevrolet Silverado wasn’t laborious sufficient on revenue, GM now’s launched into roughly $35 billion value of investments in battery manufacturing and new battery-electric car (BEV) fashions. GM has bravely projected profitability for its BEVs by 2025, boosted by federal subsidies. Clearly, the end result nonetheless hinges on client acceptance of BEVs, to not point out the potential erosion of subsidies if political local weather change engulfs Washington.

Towards that backdrop, Barra in late January raised a sign flare that buyouts have been probably with the announcement of $2 billion in value cuts by means of the top of 2024, achieved partially by lowering the scale of the work pressure. Clearly, the prospect of a worldwide recession and the decline in used-car costs was influencing GM’s planning.

Mary Barra, CEO, at CES in January 2023 (GM)

Slimming down

In late February, GM mentioned it was eliminating about 500 govt and managerial stage jobs worldwide for “efficiency associated” causes. These staff started leaving the corporate instantly. Globally, GM employed about 88,000 salaried personnel, about 58,000 within the U.S., based on its newest filings.

The February personnel discount wasn’t massive sufficient to be materials, protecting analysts and buyers looking out for the subsequent step. It got here on March 10, with the announcement that every one salaried personnel with greater than 5 years of service have been being supplied a buyout.

On April 4, Paul Jacobson, GM’s chief monetary officer, introduced the variety of staff accepting the buyout provide was consistent with GM’s expectation and can be mirrored in a $1 billion cost towards earnings. Further layoffs would not be essential, he mentioned. First quarter monetary outcomes are scheduled for launch on April 25 at 6:30 a.m.

The provide was one month’s wage for yearly of service, as much as 12 months, paid as a lump sum.

Moreover, some cash can be paid to these coated beneath the corporate’s group well being plan, a pro-rated portion of the most recent bonus, outplacement help, and the proper to maintain utilizing an organization automotive for some time period, relying on the worker’s final day of labor. All these accepting the provide might be leaving the corporate by June.

New expertise

Though the workforce discount will lighten GM’s value burden, the corporate little doubt will lose a major quantity of expertise and ability that would trigger hardships in engineering, monetary and advertising and marketing organizations. Due to the migration towards BEV fashions, GM has been hiring aggressively in recent times to construct up its experience and expertise in software program, battery engineering, digital connectivity and associated fields.

On the finish of January GM mentioned that it expects its core auto operations to carry out at a constantly sturdy stage in 2023, with full-year web revenue attributable to stockholders of $8.7 billion-$10.1 billion, EBIT-adjusted of $10.5 billion-$12.5 billion, and EPS-diluted and EPS-diluted-adjusted of $6.00-$7.00.

Moreover, Barra asserted that 2023 can even be “a breakout yr” for the Ultium Platform, the corporate’s newest battery know-how used for its latest EV fashions such because the Cadillac Lyriq and the Chevrolet Silverado EV. The BrightDrop Zevo 600 supply van is aimed toward industrial clients. Clearly, she’s banking on sturdy acceptance of GM’s new BEV fashions.

EV future

Thus far, GM’s BEVs encompass fashions just like the GMC Hummer EV and Lyriq, that are priced for prosperous customers. Popularly priced Chevrolet Bolt and Bolt EUV BEVs have achieved document gross sales, although their battery know-how is changing into outdated; later this yr GM will introduce Chevrolet Silverado EV, Blazer EV and Equinox EV. The automaker’s objective is to construct and promote 400,000 BEVs by means of the primary half of 2023 – which might be a formidable achievement.

GM’s Cruise subsidiary is increasing robotaxi operations in San Francisco and poised to enter Austin and Phoenix markets – vital income, to not point out revenue, look like years sooner or later.

The jury remains to be out on electrification – particularly, the period of time wanted earlier than mainstream patrons are prepared to change from standard propulsion know-how (inner combustion engines) to battery electrics. This uncertainty hits GM particularly laborious for the reason that laws and incentives within the U.S., GM’s most vital market, are the least binding, in comparison with China and the European Union.

In different phrases, if client uptake of BEVs takes longer than projected then GM shareholders must wait longer for a payoff from the tens of billions invested in new battery crops and BEV fashions. Though the expansion price of BEV gross sales sounds spectacular, absolutely the quantity stays somewhat small in comparison with gross sales of standard fashions. Further authorities funding and regulatory motion might speed up BEV gross sales — although that is a shaky premise on which to hold an funding.

Wall Avenue analysts are typically sanguine. The consensus assigns a “Purchase” score to GM shares, with a number of assessing GM as a “Robust Purchase.” I are typically extra persuaded by SeekingAlpha’s Quant Ranking of “Maintain,” which seems to be influenced by the D- grade given for development of income and earnings.

GM’s long-term potential is nice. Reviewers give its fashions sturdy marks. But within the face of world competitors, financial headwinds, large and expensive electrification prices, GM has nonetheless to show it might earn a living on a constant and rising foundation. Buyers who’ve held on to positions in GM could want to wait a bit longer to see if mainstream customers will flock to the automaker’s new BEV lineup – and are prepared to pay premium costs, which might be mirrored in rising earnings.

With out extra proof in hand, including shares to at least one’s portfolio appears to be like dangerous. Thus, GM stays a maintain.