In these instances, double down — in your expertise, in your information, on you. Be part of us Aug. 8-10 at Inman Join Las Vegas to lean into the shift and study from one of the best. Get your ticket now for one of the best value.

After promoting its correspondent lending enterprise and shedding lots of of employees final yr, Homepoint plans to get out of the enterprise of originating mortgages altogether by promoting its wholesale mortgage enterprise to rival The Mortgage Retailer Inc.

Mark Lefanowicz

However in saying the deal Friday, mum or dad firm Dwelling Level Capital Inc. mentioned it can additionally take an fairness stake in The Mortgage Retailer, and that Homepoint govt Phil Shoemaker will probably be put in as The Mortgage Retailer’s new chief govt officer. The Mortgage Retailer’s present CEO Mark Lefanowicz will function govt chairman of the corporate’s board.

Phil Shoemaker

“I’m pleased with what we completed at Homepoint and grateful for the expertise,” mentioned Homepoint’s President of originations, Shoemaker, in an announcement. “I’m trying ahead to the following chapter at The Mortgage Retailer the place we are going to proceed making a optimistic affect throughout the wholesale lending neighborhood.”

Phrases of the sale weren’t introduced. But when the deal closes as anticipated by the tip of the second quarter, it can additional The Mortgage Retailer’s aim to change into a number one nationwide wholesale mortgage lender providing “aggressively priced” typical, jumbo, VA, and non-QM loans, the corporate mentioned.

Though Homepoint noticed its wholesale originations plummet by 68 % final yr to $22.39 billion, it was nonetheless the third-largest wholesale lender by origination quantity, in response to Inside Mortgage Finance.

Brandon Stein

“At The Mortgage Retailer, we’ve constructed an environment friendly platform that gives what we consider is really a best-in-class expertise for our companions,” mentioned The Mortgage Retailer President Brandon Stein in an announcement. “Combining that with the visionary management of Phil Shoemaker and a extremely regarded gross sales and operations staff, The Mortgage Retailer is well-positioned to sustainably scale our enterprise.”

Homepoint mentioned it can proceed to handle mortgage servicing rights on a portfolio of greater than 300,000 loans with an unpaid principal stability of $89.28 billion as of Dec. 31.

Shares in Homepoint, which have traded for as little as 99 cents and as a lot as $4.65 over the past yr, have been up 20 % in mild buying and selling Thursday to shut at $2.07. Markets have been closed following the announcement of the deal for Good Friday.

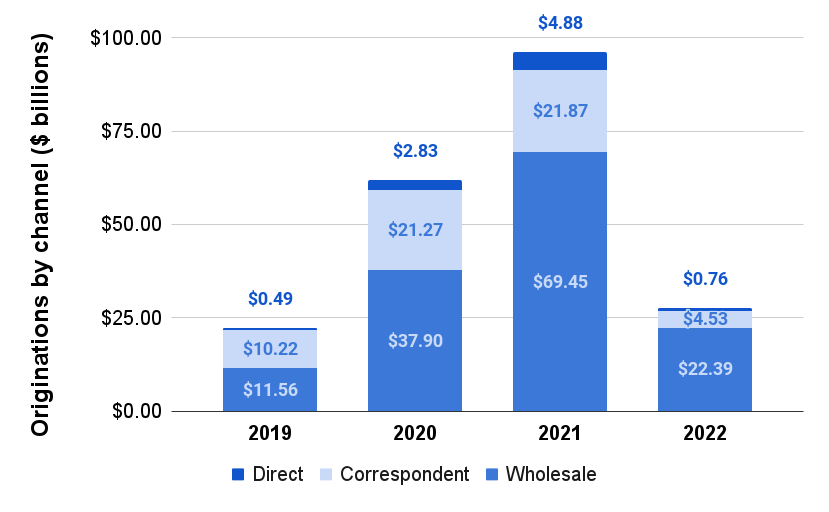

Homepoint mortgage originations 2019-2022

Homepoint mortgage originations by channel (wholesale, correspondent, direct) 2019-2022 | Supply: Dwelling Level Capital annual experiences

Based in 2015 and headquartered in Ann Arbor, Michigan, till lately Homepoint originated mortgages by three channels: Wholesale, correspondent and direct.

By its wholesale channel, Homepoint funded loans originated by greater than 9,259 mortgage dealer companions as of Dec. 31. When rates of interest plummeted throughout the pandemic, Homepoint was in a position to develop its wholesale mortgage originations by 228 % in 2020 and one other 83 % in 2021, to a peak of $69.45 billion.

However when mortgage charges soared final yr, Homepoint’s wholesale mortgage originations tanked, forcing the corporate to downsize. With different lenders additionally taking a success to their enterprise, Homepoint nonetheless managed to carve out 6.6 % market share within the wholesale channel final yr, up from 1.6 % in 2017, in response to Inside Mortgage Finance.

Though the wholesale channel has been Homepoint’s main technique of originating loans, till final yr it additionally bought closed and funded mortgages from a community of correspondent lenders — primarily small- to medium-sized impartial mortgage banks, builder associates and monetary establishments.

As lately as 2019, Homepoint’s correspondent channel accounted for practically half of the corporate’s mortgage manufacturing (46 %).

However Homepoint left the correspondent enterprise final yr, promoting its correspondent lending channel (and a subsidiary, Dwelling Level Asset Administration LLC) to rival Planet Dwelling Lending LLC. That deal was introduced final April and closed on June 1, 2022.

Planet Dwelling Lending paid $2.5 million in money for Homepoint’s correspondent lending enterprise, plus 2022 earnout revenue of $900,000, in response to Dwelling Level Capital’s newest annual report back to buyers. Planet Dwelling Lending will proceed making earnout funds to Homepoints based mostly on origination quantity by June 1, 2024.

Homepoint’s third avenue for originating mortgages was its direct channel, during which Homepoint refinanced debtors already making funds on mortgages serviced by Homepoint. Direct originations peaked at $4.88 billion in 2021, earlier than plummeting to $758 million final yr.

Homepoint’s servicing portfolio 2019-2022

On the finish of 2022, Homepoint owned the servicing rights to gather funds on 317,000 mortgages with excellent balances totaling $89.28 billion, a 33 % drop from 2021.

Brief on money on the finish of the yr, Homepoint offered roughly $6 billion of the corporate’s Ginnie Mae servicing rights throughout the fourth quarter, producing proceeds totaling $87.8 million.

However mortgage servicing will proceed to “generate vital returns and money stream over time,” the corporate mentioned Friday in saying its exit from wholesale lending.

In reporting a $163.7 million 2022 web loss on March 9, Homepoint mentioned mortgage servicing was a web optimistic, producing $277.5 million in income and boosting the corporate’s backside line by $121.8 million after deducting fastened prices.

Final yr Homepoint signed an settlement with First American Monetary Company subsidiary ServiceMac LLC to behave as its subservicer. Whereas ServiceMac has been accumulating funds from debtors on Homepoint’s behalf for the reason that second quarter of 2022, Homepoint retains the underlying mortgage servicing rights.

Hiring ServiceMac as a subservicer whereas retaining the servicing rights permits Homepoint “to take care of a decrease, extra variable price construction and offers larger flexibility when strategically promoting sure non-core MSRs,” the corporate mentioned.

Get Inman’s Additional Credit score E-newsletter delivered proper to your inbox. A weekly roundup of all the largest information on this planet of mortgages and closings delivered each Wednesday. Click on right here to subscribe.

E-mail Matt Carter