Is ChatGPT, the Revolutionary AI, a Gold Bug? The AI Suggests Large Diversification Throughout a Vary of Money-Like Property and Commodities

NEW YORK, April 5, 2023 /PRNewswire/ — A brand new report by Gold IRA Information discovered that ChatGPT’s ultimate mannequin of a “recession proof” funding portfolio consists of massive allocations (20%) in gold and different valuable metals. This determine far exceeds the quantity proposed by distinguished “gold bug” wealth managers resembling Ray Dalio and Peter Schiff.

Q1 2023 hedge fund letters, conferences and extra

Gates Capital Administration Reduces Threat After Uncommon Down Yr [Exclusive]

Gates Capital Administration’s ECF Worth Funds have a improbable observe file. The funds (full-name Extra Money Move Worth Funds), which put money into an event-driven fairness and credit score technique, have produced a 12.6% annualised return over the previous 26 years. The funds added 7.7% total within the second half of 2022, outperforming the three.4% return for Learn Extra

ChatGPT’s Recession-Proof Portfolio Breakdown

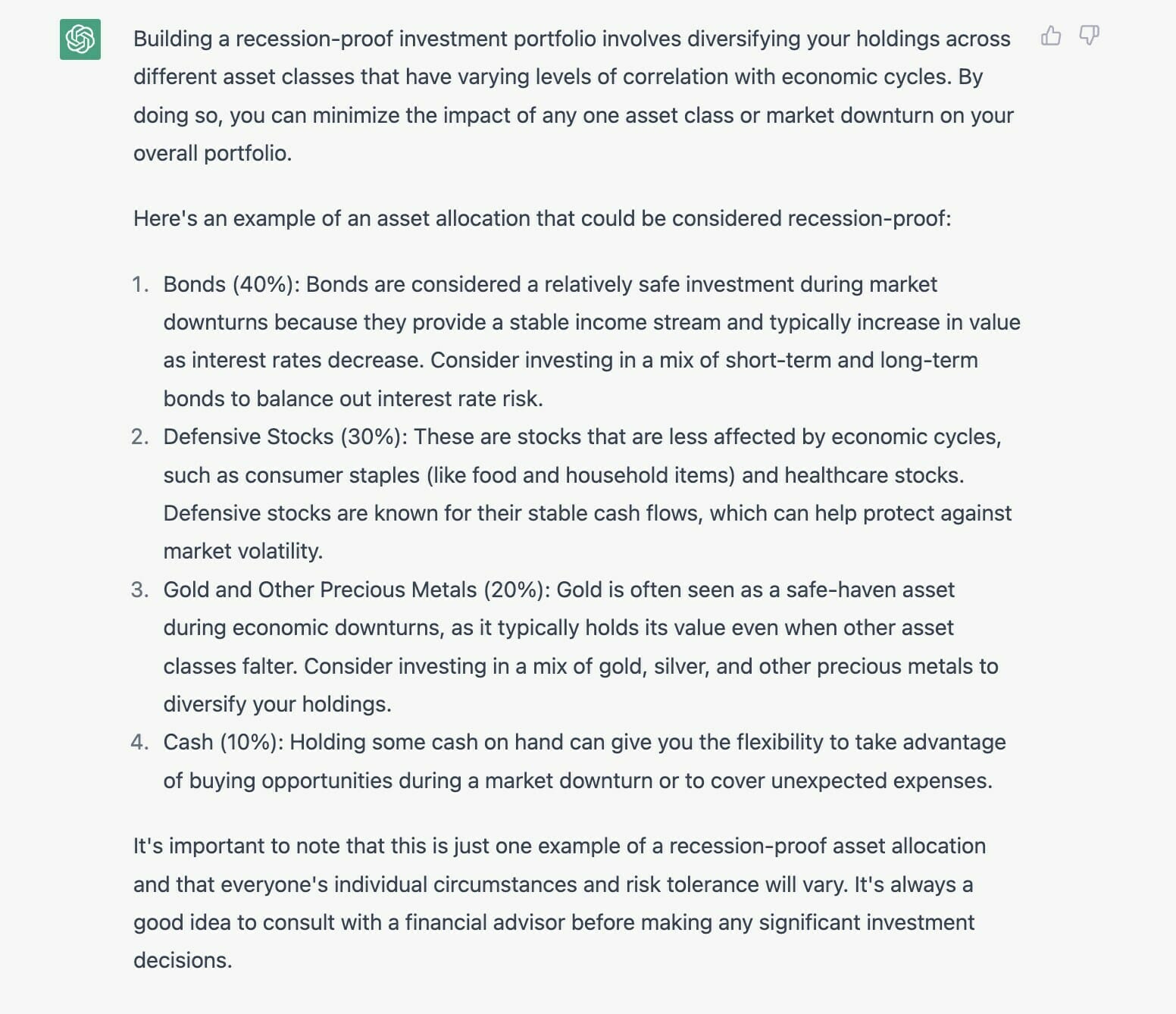

As depicted in Picture 1, ChatGPT recommends investing in a mixture of defensive shares, bonds, and money to create a really recession-resistant portfolio. Defensive shares resembling shopper staples and healthcare shares have a tendency to carry up higher than different sectors throughout a recession, whereas bonds present stability and a supply of mounted revenue.

In abstract, ChatGPT recommends the next asset allocation technique to maximally defend one’s investments from recessions:

Bonds (40%): fixed-income authorities and company bonds and Treasury payments, together with publicly listed mixture bond indices.

Defensive shares (30%): blue chip shares which might be affected much less by market fluctuations, resembling healthcare, utilities, and important shopper items.

Gold and different metals (20%): recommended a mixture of bodily and “paper-backed” gold and silver belongings, together with gold ETFs and mining shares

Money and equivalents (10%): recommended U.S. {dollars}, cash market funds, and certificates of deposit

The importance of those findings is that it presents buyers a viable technique for safeguarding their portfolios in opposition to financial uncertainty. Within the wake of the COVID-19 pandemic and attendant financial downturn, many buyers are on the lookout for methods to defend their life financial savings from recessionary results.

Report Abstract

The worldwide economic system is not any stranger to recessions, and with the latest financial institution failures and Fed insurance policies, many buyers are on the lookout for methods to guard their portfolios from financial uncertainty. Enter gold, a valuable steel that has lengthy been touted as a safe-haven asset in instances of market turmoil.

In response to ChatGPT, the world’s main artificially clever massive language mannequin created by Silicon Valley-based OpenAI, a well-diversified funding portfolio ought to embrace an allocation of a minimum of 20 p.c to gold and different valuable as a recession hedge. It is a vital growth conventional monetary advisors sometimes advocate for a decrease allocation share, often within the vary of 5 to 10 p.c.

“Gold has traditionally held its worth throughout financial downturns, making it a horny possibility for buyers seeking to defend their portfolios,” wrote ChatGPT. “Through the 2007-2009 world recession, for instance, the value of gold elevated by over 25%. A diversified portfolio that features a mixture of asset courses, together with gold, may help mitigate the impression of market downturns and supply stability for buyers.”

Total, ChatGPT’s suggestion of a 20% allocation to gold as a recession hedge is a notable and helpful contribution to the sphere of funding administration. Nonetheless, buyers are strongly inspired to seek the advice of with a monetary advisor to find out their particular person threat tolerance and develop a well-diversified funding technique that meets their distinctive wants.

Learn the whole report, and ChatGPT’s full mannequin portfolio, at Gold IRA Information’s web site.