Printed on April 1st, 2023 by Nikolaos Sismanis

A&W Income Royalties Revenue Fund (AWRRF) has two interesting funding traits:

#1: It’s a high-yield inventory primarily based on its 5.3% dividend yield.Associated: Listing of 5%+ yielding shares.#2: It pays dividends month-to-month as an alternative of quarterly.Associated: Listing of month-to-month dividend shares

You’ll be able to obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter, like dividend yield and payout ratio) by clicking on the hyperlink beneath:

The mix of a excessive dividend yield and a month-to-month dividend render A&W Income Royalties Revenue Fund interesting to income-oriented traders.

However there’s extra to the corporate than simply these elements. Preserve studying this text to study extra about A&W Income Royalties Revenue Fund.

Enterprise Overview

A&W Income Royalties Revenue Fund is a limited-purpose belief that owns the A&W logos used within the A&W fast service restaurant enterprise in Canada. The logos comprise a number of the best-known model names within the Canadian meals service business. Particularly, the belief’s highly effective lineup of nice meals and drinks and established manufacturers embrace A&W Root Beer, The Burger Household, and Chubby Rooster.

The belief licenses these logos to A&W Meals Providers of Canada. In alternate, these eating places enter a royalty pool and are required to pay a royalty of three% of their gross sales.

The A&W Income Royalties Revenue Fund stands out as a “top-line” fund, as its income is solely derived from the gross sales of A&W eating places, with solely minimal working bills, curiosity on Commerce Marks’ time period debt, and earnings taxes subtracted to get to web earnings.

This distinctive construction shields the Fund from the fluctuating earnings and bills related to really working the eating places. Consequently, the Fund enjoys safety from inflation and a reliable stream of income, amongst different advantages.

Progress Prospects

Much like different royalty trusts of its sort that we’ve analyzed, like Boston Pizza Royalty Revenue Fund, the belief’s development prospects and total efficiency hinge on simply two key elements. The primary is the variety of franchised eating places in its royalty pool, whereas the second is the speed of development in same-restaurant gross sales.

Since its inception in 2002, the variety of franchised eating places within the belief’s royalty pool has elevated each single 12 months. This is a superb indicator of the belief’s success, because it suggests that there’s a excessive demand amongst franchisees for A&W’s manufacturers, indicating that the eating places are probably performing exceptionally properly.

The underlying success of A&W’s manufacturers can be mirrored in the truth that over 70% of latest A&W eating places opened over the previous three years had been opened by current A&W franchisees, whereas greater than 600 A&W eating places are owned by franchisees who personal at the very least 5 eating places. In 2022, the variety of eating places within the Royalty Pool rose by 21 places to $1,015.

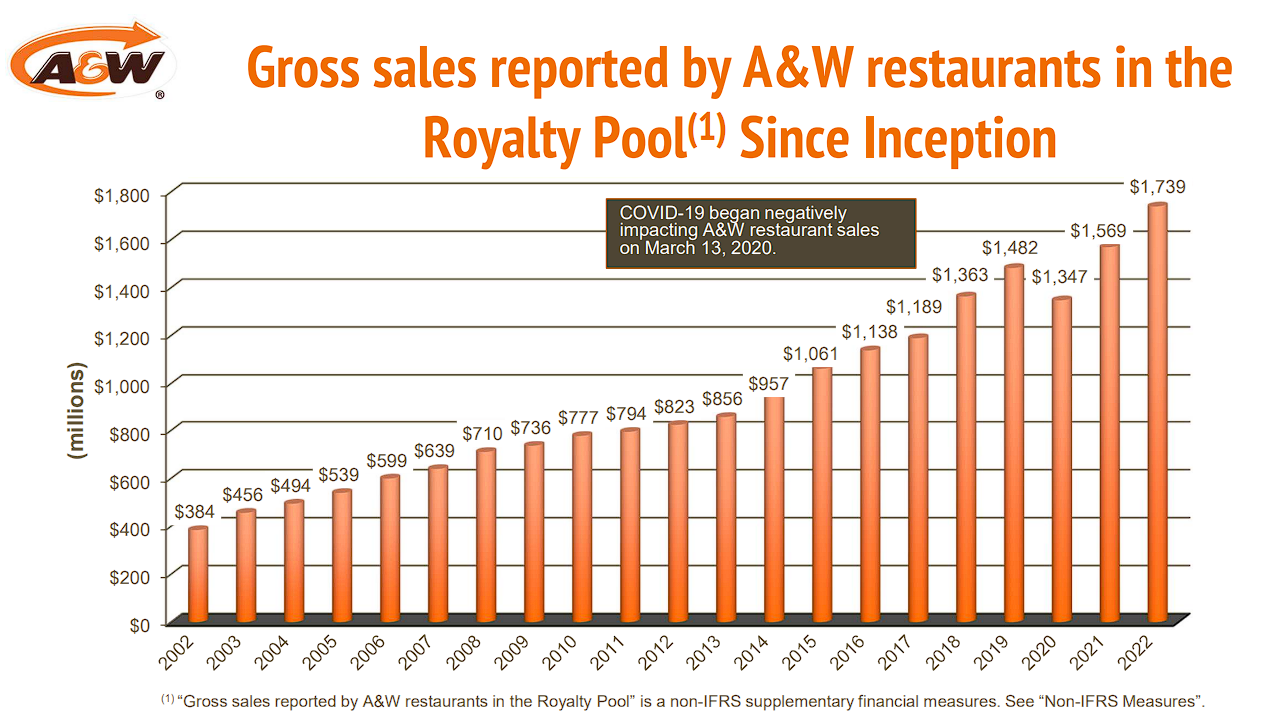

Supply: Investor Presentation

A&W eating places have a notable report of accelerating revenues by way of menu optimizations and operational efficiencies, which has resulted in rising same-store gross sales. Though the COVID-19 pandemic had a destructive impression on gross sales attributable to strict lockdowns, they rebounded rapidly as soon as reopened.

Supply: Investor Presentation

The mix of a quickly rising variety of eating places together with steadily larger same-store gross sales has resulted in exceptional product sales development within the belief’s royalty pool. Although product sales quickly declined in 2022 on account of the pandemic, new restaurant openings and rebounding same-store gross sales resulted in report royalty-eligible product sales of C$1.74 billion in 2022.

Supply: Investor Presentation

The above bar chart successfully showcases the belief’s recession-resistant royalty mannequin, as reasonably priced fast-food chains like A&W sometimes expertise resilient gross sales throughout market downturns. Consequently, the belief’s royalty-eligible product sales continued to develop during the Nice Monetary Disaster.

The belief’s decoupling from every restaurant’s particular person working bills can be obvious within the regular development of its product sales, which is the only real issue that determines the belief’s royalty income.

Wanting forward, we anticipate that the belief’s development potential will stay sturdy, given the sustained curiosity amongst franchisees in opening new A&W eating places and the natural development in same-store gross sales at A&W-licensed places over time.

Dividend Evaluation

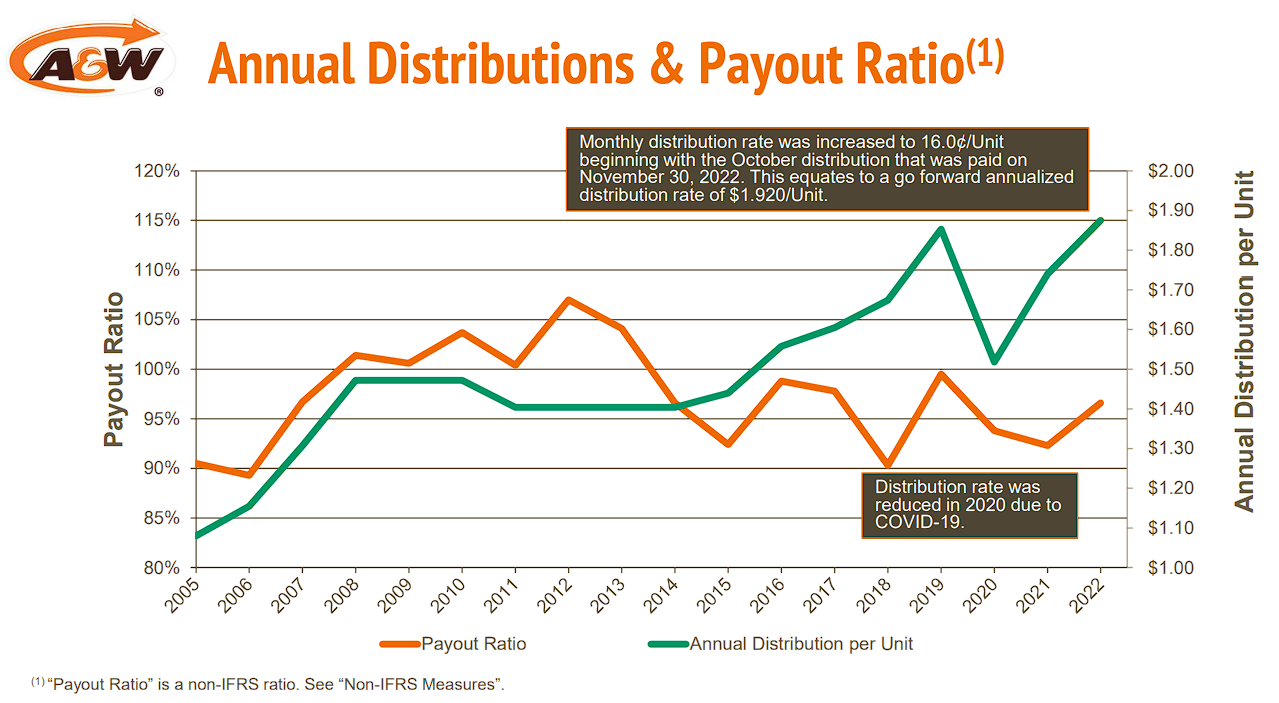

In line with the belief’s goal of distributing all of its earnings to unitholders, its payout ratio has persistently remained close to 100%. As demonstrated earlier by the upward pattern within the firm’s royalty-eligible product sales, the belief’s distributions have additionally elevated over time. Administration could barely alter the payout ratio to make sure a extra predictable month-to-month earnings for unitholders, smoothing out the speed of month-to-month distributions over time.

In 2022, the belief’s payout ratio was 96.6%, paying out a report C$1.875 in distributions per unit out of the C$1.941 in distributable money per unit.

Supply: Investor Presentation

Traders mustn’t anticipate distribution will increase or distribution “cuts” however as an alternative anticipate that every 12 months’s complete distributions per unit will differ primarily based on the underlying product sales of A&W-licensed eating places.

That mentioned, we consider that over time, the belief will proceed to pay out bigger distributions, following our aforementioned rationale concerning sturdy franchise curiosity and better same-store gross sales.

The present month-to-month distribution of C$0.16 interprets to an annualized price of C$1.92 (or $1.42), implying a yield of 5.3%. It might not be an infinite yield, however the dividend’s potential for development is important and provides to its total enchantment.

Closing Ideas

A&W Income Royalties Revenue Fund’s funding case is fairly compelling. Its frictionless income mannequin and objective of distributing everything of its earnings, together with the extremely engaging frequency of its month-to-month payouts, make it a extremely engaging decide for income-oriented traders.

The belief’s yield of 5.3% is particularly engaging, and it’s anticipated to develop consistent with the established pattern of elevated franchised places and same-store gross sales development. Whereas excessive occasions just like the COVID-19 pandemic could quickly impression distributions, we’re assured that they are going to proceed to rise over time. Regardless of the pandemic’s strict lockdowns in 2020 and 2021, the belief’s earnings and distributions hit report ranges in 2022, highlighting the resilience of its manufacturers and royalty mannequin.

In conclusion, we consider that A&W Income Royalties Revenue Fund could possibly be a becoming alternative for earnings traders searching for a notable yield with the potential for dividend development in a sturdy and resilient funding car.

If you’re thinking about discovering extra high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases shall be helpful:

The main home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].