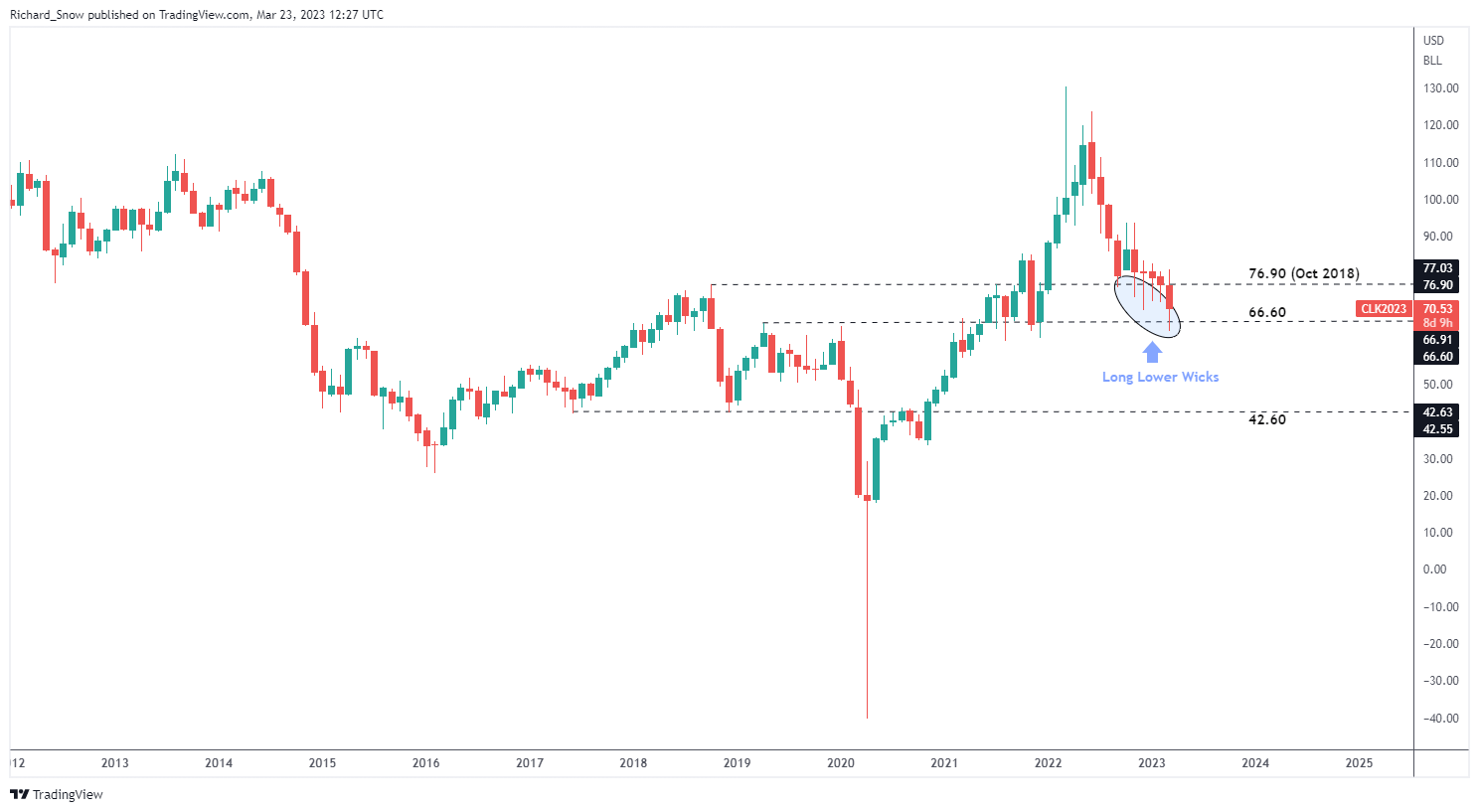

For many of Q1 2023 WTI crude oil costs oscillated between two very essential ranges as merchants tried to gauge the longer-term course of the commodity. The extent of resistance at $82.50 supplied a strong ceiling, whereas the higher band of the $67 – $72 goal zone to replenish SPR provides supplied help for many of the quarter, till we noticed a late push, deeper into the goal vary, in the direction of $67 the place costs struggled to realize a every day shut under that degree. Whereas this text concentrates on oil‘s technical panorama, the oil market is closely influenced by fundamentals like demand and provide – obtain the complete Q2 forecast under:

Really useful by Richard Snow

Obtain the complete forecast for elementary insights for Q2

WTI Crude Oil (Every day Chart)

Supply TradingView, chart ready by Richard Snow, Analyst

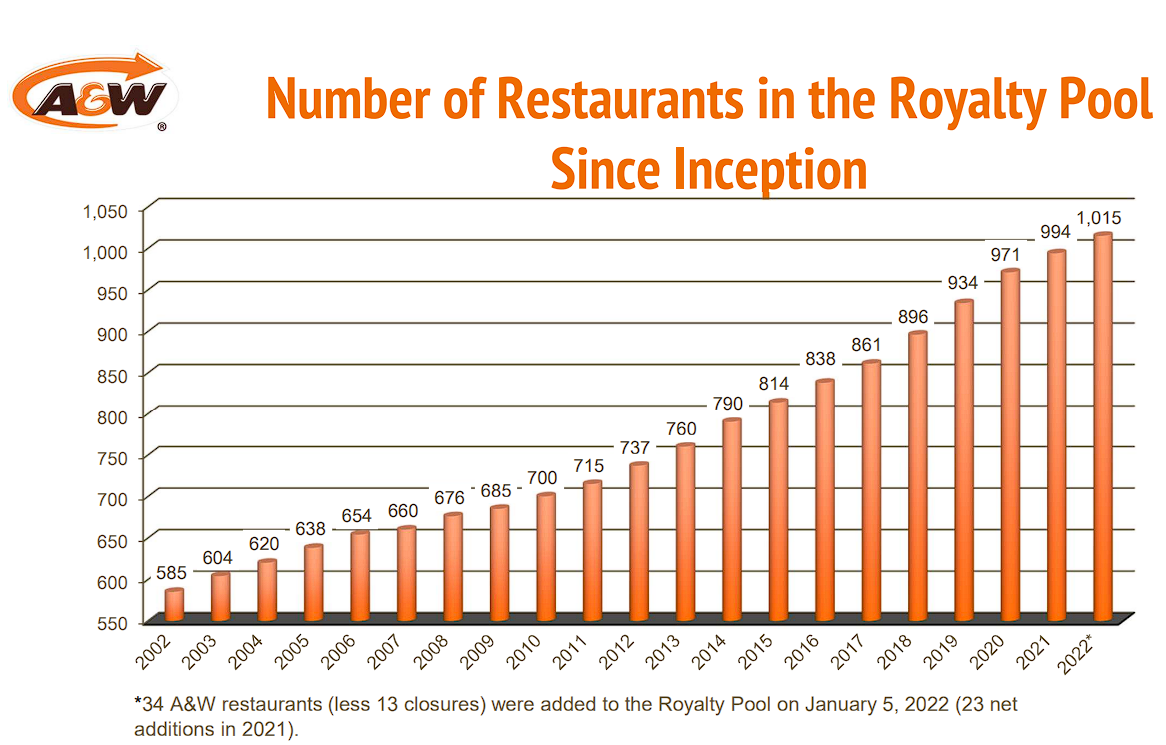

It’s helpful to zoom out to the month-to-month chart to see how the value motion in Q1 matches into the longer-term pattern. For the reason that huge value spikes in Q1 2022, oil costs have primarily been in decline – a lot to the aid of world shoppers as such a drastic rise set into movement an extended interval of unacceptably excessive inflation.

Whereas the long-term pattern is definitely a downtrend, one thing to notice is the frequency of month-to-month candles exhibiting prolonged decrease wicks, presumably an indication of a fatigue. Primarily, this reveals that whereas costs traded on the lows, there was a reluctance to remain at these ranges as bulls pushed costs up – suggesting that bearish momentum might fade within the coming quarters of 2023 as bulls start to see worth at decrease ranges.

WTI Crude Oil (Month-to-month Chart)

Supply TradingView, chart ready by Richard Snow, Analyst

Technical Forecast: Impartial with Bearish Potential In direction of $55

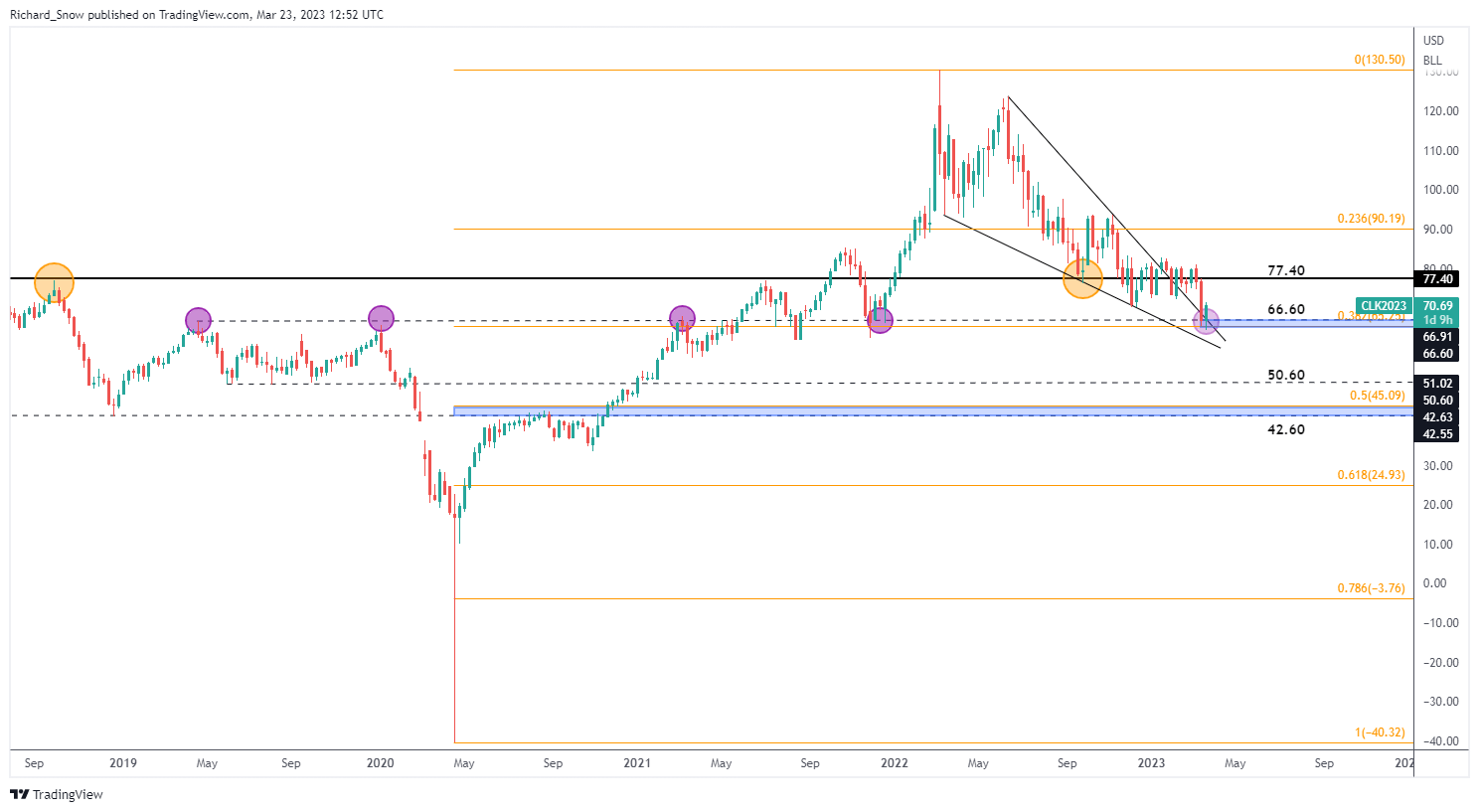

The weekly WTI chart revealed what seemed to be an upside breakout, above the falling wedge. Nonetheless, current risky value motion, in response to a possible ststemic banking disaster, resulted in oil falling proper again throughout the wedge formation the place it encountered a notable zone of help.

The confluence zone in query consists of the 38.2% Fibonacci retracement of the 2020 to 2022 main transfer ($64.25); and the decrease sure of the recognized vary favored by the Biden administration to refill SPR shares at ($67). The $66.70 or roughly $67.00 degree has proved to supply a pivot level for oil both as resistance, like in 2019 and 2020, or as help since 2021.

Given that there’s but to be a breakdown of the present downtrend, and we’re nonetheless witnessing decrease highs and decrease lows, the steering for WTI into Q2 stays tilted to the bearish facet. If we see a imply reversion in the direction of ranges seen earlier than the massive bank-induced sell-off (+- $75), oil costs might re-enter the channel of consolidation, shifting largely sideways.

Nonetheless, within the absence of proof on the contrary, the longer-term downtrend stays, opening up a transfer decrease. A conclusive break under the $65.25 zone of confluence would recommend the subsequent main value degree turns into $50.60. The quarterly common true vary sits at a typical transfer of $23 which has been influenced by the huge value swings since 2020 and subsequently, within the absence of a world banking disaster, must be moderated barely. However, the present pattern means that even when oil costs rise again to $75, the potential to commerce above $50, round $55 stays potential.

With oil markets so inextricably linked to fundamentals like demand and provide – with provide being manipulated by main oil producers like OPEC – it stays to be seen if such a decline can persist given OPEC’s capacity to rein in oil provide/output in an try to keep away from giant value declines.

WTI Crude Oil (Weekly Chart)

Supply TradingView, chart ready by Richard Snow, Analyst

Commerce Smarter – Join the DailyFX E-newsletter

Keep updated with present themes driving markets

Subscribe to E-newsletter

ingredient contained in the ingredient. That is in all probability not what you meant to do!

Load your software’s JavaScript bundle contained in the ingredient as a substitute.

Source link