Key Takeaways

Bitcoin volatility is the best level since July 2022

Liquidity is extraordinarily skinny which is pushing volatility larger and accentuating value strikes

$4.2 billion of choices expire Friday, with bull set to revenue following the current surge as much as $28,000

Yesterday, I wrote a chunk taking a look at how the correlation between Bitcoin and the inventory market, notably tech shares, has come again up. The connection had loosened amid the banking turmoil that struck monetary markets, triggered by the collapse of Silicon Valley Financial institution.

In addition to rising correlation, the market can also be swinging wildly – the volatility is as excessive because it has been since July 2022, across the time Celsius despatched evaporated into skinny air and despatched the market into mayhem.

Why is volatility rising?

The volatility spike isn’t a surprise in gentle of the glut of liquidity at present within the markets. We crafted up a chunk on this earlier this week, assessing how 45% of stablecoins had flowed out of exchanges within the final 4 months, with the stability now on the lowest level since October 2021.

It offers context to the current Bitcoin value rise. With much less liquidity within the markets, strikes are naturally extra violent, and Bitcoin has surged as much as $28,000, now up 68% on the 12 months.

Whereas the transfer to the upside has been exacerbated by this skinny liquidity, the alternative additionally holds true: the draw back danger is elevated when markets are so skinny.

It paints an image of excessive danger for an asset that already oscillates wildly at one of the best of instances.

Derivatives add to volatility

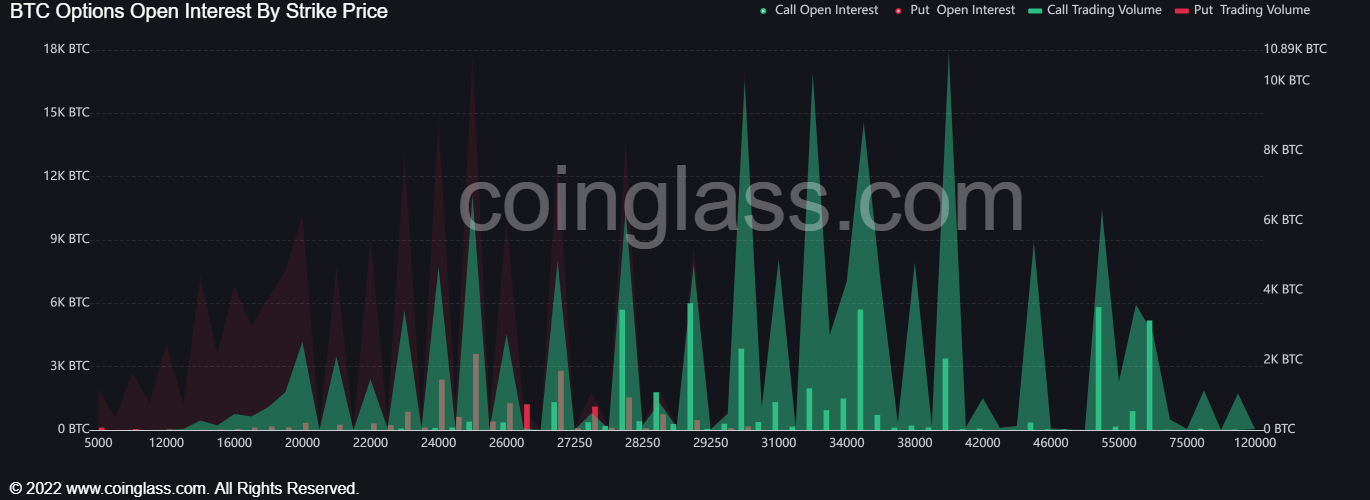

One other issue? Derivatives open curiosity is completely hovering, with the beneath chart from Coinglass displaying that choices open curiosity is at its highest level since November 2021.

As I write this on March thirty first, a mammoth $4.2 billion of Bitcoin choices are set to run out. The beneath chart additionally reveals the strike costs of the choices – with a name/put ratio of two.09 and Bitcoin at present buying and selling near $28,000, will probably be a worthwhile day for a lot of merchants.

Digging into the numbers, there are 97,300 name choices expiring at a strike value of $28,000 or much less, in comparison with 24,500 put choices. The greenback cut up is over $2 billion in favour of calls.

strike costs of the subsequent stage up, it’s just about all name choices. Between $28,000 and $32,000 there are 48,000 name choices towards 400 put choices with a $1.4 billion cut up in favour of calls.

After a 12 months of bears dominating, there’ll lastly be some bulls primed to revenue.

Certainly, trying on the Bitcoin spot holdings, it’s displaying extra constructive information all throughout the market. In December, the vast majority of Bitcoins have been in loss-making positions, when evaluating the market value to the worth at which they final moved.

Right this moment, nevertheless, 74% of the provision is in revenue when utilizing the identical metric.

With rate of interest coverage expectations softening, Bitcoin has lastly been allowed room to run. Nonetheless, with skinny liquidity and excessive volatility comes danger, though relating to Bitcoin, danger is hardly a overseas idea.