CGinspiration

By Iris Pang, Chief Economist, Larger China

The Folks’s Financial institution of China has already lower its Required Reserve Ratio and has continued to pump liquidity into the cash market over the previous few days. Is that this about international market volatility or is it extra concerning the home financial system?

What’s behind the big liquidity injection by the PBoC?

China’s central financial institution, the PBoC, has injected important liquidity into the market since 21 March. From the twenty first to the twenty ninth of the month, the central financial institution injected greater than CNY850 billion of internet liquidity into the monetary system. This contains CNY352bn injected by way of day by day open market operations and CNY500bn by reducing the Required Reserve Ratio (RRR) which took impact on 27 March.

We consider that there are at the very least two issues behind these liquidity injections.

These operations are occurring at the tip of the primary quarter. In China, mortgage development for the yr is normally booked within the first three months. This can be a seasonal phenomenon and pushes up interbank rates of interest on the finish of the primary quarter.

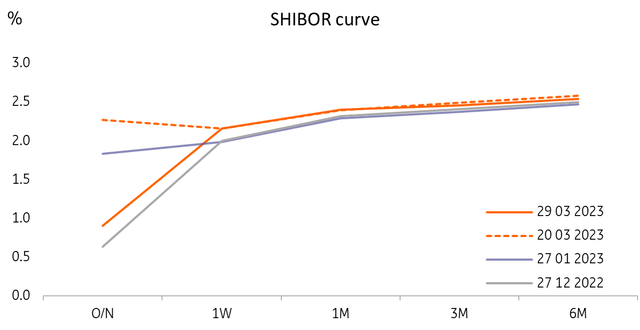

Because the chart exhibits, the in a single day SHIBOR touched 2.5% on 20 March. Subsequently, we predict that mortgage development ought to proceed to be very robust in March in comparison with 2022, even after the fast development within the first two months. If that is the primary motive for the PBoC’s huge liquidity injection, this needs to be seen as a optimistic signal for financial development.

The volatility in international monetary markets is just not over; there could also be some ups and downs forward. China has a extra open capital account than previously and international occasions could have some influence on the Chinese language market.

As such, the PBoC could also be cushioning any potential volatility. That is extra of a precautionary measure and shouldn’t be over-interpreted.

Interbank rates of interest present that liquidity was tight earlier than the PBoC’s injection

Supply: CEIC, ING

The market is discussing a fee lower, however we do not agree

The market is actively discussing that the PBoC will lower the 7D coverage fee and the medium-term lending facility (MLF) fee, that are presently at 2.0% and a couple of.75%, respectively. The dialogue has intensified, particularly after the PBoC introduced a lower within the RRR this month.

We don’t see the necessity for China to decrease rates of interest. The financial system is recovering right now, though not as quick because the market anticipated although that is due extra to the market’s overestimation of the velocity of the rebound.

Exterior markets are weakening and export exercise shall be dampened. However China’s rate of interest cuts is not going to assist exports. Furthermore, an excessively accommodative financial coverage could appeal to some pointless investments. Because the financial system recovers extra shortly within the second half of the yr, rate of interest cuts might pose a danger of financial overheating.

Subsequently, we maintain our forecast for an unchanged coverage fee in 2023. We additionally don’t see the necessity for an additional deposit reserve ratio lower in China, as the height in mortgage development ought to have handed after the primary quarter.

Content material Disclaimer

This publication has been ready by ING solely for data functions no matter a selected person’s means, monetary state of affairs or funding goals. The knowledge doesn’t represent funding advice, and neither is it funding, authorized or tax recommendation or a suggestion or solicitation to buy or promote any monetary instrument. Learn extra

Unique Put up

Editor’s Be aware: The abstract bullets for this text had been chosen by Searching for Alpha editors.