As a banking turmoil has unleashed throughout two continents, buyers have been piling into gold and gold equities once more. The dear metallic regaining its lustre amid present market uncertainty.

Gold mining firms surged early final week as gold traded round a one-year excessive, bucking the development in wider Australian markets.

Gold’s secure haven enchantment is again in drive, as buyers flocked to the yellow metallic following the Silicon Valley Financial institution (SVB) collapse and Credit score Suisse bail out, pushing gold costs up.

Chart 1: Gold benefitting from

monetary instability

Supply: Morningstar, Macquarie Technique, to COB 21 March 2023

Gold costs have additionally been boosted from the large drop in US authorities bond yields and a decline within the US greenback (as measured by the DXY Index). Decrease bond yields cut back the chance price of holding a metallic that pays no revenue. A weaker greenback lifts the worth of commodities which might be denominated within the US foreign money.

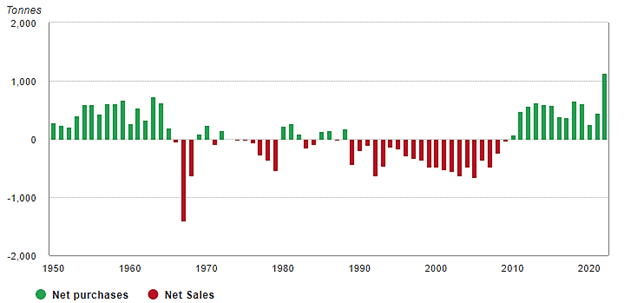

Chart 2: Gold costs have additionally been boosted by weak point within the USD (DXY)

Supply: Bloomberg.

The Fed signifies that fee cuts usually are not in scope till 2024, opposite to what markets imagine following the the SVB fallout. Our view is gold can be a beneficiary if the Federal Reserve (Fed) paused rate of interest will increase in response to issues within the banking system.

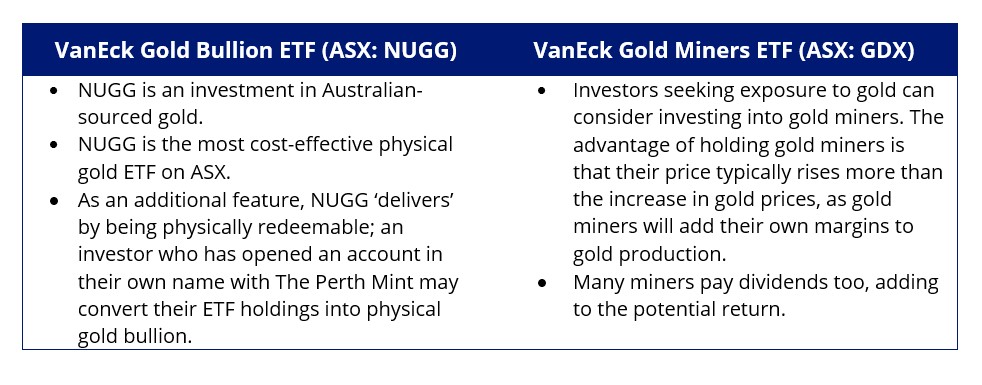

The World Gold Council just lately stated, although not with out dangers, a very good case for gold stays in place for 2023 pushed by: elevated geopolitical threat; a developed market financial slowdown; a peak in rates of interest, and dangers to fairness valuations. As well as, continued central financial institution shopping for can’t be dominated out.

Central financial institution shopping for in 2022 was the very best on report.

Chart 3: Central financial institution demand for gold rose in 2022

Supply: World Gold Council

It’s not simply the gold worth that has benefited from the present disaster in confidence.

Gold miners

Gold miners stand to learn from the present instability as their steadiness sheets stay robust they usually usually rise greater than the gold worth in an upswing. If inflation stays elevated for a number of years, the monetary system won’t be able to return to regular for an prolonged interval. This might create a beneficial setting for gold miners.

As gold equities have been underperforming the gold worth over the previous few years, gold equities stay traditionally low-cost relative to the worth of bullion.

Gold miners are likely to outperform gold bullion when the worth rises, and underperform when the gold worth falls. This has been true this month, with VanEck’s Gold Miners ETF (ASX:GDF) returning 14.04% to this point in March, in comparison with the 8.46% rise of the LBMA PM Gold Worth.1 (All returns as at 20 March 2023, supply LBMA, Morningstar.)

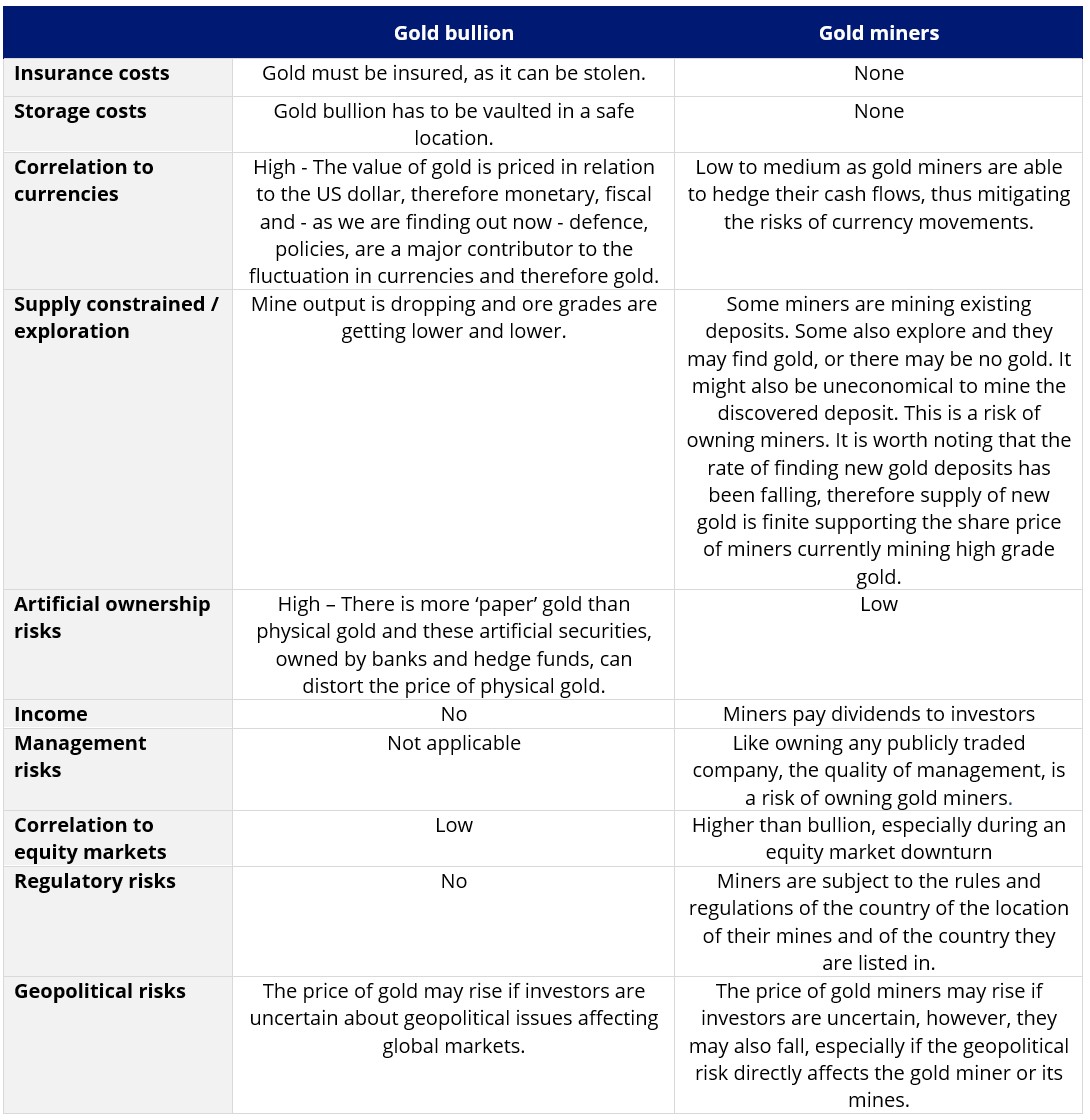

ETFs are an environment friendly approach for buyers to entry gold investing.

Accessing gold by means of ETFs

VanEck’s world management in gold investing stretches greater than 50 years, encompassing gold equites and bullion throughout ETFs and lively funds.

Two ETFs for portfolio issues:

NUGG – accessing bodily gold, that ‘delivers’

GDX – investing in a diversified portfolio of gold mining firms

ETF

VanEck Gold Bullion ETF (ASX:NUGG)

Different Belongings

ETF

VanEck Gold Miners ETF (ASX:GDX)

World Shares

Under we define the dangers of every sort of publicity to gold, proudly owning gold bullion and proudly owning gold miners:

Variations between gold miners and bullion

Whereas every gold technique has its advantage for portfolio inclusion, you must assess all of the dangers and think about your funding aims.

Unlock alternatives with VanEck

VanEck’s funding methods are designed to offer you unequalled entry to markets, sectors and clever funding concepts. Discover out extra.

By no means miss an replace

Keep updated with my present content material by

following me beneath and also you’ll be notified each time I submit a wire