HT Ganzo

Introduction

I’ve written a complete of six articles on SA about DR Congo-focused tin miner Alphamin Assets (OTCPK:AFMJF) (TSXV:AFM:CA). The newest of them was in November and in it I mentioned that the corporate was beginning to look undervalued as tin costs rebounded from November lows.

Nicely, Alphamin not too long ago launched its monetary outcomes for This autumn 2022, and I feel that the quarterly EBITDA of $27 million was at a good degree contemplating the typical tin worth achieved slumped by 44.2% yr on yr. That being mentioned, I am not bullish on the inventory as tin costs have been below strain over the previous few months on account of excessive international inflation. For my part, 2023 might be a difficult yr for Alphamin. Let’s evaluation.

Overview of the This autumn 2022 monetary outcomes

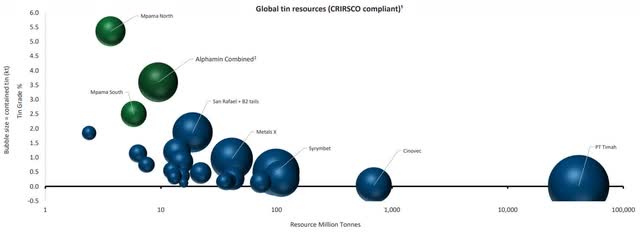

In case you have not learn any of my earlier articles about Alphamin, here is a fast description of the enterprise. The corporate is predicated in Mauritius and its foremost asset is a 84.14% curiosity within the Bisie tin advanced within the Walikale territory of the province of North Kivu within the DRC. The challenge accommodates the Mpama North and Mpama South deposits, and the grades on the former are about 4 instances increased than most different working tin mines internationally. As of June 2022, Mpama North had measured and indicated assets of 155,700 tonnes of tin at a mean grade of 4.98%, Following an in depth drilling marketing campaign in 2022, the indicated useful resource at Mpama South soared by 286% to 80,200 tonnes at a mean grade of two.46%.

Alphamin Assets

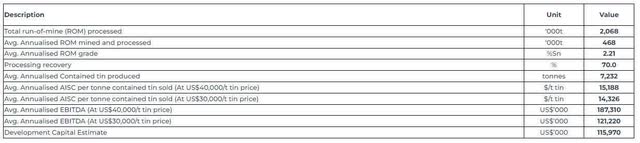

Mpama North has an annual output of about 12,000 tonnes of tin and Alphamin is constructing a mine at Mpama South that’s anticipated to spice up manufacturing by about 7,200 tonnes per yr. The challenge has an preliminary CAPEX of about $116 million and is predicted to be accomplished by December. It would increase Alphamin’s share of worldwide tin manufacturing to about 6.6%. Based on a preliminary financial evaluation launched in March 2022, the all-in sustaining prices (AISC) at Mpama South are anticipated to be near the degrees of Mpama North regardless of the a lot decrease grade.

Alphamin Assets

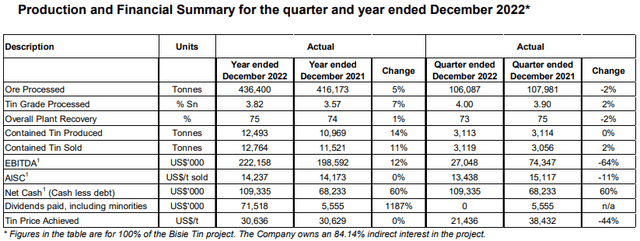

Turning our consideration to the This autumn outcomes for Bisie, you possibly can see from the desk under that tin manufacturing got here in at 3,113 tonnes. This exceeded the market steerage of three,000 tonnes and AISC fell by 11.1% yr on yr to $13,438 per tonne. Sadly, the principle cause prices fell was low tin costs as a big a part of AISC is tied to the worth of the metallic. The common tin worth achieved in This autumn crashed by 44.2% to $21,436 per tonne as rising costs in November and December could not compensate for a weak worth surroundings in October. On a optimistic be aware, Alphamin completed December with money and money equivalents of $ 119.4 million, which put the web money place at $109.3 million.

Alphamin Assets

Sadly for Alphamin, tin costs have been falling quickly since briefly surpassing $32,000 per tonne in late January and I do not anticipate them to get well anytime quickly. Plainly the corporate’s Q1 2022 monetary outcomes are prone to be underwhelming.

Buying and selling Economics

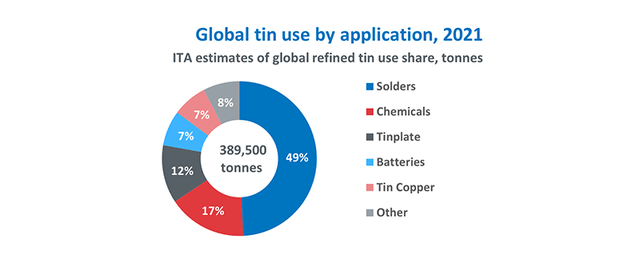

So, why are tin costs declining in the mean time? Nicely, knowledge from the Worldwide Tin Affiliation reveals that about half of worldwide tin demand comes from soldering for digital circuit boards.

Worldwide Tin Affiliation

Low tin inventories and constrained manufacturing on account of Covid-19 lockdowns led to a big worth enhance within the first half of 2022. Nevertheless, with manufacturing ramping up and excessive inflation and rising rates of interest decreasing demand for digital merchandise, costs are actually below strain. Based on knowledge from the Worldwide Tin Affiliation, tin demand is estimated to have fallen by 0.6% in 2022 on account of excessive inflation. That is considerably under the earlier forecasts for progress of 3-4%. Contemplating inflation charges internationally stay excessive and main central banks are nonetheless elevating rates of interest, I anticipate the tin market to stay difficult in 2023. For my part, the typical tin worth achieved by Alphamin throughout this yr is prone to be about $20,000-$22,000 per tonne. Contemplating Mpama South is predicted to be commissioned round December, I anticipate Bisie’s 2023 output to face at about 12,000 tonnes of tin which might put Alphamin’s EBITDA for the yr within the area of $100 million.

General, I feel this might be a superb time for buyers to trim or shut positions. Whereas I imagine that 2023 shall be a tricky yr for Alphamin, brief promoting mining firms is harmful as the costs of commodities are notoriously risky. I stay optimistic about the long run prospects for Alphamin and tin demand on account of rising demand from electrical car batteries. Contemplating that the Worldwide Tin Affiliation regards $30,000 per tonne as the bottom worth required to draw new funding within the sector, I feel that it is seemingly demand will surpass provide over the approaching years.

Wanting on the dangers for the bear case, potential catalysts for tin costs in 2023 embrace a ban on exports of tin ingots in Indonesia in addition to elevated competitors within the tin smelting enterprise. As well as, the closure of any main mine might ship costs hovering. The latest instance was in January when tin briefly elevated above $30,000 per tonne as Peruvian mining large Minsur briefly suspended operations at its San Rafael tin mine on account of nationwide protests.

Investor takeaway

Alphamin completed 2022 on a powerful be aware and excessive tin costs in the course of the first half of the yr allowed it to fund the event of Mpama South with out resorting to debt. The corporate has a powerful steadiness sheet and it managed to develop the assets at Bisie considerably over the previous yr.

Nevertheless, I feel that tin costs are prone to hover round $20,000 per tonne in 2023 as excessive inflation and rising charges are sapping demand for discretionary items. For my part, Alphamin’s EBITDA is prone to be within the area of $100 million in 2023 and this does not appear to be a very good time to open a place right here. For my part, it might be greatest for risk-averse buyers to keep away from this inventory.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please pay attention to the dangers related to these shares.