It isn’t solely the Fed this time but in addition the US Banks and extra exactly the SVB Monetary Group SIVB which drifted by -60.41% yesterday. Shares of SVB, the father or mother of Silicon Valley Financial institution, disclosed the loss and sought to boost $2.25 billion in recent capital by promoting new shares. The 4 largest US banks misplaced $47 bln in Market Worth! (BoA, Citi, JP Morgan, Wells Fargo). Jobless Claims unexpectedly ticked up. Germany February last CPI stays sticky at +8.7% vs +8.7% y/y prelim. UK January month-to-month GDP +0.3% vs +0.1% m/m anticipated.

In a single day: BoJ left coverage unchanged, as universally anticipated, in Governor Kuroda’s last assembly. The coverage price was left regular at -0.1%, together with a 0.5% cap on the 10-year JGB yield (YCC).The vote was a unanimous 9-0. JGB & Nikkei (-1.67%) sinks in a single day, the Kuroda swansong maintains Yield Curve Management with no tweaks and outlook stays as Dovish as ever. China’s Xi Jinping takes third time period as President with eye on US.

USDIndex gapped right down to 104.62 low.

VIX climbed 18%, the largest soar since June, to 22.42.

Euro jumped to 1.0590, Sterling up at 1.1950. Yen jumped to 136.96 from 135.80. USDCAD at 1.3850 excessive.

Treasury yields plunged Thursday, first richening on the cooling in weekly jobless claims, then extending decrease as Wall Avenue slumped sharply. Technical shopping for additionally supported the rally in Treasuries.

Shares – US100 dove by -2.05%. The US500 -1.85%. The US30 dropped -1.66%. Russell slid -3%, Topix Banks -5.83%. PacWest Bancorp fell 25%, and First Republic Financial institution misplaced 17%. Charles Schwab Corp. fell 13%, whereas US Bancorp misplaced 7%. America’s largest financial institution, JPMorgan Chase & Co., fell 5.4%. Twitter and Elon Musk face authorized dangers in FTC Probe. Tesla (-4.99%).

USOil – dips to $74.93.

Gold – rebounds to $1834.79 however appears to be capped round right here by the hawkish Fed outlook.

Cryptocurrencies – BTC – under $20K, stuffed January’s hole! Subsequent helps at 2022 backside!

Right now – NFP and Canadian Labor information!

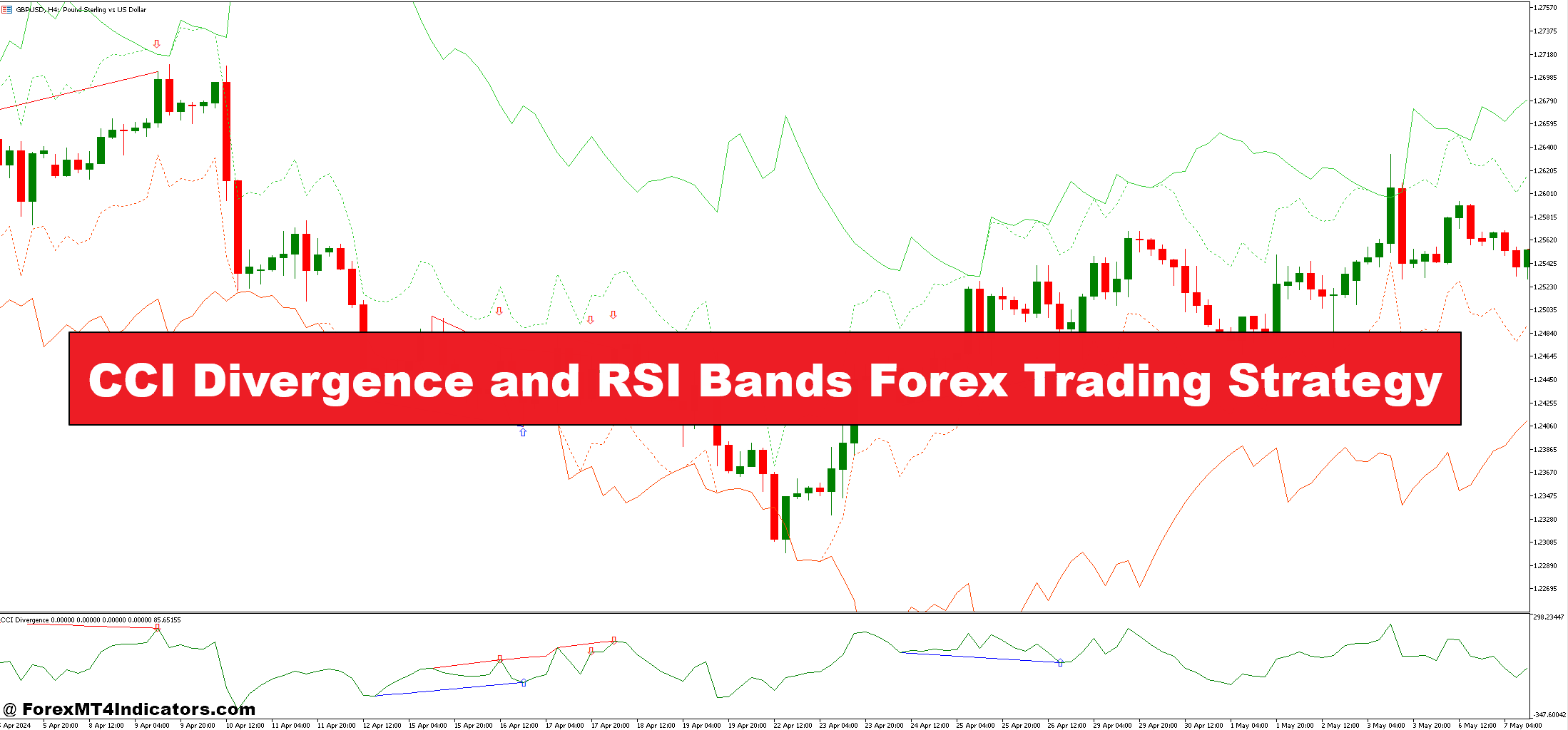

Largest FX Mover @ (07:30 GMT) VIX(+18%). Spiked to 22.42. MAs are actually flat, MACD histogram & sign line stay nicely above 0, RSI 79 however flat, Stochastics falling, H1 ATR 0.36, Each day ATR 1.24.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is supplied as a common advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or ought to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.