Up to date on March seventh, 2023 by Samuel Smith

At first look, PennantPark Floating Charge Capital (PFLT) has nice attraction to earnings traders. That’s as a result of PennantPark has a staggering 10.8% dividend yield. As well as, in contrast to lots of its rivals, the corporate has managed to pay the identical dividend per share for seven consecutive years.

PennantPark is one in every of over 100 shares in our protection universe with a 5%+ dividend yield. You’ll be able to see your complete listing of 5%+ yielding shares by clicking right here.

Not solely that, however PennantPark additionally pays its dividend every month. This enables traders to compound their wealth much more shortly than a inventory that pays a quarterly or semi-annual dividend.

There are at the moment 69 month-to-month dividend shares. You’ll be able to obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink beneath:

However, as is so typically the case with sky-high dividend yields, PennantPark’s enticing dividend yield could also be too good to be true.

This text will talk about the corporate’s enterprise mannequin, and whether or not or not the payout is sustainable over the long run.

Enterprise Overview

PennantPark is a Enterprise Growth Firm, or BDC. It supplies principally debt financing, sometimes first-lien secured debt, senior notes, second lien debt, mezzanine loans, or personal high-yield debt. It makes a speciality of making debt investments to middle-market corporations. To a lesser extent, it additionally makes most well-liked and customary fairness investments. The newest steadiness sheet confirmed about 87% of the corporate’s complete investments have been in first-lien senior secured debt.

The corporate’s portfolio is extremely diversified, with no specific trade making up greater than 8% of the overall combine, and the bulk comprising lower than 3% of the overall.

Supply: Investor Presentation

As well as, the corporate’s portfolio is floating charge, which opens up its yields to rate of interest volatility. This may be good in occasions of rising charges however is unfavorable ought to charges decline.

An outline of the corporate’s funding philosophy reveals PennantPark prefers middle-market corporations with $15 million to $50 million in annual EBITDA and has a excessive charge of underwriting success.

Solely 16 of the corporate’s 391 investments since inception have reached the non-accrual stage. This monitor document of excellent underwriting is a key benefit for PennantPark, and it’s this excellent credit score high quality that has helped the corporate keep its dividend on the similar charge for a number of years.

Supply: Investor Presentation

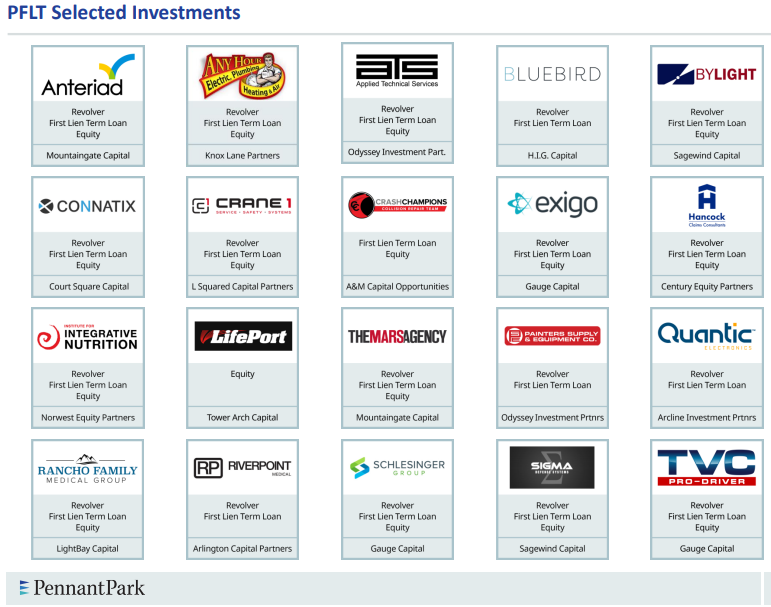

Above is a sampling of the varieties of investments the corporate makes in goal corporations. Not solely are the targets themselves from numerous industries and geographies, however PennantPark has a wide range of devices with which to make its investments.

First-lien secured debt is the popular instrument given its favorable reimbursement place, however the firm will do revolvers and fairness injections as effectively. That is primarily a floating debt funding agency, nonetheless.

Progress Prospects

PennantPark has demonstrated a monitor document of profitable investments. Nonetheless, its publicity to floating charge devices has triggered its common portfolio yield to fall over the previous a number of years. The yield on PennantPark’s portfolio peaked at simply over 9% on the finish of 2018, however the firm confronted declines within the subsequent years. Nonetheless, the typical portfolio yield is again to 11.3% following the sizable will increase in charges we’ve seen in 2022 and 2023 to date.

As PennantPark’s portfolio is comprised of floating charge devices – principally tied to LIBOR – it advantages when rates of interest are rising. Low charges over the previous decade suppressed the corporate’s funding earnings, however the potential for larger charges is a future catalyst. To an extent, that has come true in 2022-2023 with rising charges.

Monetary outcomes for the primary fiscal quarter ended December 31, 2022, have been introduced by PennantPark Floating Charge Capital Ltd. on February eighth, 2023. The Board of Administrators declared a distribution of $0.10 per share, representing a 5.3% improve from the latest distribution.

Throughout the three months ended December 31, 2022, funding earnings amounted to $31.3 million, comprising $27.6 million from first lien secured debt and $3.7 million from different investments. By comparability, for the three months ended December 31, 2021, funding earnings was $26.3 million, which included $20.1 million from first lien secured debt and $6.2 million from different investments.

The first cause for the rise in funding earnings from the identical interval within the prior 12 months was the rise in the price yield of the corporate’s debt portfolio.

Whereas we consider PennantPark has the monitor document and monetary means to proceed rising within the coming years, we now have issues over its skill to take care of its dividend. We forecast simply 0.1% common annualized development within the coming years on an earnings foundation, from our 2023 base of $1.24 per share.

Dividend Evaluation

PennantPark pays a month-to-month distribution of $0.10 per share. The inventory has a really enticing annualized dividend yield of 10.8%. Even higher, it makes month-to-month dividend funds, so traders obtain their dividends extra continuously than they’d on a quarterly schedule.

Associated: The ten Highest Yielding Month-to-month Dividend Payers

Nonetheless, it is usually necessary to evaluate whether or not the dividend is sustainable. Abnormally excessive dividend yields might be a sign that the dividend is at risk. We’d count on a BDC to have a excessive yield, however the 10.8% yield is excessive even by BDC requirements.

PennantPark Floating Charge additionally has a extremely leveraged steadiness sheet and a payout ratio that typically nears or exceeds 100% of earnings. Whereas the firm can most likely maintain this mannequin whereas the financial system is operating easily – because the steady dividend over the previous decade has proven – it could collapse if the financial system experiences a major and extended downturn that might trigger its loans to underperform.

Nonetheless, shareholders ought to definitely not count on a distribution improve within the close to time period given how shut the payout is to earnings as we speak. PennantPark’s skill to develop the portfolio and its common yields, whereas maintaining bills below management, will decide if the distribution is sustainable.

The corporate at the moment earns extra in NII than it pays out in distributions. Thus, we aren’t anticipating a dividend minimize, however add that if credit score high quality deteriorates, or if charges transfer down, PennantPark’s earnings will endure and a dividend minimize might develop into a actuality. We be aware this hasn’t occurred but, however dangers have risen for PennantPark given the way in which its portfolio is constructed with floating-rate devices. Charges are nonetheless rising as we speak, so we don’t see the dividend as in danger as we speak. Nonetheless, it’s one thing traders ought to monitor repeatedly.

Last Ideas

The outdated saying “high-risk, high-reward” appears to use to PennantPark. It definitely has a horny dividend yield on paper, however there probably might be dividend issues down the street if rates of interest transfer decrease.

If the whole lot goes in keeping with plan, the inventory may generate practically double-digit complete returns on an annual foundation from the yield alone.

There may be an elevated degree of threat for the corporate. If PennantPark doesn’t develop funding earnings, it might be pressured to scale back the dividend sooner or later sooner or later, however we don’t at the moment forecast that.

Nonetheless, traders ought to tread rigorously, and solely these with the next threat tolerance ought to think about shopping for PennantPark regardless of the very excessive yield.

If you’re all for discovering extra high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases shall be helpful:

The key home inventory market indices are one other stable useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].