ImagineGolf/iStock through Getty Pictures

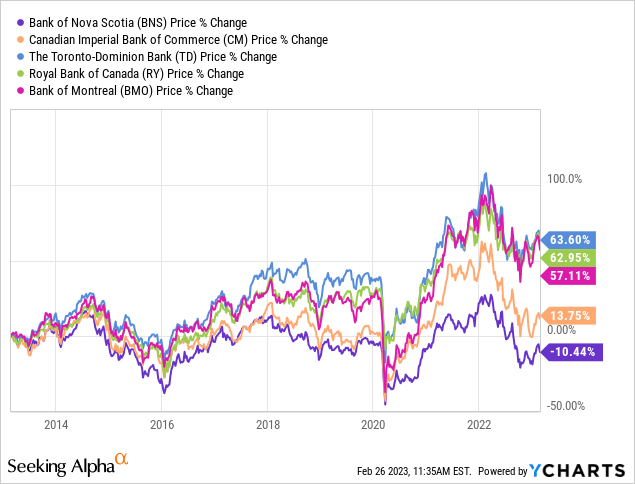

The Financial institution of Nova Scotia (NYSE:BNS) has lengthy set itself other than its Canadian rivals via its publicity to rising markets. I’ve lined them a number of occasions over time, and the financial institution has been a laggard in contrast to the general American inventory market, whereas a few of its friends have outperformed.

Looking for Alpha

My perspective has shifted a bit on this, and I wished to replace my readers on the place the financial institution presently stands, and what the previous decade has regarded like in comparison with the financial institution’s friends.

Looking for Alpha

In latest articles, I’ve mentioned the significance of trying within the rear-view mirror concurrently trying ahead. Winners preserve successful, and an funding in an organization that has lagged the market wants some sort of optimistic catalyst which you could hold your hat on enhancing the corporate’s outcomes going ahead.

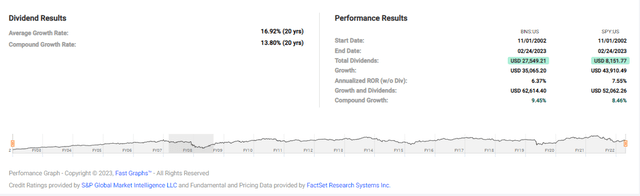

BNS has barely outperformed the market over the long run on account of its beneficiant dividend. Prior to now 2 a long time, the corporate’s worth appreciation has resulted in 6% annualized returns, in comparison with 7.5% for SPY. Nevertheless, including in dividends, an funding in BNS would have resulted in nearer to 9.5% annualized whole returns versus 7.6% in SPY. Nevertheless, the previous ten years, the corporate has underperformed. Since 2013, BNS has returned 2.4% annualized (that is together with the dividend), whereas SPY has returned 13.5%.

Looking for Alpha

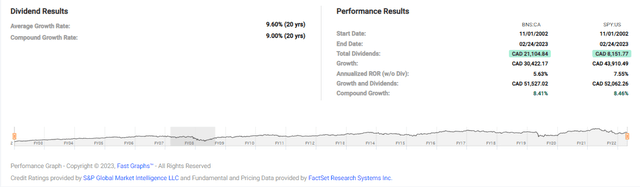

Trying on the Canadian itemizing, the American itemizing has outperformed on account of foreign exchange fluctuations over the long run. An funding within the Canadian itemizing over the previous 2 a long time has returned 8.4% annualized. Over the previous decade, the Canadian itemizing has generated returns of 5.1% annualized in opposition to 2.4% for the American itemizing. For me, I am going to personal the American itemizing regardless, and hope the international change will common out over the long term.

inventory worth returns in opposition to the peer group, BNS has considerably underperformed. An funding in 2013 would have misplaced 10.4% not together with dividends in comparison with a 63% return for the two main Canadian banks, Royal Financial institution of Canada and Toronto-Dominion Financial institution.

So, what’s totally different? The advantages of the Canadian banking market ought to profit all of the banks, and do contemplating the profitability and working metrics. Add to that, BNS has constantly been among the many leaders in its effectivity ratios, or working bills in opposition to revenues. All of the banks have invested closely in digital initiatives over time to convey the banks as much as par. BNS seems to have carried out so responsibly and with an eye fixed to expense development.

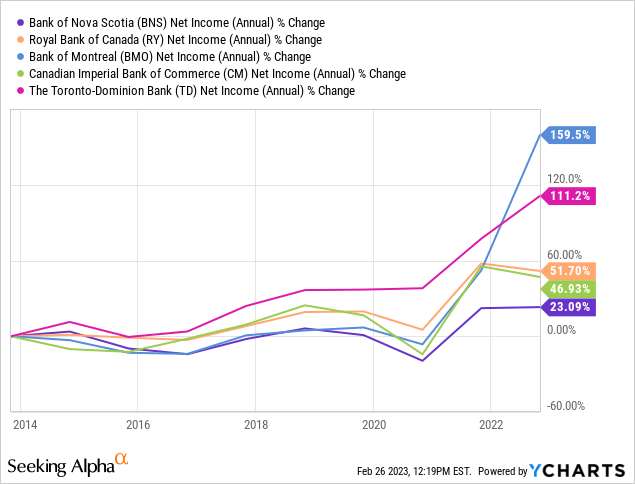

So far as internet earnings goes, BNS is valued cheaper at this time than it was. Though the inventory worth has declined over the previous decade (USD denominated), internet earnings has elevated. The rise is less than par, nevertheless. BMO had a latest surge in the newest 12 months, however was comparatively in-line with Canadian Imperial Financial institution of Commerce and RY previous to that. TD leads the pack, which is not shocking contemplating the success the corporate has pushed in its American operations. BNS is the clear laggard right here.

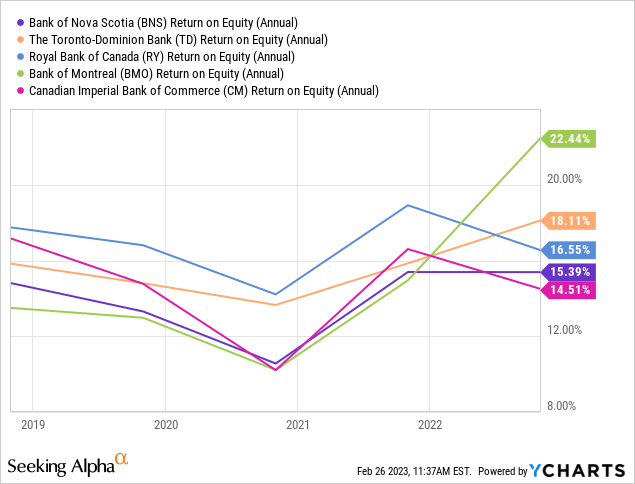

returns on fairness paints a barely totally different image. BNS maintains a return on fairness higher than CM, which is probably going on account of CM’s late-entry into the American market contemplating the financial institution used to steer the group when it operated solely in Canada. Once more, TD leads the pack and BMO had a latest surge based mostly on their earnings bump. There is a theme growing right here.

The last word challenge is the corporate’s worldwide operations. In the newest 12 months, BNS drove a 26.4% return on fairness in its Canadian Banking operations, up from 25.3% in 2021. Nevertheless, the Worldwide Banking phase drove 13% ROE from 10.6% the 12 months prior. Though these figures aren’t horrible in comparison with the world banking phase, worldwide banking is finally dilutive to BNS ROE over time.

The upper returns on fairness general come from the Canadian banking market. The federal government enforces the oligopoly and maintains a strict regulatory setting which lowers danger, retains out international competitors, and finally drives increased profitability. I’ve written at size about this in previous articles, nevertheless it bears repeating. The bigger the Canadian banks’ operations get exterior of Canada, the extra seemingly you see returns on fairness dip. It seems the American market has been higher for TD than the Pacific Alliance and worldwide markets have been for BNS.

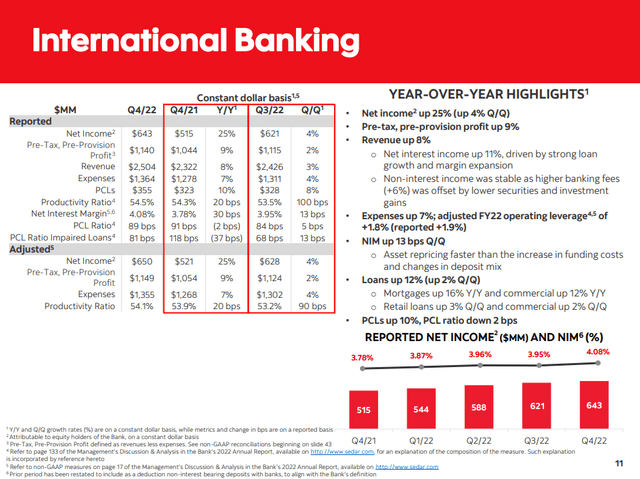

Firm Presentation

So far as the financial institution’s worldwide outcomes, profitability bounced again this previous 12 months. Internet earnings grew 25% yoy, and BNS maintains a better internet curiosity margin in worldwide banking than the house market.

The issue right here is the excessive development buyers anticipated from this phase have not materialized. BNS has a foothold and has opportunistically grown within the markets most well-suited to accretive bottom-line development. The chance is immense.

Latin America is underbanked, general, and because the economies develop in these nations, BNS sustaining a management place there ought to yield robust outcomes. Nevertheless, to this point, the phase has been extra of a drag on the corporate’s outcomes than a boon. Effectivity ratios there improved from 54.2% to 53.2% in 2022, however nonetheless lag the Canadian operation’s 44.6%, an enchancment from 45.2% in 2021. The financial institution has had problem reaching its all-bank effectivity ratio goal of fifty%, which was torpedoed by the pandemic.

In all, BNS invested within the Pacific Alliance to spur development, to blended outcomes. The funding has weighed on the financial institution general, however earnings are rising, if slowly.

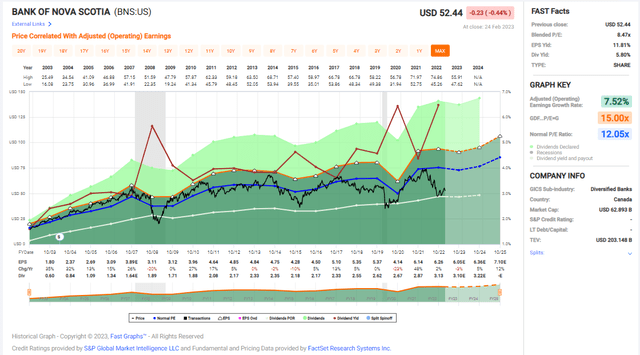

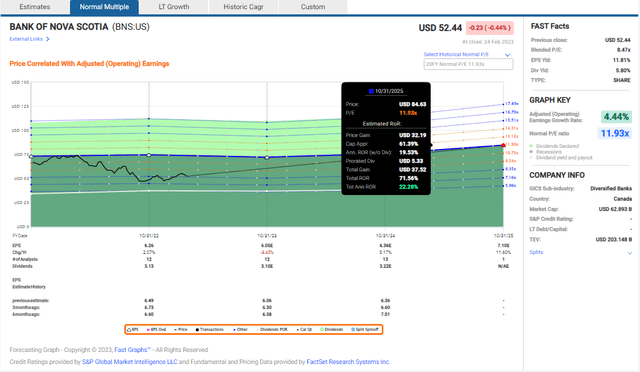

FAST Graphs

Trying on the previous 20 years or so, BNS inventory is buying and selling at a reasonably substantial low cost to its long-term common of 12X earnings. The dividend yield has ballooned to five.8%, appreciable increased than the earlier occasions I’ve written on the corporate and far increased than friends RY, TD, and BMO.

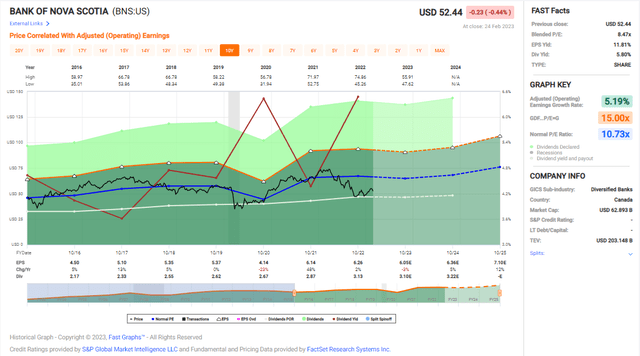

FAST Graphs

Zooming in a bit bit, it is simpler to know why. Earnings development has dropped from the long-term common of seven.5% to five% up to now decade, and the financial institution’s common a number of has come down with it to 10.7X earnings. The financial institution continues to be undervalued in comparison with that common, however much less so.

FAST Graphs

Based mostly on a return to 12X earnings, an funding at this time may yield an annualized whole return of as much as 22%. Nevertheless, it is tough to see the catalyst to drive it there. I do assume BNS is undervalued, even contemplating its lagging efficiency indicators.

I believe an funding at this time will internet you a strong dividend yield, which may be very unlikely to be minimize. Reversion to the imply as the general financial setting improves ought to present buyers a strong return from right here. Nevertheless, I view an funding at this time as extra short-term with an eye fixed as to if the financial institution can flip it round. The CEO is popping over this month, as Brian Porter retires and is changed by board member L. Scott Thomson. Thomson took over earlier this month and has been a member of the board of administrators since 2016. Nevertheless, previous to that, he labored at Talisman Vitality, Bell Canada, and Goldman Sachs.

It is going to be fascinating to see how he steers the ship from right here. Bringing in an outsider might be good for the financial institution, contemplating its relative underperformance in opposition to the peer group. Nevertheless, it is a danger.

Macro dangers stay, and the Canadian housing market is clearly a degree of competition for an funding in any Canadian financial institution. I’ve mentioned that in earlier articles, and it isn’t one thing I see as a big danger to a long-term thesis. Nevertheless, a housing downturn is probably going, and reducing charges is possible into the top of subsequent 12 months. BNS administration has mentioned being well-positioned to learn from a reducing fee setting, shifting product combine round. They need to be, contemplating the zero rate of interest setting of the last decade earlier than the pandemic.

In all, I believe BNS inventory is a purchase right here on a shorter-term reversion to the imply. As for a longer-term funding, I am going to follow RY and TD for now till I see enhancements within the firm’s development initiatives.