sarawuth702

Funding Thesis

On the present value, the market appears to be valuing Preformed Line Merchandise (NASDAQ:PLPC) as if it’s a no-growth firm. Whereas the corporate has had regular revenues and income for a few years, since roughly 2016 the corporate has began to develop persistently. Most of this development has been pushed by its U.S. phase as the corporate’s product portfolio is benefitting from developments in 5G adoption, electrical car infrastructure and grid upgrades, and photo voltaic power adoption. Preformed Line Merchandise is supporting this development via innovation and acquisitions. Traders may benefit as revenues proceed to climb, and the market lastly realizes the trajectory of this seemingly misunderstood or ignored firm.

Introduction

Preformed Line Merchandise has been round since shortly after World Warfare II when its founder Tom Peterson invented a helical preformed rod to safe cables. The primary facility was in Cleveland, Ohio, however the firm shortly started to increase each within the U.S. and globally. At the moment, the corporate exists in over 20 international locations and helps quite a lot of industries, primarily Communications and Vitality. It produces a menagerie of merchandise largely within the realm of {hardware}, and the corporate additionally gives inspection providers akin to energy line inspection utilizing drones.

Base-Case Valuation

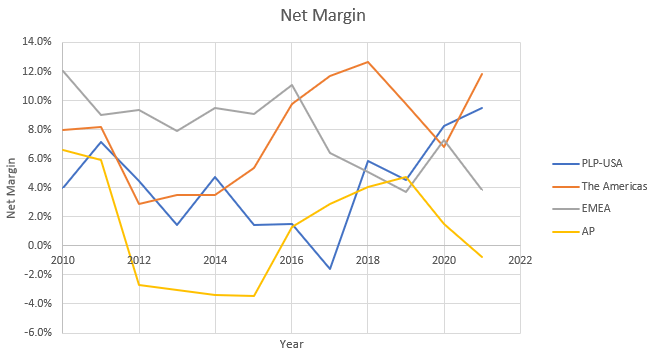

The market appears to be assuming that Preformed Line Merchandise goes to haven’t any development, as might be proven in a easy valuation. In a no-growth situation, one can calculate the worth of a inventory based mostly with the PE ratio, which is able to merely be 1/(low cost fee). I usually use a reduction fee of seven%, which might give a PE of 14.3. Since I need to take into account this over the long-term, I don’t merely need to use the present EPS. These days, the corporate has had increased web margins, however margins have different over time, as proven within the following desk:

12 months

Internet Margin

2010

6.8%

2011

7.3%

2012

6.7%

2013

5.0%

2014

3.3%

2015

1.9%

2016

4.5%

2017

3.3%

2018

6.1%

2019

5.2%

2020

6.4%

2021

6.9%

Common

5.3%

Click on to enlarge

If I take the trailing 12-month income of $597M and multiply by a web margin of 5.3% and by a PE ratio of 14.3 I get a valuation of $91.87-not removed from the present share value. In a base-case no-growth situation, the inventory is pretty priced. Nevertheless, because the firm is in actual fact rising as I’ll describe beneath, the present value is clearly at a reduction to the place the inventory ought to be buying and selling.

The Progress Breakdown

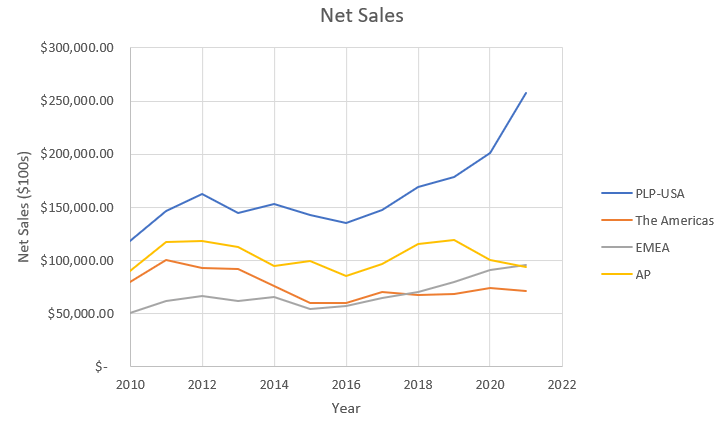

Preformed Line Merchandise has had steadily rising web gross sales revenues over the previous a number of years and simply broke via the $500M threshold in 2021. Nevertheless, the corporate has not been rising the identical throughout all segments. It breaks down its enterprise by geographies: the US; the Americas (North and South America, excluding the U.S.); Europe, the Center East, and Africa (EMEA); and Asia-Pacific. Traditionally, all of those segments have been comparatively regular, however lately Asia-Pacific suffered from the Covid-related lockdowns as was defined within the 2021 annual report:

Whereas the continuing COVID-19 pandemic has not had a fabric impact on our total outcomes, it has continued to create challenges for us in international locations which have important outbreak mitigation methods, specifically, international locations in our Asia-Pacific enterprise phase, which led to non permanent venture postponements and continued to influence outcomes on this phase.

Then again, PLP-USA has grown web gross sales considerably with 28% development from 2020 to 2021. EMEA has had some development as effectively over the previous few years, however in any other case the EMEA phase and the Americas phase have stayed comparatively steady. The chart beneath exhibits the revenues for all 4 segments since 2010.

Creator created with information from PLPC annual stories

The corporate sells the sorts of merchandise most individuals neglect about however which can be completely essential-things like mounting brackets, connectors, guards, insulators, and different {hardware}. Whereas these things could seem boring, the corporate is approaching them in progressive methods and has positioned itself to learn from some very high-growth developments.

5G Adoption

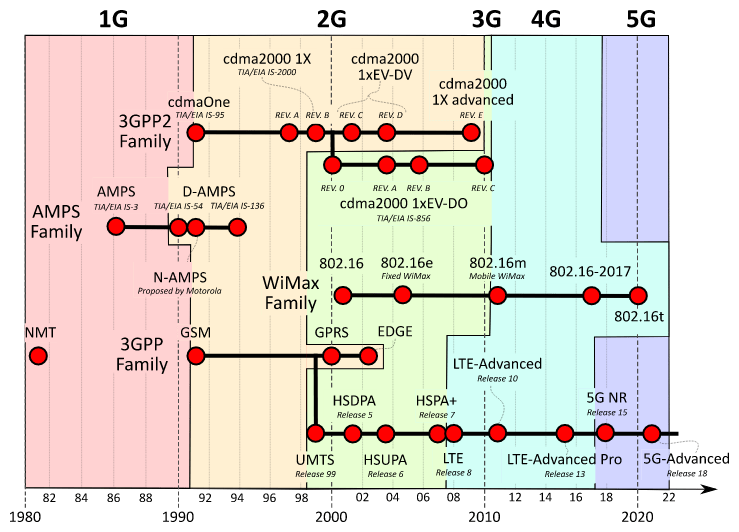

Over the previous a number of many years, the communications trade has superior via 5 generations of know-how, comprised of quite a few particular applied sciences. Every of those generations has lasted roughly 10 years, as might be seen within the determine beneath.

Wikicommons

Primarily based on this, we’re solely 4 years into the 5G adoption cycle and nonetheless have a number of years to go. Because of this, CAGR estimates for the 5G market are fairly optimistic, starting from 34% to nearly 60%.

For the reason that mid-90s, Preformed Line Merchandise has developed equipment for the fiber optics trade, together with the COYOTE® model of fiber optics closures and equipment. The corporate has continued to assist this a part of the enterprise and, in 2019, acquired MICOS TELCOM s.r.o., additional enabling 5G assist. Preformed Line Merchandise has continued to innovate on these merchandise, growing improved variations such because the COYOTE® HD Dome Closure beneath.

Preformed Line Merchandise

With a portfolio of merchandise that assist fashionable communications networks, Preformed Line Merchandise is in an incredible place to learn from the development towards 5G.

Electrical Automobiles

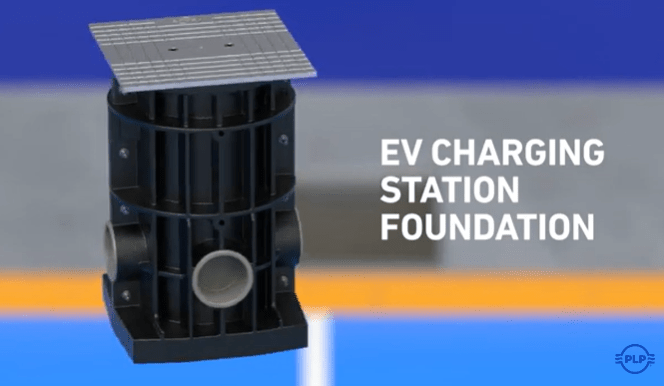

As the electrical car market expands, the electrical car charging infrastructure should increase with it. Sluggish charger installations are rising; even on the low-end globally, the variety of gradual chargers within the U.S. grew 12% in 2021. Once more, Preformed Line Merchandise is able to take benefit, having developed an EV charging station basis. To not point out, the corporate provides all types of distribution, transmission, and substation merchandise to assist get the electrical energy to the chargers within the first place.

Preformed Line Merchandise

Photo voltaic Vitality

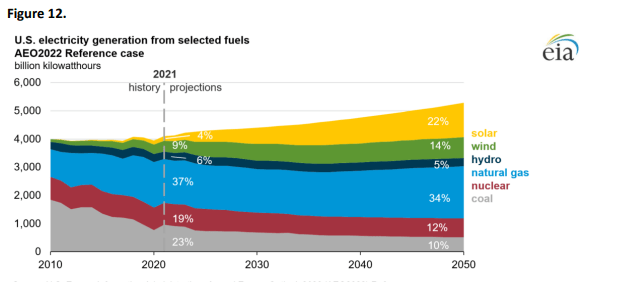

The push for renewable power is obvious, and photo voltaic is projected by the U.S. Vitality Info Administration (eia) to develop sooner than all different varieties of renewable power sources, as of 2022.

2022 Annual Vitality Outlook (eia)

Preformed Line Merchandise has been within the solar energy {hardware} enterprise for years, producing floor mounts, pole mounts, and roof mounts. One of the crucial progressive merchandise it has is a photo voltaic panel carport.

Preformed Line Merchandise

Preformed Line Merchandise is once more producing the boring accent merchandise, however in one of many quickest rising markets within the power sector.

Acquisitions

One of many methods Preformed Line Merchandise has chosen to assist its expansion-in addition to its personal innovation-is via acquisitions of complementary companies. Simply this month, it acquired Plastics Pilot, Inc. in Ohio to increase its injection molding capabilities and its manufacturing footprint. In June of final yr, it acquired Fonderie Richelieu to increase its native manufacturing functionality in Canada. In March 2022, it acquired a molded components producer, HOLPLAST s.r.o., within the Czech Republic. All of that was simply up to now 12 months. The sample appears to be that Preformed Line Merchandise acquires small firms with whom it has had long-standing relationships as companions or suppliers, so these acquisitions appear very strategic.

Financials & Dangers

Preformed Line Merchandise has sturdy financials. It has $308 million in present belongings, a lot to cowl its present liabilities of $120 million. Its long-term debt is just $56 million. Even when the opposite non-current liabilities and deferred revenue taxes of $23 million is added in, its long-term debt to fairness is just 0.17. Its gross margins have been extremely constant, starting from 29% to 33% since 2010 no less than. Whereas web revenue has been destructive in a few of its segments on occasion, akin to in AP from 2012 to 2015, in whole the enterprise has been worthwhile for a few years. The chart beneath exhibits web margin percentages by phase over time.

Creator created with information from PLPC annual stories

One other encouraging statistic is that the p.c held by insiders is extremely excessive, at over 51%. All indicators level to this being a powerful firm that has been neglected by the market. For me to be involved concerning the efficiency of this firm, one thing fairly important must occur. The U.S. phase must falter, which is feasible; PLP-USA briefly had a destructive web margin in 2017. Even then, with a globally numerous market presence, the opposite segments may assist carry the corporate as they’ve accomplished whereas the AP phase has suffered from Covid-19 lockdowns.

Conclusion

The market is treating PLPC as if the corporate is about up for no development, although in actual fact it has grown steadily for a number of years now and is poised to proceed. Most of that development is coming from the U.S. phase, because the services Preformed Line Merchandise gives assist a few of the quickest rising markets. The corporate stands to learn from developments towards 5G, electrical autos, and photo voltaic power. It’s supporting that growth via steady innovation and strategic acquisitions. With a powerful steadiness sheet and a worldwide footprint, this firm that has been round for over 75 years will probably be right here for 75 extra. I fee this inventory as a powerful purchase because the market underestimates how this firm is already rising, increasing, and innovating, supporting some extremely high-growth developments.