Up to date on February 18th, 2023 by Samuel Smith

Spreadsheet information up to date each day; Prime 10 checklist is up to date when the article is up to date

Return on invested capital, or ROIC, is a beneficial monetary ratio that buyers can add to their analysis course of.

Understanding ROIC and utilizing it to display screen for top ROIC shares is an efficient option to give attention to the highest-quality companies.

With this in thoughts, we ran a inventory display screen to give attention to the best ROIC shares within the S&P 500.

You’ll be able to obtain a free copy of the highest 100 shares with the best ROIC (together with essential monetary metrics like dividend yields and price-to-earnings ratio) by clicking on the hyperlink beneath:

Utilizing ROIC permits buyers to filter out the highest-quality companies which are successfully producing a return on capital.

This text will clarify ROIC and its usefulness for buyers. It would additionally checklist the highest 10 highest ROIC shares proper now.

Desk Of Contents

You should utilize the hyperlinks beneath to immediately soar to a person part of the article:

What Is ROIC?

Put merely, return on invested capital (ROIC) is a monetary ratio that exhibits an organization’s means to allocate capital. The frequent system to calculate ROIC is to divide an organization’s after-tax web working revenue, by the sum of its debt and fairness capital.

As soon as the ROIC is calculated, it’s evaluated in opposition to an organization’s weighted common price of capital, generally known as WACC. If an organization’s WACC isn’t instantly accessible, it may be calculated by taking a weighted common of the price of an organization’s debt and fairness.

Value of debt is calculated by averaging the yield to maturity for an organization’s excellent debt. That is pretty straightforward to search out, as a publicly-traded firm should report its debt obligations.

Value of fairness is usually calculated through the use of the capital asset pricing mannequin, in any other case often called CAPM.

As soon as the WACC is calculated, it may be in contrast with the ROIC. Traders need to see an organization’s ROIC exceed its WACC. This means the underlying enterprise is efficiently investing its capital to generate a worthwhile return. On this method, the corporate is creating financial worth.

Typically, shares producing the best ROIC are doing the perfect job of allocating their buyers’ capital. With this in thoughts, the next part ranks the ten shares with the best ROIC.

The Prime 10 Highest ROIC Shares

The next 10 shares have the best ROIC. Shares are listed so as from lowest to highest.

Excessive ROIC Inventory #10: Darden Eating places Inc. (DRI)

Return on invested capital: 30.8%

Darden Eating places Inc. is a restaurant firm with a portfolio of manufacturers together with Olive Backyard, LongHorn Steakhouse, Cheddar’s Scratch Kitchen, Yard Home, The Capital Grille, Seasons 52, Bahama Breeze, and Eddie V’s. The corporate employs 165,000 crew members, and as of the fiscal 12 months ending Might 31, 2022, it owns and operates over 1,800 eating places in the USA and Canada, and 71 franchisees serve eating places. Darden Eating places Inc. has a $16.9 billion market capitalization and a 10-year dividend CAGR of 15.0% earlier than the COVID-19 pandemic. Nonetheless, just lately the corporate has been very aggressive in growing its dividend.

Darden Eating places, Inc. has grown working margins for the previous 5 years. 2014 working margin was 4.6%, which elevated to 9.9% on the finish of 2022. This efficiency was attributable to income development, outpacing promoting, common, and administrative bills. Nonetheless, the working margin is at present sitting at a 12.1% fee. After FY2022, we forecast 4% earnings-per-share development yearly over the following 5 years, which is able to give the corporate anticipated earnings of $9.50 per share for 2028. Web margin has additionally been growing over the previous few years, which is able to assist with earnings development.

Supply: Investor Presentation

Click on right here to obtain our most up-to-date Positive Evaluation report on Darden Eating places Inc. (preview of web page 1 of three proven beneath):

Excessive ROIC Inventory #9: Greatest Purchase Co. Inc. (BBY)

Return on invested capital: 35.5%

Greatest Purchase Co. Inc. is considered one of North America’s largest shopper electronics retailers, with operations within the U.S. and Canada. Greatest Purchase sells shopper electronics, private computer systems, software program, cellular units, and home equipment and offers providers. On the finish of Q3 FY2023, Greatest Purchase operated 925 Greatest Purchase shops and 19 Greatest Purchase Outlet Facilities within the U.S., 21 Pacific Gross sales Shops, 14 Yardbird Shops, 127 Greatest Purchase shops in Canada, and 33 Greatest Purchase Cell Stand-Alone Shops in Canada. Greatest Purchase exited its Mexico operations in fiscal 2021. The corporate continues to decrease complete retailer depend persevering with a long-term pattern. The corporate’s annual gross sales exceeded $51.7B in fiscal 2022.

Greatest Purchase’s diluted non-GAAP EPS development is risky due to the Nice Recession and the transition to on-line purchasing. In reality, gross sales development was flat-to-negative from fiscal 2012 to 2017. Nonetheless, the corporate’s efforts to prioritize on-line gross sales development, optimize retailer depend and extract price efficiencies led to natural gross sales development and better earnings accelerated by the COVID-19 pandemic. However now gross sales are declining quickly as customers return to extra regular shopping for habits and federal stimulus {dollars} expire. Moreover, inflation and provide chain disruptions are impacting margins. We’re forecasting, on common, 4% EPS and lowered DPS development to six% out to fiscal 2028, however development shall be uneven.

Click on right here to obtain our most up-to-date Positive Evaluation report on Greatest Purchase Co. Inc. (preview of web page 1 of three proven beneath):

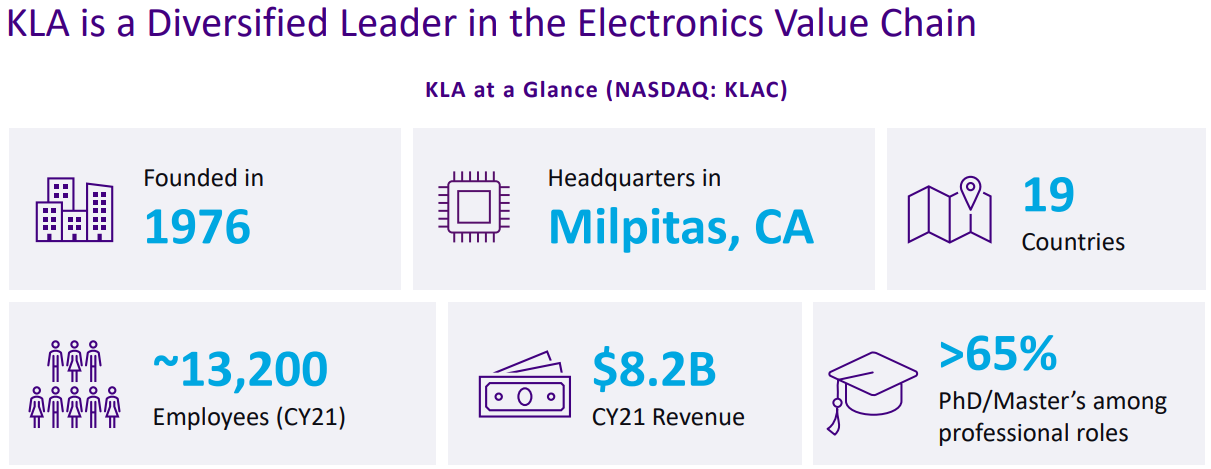

Excessive ROIC Inventory #8: KLA Company (KLAC)

Return on invested capital: 39.4%

KLA Company is a provider to the semiconductor business. The corporate provides course of management and yieldmanagement programs for semiconductor producers reminiscent of TSMC, Samsung and Micron. KLA was created in 1997,via a merger between KLA Devices and Tencor Devices, and has grown via a variety of acquisitionssince then. The corporate is headquartered in Milpitas, CA.

KLA Company’s earnings-per-share development has traditionally come from a mixture of income development, margin enhancements, and share repurchases. The income development outlook stays sturdy, as KLA has been in a position to develop its gross sales significantly over the past couple of quarters. Nearly all of KLA’s revenues come from product gross sales, however service revenues have gotten more and more essential. This can be a optimistic in the long term, as a better fee of recurring service revenues ought to assist KLA’s prime line change into much less cyclical.

Supply: Investor Presentation

Click on right here to obtain our most up-to-date Positive Evaluation report on KLA Company. (preview of web page 1 of three proven beneath):

Excessive ROIC Inventory #7: Ulta Magnificence, Inc. (ULTA)

Return on invested capital: 45.0%

Ulta has considerably impacted the American magnificence retail business with its sturdy model energy. At the moment working completely within the US, the corporate had deliberate a Canadian growth, which was later cancelled earlier than the pandemic outbreak. Ulta’s loyalty program is extremely regarded and among the many finest within the retail sector, a typical attribute of the main retailers that I cowl.

As of the newest replace, this system had 39 million members, which represents a 9% YoY enhance and accounts for roughly 1 / 4 of all ladies within the US. This group generates 95% of gross sales and averages $200 of spend per 12 months. The advertising and marketing and information benefits supplied by this program are immensely beneficial and provide a aggressive edge for the corporate.

Within the magnificence product gross sales business, prime manufacturers maintain important energy and decide the areas the place their merchandise are bought. These high-end manufacturers are extremely selective, and the long-standing relationships developed over time forestall newcomers and a few e-commerce firms from accessing their merchandise. Initially, this may occasionally not appear economically possible. Nonetheless, the picture of luxurious merchandise is essential. This offers Ulta an almost impenetrable benefit that few retailers can match.

Excessive ROIC Inventory #6: Gen Digital (GEN)

Return on invested capital: 49.1%

Gen Digital was fashioned after the merger of NortonLifeLock and Avast. The corporate offers safety options for customers all over the world. It affords Norton 360, an built-in platform offering safety with a subscription mannequin for private computer systems and cellular units.

It additionally affords Norton and LifeLock identification theft safety answer that gives monitoring, alerts, and restoration providers to its clients. The corporate additionally offers Norton Safe VPN options.

GEN inventory has a market capitalization above $13 billion. Shares have a present dividend yield of two.3%.

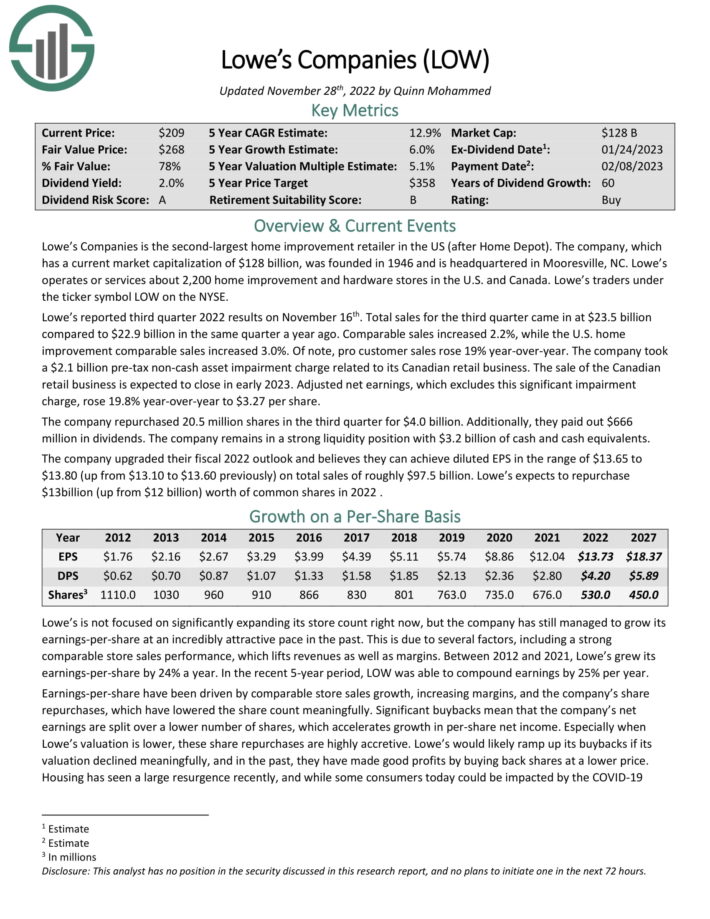

Excessive ROIC Inventory #5: Lowe’s Corporations (LOW)

Return on invested capital: 56.8%

Lowe’s Corporations is the second-largest house enchancment retailer within the US (after Dwelling Depot). Lowe’s operates or services greater than 2,200 house enchancment and {hardware} shops within the U.S. and Canada.

Lowe’s reported third quarter 2022 outcomes on November sixteenth. Whole gross sales for the third quarter got here in at $23.5 billion in comparison with $22.9 billion in the identical quarter a 12 months in the past. Comparable gross sales elevated 2.2%, whereas the U.S. house enchancment comparable gross sales elevated 3.0%. Of observe, professional buyer gross sales rose 19% year-over-year.

The corporate took a $2.1 billion pre-tax non-cash asset impairment cost associated to its Canadian retail enterprise. The sale of the Canadian retail enterprise is anticipated to shut in early 2023. Adjusted web earnings, which excludes this important impairment cost, rose 19.8% year-over-year to $3.27 per share.

The mixture of a number of growth, 6% anticipated EPS development and the two.2% dividend yield result in complete anticipated returns of 12.6% per 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on Lowe’s (preview of web page 1 of three proven beneath):

Excessive ROIC Inventory #4: Apple, Inc. (AAPL)

Return on invested capital: 59.5%

Apple revolutionized private expertise with the introduction of the Macintosh in 1984. As we speak the expertise firm designs, manufactures and sells merchandise reminiscent of iPhones, iPads, Mac, Apple Watch and Apple TV. Apple additionally has a providers enterprise that sells music, apps, and subscriptions.

Apple is the #1 holding of Berkshire Hathaway (BRK.B), making the expertise large one of many prime Warren Buffett shares. Apple can be a prime holding of different influential buyers, reminiscent of Kevin O’Leary.

On February 2nd, 2023, Apple reported Q1 fiscal 12 months 2023 outcomes for the interval ending December thirty first, 2022 (Apple’s fiscal 12 months ends the final Saturday in September). For the quarter, Apple generated income of $117.154 billion, a -5.5% decline in comparison with Q1 2022. Product gross sales had been down -7.7%, pushed by an -8.2% decline in iPhones (56% of complete gross sales). Service gross sales elevated 6.4% to $20.8 billion and made up 17.7% of all gross sales within the quarter. Web revenue equaled $29.998 billion or $1.88 per share in comparison with $34.630 billion or $2.10 per share in Q1 2022.

Click on right here to obtain our most up-to-date Positive Evaluation report on AAPL (preview of web page 1 of three proven beneath):

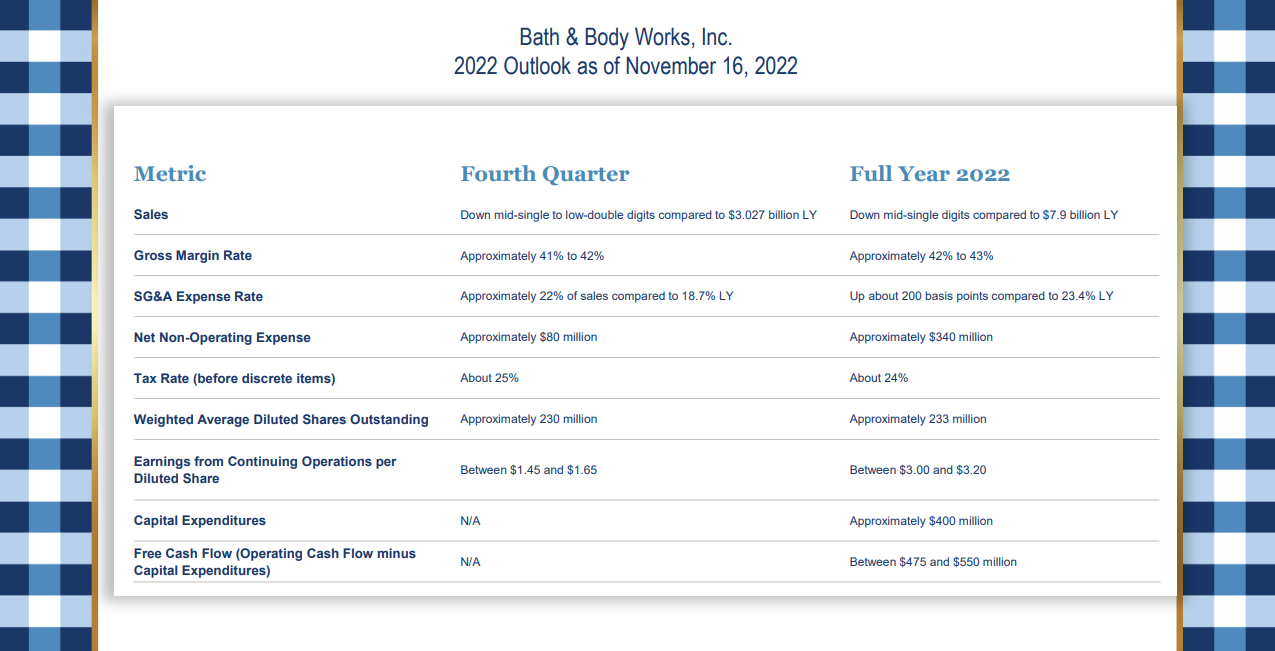

Excessive ROIC Inventory #3: Tub & Physique Works (BBWI)

Return on invested capital: 87.0%

Tub & Physique Works is a specialty retailer of house perfume, physique care, and soaps and sanitizer merchandise. Its manufacturers embody Tub & Physique Works, White Barn, and extra.

The corporate operates over 1,700 company-operated retail shops and one other 300+ worldwide partner-operated shops. The corporate was previously often called L Manufacturers, Inc. and adjusted its identify to Tub & Physique Works, Inc. in August 2021.

Supply: Investor Presentation

Excessive ROIC Inventory #2: HP Inc. (HPQ)

Return on invested capital: 87.0%

Hewlett-Packard’s origins might be traced again to 1935 when two males began a enterprise in a one-car storage. Over the previous eight a long time, the corporate has made important contributions in digital check tools, computing, information storage, networking, software program, and providers.

On November 1st, 2015, Hewlett-Packard spun off its enterprise expertise infrastructure, software program, and providers enterprise, often called Hewlett Packard Enterprise Firm (HPE), and rebranded itself as HP Inc. (HPQ). As we speak, HP Inc. primarily focuses on two essential segments: its product line of printers and its private programs, which embody computer systems and cellular units.

Click on right here to obtain our most up-to-date Positive Evaluation report on HP Inc. (preview of web page 1 of three proven beneath):

Excessive ROIC Inventory #1: AutoZone Inc. (AZO)

Return on invested capital: 180.5%

After opening its first retailer on July 4th, 1979, AutoZone has grown into the main retailer and distributor of automotive alternative elements and accessories, with extra than 6,000 shops within the U.S., Puerto Rico, Mexico, and Brazil. AutoZone carries new and re-manufactured elements, upkeep objects, and equipment for automobiles, SUVs, vans, and light-weight vehicles.

AutoZone has confirmed to be recession–resistant due to the character of its enterprise. Throughout tough financial intervals, the gross sales of recent automobiles fall considerably, inflicting the typical age of automobiles to extend. This favors AutoZone’s enterprise. In the Nice Recession, when most firms noticed their earnings plunge, AutoZone grew its EPS by 18% in 2008 and one other 17% in 2009.

Last Ideas

There are numerous alternative ways for buyers to worth shares. One well-liked valuation methodology is to calculate an organization’s return on invested capital. By doing so, buyers can get a greater gauge of firms that do the perfect job of investing their capital.

ROIC is on no account the one metric that buyers ought to use to purchase shares. There are numerous different worthwhile valuation strategies that buyers ought to think about. That mentioned, the highest 10 ROIC shares on this checklist have confirmed the flexibility to create financial worth for shareholders.

Additional Studying

If you’re enthusiastic about discovering high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases shall be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].