Sundry Pictures

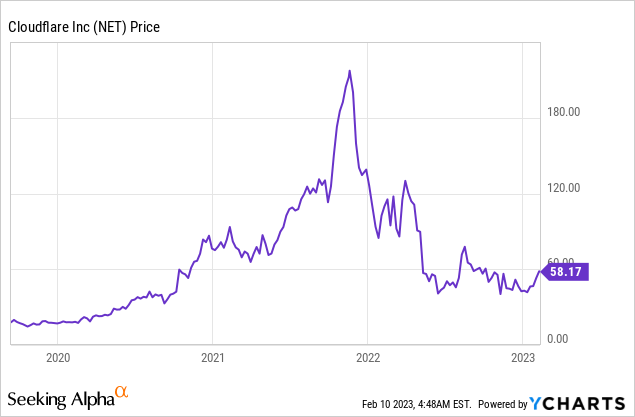

Cloudflare (NYSE:NET) is the world’s largest supplier of a Content material Supply Networks [CDNs], which is mainly a footprint of information centres which maintain a cached model of an internet site in numerous places throughout the globe. The essential concept is if you entry an internet site linked by way of Cloudflare, it is sends you the content material from the closest location, which ends up in sooner loading occasions. Cloudflare has grown to develop into a significant participant on this trade and presently serves ~33% of the Fortune 500. The corporate additionally has a partnership with Apple (AAPL) for its iCloud Personal Relay, which helps Apple customers to cover their IP deal with when looking. Given the issues about “cookies” and privateness, this might be a continued development alternative for Cloudflare. As well as, I found viral platform ChatGPT is one in all Cloudflare’s prospects and the corporate has a possibility to profit from the expansion within the AI trade. In my December put up on Cloudflare I coated its third quarter outcomes and thus on this put up I am might be diving into its fourth quarter outcomes and the AI alternative, let’s dive in.

Enterprise Mannequin Evaluation

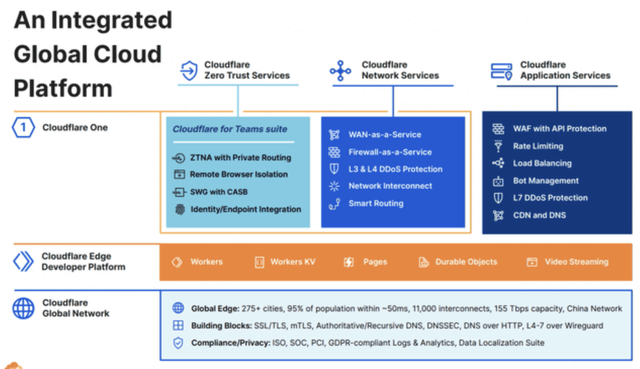

In my September put up on Cloudflare I coated its enterprise mannequin in nice element, on this put up I’ll simply do a fast overview. As talked about within the introduction, Cloudflare is a CDN supplier primarily however it additionally has constructed out its “Cloudflare One Platform”. This platform contains three predominant pillars its Zero Belief service, its Community companies and its functions.

Cloudflare One Platform (Cloudflare)

I consider “Zero Belief” community safety is an space of huge potential. This mainly means customers to a community are given “least privileged entry” by default. A terrific analogy is think about you’re coming into a company workplace (as a customer) and should register for safety causes. In a “Zero Belief” situation, you’re given a badge which provides you entry to a selected assembly room or space, however not your entire organisation. That is way more safe because it successfully means the individual cannot “transfer laterally” and stroll right into a confidential R&D division to steal firm secrets and techniques. The identical is true in I.T networks, Zero Belief mainly offers a person solely entry to the I.T functions they require for his or her function. This may occasionally seem to be widespread sense however most I.T networks are literally designed within the reverse means, the place as soon as a person has entry, they will use nearly each software. Cloudflare continues to be pretty early journey in its Zero Belief product journey and has new options coming in March/April 2023. Nevertheless, the corporate has enormous potential given Gartner forecasts 10% of enormous organizations can have a safe and measurable Zero Belief structure in place by 2026. As well as, the trade is forecast to develop at a 17.3% compounded annual development price up till 2027. Its Community companies embody; Firewall as a service, WAN or Huge Space Community as a service, good routing and extra. Whereas its functions embody very important gadgets akin to Internet Utility Firewalls [WAF] to cease DDoS cybersecurity assaults and cargo balancing to assist functions run easily.

The Neglected AI Alternative

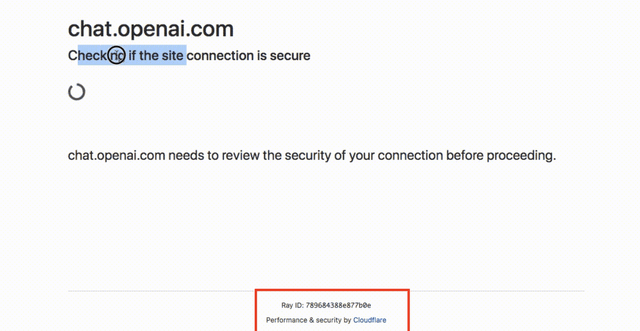

AI has been a scorching matter lately and the trade is forecast to develop at a fast 37.3% compounded annual development price [CAGR] up till 2030. Trade “hype” has additionally been backed up by many actual world functions. A well-liked software launched in November 2022, was Open AI’s ChatGPT, the generative AI chatbot platform, which went viral on-line. This “iPhone second” was a catalyst for buyers to speculate into a spread of firms akin to Microsoft (MSFT), who was an early investor into Open AI and invested an extra $10 billion into the corporate. As well as, AI shares akin to C3.ai (AI), have jumped in value by over 169% since January, regardless of not being instantly associated to Open AI. Nevertheless, I consider many buyers neglected the truth that ChatGPT presently has its efficiency and safety managed by Cloudflare, which then connects to Microsoft Azure. The corporate would not promote this instantly however the observant amongst you’ll discover, that on the connection display screen which generally exhibits up when accessing ChatGPT, it say on the backside “Efficiency & Safety by Cloudflare” (see beneath screenshot). I actually found this in February 2023 and it acts as indication of Cloudflare’s potential to supply related companies to different AI firms.

ChatGPT Cloudflare (Writer screenshot )

The extra ChatGPT customers which use the applying (and thus Cloudflare’s community), the higher quantity of income Cloudflare makes. Particularly as web sites develop, they typically require many extra of the aforementioned companies from improved firewalls to load balancing and so forth. AI firms additionally typically want an answer to run fashions throughout mannequin cloud suppliers, however this may be hampered by “information egrees” insurance policies, which frequently means an organization is charged to entry its personal coaching information from a selected cloud supplier. Cloudflare has a few options for this akin to Cloudflare Employee and its R2 merchandise. Thus Cloudflare is poised to develop into the go to supplier for AI workloads and different hybrid impartial networks.

Fourth Quarter Breakdown

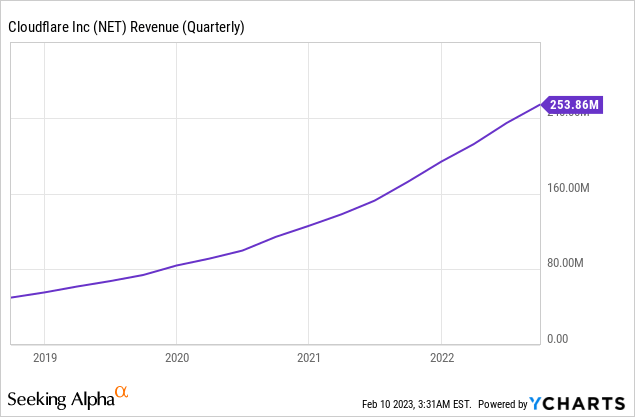

Cloudflare reported robust monetary outcomes for the fourth quarter of 2022. The corporate reported income of $247.7 million which elevated by a fast 42% yr over yr and beat analyst expectations by $0.63 million. This was pushed an additional 134 massive prospects, which pay Cloudflare over $100,000 every year. The income from these bigger prospects additionally elevated by a fast 56% yr over yr and contributed to 63% of its whole. It is a optimistic signal as typically bigger firms have higher potential for cross promoting and likewise are typically extra “sticky” by nature. Due to this fact it was not a shock to find Cloudflare has a brilliant excessive greenback primarily based web retention price of 122%, this implies prospects are staying with the platform and spending extra.

It was nice to see Cloudflare’s prospects vary throughout quite a lot of industries from monetary companies to power, authorities and utilities. This implies the corporate is much less susceptible to a cyclical downturn in a single trade. Extra lately these buyer wins included a Fortune 500 power firm, which signed up a 3 yr deal price $1.6 million, for quite a lot of Zero Belief merchandise. As well as, a Fortune 500 monetary companies firm, expanded its settlement to a $1.1 million, three yr deal. The enterprise did this so as consolidate distributors and once more setup a Zero Belief structure, which is a robust development trade I mentioned within the introduction. “Vendor consolidation” additionally seemed to be a preferred buyer worth proposition, as a Europe primarily based monetary companies big signed a $1.8 million deal, for that motive. Over in Africa, Cloudflare signed an enormous $2.8 million take care of a utility firm for an unlimited Web of Issues [IoT] rollout. This firm is utilising Cloudflare’s community monitoring instruments, to trace round 3,300 sensors. That is an intriguing use case, which undoubtedly opens up the door to additional IoT alternatives. The IoT is forecast to develop at a 26.4% compounded annual development price [CAGR] and attain a worth of over $2.465 trillion by 2029.

In mid December 2022, Cloudflare additionally acquired the distinguished FedRAMP certification, which suggests the corporate can now promote to governments a lot simpler. Its first federal contract was a $7.2 million 5 yr take care of .gov within the U.S. Which means the White Home emails and its press webpages at the moment are enabled by Cloudflare, a giant accountability but additionally an incredible endorsement for Cloudflare. The state of North Carolina additionally has a $3 million deal to assist with election safety, which can be a scorching matter and will provide an extra alternative.

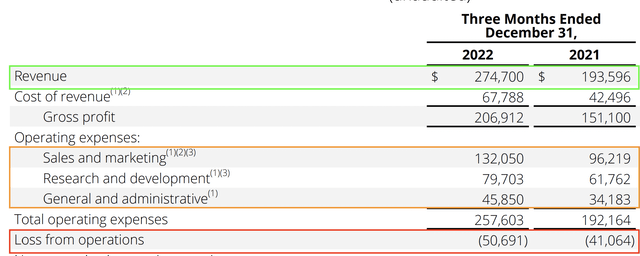

Margins and Bills

Breaking down the margins, for This autumn,22 Cloudflare reported a gross margin of 77.4%, which is above its long run common of 75% which is a optimistic. The corporate did generate an working lack of $50.7 million, which was worse than the prior yr’s loss $41.4 million, in This autumn,21. This was primarily pushed by a 34% improve in working bills to $257.6 million. Nevertheless, a optimistic was bills as a portion of income declined from 99% in This autumn,21 to 93.77% by This autumn,22. This was a results of administration slashing prices in This autumn,22 and working leverage beginning to present within the enterprise.

Cloudflare funds (Revenue assertion, writer annotations)

One other optimistic is 30.9% or $79.7 million of its bills is derived from R&D bills and thus I do not take into account this to be a unfavourable as the corporate should frequently spend money on its product to remain forward of the competitors.

Cloudflare has $1.6 billion in money, money equivalents and marketable securities on its stability sheet, which is stable. The enterprise does have pretty excessive debt of $1.4 billion within the type of convertible senior notes, however the majority of this appears to be “long run” by nature, thus not due inside the subsequent 2 years.

Valuation and Forecasts

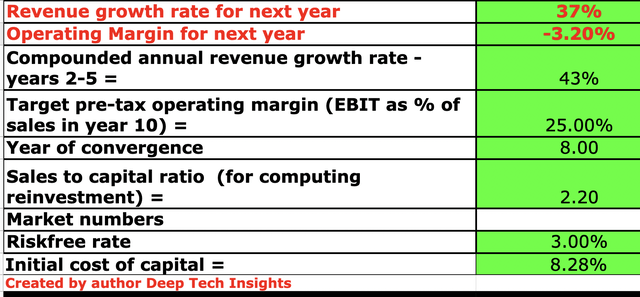

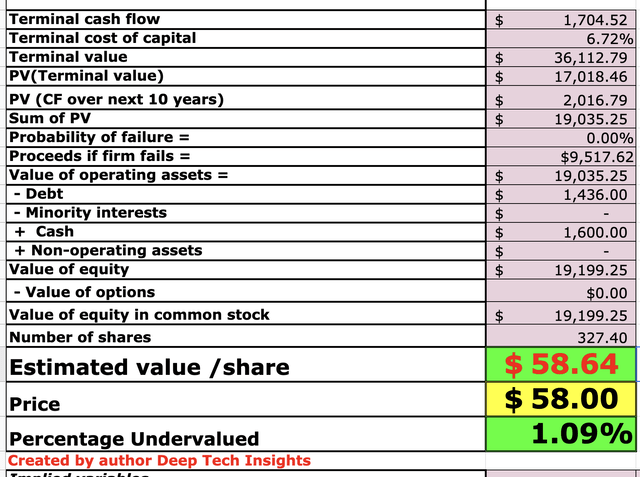

So as to worth Cloudflare I’ve plugged its newest financials into my discounted money circulation valuation mannequin. I’ve forecast 37% income development for “subsequent yr” which in my mannequin refers back to the full yr of 2023. This development price is predicated upon managements steering for the yr, in addition to my very own forecasts of continued development in merchandise associated to Zero Belief. In years 2 to five, I’ve forecast a sooner development price of 43% per yr. This may occasionally appear optimistic however it’s mainly 1% greater than the This autumn,22 YoY development price of 42%. I count on this to be pushed by a rebound within the economic system, which I anticipated to have barely muted demand in 2023 (I’ll talk about extra on this within the “Dangers” part). I’m additionally forecasted tailwinds from AI, to assist improve income development in 2024 onwards, however that is actually an additional bonus.

Cloudflare inventory valuation 1 (created by writer Deep Tech Insights)

To extend the accuracy of the valuation, I’ve capitalized the corporate’s intensive R&D investments, which boosted the web earnings margin to unfavourable 3.2% in 2022. I’ve forecast this margin to develop to 25% over the following 8 years. That is pretty optimistic however not unbelievable given the typical margin of a software program firm is 23% and I consider Cloudflare is “above common” as a consequence of its Fortune 500 buyer base, which has excessive retention. The truth is, administration is bullish on its future retention charges believes it will probably develop this from an incredible 122% to an distinctive 130% web greenback retention price, as its Zero belief and R2 merchandise acquire extra traction. As well as, a portion of Cloudflare’s prospects are within the cryptocurrency trade akin to the biggest alternate within the U.S, Coinbase (COIN), in addition to the notorious FTX and others akin to Bitfinex and WazirX. We’re presently experiencing a “crypto winter”, which has resulted in a slowdown in buying and selling. If crypto rebound sooner or later, then this might assist bolster Cloudflare’s, income and likewise assist margins. Cloudflare generated optimistic free money circulation within the second half of 2022, and administration forecasts this to proceed into 2023, which is a optimistic.

Cloudflare inventory valuation 2 (Created by writer Deep Tech Insights)

Given these elements I get a good worth of $58.64 per share, which is near the $58 share value on the time of writing. Due to this fact I’ll deem the inventory to be “pretty valued”, as typically for me to think about a inventory to be “undervalued” I search for not less than 10% beneath its intrinsic worth. Nevertheless, this all relies upon upon your particular investing type.

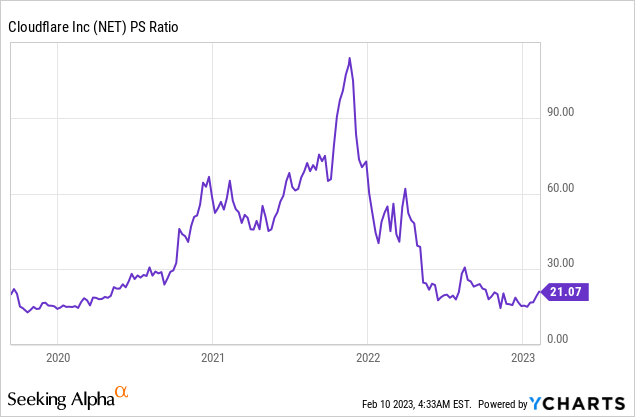

As an additional datapoint, Cloudflare trades at a value to gross sales ratio = 21, which is 45% cheaper than its 5 yr common.

Dangers

Longer Gross sales Cycles/Recession

Many analysts have forecast a recession in 2023, thus I consider this may occasionally lead to a requirement slowdown for Cloudflare. In its earnings name administration acknowledged that they’re seeing prospects “take longer” to signal growth offers and procurement departments are scrutinising way more so.

Closing Ideas

Cloudflare has confirmed its steel as a number one content material supply community and supplier of excessive efficiency, safe functions. The corporate’s adoption by ChatGPT, will probably act as a brief time period catalyst for the inventory, but additionally opens up additional alternatives within the AI trade. Even regardless of this its Zero belief merchandise are rising quick and its FedRAMP certification opens up the federal government market. The one concern with this inventory is its valuation which is not precisely low-cost after the latest run up in value, however it’s “pretty valued” intrinsically in my eyes and undervalued relative to historic multiples.