sevendeman/iStock by way of Getty Photographs

Funding Abstract

As we proceed to construct our allocations to novel developments in complicated illness segments, we carried out a deep dive of the current momentum Keros Therapeutics, Inc (NASDAQ:KROS). The corporate is constructing momentum round its two fundamental candidates, KER-050 and KER-047. Right here I am going to current our in-depth findings underpinning our purchase thesis.

As a fast overview, KER-050 is an engineered ligand entice, and KROS has medical trials underway investigating its administration of cytopenia [low blood cell counts], together with anaemia and thrombocytopenia, in sufferers with myelodysplastic syndromes (“MDS”) and myelofibrosis (“MF”). For reference, MDS and MF are various kinds of cancers. Referring to the KER-050 ligand entice, it’s constructed utilizing a modified activin receptor kind IIA. It is a part of the reworking development issue beta (“TGF-β”) receptor, that’s fused with the fragment crystallizable (“Fc”) area on the human antibody.

Moreover, KER-047 has been designed as a particular and potent ALK2 inhibitor [also a TGF-β receptor]. The goal of KER-047 is purposeful iron deficiency brought on by elevated ALK2 signalling, with iron-refractory iron deficiency anaemia (“IRIDA”) being the preliminary goal.

Notice: Earlier than persevering with, traders should take into account there are a number of dangers that might nullify this thesis. Particularly, failed examine information on KROS’ investigational compounds would end in a big selloff. To not neglect, the inventory may reprice decrease based mostly on its lack of revenues and earnings, ought to the market’s threat urge for food shift to elements of high quality. Our value targets are derived from market generated information and might be flawed as nicely. Buyers ought to acknowledge these dangers earlier than continuing.

KER-050 gaining substantial traction

On the sixty fourth American Society of Haematology Annual Assembly and Exposition, KROS introduced additional information on its KER-050 compound:

Information from its ongoing Part 2 medical trial of KER-050 in MDS Preliminary Part 2 information from its trials of KER-050 in MF sufferers, and Part 2 information investigating KER-047 in IRIDA sufferers.

We’re notably targeted on information from the Part 2 medical trials for KER-050. The primary is analyzing its effectiveness in sufferers with varied threat ranges of MDS. The trial has two elements. Half 1, specializing in figuring out the suitable dosing, by means of a dose escalation course of. The affected person cohort on this half have been divided equally between these with and with out ring sideroblasts [commonly seen in MDS]. Every got KER-050 each 28 days for as much as 4 cycles at dosages starting from 0.75-5.0 mg/kg. Partly 2, the confirmed dose was 3.75 mg/kg with the opportunity of growing or lowering the vary based mostly on particular person titration guidelines.

After finishing half 1, eligible sufferers got the chance to escalate to the really helpful dose and obtain long-term remedy with KER-050 for as much as 20 further cycles. On the information cut-off, 51.7% [n=15] of the evaluable sufferers achieved an total erythroid response, outlined as, both a major enhance in haemoglobin ranges, or a discount in transfused pink blood cells, or a interval of transfusion independence for at the very least 8 weeks. The important thing level to extrapolate, is that these outcomes help that KER-050 may current a differentiated mechanism to advertise haematopoiesis [the process of creating blood and bone marrow cells].

Extra information was extrapolated after an exploratory investigation of biomarkers of iron overload (“IO”) was additionally introduced, incorporating information from 31 topics who underwent as much as 4 cycles of KER-050 remedy partially 1 of the trial. Out of those, 58.1% [n=18] have been labeled as having closely transfused β-thalassemia (“HTB”). Baseline assessments revealed that transfusion-dependent sufferers displayed a higher diploma of ineffective haematopoiesis as in comparison with non-transfused (“NT”) sufferers. This was evidenced by the diminished ranges of haemoglobin, reticulocytes and soluble transferrin receptor (“STFR”).

Moreover, decrease ranges of transferrin and elevated ranges of serum ferritin -especially amongst HTB sufferers – point out extra extreme IO in transfusion-dependent sufferers compared to NT sufferers.

Evaluations carried out as of the info deadline disclosed the next key observations:

With KER-050 remedy, STFR ranges elevated considerably, notably in HTB sufferers, whereas ferritin ranges decreased. Amongst sufferers who achieved Hematological Enchancment-erythroid (HI-E) or Transfusion Independence (TI), decreases in serum ferritin have been typically noticed. Such decreases have been extra outstanding amongst sufferers with baseline ferritin values exceeding 500 ng/mL, suggesting the potential for KER-050 to mitigate IO in topics most impacted by the situation. A correlation was established between reductions in transfusion burden, as decided by the variety of RBCs transfused over eight weeks, and reductions in serum ferritin, notably in sufferers who achieved TI.

Importantly, outcomes from the trial, and the exploratory evaluation, help the speculation that KER-050 holds promise for enhancing haematopoiesis, decreasing transfusion burden, and mitigating IO, notably in topics who obtain frequent RBC transfusions.

KROS market generated information

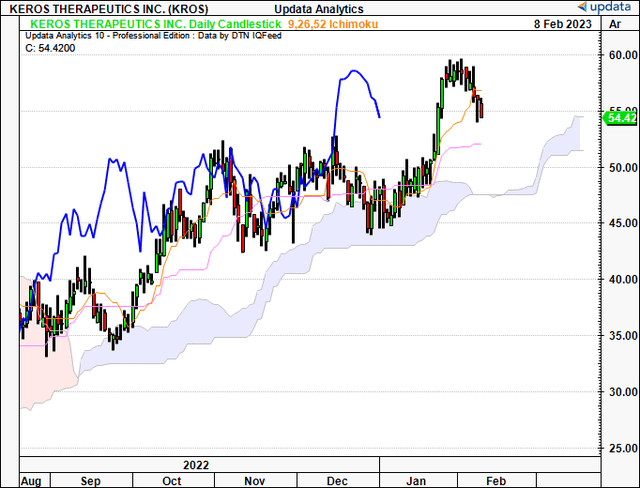

Technicals are quintessential in evaluating medical stage biotech’s to know what’s already within the value. The inventory has rallied for the majority of H2 FY22′ up to now. A pointy cross of the 50DMA and 250DMA has seen the inventory experience the 50DMA as help to the present week. The rally misplaced some momentum in January however has reclaimed help on the key ranges proven.

Exhibit 1. KROS value evolution [weekly bars, log scale]

Information: Updata

On the every day cloud chart, trying to the approaching weeks, we’re nonetheless bullish above the cloud, even with the cooling of the pattern. We glance to help forming at $54 by finish of February. We’re constructive on this chart.

Exhibit 2. Bullish above the cloud on every day chart

Information: Updata

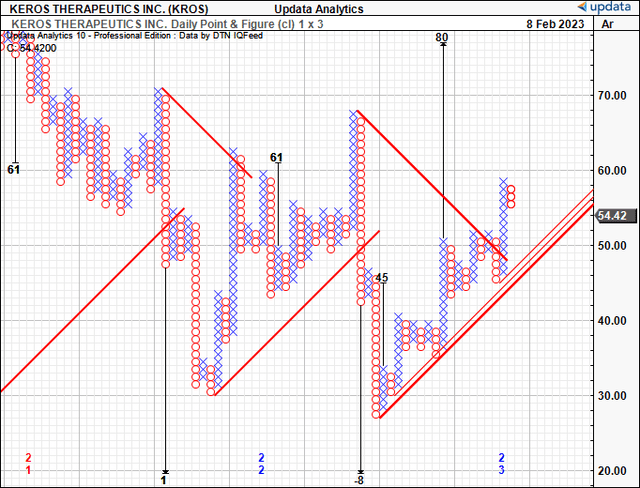

Consequently, we have now upsides to $80 on our level and determine research. That is on a 1×3 field reversal and filters out the pointless volatility in between giant value swings. We need to this as an preliminary goal.

Exhibit 3. Upside value targets to $80

Information: Updata

Briefly

Information is promising for KROS’ KER-050 compound and we have been interested in the market’s response on its current displays and examine readouts. Buyers are rewarding the corporate on its novel hypotheses and we’re eyeing potential upsides to $80. Web-net, fee purchase.