tumsasedgars/iStock by way of Getty Photographs

Thesis

Eaton Vance Tax-Managed Purchase-Write Technique Fund (EXD) is an fairness buy-write fund. The car was due for a vote final week for its proposed merger with Eaton Vance Tax-Managed Purchase-Write Alternatives Fund (ETV):

The proposed merger is topic to approval by Acquired Fund shareholders at a Particular Assembly of Shareholders scheduled for Thursday, February 2, 2023. A proxy assertion/prospectus containing details about the assembly and the proposed merger will probably be mailed to the Acquired Fund’s shareholders of report as of November 21, 2022. No motion is required by shareholders of the Buying Fund. Every Fund is a diversified closed-end administration funding firm sponsored and managed by Eaton Vance Administration. Every Fund is listed on the New York Inventory Change.

We had anticipated the assembly and the vote to undergo, and have some form of outcome on the proposed merger. Sadly, it was not that approach:

BOSTON–Eaton Vance Tax-Managed Purchase-Write Technique Fund (NYSE: EXD) (the “Fund”) held a particular assembly of shareholders earlier at present (the “Particular Assembly”). On the Particular Assembly, Fund shareholders had been requested to approve an Settlement and Plan of Reorganization pursuant to which the Fund will probably be reorganized with and into Eaton Vance Tax-Managed Purchase-Write Alternatives Fund (NYSE: ETV), as authorised by the Fund’s Board of Trustees. The Particular Assembly was adjourned to March 16, 2023 at 1:00 p.m. Japanese time to permit extra time for shareholders to vote. The November 21, 2022 report date for shareholders entitled to vote on the adjourned Particular Assembly stays unchanged. Details about the adjourned Particular Assembly seems under.

Supply: Enterprise Wire

It appears that evidently the trustees couldn’t get a easy majority wanted given lack of participation, therefore the vote was postponed. It is a little bit of a shock provided that each funds come from Eaton Vance, and the fund administration ought to have an excellent understanding of the shareholders within the fund and potential urge for food for what had been put ahead. Appears to be like like Eaton dropped the ball a bit on this one.

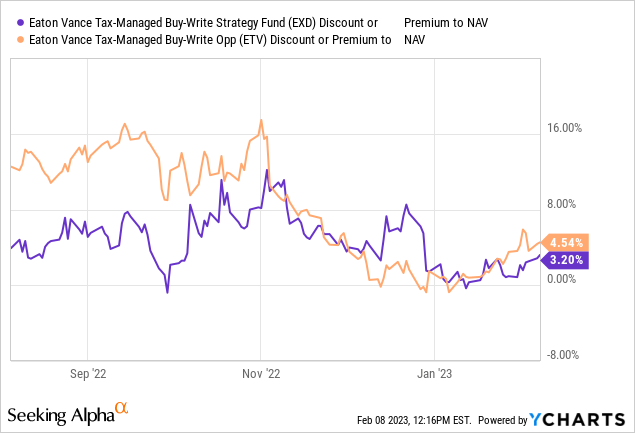

For the reason that preliminary merger information got here out, EXD and ETV have began to commerce at very related premiums to NAV, which presently stand at 3.2% and 4.5% respectively. The market is principally telling us the merger will finally undergo. EXD holders have seen a pleasant pick-up in pricing because the market firmed up the premium put up the merger announcement, and we even noticed a stunning growth in late December the place the premium to web asset worth for EXD exceeded the one for ETV by nearly 8%! That’s unprecedented, and EXD ought to have been offered vs ETV at that time.

We really feel Eaton dropped the ball a bit on this merger proposal by not careening sufficient help from shareholders previous to the vote day, however they’ll finally handle to push it by. Till the ultimate approval, substantial divergences in premiums to NAVs for the 2 CEFs needs to be actively traded, betting on a imply reversion and approval of the merger.

Premium / Low cost to NAV

We are able to see a pleasant correlation between the premiums to NAV for the 2 CEFs because the merger announcement:

After the proposed merger was introduced, we noticed a considerable bounce within the premium to NAV for EXD. At present, the 2 funds are buying and selling at very related premiums, which tells us the market thinks the merger will finally undergo.

Conclusion

EXD is ready to be merged into ETV. Sadly, Eaton dropped the ball on the scheduled assembly and securing the mandatory votes, with the particular assembly now postponed to March. We really feel the merger will finally undergo, and the market is telling us an analogous story, with the 2 CEFs having very related premiums to NAV. Nevertheless, given the volatility current within the wider markets, arbitrage alternatives can come up in these two names. Again in December, we noticed EXD transfer to an unprecedented 8% premium over ETV, an occasion which ought to have been offered into (i.e., an investor ought to have offered EXD and purchased ETV). We imagine the merger will finally undergo, and any volatility pushed dislocation within the premium differential right here might be traded by an energetic retail investor. This relationship needs to be intently watched and monitored for arbitrage alternatives.

Editor’s Word: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.