Up to date on February fifth, 2023 by Felix Matinez

Sherwin-Williams (SHW) is a legendary dividend development inventory. It has elevated its dividend for 44 consecutive years, placing it in a really uncommon firm in relation to elevating payouts to shareholders.

As a member of the Dividend Aristocrats, Sherwin-Williams is considered one of simply 66 S&P 500 shares which have raised their dividends annually for 25+ years.

We imagine the Dividend Aristocrats are glorious shares for producing steadily rising passive earnings over time. With this in thoughts, we created a listing of all 68 Dividend Aristocrats.

You may obtain the complete Dividend Aristocrats record, with essential metrics like dividend yields and price-to-earnings ratios, by clicking on the hyperlink under:

Sherwin-Williams stands out due to its outstanding charge of dividend development. Even higher, the corporate exhibits no signal of slowing down. It has regularly elevated its dividend by double-digits on a proportion foundation. Nevertheless, for 2022, the corporate raised its dividend by 9.1%.

Sherwin-Williams’ sizable dividend development forecast makes it an interesting inventory to dividend development buyers. On the similar time, an elevated valuation makes the inventory much less engaging on a valuation foundation.

This text will analyze the funding prospects of Sherwin-Williams in better element.

Enterprise Overview

Sherwin-Williams is the world’s second-largest producer of paints and coatings. The corporate distributes its merchandise by way of wholesalers in addition to retail shops. Sherwin-Williams was based in 1866 and has grown to a market capitalization of $62.3 billion on annual gross sales above $22.1 billion.

The corporate distributes its merchandise by way of wholesalers and retail shops with the Sherwin-Williams title. Its solely competitor of comparable dimension is fellow Dividend Aristocrat PPG Industries (PPG).

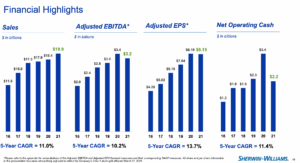

Supply: Investor Presentation

Sherwin-Williams is actually a market chief. The corporate grew to become considerably bigger after its acquisition of Valspar. The Valspar merger was transformative for Sherwin-Williams.

Submit-merger, Sherwin-Williams is a way more diversified firm than it was previous to the Valspar buy. Administration believes it might ship sturdy earnings-per-share development with much less volatility and variability in earnings.

This proved true in 2021 and 2022, a 12 months of restoration for each Sherwin-Williams and the U.S. economic system. On January 26th, 2023, Sherwin–Williams launched This autumn 2022 outcomes. For the quarter, Sherwin–Williams generated income of $5.230 billion, a 9.8% improve in comparison with This autumn 2021.

Income within the Efficiency Coatings group rose 4.2%, however was closely offset by a 13.8% decline within the Shopper Manufacturers Group, however a 15.7% improve within the Americas Group. Adjusted earnings–per–share equaled $1.89 versus $1.34 in This autumn 2021.

Sherwin–Williams additionally up to date its 2023 steering. The corporate anticipates a down mid-single-digit proportion to flat internet gross sales for 2023 and $7.95 to $8.65 in adjusted earnings–per–share.

Progress Prospects

Sherwin-Williams has grown at sturdy charges over the previous couple of years. The Valspar acquisition helped drive vital top-line growth, as did the sturdy efficiency of the U.S. housing market.

Wanting forward, Sherwin-Williams stands to profit from broad-based demand for its merchandise, particularly within the worldwide markets. Demand for Sherwin-Williams merchandise is predicted to develop most quickly within the Asia-Pacific area.

As well as, the corporate has a scale not like any of its rivals in Latin America and North America. There may be nonetheless loads of development potential in its extra mature markets, however the Valspar acquisition helped to expedite growth into Asia-Pacific, the place the corporate is comparatively small.

The sturdy U.S. housing market is an extra development catalyst. Low unemployment and rising house values are continued tailwinds for Sherwin-Williams, though a rising rate of interest cycle might put a dent within the firm’s development.

Nonetheless, administration is optimistic concerning the firm’s future outlook, as trade fundamentals stay supportive of development.

Supply: Investor Presentation

Continued restoration for the U.S. economic system in 2023 would enhance the housing market, notably Sherwin-Williams.

Revenues are only one element of Sherwin-Williams’ future development in earnings-per-share. The corporate generates extra money circulate, which it might use to repurchase shares annually, thereby boosting EPS.

Sherwin-Williams has loads of alternatives to develop its gross sales and earnings for the foreseeable future. The corporate has a broad and deep portfolio of standard manufacturers with excessive margins and a constructive gross sales development outlook.

Briefly, despite the fact that Sherwin-Williams is the dominant participant in its sector, it nonetheless has an extended runway for development. Total, we count on 9% annual earnings-per-share development within the subsequent 5 years.

Aggressive Benefits & Recession Efficiency

Sherwin-Williams shouldn’t be a recession-resistant Dividend Aristocrat. The corporate’s efficiency depends upon a wholesome U.S. and worldwide housing market, which is the underlying driver of paint and coatings gross sales.

Sherwin-Williams has a excessive stage of leverage to development markets in addition to new buildings, which want a myriad of coating merchandise.

Associated: See our favourite development shares analyzed intimately.

However the firm does have a silver lining throughout recessions. We imagine householders usually tend to repaint their homes than to maneuver utterly or tackle extra expensive repairs throughout a recession.

On stability, recessions negatively impression Sherwin-Williams’ earnings. This may be seen by trying on the firm’s efficiency in the course of the 2007-2009 monetary disaster:

2007 adjusted earnings-per-share: $4.70

2008 adjusted earnings-per-share: $4.00 (15% decline)

2009 adjusted earnings-per-share: $3.78 (5.5% decline)

2010 adjusted earnings-per-share: $4.21 (11% improve)

It took Sherwin-Williams’ earnings three full years to get better from its Nice Recession lows; nonetheless, the corporate remained worthwhile and continued to lift its dividend (which is why it stays a Dividend Aristocrat right now).

We count on the dividend improve streak will proceed in the course of the subsequent recession, however buyers ought to observe that its earnings, and due to this fact the share value, will probably see significant declines in a downturn.

Valuation & Anticipated Complete Returns

Sherwin-Williams has lots of the traits of a high-quality enterprise, and it’s valued at a premium. The inventory trades with a price-to-earnings a number of of 28.6, primarily based on its 2023 earnings-per-share estimate of $8.30, which compares to our estimate of truthful worth of 23.

That means a ~3.5% annual discount to shareholder returns within the subsequent 5 years.

Nevertheless, this isn’t a inventory that’s more likely to sink to a low price-to-earnings ratio, given its enormously profitable historical past of rising earnings. Traders are prepared to pay extra for premium development, and Sherwin-Williams matches that description.

We count on 9% annual EPS development for Sherwin-Williams. The inventory additionally has a safe dividend, which yields 0.9% proper now. This ends in annual anticipated returns of simply ~6.4% over the subsequent 5 years.

The unfavorable valuation makes the inventory overvalued. The dividend yield remains to be comparatively low, which isn’t a compelling motive to purchase the inventory both.

Nevertheless, the excessive dividend development charge makes the inventory engaging for long-term buyers. The corporate’s dividend can be very protected, with a projected 2023 payout ratio of simply 28%.

Ultimate Ideas

Sherwin Williams’ acquisition of Valspar created compelling development alternatives for this high-quality dividend development inventory. The corporate ought to proceed to develop its income, earnings, and dividends at a excessive charge over the subsequent a number of years, barring a serious recession.

Nevertheless, the valuation is simply too excessive to warrant a purchase advice presently. This can be a typical instance of an amazing enterprise buying and selling at a not-so-great value.

We expect there’s plenty of development forward together with continued dividend will increase annually, however the very excessive valuation might negatively impression shareholder returns. We charge Sherwin-Williams a promote on valuation.

Moreover, the next Positive Dividend databases include probably the most dependable dividend growers in our funding universe:

In the event you’re searching for shares with distinctive dividend traits, contemplate the next Positive Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].