Daniel Grizelj/DigitalVision by way of Getty Photographs

As we head into the tip of January, technical situations in main inventory indexes are displaying a variety of power. We see strong justification for short-term (< 2 weeks) swing longs, with the potential to increase these trades into additional swings if supported by market motion. Within the chart on the high of this publish, we see stress in opposition to, and a attainable break, of a longer-term trendline.

Sure, we nonetheless maintain longer-term considerations, and discover the inversion of the yield curve a distressing sign for the market. Frankly, we expect a bear market that would simply trim 50% from indexes is within the playing cards, however timing is the whole lot. It is actually attainable that indexes might make all-time highs earlier than rolling over right into a bear market. We see no contradiction in being longer-term bears however short-term, aggressive, bulls (and, to be clear, we stay bulls on very lengthy timeframes. Bear markets are instances to purchase shares for enduring wealth.)

Fitzgerald mentioned, “The take a look at of a first-rate intelligence is the flexibility to carry two opposing concepts in thoughts on the identical time and nonetheless retain the flexibility to perform.” Maybe the present market is a take a look at of that skill.

Different probably bullish elements

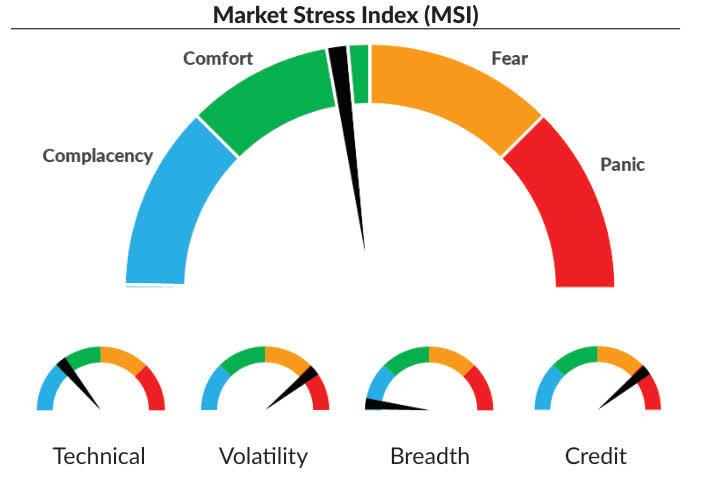

Our MSI has moved into the Consolation zone. Whereas there isn’t a clear sign right here, power from Breadth and Technical elements affirm underlying bullish conviction.

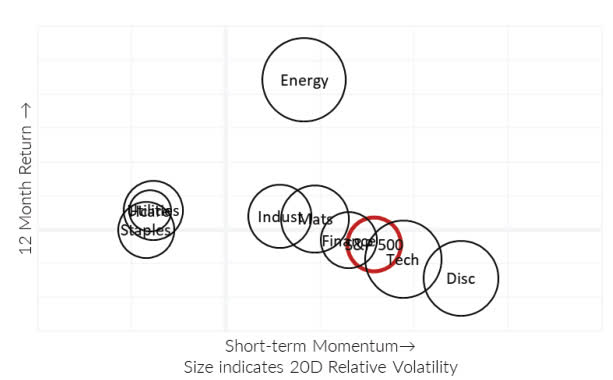

We checked out sector management by means of our bubble diagram just a few weeks in the past. Latest weeks have seen Tech and Discretionary transfer additional to the best, indicating extra outperformance and management from these risk-on teams. Notice that defensive sectors stay strong underperformers; that is one other affirmation of market optimism.

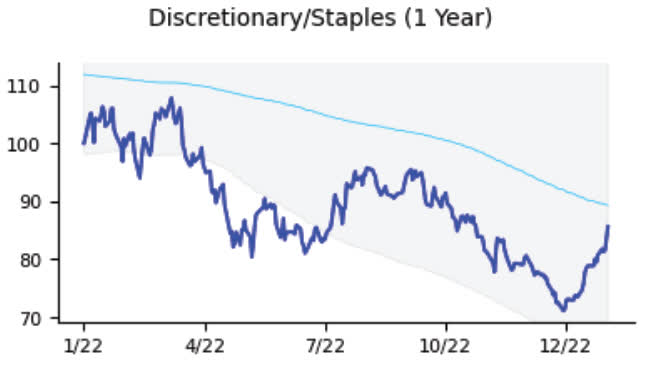

We watch the unfold between Discretionary and Staples as one other barometer of market psychology. We discover value action-driven measures extra dependable than surveys, and this measure exhibits merchants are snug on this surroundings and are seemingly anticipating larger costs.

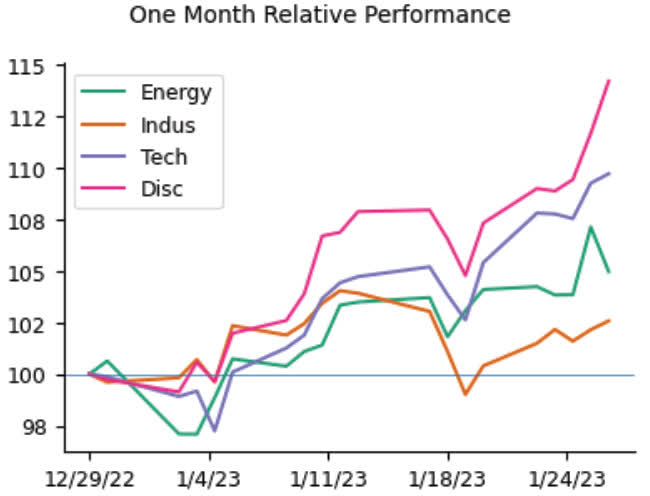

Right here is one other relative efficiency presentation, displaying that Vitality has given up some management to Tech and Discretionary.

All of those measures are confirming, not main, indicators, however they moderately strongly help what we see in value motion and market construction.

Authentic Publish

Editor’s Notice: The abstract bullets for this text had been chosen by Searching for Alpha editors.