jetcityimage/iStock Editorial through Getty Photographs

Kirkland’s, Inc. (NASDAQ:KIRK) is one other house furnishing firm using the present wave of the COVID-19 increase, adopted by elevated competitors, demand drop, and ongoing financial headwinds. The market is shedding religion within the enterprise, which now solely has a market cap of $46.94 million, whereas its annual income is way greater at $558.18 million. Over the past three quarters, the corporate has reported unprofitable outcomes and missed EPS expectations.

Ten-year inventory development (SeekingAlpha.com)

The basics of this firm are deteriorating. We noticed gross sales declining above estimations over the Christmas interval, gross margins are diminishing, debt is piling on, money circulate is damaging, and stock is rising. Though the inventory value has grown over the past six months, this might be associated to the excessive brief curiosity. With the droop in house decor demand and the economic system’s slowdown, there’s little to stay round for. Due to this fact I like to recommend a promote score.

Overview

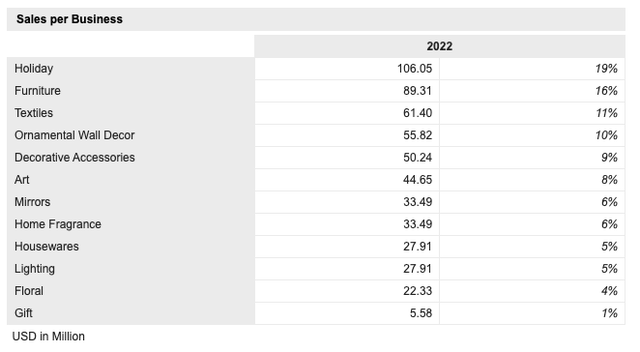

KIRK began in 1966 as a franchised present store. At this time it’s a specialty furnishings and residential decor retailer working 350 shops throughout 35 states and has one e-commerce web site. One among its strengths has been sustaining a excessive gross revenue margin as a consequence of its direct sourcing technique. Its model portfolio contains the next; Kirkland’s, Kirkland’s House, Kirkland’s House Outlet, Kirkland’s Outlet and The Kirkland Assortment. Within the picture beneath, we are able to see annual gross sales damaged down per enterprise section.

Sale per enterprise (marketscreener.com)

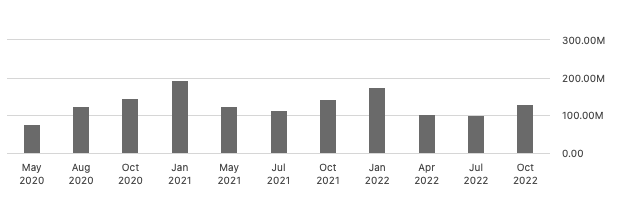

Its income is extremely seasonal. Vacation occasions, together with Christmas and Thanks Giving “Harvest”, are peak quarters, whereas summer time is traditionally the weakest season.

Income per quarter (SeekingAlpha.com)

Since 2020 KIRK has been chopping prices and streamlining its enterprise by lowering its retailer depend, relocating to extra worthwhile areas and bettering e-commerce which now makes up 27% of complete gross sales final quarter. Nonetheless, the business headwinds have began to weigh heavier on the enterprise; TTM gross revenue margin is 26.96%, in comparison with 33.76% for FY2021, and TTM internet revenue is damaging $28.4 million, which ought to enhance after This autumn 2022 outcomes. Nonetheless, we already know that vacation gross sales have been a lot decrease than forecasted as a consequence of decrease buyer site visitors, and the Harvest season was disappointing in Q3 2022.

Financials

Issues will not be wanting nice for KIRK. In Q3 2022’s transcript, the administration emphasised its vacation season to extend gross sales and enhance its stock ranges. Nonetheless, we are going to proceed to see rising stock and a dwindling money provide. Income has slowly been reducing, with TTM at $512.5 million, which is decrease than in FY2015, impacted by lowering demand and restructuring efforts involving closing a lot of its shops. TTM internet revenue is at a damaging $28.4 million.

Annual income and gross revenue (SeekingAlpha.com)

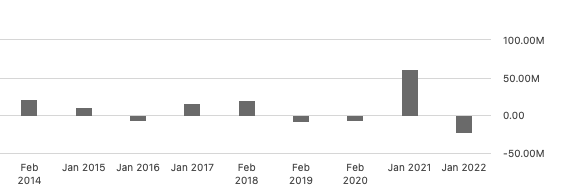

Free money circulate is dwindling, though there was a quick COVID-19 demand-induced spike. Nonetheless, the enterprise has not had a wholesome money circulate for years which is crucial to speculate again into the corporate, give again to buyers and repay debt. TTM is a damaging levered money circulate of $35.9 million.

Levered free money circulate (SeekingAlpha.com)

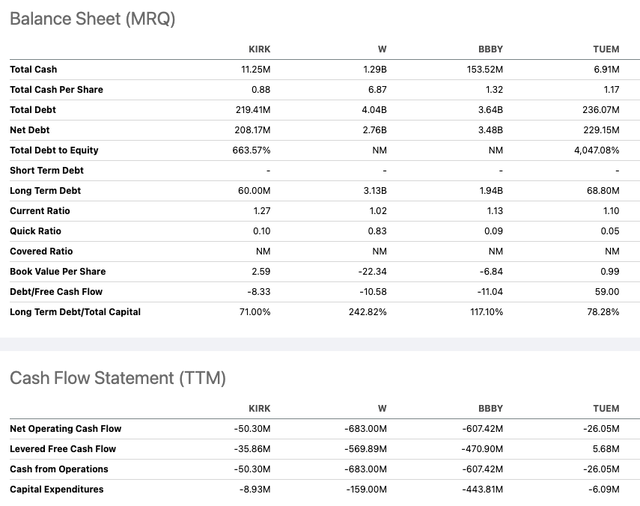

If we take a look at the steadiness sheet, complete debt has elevated from zero over the past 4 years to $219.4 million. Holding in thoughts that income final yr was solely $558.18 million, this turns into a really dangerous play. Much more, we see that the whole debt-to-equity is 663.57%. Its complete money is $11.25 million. If we take the liquidity ratios, we are able to see an appropriate present ratio of 1.27. Nonetheless, the fast ratio is meagre, even for the retail business, at 0.10. The business common is round 0.6 as a consequence of conserving comparatively excessive stock ranges. KIRK’s stock has been creeping upward previous wholesome ranges at $126.3 million.

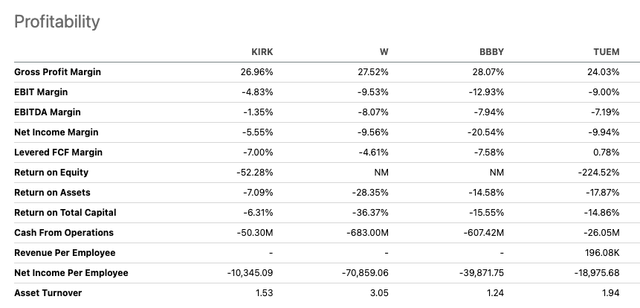

The extremely aggressive house furnishing business is doing poorly throughout the board. We have seen friends akin to Tuesday Morning (OTC:TUEM), getting ready doubtlessly to file for chapter quickly, Wayfair (W) and Mattress Bathtub and Past (BBBY) all in turmoil. Corporations have all been impacted by unpredictable client spending and continued inflationary and recessionary pressures. Though KIRK’s administration workforce is optimistic about regaining stability in 2023, if we evaluate the inventory throughout some crucial metrics to those struggling friends, we are able to see that KIRK is in an analogous harmful boat. Its gross revenue margin is barely greater than discounter TUEM at 26.96%, though KIRK gala’s higher on internet revenue margin with a damaging 5.55%.

Profitability comparability (SeekingAlpha.com)

Throughout the steadiness sheet and money circulate, KIRK is similar to TUEM, though TUEM has a optimistic free money circulate of $5.68 million in comparison with KIRK’s damaging free money circulate of $35.86 million.

Peer comparability (SeekingAlpha.com)

Ultimate ideas

Though KIRK has restructured its enterprise by lowering retailer depend and rising e-commerce to 27% of gross sales this previous quarter, if we take a look at the enterprise efficiency, ignoring COVID-19 fueled demand, free money circulate has been reducing, debt has been rising, and gross sales are reducing, even throughout peak vacation seasons. Amidst ongoing headwinds and unpredictable buyer buying behaviours resulting in surplus stock and a scarcity of money, I don’t advocate shopping for this inventory and concern that the efficiency will proceed to hit new lows if we take a look at what is going on to related friends within the business. Due to this fact I like to recommend a promote score.

Editor’s Notice: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.