Microsoft CEO Satya Nadella leaves the Elysee Palace after a gathering with the French President Emmanuel Macron in Paris on Might 23, 2018.

Aurelien Morissard | IP3 | Getty Pictures

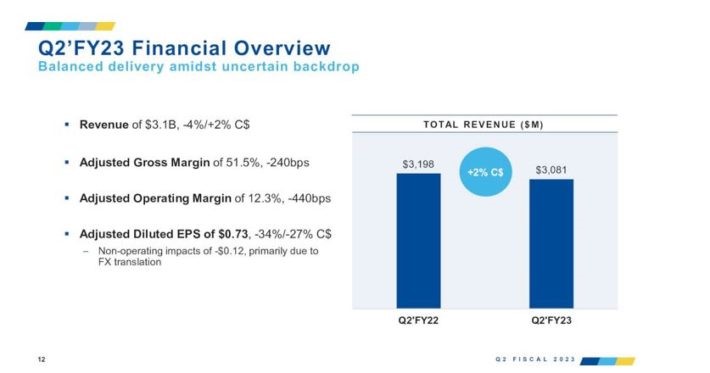

Microsoft executives on Tuesday informed analysts to count on a continuation of the weak tempo of enterprise that emerged in December, which harm the software program maker’s fiscal second quarter outcomes.

“In our business enterprise we count on enterprise developments that we noticed on the finish of December to proceed into Q3,” Amy Hood, Microsoft’s chief monetary officer, mentioned on a convention name.

Particularly, he firm noticed much less progress than anticipated in Microsoft 365 productiveness software program subscriptions, id and safety providers, and business-oriented Home windows merchandise.

Progress in consumption of the corporate’s cloud computing service Azure additionally slowed down, she mentioned.

The corporate sells merchandise reminiscent of Xbox consoles and Floor PCs to customers, however most of its income comes from business shoppers reminiscent of corporations, colleges, and governments. That is the place the influence will present up. A metric dubbed Microsoft Cloud — together with Azure, business subscriptions to Microsoft 365, business LinkedIn providers and Dynamics 365 enterprise software program — now represents 51% of whole gross sales.

Giant organizations are optimizing their spending on cloud providers, a key space of progress for Microsoft, CEO Satya Nadella mentioned. That habits additionally performed out within the fiscal first quarter, and in October, Amazon additionally talked about the way it had been serving to cloud prospects optimize their prices.

Microsoft made product modifications to focus on locations the place prospects might decrease their cloud payments, Nadella mentioned.

Hood mentioned mentioned Azure progress would decelerate extra. Within the full December quarter, income from Azure and different cloud providers rose 42% in fixed foreign money. However in December, Hood mentioned, progress was within the mid-30% vary in fixed foreign money, and he or she forecast an extra slowdown of 4-5 proportion factors within the present quarter, which ends in March.

The slowdown that began in December must also carry by means of to Q3 outcomes for Home windows business merchandise and cloud providers, a class that features Home windows quantity licenses for companies, Hood mentioned. Her forecast included flat income for Home windows business merchandise and cloud providers, in contrast with a decline of three% within the fiscal second quarter.

WATCH: Financial recession has already been priced into shares, says Virtus’ Joe Terranova